Market snapshot: return of the tariff threat

A buoyant festive period has been replaced by a clear sense of unease around geopolitical events triggered by the US. ii's head of markets assesses the current situation.

19th January 2026 08:25

by Richard Hunter from interactive investor

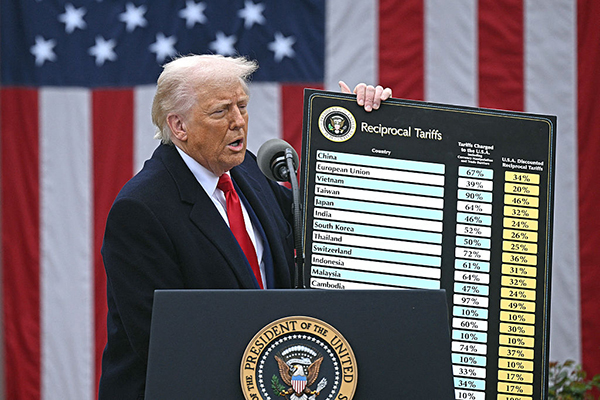

US markets ended last week on the back foot as Presidential interference yet again took its toll.

The latest salvo from the White House related not only to the desire to take control of Greenland, but also the threat to impose hefty tariffs on eight European countries who are in opposition to the plan.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

At the same time, and despite a generally promising set of results across the sector, banks remained under pressure as the implications of a cap on credit card rates prevailed. The banks have already voiced their opposition where, quite apart from their own commercial interests, there could be a lessening of available credit to both individuals and small businesses, the former of which is a crucial plank in US economic growth.

In addition, the succession plan for the Chair of the Federal Reserve took another turn, with investors fearing that political pressure could supplant the Fed’s important independence and in turn fuel inflation at a time when higher prices are beginning to come under control.

In the meantime, this week will bring the latest Personal Consumption Expenditures index reading, the Fed’s preferred measure of inflation, although barring a major shock the consensus very much remains that there will be no change to interest rates this month.

- Stockwatch: further upside in this FTSE 100 growth share?

- Shares for the future: how I find companies for my Decision Engine

- Investment outlook: expert opinion, analysis and ideas

Although US markets will be closed in observance of Martin Luther King Jr Day, very early futures indications for tomorrow show that the geopolitical backdrop could lead to further weakness. In the year so far, and despite last week’s marginal declines, the main indices have made some progress, with gains of 1.4% and 1.2% for the S&P500 and Nasdaq respectively.

Further indications of the rotation trade into more traditional as well as smaller cap stocks have been reflected by gains of 2.7% for the Dow Jones and an early 7% spike across the Russell 2000 index.

Asian markets swerved the latest geopolitical developments but were mixed on domestic updates. China reported 5% growth in its economy last year, eliminating some of the concerns which had overhung the market given the headwinds of tepid consumer demand, high youth unemployment and a beleaguered property sector. In Japan, the domestic political reaction to a proposed new parliament has come with some uncertainty, as a potential cut in tax rates could exacerbate any budget weakness.

On home shores, markets were unable to shake off the global insouciance at the open, not least of which was due to the potential extra 10% tariffs which could be levied on the UK given their inclusion in the group of eight countries opposing the US President’s intended move on Greenland.

- 20 top small-cap share tips for 2026

- 21 top growth stocks for 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

By the same token, however, the uncertainty propelled the likes of gold and silver to record levels as the haven trade persisted, giving further boosts to two blue-chips which had provided stellar returns over the last year. Over the previous 12 months, Endeavour Mining (LSE:EDV) shares have now risen by 172%, while Fresnillo (LSE:FRES) have added an eye-watering 471% as investors flocked to these simple plays on the resource trade.

The general unease also boosted defence stocks such as BAE Systems (LSE:BA.) and Babcock International Group (LSE:BAB), although the FTSE100 as a whole retreated on a broad markdown which included further weakness for Barclays (LSE:BARC) shares given its exposure to the US credit card market, where the proposed caps are weighing on US banks. Even so, the premier index remains ahead by 2.8% in the first few weeks of trading this year and continues to provide a number of alternatives to investors seeking more stable asset destinations.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.