The investment trusts to benefit from regulatory reform

Disruption is threatened by increased regulation, with clear consequences for investment strategists.

13th September 2019 15:42

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

New research suggests disruption is threatened by increased regulation, with clear consequences for investment strategists...

Nanny knows best: how regulation is influencing returns

Callum Stokeld is an investment trust analyst at Kepler Trust Intelligence.

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

The most terrifying words in the English language are, or were at least according to the late president of the United States Ronald Regan: "I'm from the government and I'm here to help." and for investors in global smaller companies, this could be prescient.

Most investors into smaller caps are attracted by the prospect of exponential business growth. Young companies with innovative products are supposed to offer a disruptive threat to established companies, with huge potential markets to grow into. However, developments in society and politics could be calling into question the ability of smaller companies to generate the same excess returns in the coming decades.

The chief issue is regulation: while regulation is often mooted as in the interest of society at large, there is evidence that in recent years the chief beneficiaries of regulation have been the large players in existing industries, who are better able to adapt to the increasing costs. In this study we consider how the regulatory burden is affecting markets around the world and what it means for investors in the various regions.

The decline of competition

Whilst investing in companies with an 'economic moat' has been popular for many years (see our recent strategy note on quality), a new paper by Gutierrez and Philippon from New York University1 seems to provide evidence that barriers to entry have become structurally greater across many sectors, further boosting this strategy.

They used a valuation measure called Tobin's 'Q ratio, which measures a sector's market value against the replacement value of the underlying assets. A high Q ratio should theoretically suggest opportunities for disruption, as it should imply that it is relatively cheap for a new company to enter the field, while equity in that field is expensive. In turn, new entrants should over time lead to a lower Q ratio, as the value of the equity of the sector's companies will fall to reflect the lower returns on offer.

Until the late 1990s, the authors found that this was indeed how it worked in practice; indeed, the economist Andrew Smithers published evidence around this time that Q had historically had the best forecasting record for long-term returns – i.e. if a sector or the market had a high Q ratio, it was strongly suggestive that returns to investors would be poor and vice versa2. However, this relationship has since broken down, with high Q levels seemingly no longer serving as an attraction to new entrants.

One possible reason why is that returns to scale may not be properly accounted for. This seems plausible in a world where the 'network effects' of goliaths such as Amazon and Facebook are readily apparent. Yet Gutierrez and Philippon's study finds that the concentration of an industry is not linked to the decline in the predictive power of Q. In other words, it is not the benefits of scale to a few giants which are keeping new entrants out of the markets. This corroborates earlier studies, which similarly found no significant increases in returns to scale in recent years3.

Another reason could be that intangible assets have been poorly captured in the analysis – the technology companies of today typically have much higher intangible assets and lower tangible assets than the typical company of the past. However, the authors find that intangible investment is not the culprit. In any case, other studies have suggested that Tobin's Q adequately captures intangible investment4.

However, the authors did find an identifiable relationship between greater levels of regulation in a sector and a decline in the predictive power of Q. Large bursts of regulation in a sector are also shown to correlate to increased profitability within that sector, which was not the case in the past. They also found a relationship between total lobbying spend and regulatory burdens, with a corollary effect being higher profits and fewer new entrants – but only after 2000. Since 2000, large regulatory changes have led to higher profitability for incumbent companies, fewer new entrants and a decline in the predictive power of Q.

The impact of regulation

The trend to greater regulation, then, has generally had the effect of benefitting larger companies at the expense of smaller companies. Compliance burdens to new regulations often have relatively fixed cost bases (in both time and monetary values), which the burden of meeting is effectively easier to manage for companies that hold greater scale or existing infrastructure.

