Stockwatch: further upside in this FTSE 100 growth share?

From small-cap to blue-chip, this company has had a meteoric rise and continues to thrive. Analyst Edmond Jackson explains his take on the stock.

16th January 2026 11:01

by Edmond Jackson from interactive investor

After engaging the speculative roller coaster of AIM-listed semiconductor wafer manufacturer IQE (LSE:IQE)last week, the example of FTSE 100 star Diploma (LSE:DPLM) is an interesting and stark contrast – with key lessons for stock pickers.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Diploma is a technology business in the sense that its life sciences division makes medical instruments, diagnostic equipment and lab products for doctors and scientists. But the group does not face a “feast to famine” demand profile like I cited for tech companies in my last piece, where the market can shift radically every few years and the business may have to reinvent itself.

The group has a slight flavour of “industrial cyclical” in the sense that its controls side provides wires and cables, connectors and automation parts – “the bolts that hold planes and race cars together” – and its seals side provides gaskets, hydraulic hoses and fittings with applications from tractors to wind turbines. Yet earnings quality is implied by the essential nature of these products.

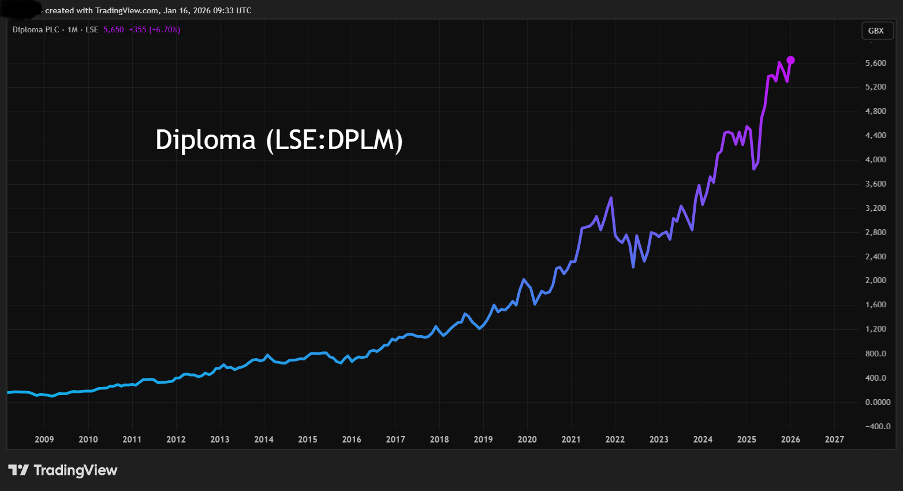

Diploma’s long-term growth chart – the best on the London market? – scotches any doubt over earnings quality:

Source: TradingView. Past performance is not a guide to future performance.

Down-to-earth virtues plus impressive financial ratios

No gripping new technology story is involved here, and while Diploma has strong market positions, there is competition. It would be a stretch to say that Diploma meets Warren Buffett’s preference for a “moat”.

A “buy and build” business model is involved, which has its critics given that some company managers execute it poorly and over-reach with debt. Yet Diploma is interesting for the strategic change it undertook at the end of the 20th century, when it exited electronic components distribution, building products and specialist steels. The decision to target controls, seals and life sciences has proved a grand slam winner, taking Diploma from small-cap to FTSE 100 status over a decade.

- Shares round-up: market reaction to Hays and Diploma updates

- Investment outlook: expert opinion, analysis and ideas

Looking back in my notes, I first drew attention to Diploma’s strengths during 2010 at 200p that April, a price/earnings (PE) below 13x appearing modest if the post-crash, global economy continued to improve. I particularly liked a record of return on capital employed averaging 28% from 2000 to 2009, even including 22% in the trough of 2009.

I said: “The trend ought to have further to run because management cut costs in response to recession and now Diploma’s markets are improving...excellent progress with a restructuring programme to establish the group in international markets...EPS [earnings per share] growth averaging 16% over the last five years, organically and by acquisitions.” The shares looked “an attractive tuck-away in an ISA or SIPP without having to worry about trading quite actively”.

The long-term virtue of attention to key financial ratios also helped in terms of a balance sheet current ratio (those assets versus liabilities) of 2.5x; no debt, and acquisitions funded by cash flow, which rose 33% to £23.5 million even in the generally tough September 2009 year. So, I reiterated Diploma’s strengths in November 2010 at 280p and August 2011 at 380p, which also holds a lesson for buying into a rising chart.

As a result of all this, Diploma shares have multiplied over 28x to 5,670p, and yesterday’s 2% rise would have constituted 55% for an April 2010 buyer. Given the yield was 4% based on an 8.0p dividend, with that having risen to a projected 66p, the locked-in yield would have been 33%. Is investment really a choice between capital growth and income?

What now with shares on 28x PE and 1.4% yield?

Of six brokers covering Diploma, all rate it a “buy” - typically targeting 6,000p, although Berenberg is 6,350p to 6,600p.

There is another lesson here, regarding the practicality of share price targets, and why I personally have become a bit sceptical that they can ever be meaningful in a long-term context. When I wrote in November 2010, Panmure Gordon – Diploma’s broker – had just raised its target to 325p, which could hardly have been “fair value” at 5.7% of Diploma’s market value just over 15 years later.

Not to dismiss efforts to ascertain what a business might be worth, aside from swings in market value, but cynics who argue that price targets are largely “a finger in the wind” do not seem unfair. The perspective is inevitably short term, but the long run is where big money is made (or lost).

