Over half of UK pension savers saving for retirement outside pension

interactive investor research reveals worrying over-reliance on cash.

19th December 2025 11:03

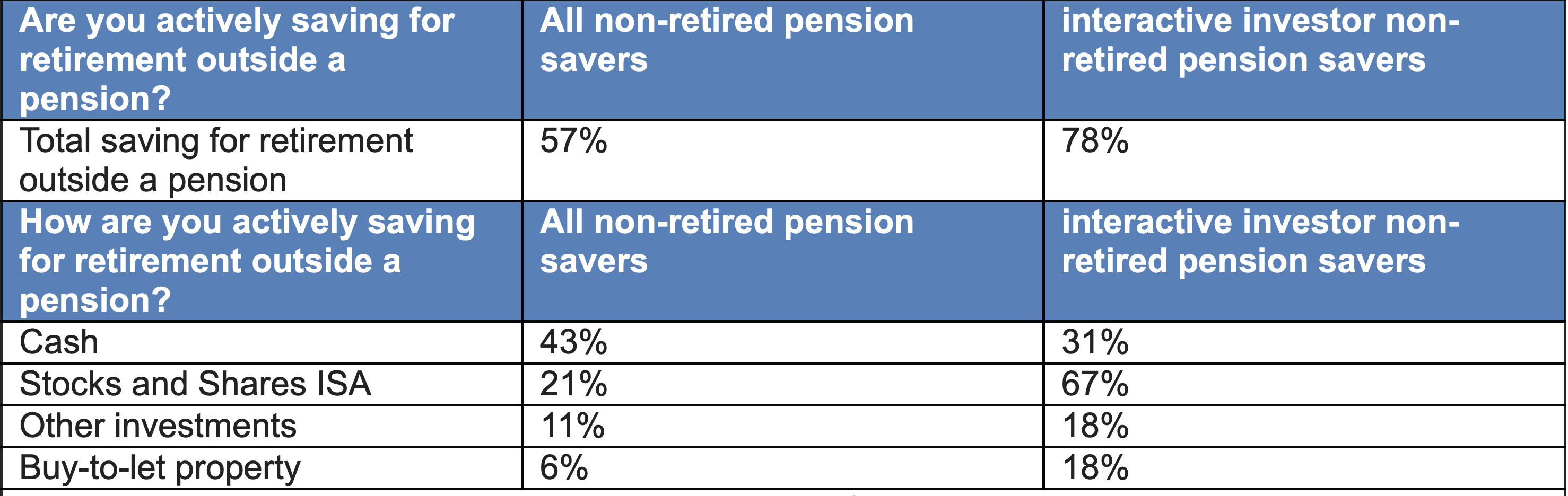

New research from interactive investor (ii), the UK’s leading flat-fee investment platform, reveals that over half of UK adults (57%)* who are still working, are saving for retirement outside of their pension - using cash savings, stocks and shares ISAs, buy-to-let properties, and other investments to build their long-term wealth**.

While on the whole this is encouraging, the data unearths a worrying trend - a striking over-reliance on low-yielding cash savings being used to fund long-term goals.

Key points:

- This latest research reveals that people are more than twice as likely to save for their retirement in cash (43%) rather than in a stocks and shares ISA (21%).

- When it comes to interactive investor customers, they are more likely to be saving outside a pension for retirement compared with the population as a whole (78% vs 57%) – a 21% gap.

Pension disillusionment and retirement saving strategies

Camilla Esmund, senior manager, interactive investor, explains: “The pension landscape has been firmly in the spotlight over the past year, especially in the months leading up to last month’s hotly anticipated Autumn Budget. Speculated reforms to the retirement landscape raised concerns over the future of pensions, potentially undermining them as an important tool for long-term financial resilience. But this isn’t a recent phenomenon.

“In the launch of interactive investor’s Great British Retirement Survey earlier this year, interactive investor called for more consistency of the pension rules. It’s clear from our research that the constant tinkering of the pension rules is harming public trust in pensions, disincentivising retirement saving, and risks widening the glaring pension engagement gap we have in the UK. Without urgent action to support savers, millions may reach later life without enough money to live comfortably.”

Esmund adds: “Pensions are a core part of building long-term financial security; they offer fantastic advantages we don’t see elsewhere, including employer contributions, upfront tax relief, tax-free growth, and a generous 25% tax-free lump sum. However, we know not enough people are saving enough into their pension.

“There are plenty of ways to be savvy about your pension saving, and as well as being strong wealth-building tools in their own right, they can also work well with other tax-efficient saving tools such as stocks & shares ISAs.

“However, it’s concerning that so many are opting to save in cash for retirement. Higher interest rates give the impression that cash savings are a good long-term option, but interest historically lags behind investment growth. This means the value of cash typically erodes over time. While it makes sense to have an adequate cash buffer, people risk missing out on years of investment compounding and could materially damage their retirement prospects.”

The role of stocks and shares ISAs and the power of consolidating investments

Esmund adds: “We can see from our data that interactive investor customers, who have enjoyed strong performance over the long term, recognise that investments tend to grow more than cash over time, using stocks and shares ISAs to boost their retirement savings.

“For those who are comfortable with taking more risk, investing in the stock market can generate more long-term growth on their funds, benefiting from compound returns. What’s more, by using an ISA they’re shielding any growth and dividends from tax, helping their pot to grow quicker.

“When it comes to supplementing their retirement pot, stocks and shares ISAs can work well, for a couple of reasons. First, unlike pensions, they can access the money at point, offering some much-treasured liquidity. And second, the tax-free treatment of ISAs withdrawals can be a great way to help their retirement income go further.

“A number of investors might be looking to consolidating their investments, too; housing multiple investments under one roof, on one platform. There are obvious benefits here when it comes to flexibility and control, as investors can monitor all their investments in one place, whether that’s their ISA or personal pension or both, helping them to plan more effectively.

“This is especially important when using various accounts to plan for a specific goal like retirement. It helps keep costs under control, too, provided the platform used offers good value. At interactive investor, a flat fee subscription model underpins our service, with plans designed to meet different customer needs for a more personalised investment experience.”

Note - excludes short-term savings, which are not set aside for retirement. These are non-retirees who have a pension but are using one or multiple additional vehicles to save for later life.

Data from Opinium Research between 13 February 2025 and 29 April 2025. The adult sample is nationally representative. The ii sample is from our interactive investor community (both customers and highly engaged newsletter subscribers).

*A note about the research sample: We spoke to 9,000 people across the UK, using award-winning consultancy Opinium Research between 13 February 2025 and 29 April 2025 to find out more about their retirement plans, financial worries and finances. The sample is split into two – 5,000 are representative of the whole UK population and these results make up the bulk of the report (weighted to be nationally representative, based on age, gender, region and ethnicity). The remaining 4,000 are from our interactive investor community (both customers and highly engaged newsletter subscribers) who are largely experienced investors and tend to be wealthier on average.

**Non-retirees who have a pension but are using one or multiple additional vehicles to save for later life

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.