The Analyst: best ways to invest in gold and silver

In the first of a new series of articles discussing topical themes and investment strategies, analyst Dzmitry Lipski looks at substantial inflows into gold and silver assets.

13th February 2026 09:08

by Dzmitry Lipski from interactive investor

Markets do not move in straight lines, and the current environment is a good reminder of that. Investors are currently navigating a mix of slowing growth, uncertain inflation, interest rates that remain higher than in the previous decade, and elevated geopolitical risks.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Over the coming weeks, I will outline a range of themes and strategies investors may consider in current environment. Each plays a different role within a diversified portfolio, and the appropriate allocation will depend on individual goals, time horizon and risk tolerance. The first area I will cover is precious metals, which have attracted substantial inflows and garnered much investor attention recently.

Strong rally then sharp volatility

Gold recently broke above the historic $5,000 per ounce level, reaching a peak near $5,600 at the end of January before falling more than 15% to around $4,500 in early February. Silver experienced even greater volatility, rising to a record $121 per ounce before declining over 40% to $72. Over the past 12 months, silver has more than doubled in value, supported partly by strong industrial demand linked to clean energy and artificial intelligence (AI).

- The secrets of the silver market explained

- Gold, silver and defence: reasons to be bullish and bearish

Recent price moves highlight how quickly sentiment can shift. After such strong gains, investors are questioning whether the rally has gone too far or whether precious metals can continue to rise amid persistent geopolitical uncertainty.

Valuations and positioning

Following a strong run over the past year, the risk-reward for both metals appears less attractive, with pullbacks a common feature after strong rallies. Some analysts argue that precious metals are no longer cheap as they are trading above their five-year average prices

Professional investor positioning also looks overextended. The latest Bank of America Global Fund Manager Survey showed that long gold was the most crowded trade, with around 50% of managers viewing gold as overvalued, tied with the highest reading on record.

Structural drivers intact

That said, gold and silver continue to benefit from longer-term structural drivers including geopolitical tensions, central bank purchases, and broader economic uncertainty. However, much of this optimism may already be reflected in current prices, potentially leading to more volatile and less predictable returns. For example, a degree of the bullish sentiment towards gold is predicated on the assumed debasement of the US dollar, but forecasting such currency trends is an almost impossible task.

Similar to gold, silver is also considered a good hedge against inflation and a reliable store of value during economic and geopolitical uncertainty. It also has more industrial application than gold and is used extensively in energy-efficient industries such as solar and electric vehicles. This means that including silver in investment portfolios offers the potential for higher returns than a pure gold allocation.

- Gold and silver prices: what the City thinks will happen next

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Historically, silver and gold have a close relationship, with a correlation coefficient of 70% over the past 10 years. As such, silver prices tend to move in tandem with gold and typically increases in value faster than gold when precious metal prices are rising.

Portfolio considerations

For most long-term investors, any exposure is better kept modest, and primarily for diversification purposes – typically no more than 10% of a portfolio. Investors should also be prepared for periods of sharp drawdowns. It’s important to remember that gold should be held as a very long-term investment, at least for three to five years, and that its value remains the same, while the US dollar depreciates constantly.

As with any alternative asset allocation, precious metals are most effective when used in moderation and as part of a broader, well-diversified portfolio. These numbers can change depending on the objective behind the inclusion of gold in a portfolio.

How to gain exposure

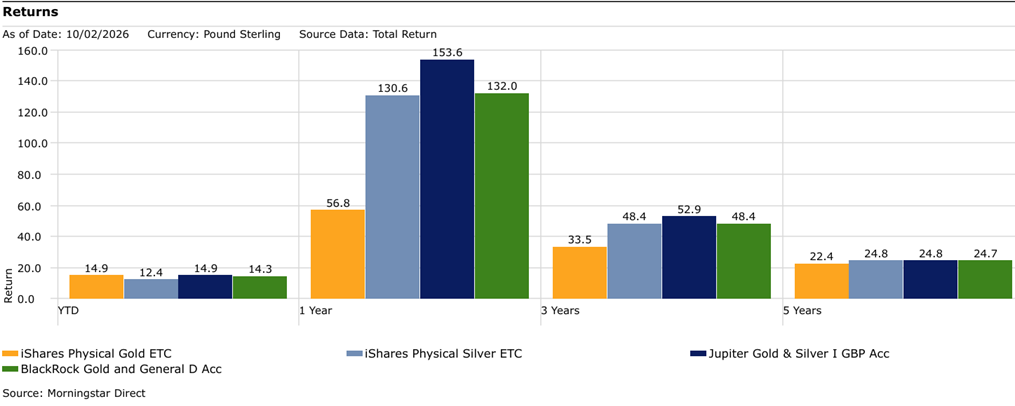

For investors who still want exposure to precious metals, low-cost exchange-traded products remain a straightforward option. Physically backed vehicles such as the iShares Physical Gold ETC GBP (LSE:SGLN) and the iShares Physical Silver ETC GBP (LSE:SSLN) provide direct exposure to spot prices and can be used efficiently within diversified portfolios.

More adventurous investors may also want to consider investing in gold mining and precious metal-related shares via BlackRock Gold and General A Acc fund. It’s one of the most highly rated in the sector and has one of the longest-established and respected management teams in any specialist area.

It is important to recognise that physical gold and mining shares behave differently. While physical gold is better for inflation hedging and diversification, gold mining stocks provide an operating leverage for investors comfortable with greater risk. When gold prices rise, miners’ margins can expand faster than the underlying metal price, potentially amplifying returns. However, this leverage works in both directions, meaning mining stocks tend to be more volatile during downturns.

For those seeking a more flexible, actively managedapproach, the Jupiter Gold & Silver I GBP Acc offers diversified access across physical gold and silver bullion as well as mining companies, with flexibility for managers to adjust positioning as market conditions evolve. However, it is most suitable for investors with a higher risk tolerance who are comfortable with volatility and potential downside.

Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.