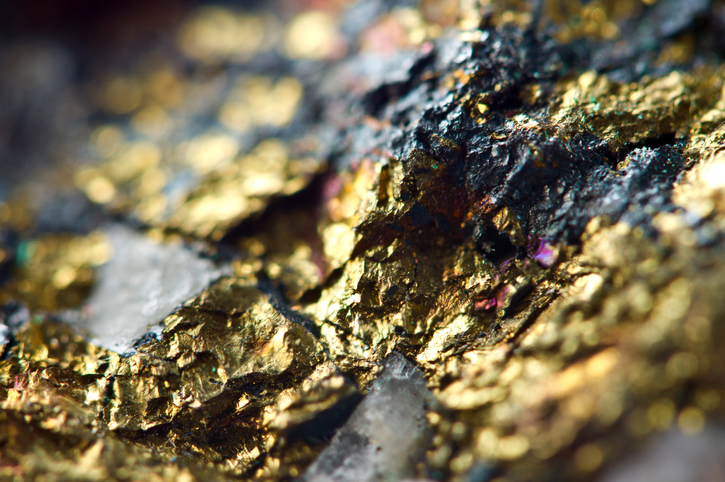

ii view: Fresnillo gold production hindered by Covid

Silver and gold prices are up nicely in 2020 and this mining play also offers dividend income.

21st October 2020 15:27

by Keith Bowman from interactive investor

Silver and gold prices are up nicely in 2020 and this mining play also offers dividend income.

Third-quarter production

- Silver production flat versus third quarter 2019

- Gold production down 17.7% versus third quarter 2019

Guidance:

- Gold production in the range of 745-775 thousand ounces (koz) now expected

Chief executive Octavio Alvidrez said:

"The health and safety of our people remains our number one priority, in particular during these challenging times in the face of a global pandemic. I remain both proud and grateful for the efforts our people across all our sites have made and the resilience they have shown in adapting so quickly to the many measures we have put in place to limit the spread of the virus.”

ii round-up:

Precious metals miner Fresnillo (LSE:FRES) lowered its full-year gold production estimate as preventive Covid-19 measures reduced staff numbers at its Herradura mine in North West Mexico.

Full-year gold production of 745-775 thousand ounces (koz) is now expected, down from a previous estimate of 785-815 koz.

Fresnillo shares fell by more than 3% in UK trading, having almost doubled in the year-to-date. Shares for fellow precious metal miner Petropavlovsk (LSE:POG) have more than doubled, while shares for Polymetal International (LSE:POLY) are up by nearly 50%.

Central bank moves to print money under the Covid-19 crisis has helped push the price of silver up by more than 80% in US dollar terms since late March global lockdowns. The price of gold is up by around a fifth since late March.

In late July, Fresnillo reported a 52% jump in adjusted first-half profits, buoyed by a combination of higher precious metal prices and group cost cutting.

Measures being taken to improve performance include actions to address contractor productivity and investing in plant and machinery, including a state-of-the-art tunnel boring machine.

The miner’s development projects remain on track, with the Pyrites Plant and optimisation of the beneficiation plant, both at Fresnillo, due for completion this year.

First-half results announced in late July saw Fresnillo declaring a dividend payment of 2.3 US cents, down on the 2019 interim payment of 2.6 cents per share.

ii view:

The mining industry is tough and often difficult for managements to navigate. Exploration success, operational issues, staff difficulties, the weather and now the challenges and disruption caused by Covid-19 all have the ability to affect operations.

For Fresnillo specifically, a highly focused portfolio of mined commodities adds to the risks when compared with more diverse rivals such as Rio Tinto (LSE:RIO) and BHP Group (LSE:BHP). Currency movements between commodities priced in US dollars, costs priced in Mexican Pesos and the share price listed on the UK stock market in sterling add further to potential volatility.

For investors, exposure to precious metals in a world of central bank money printing offers attraction. An estimated one-year dividend yield of just over 1% (not guaranteed) is still a return not generated if holding a precious metal directly. That said, operational challenges generate their own price volatility not suffered when holding the physical metal, while a near doubling in the share price in just a matter of months arguably offers its own reason for some near-term caution.

Positives:

- Implementing a performance improvement plan

- Receiving support from the Mexican Government

Negatives:

- Both silver and gold production retreated

- A near halving of the dividend suffered between 2018 and 2019

The average rating of stock market analysts:

Hold

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.