Stockwatch: four retail shares - here’s my pick of the bunch

Analyst Edmond Jackson evaluates UK retail and bull/bear perspectives, naming his favourite plays in a ‘fascinating’ sector.

19th December 2025 11:21

by Edmond Jackson from interactive investor

Retail has frequently been touted as a sector to avoid or even be short of, yet circa 10% jumps this past week in the shares of Frasers Group (LSE:FRAS) and Currys (LSE:CURY) imply that market pricing is quite jaundiced.

Companies may only need effectively to reassure that they are “on track” – Frasers, with a buyback programme, Currys’ full year to 30 April due to meet expectations – to trigger price rises.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Moreover, these two shares don’t have any short-sold element, the price jumps do not relate to any bear squeeze. Disclosed shorts over 0.5% of issued share capital are 5.1% at Sainsbury (J) (LSE:SBRY) and 9.6% at Greggs (LSE:GRG) where disclosed shorts have shot up from 0.6% last July and seven asset managers have cranked up their betting against the company this month.

Intrigue is added by today’s retail sales volumes edging 0.1% lower in November with both online and supermarket sales affected, and Black Friday sales slightly weaker. Yet department stores and clothing shops bucked the trend with a 1% rise in volumes.

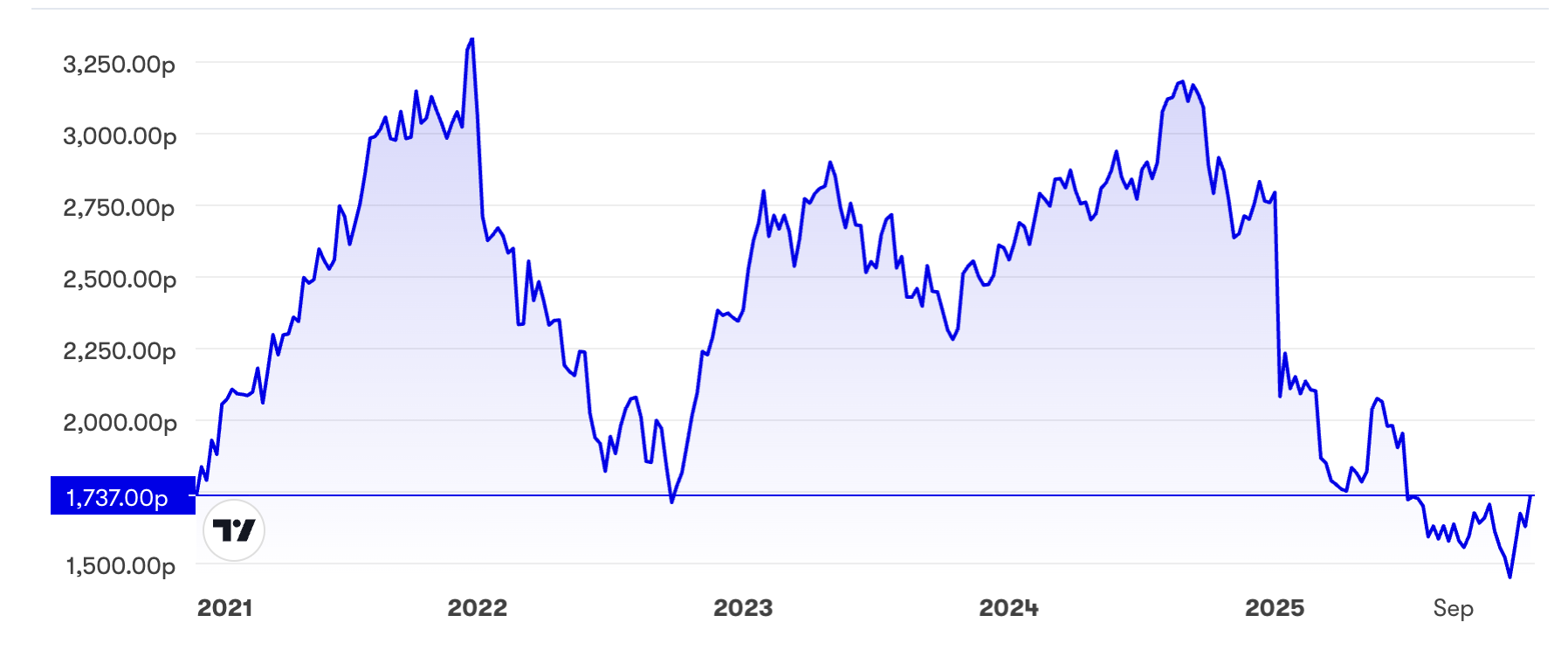

A mixed sense of public taste for Greggs shares lately

The five-year chart shows a bull/bear battle currently to confirm circa 1,740p as a support level, similarly as in early 2021 and late 2022, for what historic comparisons are worth:

Source: TradingView. Past performance is not a guide to future performance.

It kicked in from 21 November despite no news-specific trigger, the last update on 1 October being a third-quarter update, with improved trading in August and September after heat-affected July. Total sales were up 6.1% in the quarter and 6.7% year-to-date, with expectations for the full year unchanged.

According to consensus, that still implies a 14% decline in normalised earnings per share (EPS) this year with only a 5% recovery in 2026 to below what was achieved in 2022-24. At 1,737p, the near-term yield is 4.0% with 1.8x earnings cover albeit a recently deteriorating free cash flow profile.

Clearly the bears reckon that they are on to something here, despite Greggs’ 24% rebound since 21 November being assisted by a perception that the increased minimum wage is good for sausage roll and coffee sales.

Silchester International Investors snapped up 5% of the equity during November and yesterday Greggs announced that its fourth-quarter update is due on 8 January, making this one of the most keenly contested news items of early 2026.

At 1,637p on 2 December, I suggested Greggs was more likely in “buy” territory on a value basis, although from a growth perspective it seems that its best years for rolling out (unintended pun) the concept seem past.