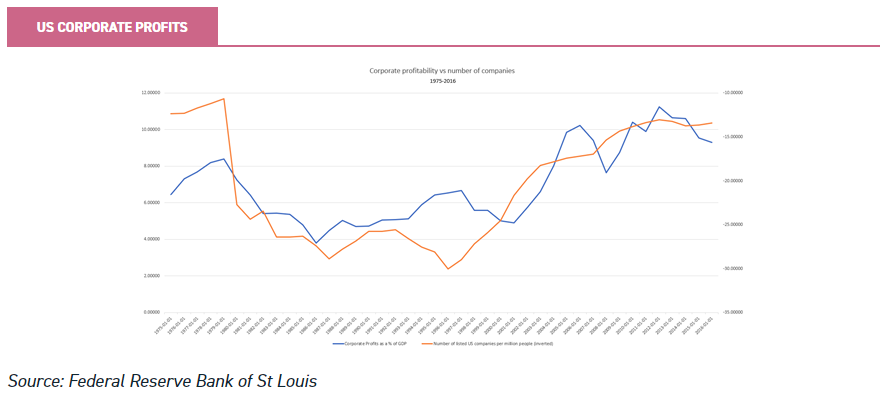

This may be one reason why corporate profits in the US have been rising while the number of public companies has been falling, as fewer new companies can break into an industry and compete away the profits of the incumbents. The graph below shows US corporate profits as a percentage of GDP, and the total number of listed companies per million people in the US. The latter is inverted, so that as the line rises it represents a reduction in the number of companies listed per million people living in the US.

There arise other serious issues from this. Studies have found that as industries become more concentrated, research & development spending is below that of less concentrated industries5, suggesting concentration and incumbency is bad for innovation and productivity growth. Younger, smaller companies tend to display greater labour productivity growth; it has been estimated that in the first five years of a company's life the average shows productivity growth of nearly 20%, yet this effect is nullified by the time the company is 10 years old6. Yet increasingly employment in the US is being created instead by large and established firms7. Productivity growth has been notably lax in much of the global economy in the post-2008-9 period, and it becomes hard not to associate this with increasing industry concentration.

For investors, all of this raises serious questions about future regulatory burdens, productivity and economic growth, and likely economic responses to various stimuli. It may be that 'no man is an island' (to the shock of the residents of Douglas); but if we see an uncoupling of attitudes to regulation going forward, we may see greater disparities in market dynamics.

We now consider the implications of regulation across a number of the world's major markets.

US

In the US, with a forthcoming presidential election in 2020, policy direction post-election will clearly have some determination on subsequent market returns. Making an assessment as to what this would be, unfortunately, involves an assessment of not only the electoral outcome, but the actual effects.

Deregulation is certainly a goal of the present administration, including an executive order which aimed to eliminate two existing regulations for every new federal regulation enacted. Measuring this is notoriously difficult, and often subjective, but the evidence seems to suggest that what has primarily occurred is in fact a sharp reduction in the rate of increase in regulations as opposed to an actual decrease.

The short-term evidence certainly suggests that incumbency advantage remains; following cuts to the US corporate tax rate, companies enjoyed bumper profits throughout much of 2018, yet the evidence at present is that a significant pick-up in capital expenditure failed to materialise. This suggests that companies do not feel the need to invest further to maintain their market position, though it should also be noted that corporate cash flow was already significantly positive prior to the tax cut (and as such companies had plentiful cash for investment should they have so wished).

If we do see a sea-change in the environment in the US, it may well be that small-cap strategies will reap the benefits. Jupiter US Smaller Companies (LSE:JUS) would benefit from a scenario where US small caps were in favour. The manager of this trust, Robert Siddles, has a significant focus on 'quality' investment metrics, and favours strong franchises (with attendant links to industry incumbency). However, the trust also has exposure to recovery stocks and turnarounds. These are strategies that could benefit from a macroeconomic environment whereby more sector disruption is seen, and market share is more fluidly proportioned.

Should the status quo persevere, however, and the regulatory burden continue increasing to the benefit of incumbents, this would be of benefit to the types of companies held by the Baillie Gifford US Growth (LSE:USA). This is a relatively new product, having launched in March 2018, but offers access to a highly experienced management team from an investment house whose investment style has enjoyed considerable success in recent years. The managers seek to identify exceptional growth opportunities offering innovations which can offer significant societal benefits.

As a result, the portfolio is highly skewed towards disruptive companies, but the management also seek to ascertain that these companies can create and subsequently maintain deep competitive moats once established. The trust invests a significant proportion (up to 50%) of its capital in unlisted businesses, noting that these are increasingly staying private for longer. This allows them access to more patient, long-term capital flows whilst they build scale to allow them to compete and disrupt.

