Shares for the future: why I’m keeping this £1bn stock in my top 10

Recent numbers are good, but there’s more to this FTSE 250 company. Analyst Richard Beddard explains why his latest score suggests they’re a good long-term investment.

11th July 2025 15:01

by Richard Beddard from interactive investor

This year’s annual report marks Richard Tyson’s first full year at Oxford Instruments (LSE:OXIG). The newish chief executive joined in October 2023.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

A customer-first strategy developed under him focuses on Oxford Instruments’ established and highly profitable businesses that facilitate imaging and analysis.

Oxford Instruments: adapting to new disorder

The company remains committed to organic growth embodied in an R&D expenditure target of 8-9%, but it has also made two modest acquisitions under its new leader. The first was in January and the second was in June last year.

These joined the Imaging and Analysis segment, which makes microscopy equipment, cameras, analytical instruments and software products principally for the materials analysis, healthcare equipment and semiconductor markets.

The company is also disposing of its NanoScience business. It makes cooling equipment that creates the very lower temperature environments needed for quantum computing. These systems are subject to export restrictions that required Nanoscience to exit China in 2024.

NanoScience had already been hived off into a separate division: Advanced Technologies. This division houses riskier businesses selling large-scale complex systems into specific markets characterised by custom builds and long project timelines.

- Shares for the future: this company deserves more credit

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The other big Advanced Technology business makes compound semiconductor fabrication equipment, a technology Oxford Instruments has developed into a volume manufacturing system.

Compound semiconductors are made from more than one element. They are more powerful than regular silicon chips and in demand for modern power-hungry applications. Oxford Instruments has tripled manufacturing capacity by investing in a new facility near Bristol.

The two segments contrast in terms of profitability. Imaging and Analysis contributed 66% of revenue and 93% of total profit in 2025, a year that NanoScience returned to profitability. In 2024, due to lost NanoScience orders in China, the division barely broke even.

NanoScience’s experience in China is an extreme example of how protectionism is disrupting export powerhouses such as Oxford Instruments, which earned 28% of revenue in the US in 2024 and 21% in China.

New trade barriers are making things harder for technology businesses that inevitably rely on overseas markets for raw materials and customers.

Oxford Instruments is adapting to the new disorder. It has performed a “regional pivot”, conforming to UK export restrictions on quantum and some semiconductor products and refocusing on “less sensitive” sales in China.

The company’s customers are also being forced from China by protectionist measures, so Oxford Instruments has consolidated its teams in south-east Asia, where sales are booming.

Oxford Instruments: by the numbers

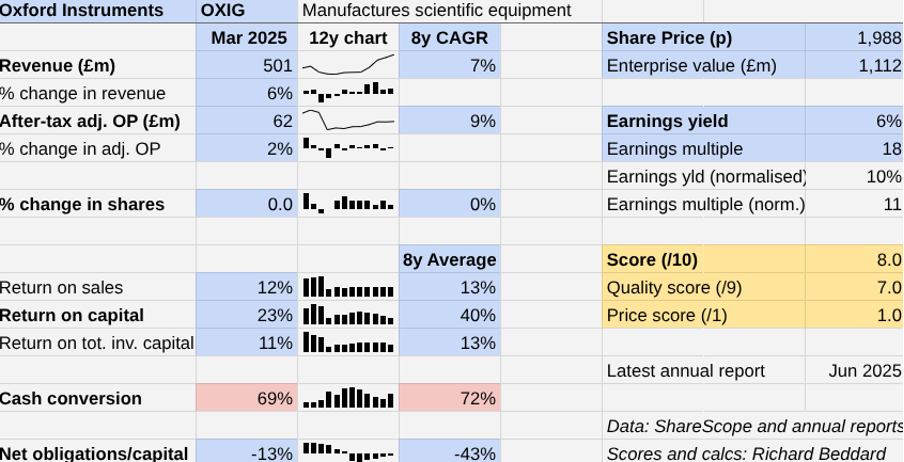

Revenue grew by 6% but adjusted profit grew a sub-par 2% in the year to March 2025. However, this figure was reduced by £8.5 million due to the effect of the weakened US dollar on profit reported in pounds.

Oxford Instruments achieved low double-digit growth in adjusted profit on a constant currency basis.

The company believes its success was due to the simplification of the business and it was despite losses at Andor Technologies, which the company is turning around.

In arriving at adjusted profit though, Oxford Instruments made major adjustments. The biggest was a £26 million write down in value of Andor, which Oxford Instruments acquired in 2014.

Andor Technologies is also probably responsible for some of the £7.8 million of exceptional restructuring costs, also ignored. The bulk of that figure (£5 million) relates to the relocation of the compound semiconductor fabrication equipment facility.

Return on capital of 23% is good, but well below Oxford Instruments’ historical average.

- The Income Investor: a cyclical FTSE 250 stock with dividend appeal

- Watch out: tech trends and overlooked UK stocks

This is largely explained by a 200% increase in capital employed since 2020 due to the investment in new facilities and products and high levels of stock, initially to weather the supply shortages after the pandemic and subsequently to cover disruption due to the factory move.

Despite the investment and acquisitions, Oxford Instruments still had more cash than financial obligations at the year end. This happy situation will be reinforced by a £57 million payday when the NanoScience sale completes later this year.

