FTSE for Friday: what are the odds of a proper Santa Rally?

10th December 2021 07:48

by Alistair Strang from Trends and Targets

The FTSE 100 has recovered strongly from the Omicron crash, but can the index keep going? Independent analyst Alistair Strang stirs the tea leaves to find out.

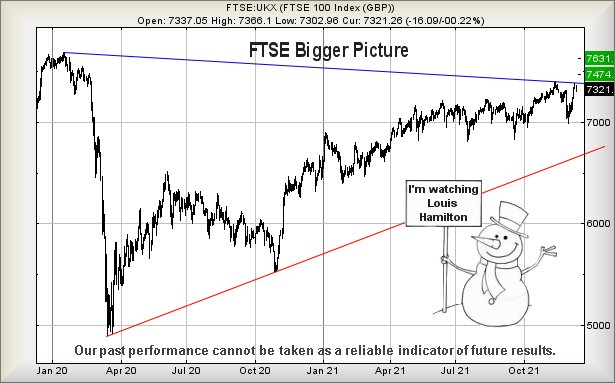

With the countdown to Christmas, as usual there’s the seasonal speculation for the possibility of a forthcoming “Santa Rally” in the marketplace. To be fair on the FTSE 100, presently trading around 7,320 points, the index only need to exceed 7,405 points to provide a pretty solid expectation for coming growth of around 4.2% from current, potentially to around 7,631 points.

Almost laughably, this would return the index to a level last seen at Christmas 2019, when the market closed on Christmas Eve at 7,632 points. Numbers can be a strange thing, yet as clearly exhibited by Genedrive (LSE:GDR) in our report yesterday, the share price indeed exceeded our 68p trigger and exactly hit our 81p initial target 44 minutes later. We also note our initial target was not exceeded, running the risk of the price messing around for a while.

- Don’t be shy, ask ii…what is a 'Santa rally' in the investing world?

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Why reading charts can help you become a better investor

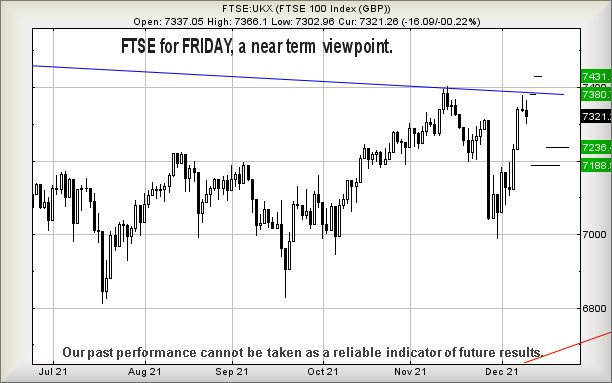

From a near-term perspective, the FTSE now requires to exceed 7,366 to suggest coming movement to an initial 7,380 points. If bettered, we can calculate a secondary at 7,431 points, quite cheerfully above the trigger level which is supposed to trigger a mythical “Santa Rally”.

However, should the dream come true in the days ahead, the Big Picture tells us above 7,405 is supposed to provoke FTSE a recovery cycle to an initial 7,474 with secondary, if bettered, at our 7,631 points.

Source: Trends and Targets. Past performance is not a guide to future performance

Should things intend for pear-shaped, below 7,287 looks capable of triggering reversal to an almost certain 7,236 points. If broken, we can calculate a secondary at 7,188 points and hopefully some sort of real bounce.

Have a good weekend, hopefully one which shall see a UK driver lift the F1 World Drivers championship for the eighth time.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.