- Analyst names top pick in this high-flying sector

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Now that Diploma is in the FTSE 100, selling essential products and with a distinguished financial record, not surprisingly fund managers regard it as a quality holding. Some premium to earning power is inevitable, especially given that artificial intelligence (AI) informs us that Diploma has never issued a profit warning, only upgrades.

Such a habit persisted in 2025 in that organic growth rate targets were raised to 8% last May then 10% in July, which actually became 11% at November’s annual results. Moreover, from the long-term financial record, last year’s reported operating margin rose to 18.1% having been 13% to 15% the previous seven years. Similarly, return on capital recovered to over 18%, if still shy of the 23% reported in 2018.

Diploma - financial summary

Year-end 30 Sep

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 485 | 545 | 538 | 787 | 1,013 | 1,200 | 1,363 | 1,525 |

| Operating margin (%) | 15.1 | 15.4 | 13.0 | 13.2 | 14.2 | 14.7 | 14.9 | 18.1 |

| Operating profit (£m) | 73.2 | 84.1 | 69.8 | 104 | 144 | 176 | 204 | 276 |

| Net profit (£m) | 53.8 | 61.9 | 49.3 | 69.8 | 94.7 | 118 | 129 | 185 |

| EPS - reported (p) | 47.6 | 54.7 | 43.5 | 56.1 | 76.0 | 90.4 | 96 | 137 |

| EPS - normalised (p) | 46.5 | 54.3 | 47.4 | 61.7 | 78.7 | 120 | 127 | 153 |

| Operating cashflow/share (p) | 57.7 | 62.1 | 75.3 | 93.3 | 100 | 145 | 144 | 199 |

| Capital expenditure/share (p) | 5.8 | 9.6 | 8.3 | 5.0 | 12.4 | 17.7 | 14.6 | 10.7 |

| Free cashflow/share (p) | 51.9 | 52.5 | 67.0 | 88.3 | 88.0 | 128 | 129 | 188 |

| Dividends per share (p) | 25.5 | 29.0 | 30.0 | 42.6 | 53.8 | 56.5 | 59.3 | 62.3 |

| Covered by earnings (x) | 1.9 | 1.9 | 1.5 | 1.3 | 1.4 | 1.6 | 1.6 | 2.2 |

| Return on total capital (%) | 23.3 | 21.4 | 12.0 | 12.9 | 12.9 | 13.0 | 13.6 | 18.2 |

| Cash (£m) | 36.0 | 27.0 | 207 | 24.8 | 41.7 | 62.4 | 55.5 | 81.7 |

| Net debt (£m) | -36.0 | 15.1 | -173 | 230 | 398 | 335 | 497 | 383 |

| Net assets (£m) | 291 | 321 | 527 | 536 | 662 | 896 | 888 | 990 |

| Net assets per share (p) | 257 | 284 | 423 | 431 | 531 | 668 | 662 | 738 |

Source: company accounts.

That key performance numbers fluctuate is, encouragingly realistic. In the 1980s and 1990s, Rentokil Initial (LSE:RTO) made a fetish out of achieving 20% annual EPS growth, only to slump from 1998, prompting a change of strategy and CEO. Adhering to very specific targets like this - especially earnings - can mean excess risk with acquisitions or aggressive accounting, although it was a 2022 acquisition that disrupted Rentokil’s long-term growth chart from 2009.

But it is hard to ignore how Diploma’s forward PEG ratio (PE-to-growth) is 1.8x, when ideally you are looking for under 1.0x and might possibly make an exception up to 1.5x. Diploma is also nowadays a £7.6 billion company and the chances of circa 20% EPS growth are becoming more challenging unless, say, a radical large acquisition is made. But that might only provide a near-term EPS boost while raising the risk profile.

A 1.4% prospective yield versus 4% in 2010 also suggests that the shares are fully valued, the hope being Diploma can “grow into” this valuation. Disrespecting such potential can often be why investors miss out on highly successful growth shares that look expensive. You would have to go back 10 years at least for the Magnificent Seven to seemingly offer value.

Interestingly, Rentokil Initial is similarly on a forward PE of 19x, a PEG of 1.9x and a yield of 2.3% - inviting the question of whether blue-chip FTSE 100 shares with international revenues have benefited from global indices at all-time highs.

Three Diploma directors have recently bought shares

Despite the all-time high on 14 January, two non-executive directors bought respectively a further £28,000 and nearly £20,000 worth of shares. These were not initial purchases by new non-executive directors encouraged to show partnership with outside shareholders.

Also, the new finance director bought £22,000 worth a month ago, which could conceivably be a condition of employment (to hold equity, not just own “risk-free” options). Yet as an existing group financial controller since 2022, last November he did exercise 9,433 share options at 0p, selling 4,446 shares to raise £234,000 (necessary significantly to pay tax arising).

While the shares slumped 23% to 3,620p last April in response to US tariffs – over half of group revenues being US-derived – the price soon advanced once it was realised that Diploma’s US businesses source over 80% of their products domestically, hence similar figures for generating revenue within the US. A local supply chain limits the direct effect of import tariffs.

Moreover, a 14 January AGM statement cited 14% organic revenue growth in the first quarter of the new financial year (before the contribution of various small acquisitions), albeit first-half weighted and with 6% guidance maintained for the full year to 30 September.

I think price in the short to medium term is likely to move with the market. Management cites a “healthy pipeline” with respect to acquisitions, which are key to enhancing growth in support of the rating. A key risk is that the PE moderates somewhat over the next five years. In terms of a firm stance, I therefore believe “hold” is more appropriate.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.