The company says it will return some of the loot to shareholders via a share buyback programme.

Scoring Oxford Instruments

I like it when companies simplify. As well as becoming easier to manage, they become easier to understand.

Oxford Instruments’ strategy is coherent to me. Compound semiconductors is an established growing market, and the company is ploughing surplus cash from its highly profitable imaging and analysis division into the acquisition of similar businesses.

Ditching NanoScience diminishes Oxford Instruments’ claim to be operating at the frontier of science, and nixes something of a moonshot, should quantum computing make it beyond being the next big thing.

It looks as though profitability in the future will be less reliant on large investments in emerging technologies than it used to be, and more reliant on piecemeal investment in established technologies in which Oxford Instruments already has a significant presence.

Oxford Instruments | OXIG | Manufactures scientific equipment | 09/07/2025 | 8/10 |

How capably has Oxford Instruments made money? | 2.0 | |||

Oxford Instruments has increased revenue modestly and profit at a high single-digit compound annual growth rate (CAGR) since 2016 by focusing on imaging and analysis technologies with broad applications in industry and academia, augmented by modest acquisitions under its newish chief executive. | ||||

How big are the risks? | 2.0 | |||

Heavy investment in R&D, other capital expenditure, and stock is weighing on profitability in the short-term, though returns may improve over the long-term. New barriers to trade are disrupting Oxford Instruments' two biggest markets - the US and China. | ||||

How fair and coherent is its strategy? | 3.0 | |||

The company is emphasising its most commercial technologies and simplifying the business. It has disposed of one of two earlier stage "Advanced Technology" businesses and it is scaling the other up to supply volume manufacturers. It has a customer first ethos. Voluntary staff turnover was 8% in 2024. | ||||

How low (high) is the share price compared to normalised profit? | 1.0 | |||

Low. A share price of 1988p values the enterprise at £1112 million, about 11 times normalised profit. | ||||

A score of 8/10 indicates Oxford Instruments is a good long-term investment. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Jet2 Ordinary Shares (LSE:JET2) and Solid State (LSE:SOLI) have published full-year results, and I expect to rescore them when they publish their annual reports.

Auto Trader Group (LSE:AUTO) has published its annual report and is due to be rescored.

0 | company | description | score | qual | price | ih% |

1 | James Latham | Imports and distributes timber and timber products | 8.0 | 1.0 | 8.0% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.1% | |

3 | Churchill China | Manufactures tableware for restaurants etc. | 7.5 | 1.0 | 7.0% | |

4 | FW Thorpe | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.5 | -0.1 | 6.7% | |

5 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.5 | 0.6 | 6.2% | |

6 | Solid State | Assembles electronic systems (e.g. computers and radios) and distributes components | 7.5 | 0.5 | 6.0% | |

7 | Focusrite | Designs recording equipment, loudspeakers, and instruments for musicians | 7.0 | 1.0 | 6.0% | |

8 | Dewhurst | Manufactures, distributes and fits lift components | 7.0 | 1.0 | 6.0% | |

9 | Oxford Instruments | Manufactures scientific equipment | 8.0 | 7.0 | 1.0 | 6.0% |

10 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.4 | 5.8% | |

11 | Hollywood Bowl | Operates tenpin bowling and indoor crazy golf centres | 7.5 | 0.3 | 5.7% | |

12 | Renew | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.5 | 0.3 | 5.6% | |

13 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.3 | 5.4% | |

14 | Macfarlane | Distributes and manufactures protective packaging | 7.0 | 0.7 | 5.4% | |

15 | James Halstead | Manufactures vinyl flooring for commercial and public spaces | 7.0 | 0.6 | 5.1% | |

16 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.5 | 5.0% | |

17 | Auto Trader | Online marketplace for motor vehicles | 8.5 | -1.1 | 4.8% | |

18 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.7% | |

19 | Games Workshop | Manufactures/retails Warhammer models, licences stories/characters | 9.0 | -1.7 | 4.7% | |

20 | Softcat | Sells hardware and software to businesses and the public sector | 8.0 | -0.8 | 4.4% | |

21 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.7 | 4.3% | |

22 | Jet2 | Flies holidaymakers to Europe, sells package holidays | 7.5 | -0.3 | 4.3% | |

23 | YouGov | Surveys and distributes public opinion online | 7.5 | -0.5 | 4.0% | |

24 | Dunelm | Retailer of furniture and homewares | 8.0 | -1.2 | 3.5% | |

25 | Volution | Manufacturer of ventilation products | 8.0 | -1.3 | 3.4% | |

26 | DotDigital | Provides automated marketing software as a service | 6.5 | 0.1 | 3.2% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.5 | 3.1% | |

28 | Judges Scientific | Manufactures scientific instruments | 7.5 | -1.6 | 1.9% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets and insurers | 7.5 | -1.6 | 1.7% | |

30 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8.0 | -2.3 | 1.5% | |

31 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.3 | 0.5% | |

32 | Cohort | Manufactures military technology, does research and consultancy | 7.5 | -2.3 | 0.4% | |

33 | Keystone Law | Runs a network of self-employed lawyers | 7.0 | -2.4 | 0.0% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Oxford Instruments and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.