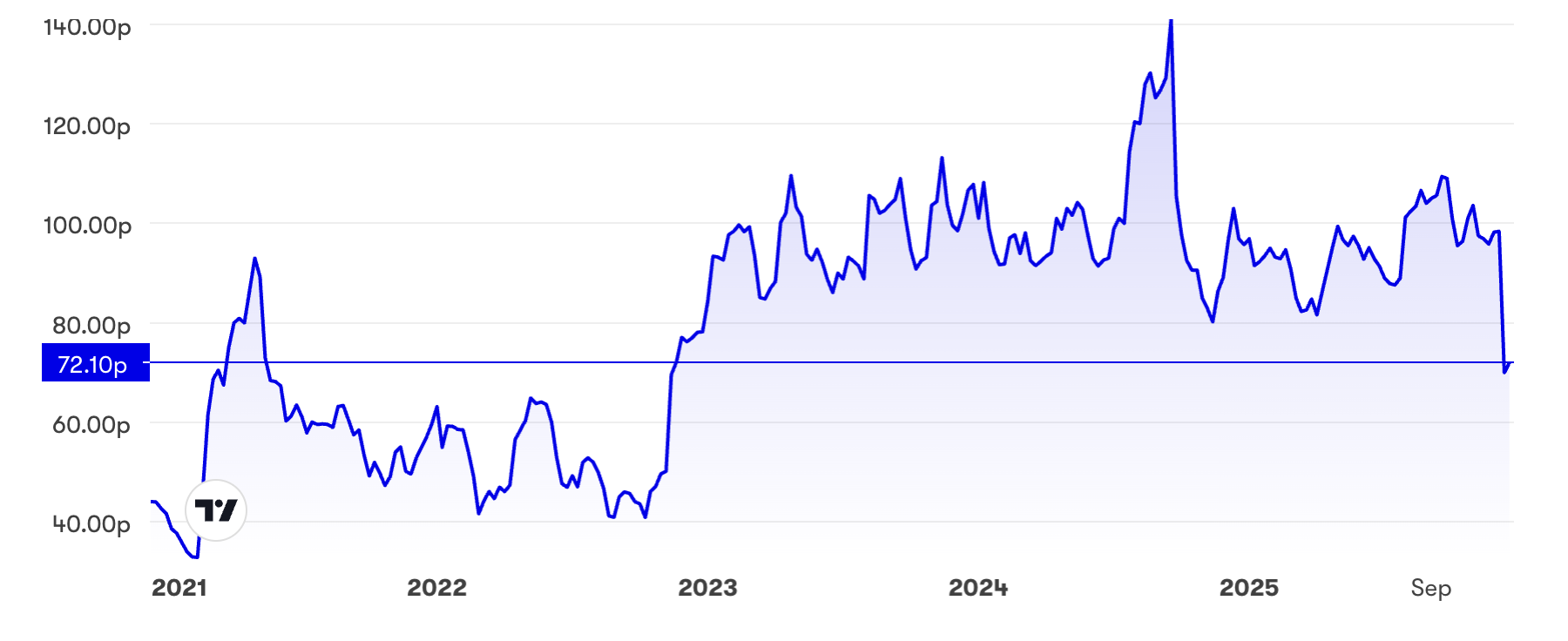

Card Factory reminds of the risks in a mercurial sector

On 12 December, greetings card retailer Card Factory (LSE:CARD) issued a sharp profit warning, cutting pre-tax expectations by 19% at the adjusted level, to £55-60 million in respect of the 31 January 2026 year.

“Pressures facing UK consumers have persisted as we moved into our most important trading period.”

Source: TradingView. Past performance is not a guide to future performance.

I haven’t been attracted to Card Factory given that cards seem a tricky area, marketing-wise. Yes, this retailer undercuts plenty of others on price and is an exclusive supplier to ALDI, thereby competing with other supermarkets offering cards for convenience, and in the “discount” segment.

I’m less convinced by cards given that the leap in postage costs may have discouraged the habit, and younger generations have lost interest, leaving cards as an apologist gesture to people one sees less often. This retailer has diversified into gifts and party supplies but I’m sceptical they cut it when consumer spending is under the cosh.

- The tariff playbook: why I’m sticking with UK markets in 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Net debt near 60% also doesn’t help, although in terms of the overall risk/reward profile currently, on 16 December the CEO bought nearly £40,000 worth at 70.3p, the CFO £15,200 worth at 70.9p and the audit committee chair, £10,000 at 72.2p.

Checking the short position, and lo and behold, Marshall Wace – the hedge fund I respect most – has 0.56%, which it did trim 0.05% on 15 December, although it has blipped around this level since first disclosed in late-April.

Another example, then, of keenly disputed bull/bear perspectives in retail, with a trading update due around 14 January.

Call me copping out of a stance right now, but at 72p, Card Factory shares currently seem chiefly about risk perception. Maybe there is some relief rally due, if hard to be sure of price/earnings (PE) and yield.

