How are pension savers positioning their portfolios?

New interactive investor data publishes unique deep-dive into self-invested personal pension (SIPP) trends, in both accumulation and drawdown.

10th December 2025 14:38

Interactive investor, the UK’s second-largest investment platform, has launched its latest iteration of its SIPP Index, covering Q2 and Q3 2025. The SIPP index looks at investment trends and behaviour in accumulation and drawdown.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The pension landscape has continued to evolve over the two years since we’ve tracked our SIPP customer data. There is a landmark pensions review under way, pensions are set to be included in inheritance tax (IHT) calculations from April 2027 with further changes revealed in last week’s Autumn Budget. While the latest Budget saw no changes to the pension tax-free lump sum, it did confirm that salary sacrifice pension contributions above £2,000 will face National Insurance from April 2029.

This index provides unique insight into how SIPP customers are currently investing and positioning their pension portfolios during their working life, when they are accumulating wealth, and in retirement once they are in drawdown.

To view the full SIPP Index report, visit our website here.

Key findings

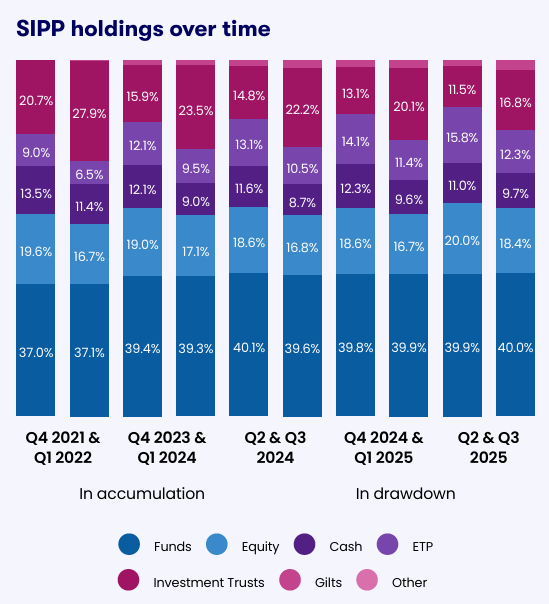

- SIPP customers continued to buy passive funds, with allocations to ETFs increasing for those in accumulation and in drawdown

- Customers bought more individual equities, with allocations at their highest level in 3 years (since Q1 2022)

- A money market fund is now the most popular holding for customers in drawdown for the first time

- Allocations to investment trusts reduced for those in accumulation and even further for those in drawdown

- Customers took a slightly earlier and bigger tax-free lump sum on average compared to the previous SIPP Index

- Both men and women continue to enjoy strong investment performance.

Commenting on the SIPP holdings data over time in both accumulation and drawdown, Kyle Caldwell, Funds and Investment Education Editor at interactive investor, says: “One of the key attractions of investment trusts is the ability to smooth income payments, which although not guaranteed, can provide a consistent stream of dividends even in choppier waters.

“Under the investment trust structure up to 15% of income generated by the underlying investments each year can be held back for a rainy day. Due to this, 10 investment trusts have achieved the remarkable feat of raising dividends each year for over half a century, while additionally there are 10 investment trusts that have raised income payouts year in, year out, for at least 20 years.

“As well as investing in mainstream markets – such as globally or investing in UK shares - investment trusts that invest in alternative asset areas, such as renewable energy infrastructure, also often pique the interest of our customers, with the high yields on offer a key attraction.

“However, demand for investment trustshas cooled in recent years, with one reason being interest rate rises. This has led to cash and low-risk bonds, such as gilts and money market funds, offering investors attractive inflation-beating yields with a lower level of risk versus investment trusts investing in shares or specialising in renewable energy. As a result, there has been less incentive for income-seeking investors to take on risk.

“Another factor at play has been the continued strong performance of global stock markets, which has led some investors to seek out global ETFs, which provide the return of the market for a low fee. While active funds offer the prospect of outperformance, this is not guaranteed and many fail to do so. Given how buoyant stock markets have been, some investors have been happy to accept the market average return.

“While time will tell, the coming years could see increased appetite for investment trusts – interest rates are falling which could see investors [happy to] increase risk in their pursuit of growing money in real terms given that this will dent the income attraction of lower-risk assets – cash and bonds.

“Moreover, there are concerns over how concentrated stock markets have become globally, and in the US, to technology companies and by extension to the artificial intelligence (AI) trend.”

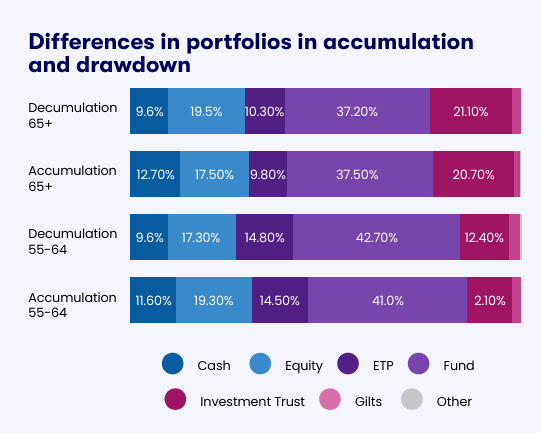

Craig Rickman adds: “When it comes to preferred asset weightings, it appears age is a bigger factor than whether the investor is in accumulation or drawdown. The data shows that investors aged 65 and over have a greater penchant for trusts, while those aged 55 to 64 have higher allocations to funds and ETPs.

“This could be explained, in part, by how we define drawdown, which is anyone who has accessed their SIPP in some shape or form, either by taking a regular income, a one-off taxable payment, a pension commencement lump sum or an uncrystallised funds pension commencement lump sum (UFPLS), where withdrawals are 25% tax-free and 75% taxable. Either way, the definition is broad and so captures those who’ve drawn money from the SIPP but might still be making either regular or ad-hoc contributions.

“What also sticks out is that those in the accumulation phase, regardless of age, are keeping a slightly higher proportion in cash than their drawdown counterparts. There are several reasons that might explain why. Some may be taking a leaf out of Warren Buffett’s book and beefing up cash reserves with concerns that markets might be overvalued. Alternatively, investors could be retaining some additional dry powder to seize stock-buying opportunities whenever they arise or taking a more defensive approach at the point they plan to access their savings draws closer.”

To view the full SIPP Index report, visit our website here.

Notes to editors

Glossary

Accumulation: Customers who have not yet taken income from their SIPP but may have taken a tax-free lump sum

Drawdown: Customers who have taken income from their SIPP

Returns: Trailing returns including dividend income ii customer performances quoted are median values to avoid the influence of outlier performance skewing the data.

Drawdown: This is defined as anyone who has taken a regular income, a one-off payment, a pension commencement lump sum or who is doing UFPLS.

The performance is calculated using the Time Weighted Rate of Return with returns calculated before each money transaction, then the results compounded over the reporting period. The time-weighted rate of return (TWR) is a measure of the compound rate of growth in a portfolio. It eliminates the distorting effects on growth rates created by inflows and outflows of money.

Then median averages are calculated independently for each group we analysed – so that outlier performances did not skew the results.

Index performance, unless otherwise stated, is ii using Morningstar, total return in GBP, to end September 2025.

Source: interactive investor - index performance: Morningstar Total Returns (base currencies) to 30 September 2025.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.