Share Sleuth: Two buys and two sells

Some selling was required to make space for this US military supplier in the Share Sleuth portfolio.

7th March 2019 11:20

by Richard Beddard from interactive investor

Some selling was required to make space for this US military supplier in the Share Sleuth portfolio.

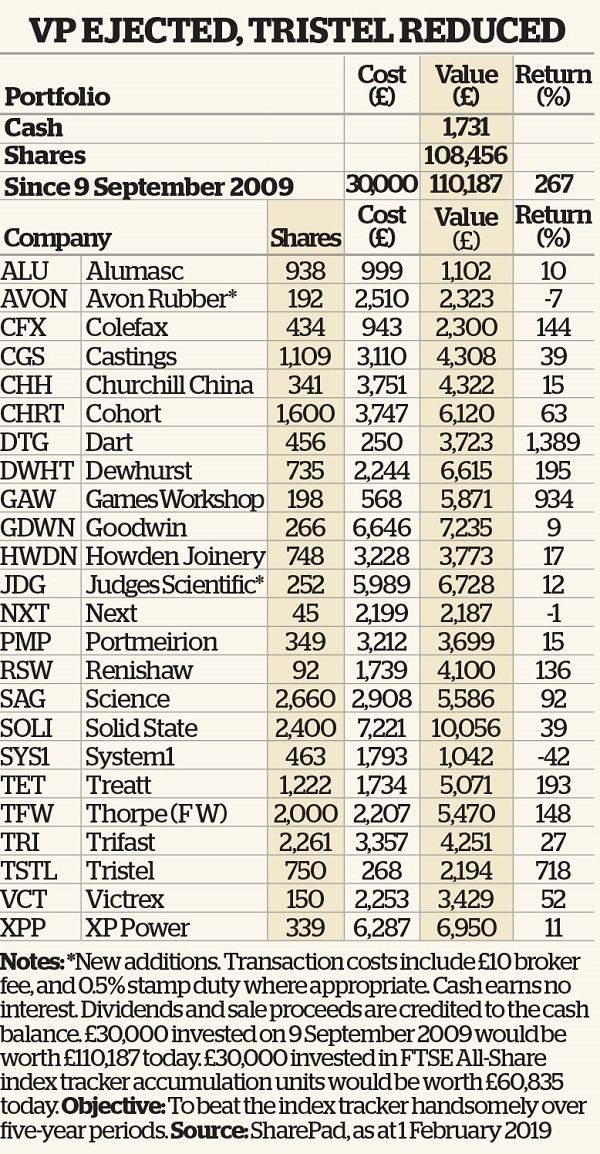

Following on from last month's trades, I have again removed or reduced my holding in two of the portfolio's shares in order to increase or add holdings in two others.

Vp (LSE:VP.), the specialist plant and tool hire company, has gone at a price of 971p, the real-time price quoted by a stockbroker. After deducting £10 in lieu of broker fees, the transaction raised £2,135. I also more than halved the portfolio's holding in Tristel (LSE:TSTL) at a price of 266p, raising £2,492 after fees. Tristel manufactures hospital disinfectant.

In their place, Avon Rubber (LSE:AVON) joins the portfolio at a price of £12.95, which cost £2,510 including charges in lieu of fees and stamp duty, and I added 102 more shares in Judges Scientific (LSE:JDG) at £24.40, for a total cost of £2,499.

While the past couple of months have involved several trades – at least half a year's worth at my usual rate – the portfolio is still evolving slowly. It now comprises 24 shares, having lost three of its smaller holdings and gained one new one. For the most part, I have been increasing holdings in existing shares that I am confident will prosper through thick and thin and that are also trading at knock-down prices, and decreasing investment in shares I am less confident about.

By rights, Tristel ought to be out of the portfolio because the shares trade on a very high multiple, 34 times the company's most recent four-year adjusted profit – but it has unique products and I am unusually confident in the business, so I have retained a small holding. Tristel is a Share Sleuth portfolio star, having earned an annualised return of nearly 36% since I added it in 2012.

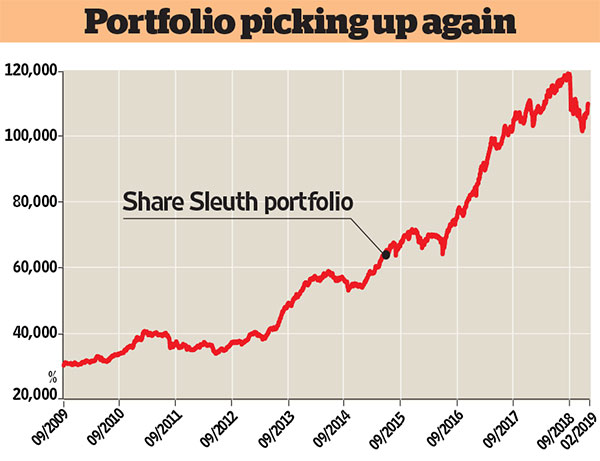

Source: interactive investor Past performance is not a guide to future performance

Sad to see Vp go

Vp has also served the portfolio well, having earned an annualised return of 21% since I added it earlier the same year. I am sad to see Vp go – seven years is not a long time to hold a share, and I might one day find a reason to add it back; but the firm is highly rated considering construction is a capricious industry and it has considerable financial obligations. That does not mean I predict doom for Vp. I just think the qualities of Judges Scientific and Avon Rubber are more undervalued by traders in the stockmarket.

I profiled Avon Rubber in the Share Watch column of Money Observer's January edition, and concluded that the company is using hard-won expertise to expand market-leading niches in protection and milking. The company has prospered hugely over the past decade from a contract to supply the US military's General Service Respirator, but orders for these gas masks, which last up to 10 years, are now expected to decline. News in January that the company has agreed a new contract for aircrew face masks, designed in collaboration with the US Department of Defence, reduces my concern that Avon Protection might be overly dependent on the General Respirator contract.

Judges Scientific is recovering from a period in which two of its biggest acquisitions were making little or no money. The whole group of 16 companies has consistently prospered, but profitability has been below par in recent years. A series of upbeat trading statements from the company suggests things may be returning to normal.

Glance at the performance table and you will see that the Avon trade has not gone particularly well in its first few weeks. The Judges trade, incidentally, has gone well, although you cannot tell from the table, as it shows the portfolio’s entire holding in each company, including the shares it already held. I make no claim to be able to read the stockmarket, so I take these short-term movements in my stride.

Buying shares with the intention of holding for 10 years or more liberates us from worrying about precisely what price we pay. If Avon Rubber is as good a company as I think it is, in 2029 it will not matter much whether I added the shares at £12.95, which I did, or £12.18, the price they fell to a few weeks later.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.