Europe & the UK

Gutierrez and Philippon studied the US economy and companies, as there is greater data availability there (the necessary data for evaluating the Q ratio is often not available, or is too short term, in other countries). Recent years have seen an increased commentary from various national leaders on the need for 'European champions' to compete globally with US and Chinese companies, suggesting there is unlikely to be political opposition to increased corporate concentration, though there are contrasting signals from competition regulators. The uncertain future of the Eurozone, and increasing political divergence in the various countries of the European Union, adds difficulty for fund selectors.

Going forward, should the environment in Europe resemble that described above (with captive regulation influenced increasingly by lobbying) then we believe investment strategies likely to outperform will be those based on identifying companies with economic moats and barriers to entry. This is typically synonymous with the 'Quality' factor investment style.

The Jupiter European Opportunities (LSE:JEO) trust managed by Alexander Darwall, has for many years concentrated on finding industry leaders with large economic moats. Strong management teams with the ability to maintain a sustainable competitive advantage are key considerations when the manager undertakes stock selection, particularly if the company already holds proprietary technology that helps enable this.

Whilst it remains early days, the general tenor of the new Johnson government seems to incline generally towards deregulation, and to use Brexit as an opportunity to substantially overhaul the UK domestic regulatory regime (though this is likely to face significant opposition from within the Conservative party). Should, however, it be able to pursue such a regime, smaller companies in the UK, shown repeatedly in investor surveys to be a 'hated' asset class in recent years, could be significant beneficiaries.

One trust which has suffered in this environment, and would benefit from improved sentiment toward the UK is Miton UK Microcap trust (LSE:MINI) managed by Gervais Williams. Whilst the top-down considerations Williams has implemented across his portfolio do not pertain directly to the issues raised above, he has in recent years identified a structural problem of underinvestment and lax productivity growth in Western economies. These have been hidden by the ability to source low-cost imports as barriers to trade reduced (offsetting inflationary pressures), which has allowed more sustained increases in leverage as central banks remained in structural easing cycles.

This is linked to the issue around incumbency being discussed: low productivity may, perhaps in part, be explained by it being difficult for new entrants to break into markets. As such, a change in environment could benefit precisely the companies he prefers, where management has aligned interests with shareholders in generating sustainable long-term growth. Companies in this portfolio tend to have low levels of debt or net cash on the balance sheet, and to have high levels of capital investment, which they can ordinarily finance from existing cash flows. Innovation is a key consideration, with the manager looking for companies which can generate natural growth over many years.

Japan

Japan is different to the rest of the world, as anyone who has eaten one of their KitKats can verify8. Corporate incumbency and longevity are more accepted and embedded within the Japanese social contract, with an attendant payoff that focuses on high levels of employee retention and remuneration at the expense of shareholders (as many activist investors have previously discovered).

However, there are tentative signs that the Abe government is more vigorously pursuing its 'Third Arrow' of 'Abenomics', and increasingly trying to reform corporate governance, reduce excessive corporate cash and unnecessary cross-shareholdings, and thereby boost business dynamism and fluidity of market share. It could therefore potentially be heading down a very different route from the US and Europe.

As we in the UK have learned to our cost, politics are unpredictable and it should not be taken for granted that these reforms will be implemented, but if they are the AVI Japan Opportunity (LSE:AJOT) trust is positioned to benefit from them should they succeed. The managers have identified a substantial universe of companies in Japan that have significant cash or transferable securities on their balance sheet, often equivalent to their entire market capitalisation. With the tailwind of the Abe reforms, the managers are looking to engage with companies to encourage them to dispense with cross-shareholdings, and return excess cash to investors.

[1] Gutierrez and Philippon: 'The Failure of Free Entry'

[2] Smither & Wright: 'Valuing Wall Street'

[3] Diez and Villegas-Sanchez: 'Global declining competition'

[4] Peters & Taylor: 'Intangible Capital and the investment-q relation'

[5] Acs and Audrestsch: 'Innovation in Large and Small Firms: An Empirical Analysis'

[6] Alon, Berger, Dent and Pugsley: 'Older and slower: The startup deficit's lasting effects on aggregate productivity growth'

[7] Grullon, Larkin and Michaely: 'Are US Industries Becoming More Concentrated?'

[8] Normandy Madden: 'Soy-Sauce-Flavored Kit Kats? In Japan, They're No.1'

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.