The fund firms winning and losing money from investors

Much of the outflows can be traced back to a few particularly unpopular funds in each group.

31st January 2020 12:15

by Tom Bailey from interactive investor

Much of the outflows can be traced back to a few particularly unpopular funds in each group.

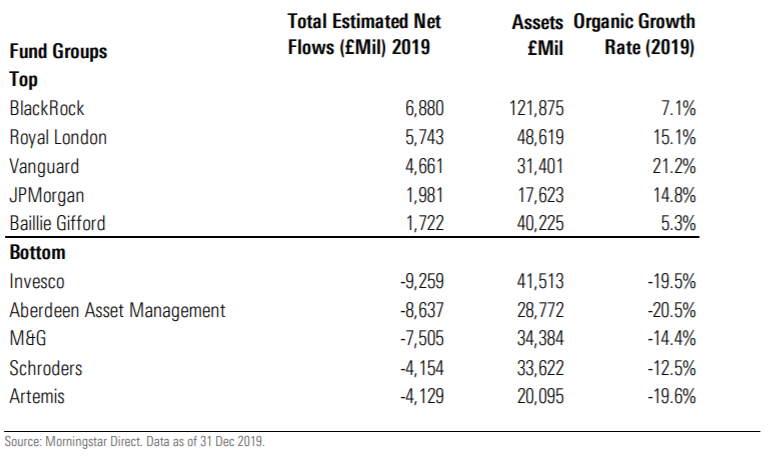

Invesco had a year it will want to forget, with investors pulling a total of £9.3 billion out of the fund groups various UK-domiciled funds in 2019.

The figures, published by Morningstar, show that Invesco saw the largest fund outflows of all fund groups over the year.

In a close second place was Aberdeen Asset Management, which saw a total of £8.2 billion worth of investors money head for the exit. M&G was in third place with £7.5 billion.

Much of those outflows could be traced back to particularly unpopular funds in each group.

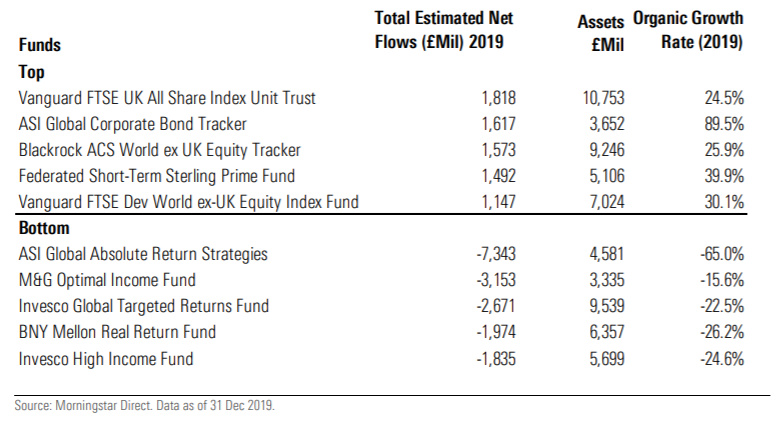

For example, Invesco Global Targeted Returns and Invesco High Income were responsible for half of Invesco’s outflows.

Meanwhile, ASI Global Absolute Return Strategies was responsible for the vast majority of Aberdeen Asset Management’s outflows, with a total of £7.3 billion being pulled out the fund. ASI Global Absolute Return Strategies saw the largest outflows of all funds in 2019 and went from the fourth largest UK-domiciled fund to 31st largest through the course of 2019.

The fund with the second largest outflows was M&G Optimal Income Fund. The £3.2 billion loss of assets made up a large part of M&G total group outflows (£7.5 billion).

Unsurprisingly, the fund groups with the largest inflows included both Vanguard and BlackRock. The latter topped the list, with inflows of £6.9 billion. Vanguard came in third place with £5.7 billion worth of inflows.

Much of this was the result of the continued shift by investors from active funds to passive funds, with 71% of inflows at BlackRock going into passive funds, and 96% at Vanguard.

While both fund groups provide actively managed funds, both groups have been pioneers of passive investing and are among the world’s largest providers of passive funds.

Both BlackRock and Vanguard also dominated the individual fund flow figures. Vanguard FTSE UK All Share Index Trust saw inflows of £1.8 billion, while BlackRock ACES World ex UK Equity Tracker took in £1.6 billion. Vanguard FTSE Developed World ex-UK Equity Index fund also took in £1.1 billion.

More surprising among list of top fund groups in 2019 was Royal London, which saw the second largest amount of inflows of £5.7 billion. Royal London Sterling Credit, Royal London Sustainable Leaders, and Royal London Cash Plus were largely responsible.

Among individual funds bonds also were also popular, with ASI Global Corporate Bond Tracker taking in £1.6 billion.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.