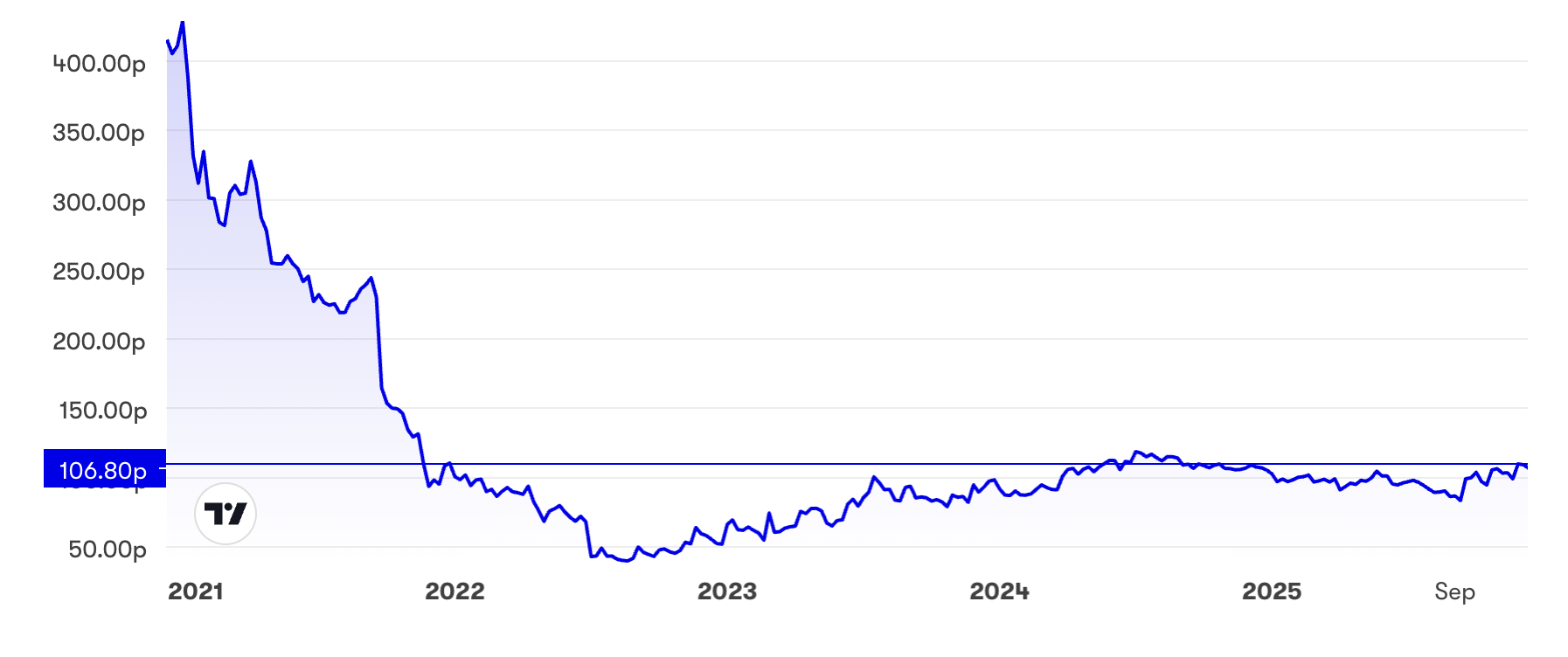

Currys and AO World show it remains possible to achieve bullish charts in retail

Could you wish for a more perfect “bowl” pattern from 2021?

Source: TradingView. Past performance is not a guide to future performance.

Currys’ 18 December interim results and outlook are highly relevant to show how adept management can succeed even in tough times in seemingly “discretionary” goods.

The shares were up 10% mid-morning yesterday after good operational progress, albeit the year to 30 April guided “in line” rather than any beat.

From a macro perspective, it would appear to imply that enough consumers are experiencing pay rises that either match or beat inflation. It remains to be seen whether “fiscal drag” – when tax thresholds fail to rise with inflation – grinds down incomes in due course, with unemployment rising over 5% a concern.

Mind also that the percentage dynamics in Currys’ results relied heavily on adjusted numbers, whereas reported pre-tax profit was only £9 million on £4.2 billion revenue. Yet this was a seasonally weak first half and a £19 million upturn on a 2024 interim loss. The last full financial year struck reported pre-tax profit of £124 million and £162 million adjusted.

It illustrates how crucial the Christmas buying period is, where a trading update came this year on 15 January. The CEO cites entering the peak period “well prepared, with strong stock availability and market-leading deals”.

Notably, the disclosed short position fully closed out by early 2024, having been over 6% of the issued equity in 2022.

I drew attention to Currys as a “buy” at 57p in May 2023, as a classic “value” share given its strong position in consumer electrical retail. Yes, nowadays there are rivals such as AO World (LSE:AO.) and Argos, but the Currys group also includes Dixons and PC World, which are very strongly established across the UK and the Nordics.

AO sports a different chart, with a rising trend from around 40p in August 2022, albeit after a sharp de-rating:

Source: TradingView. Past performance is not a guide to future performance.

I have consistently struggled with the PE/yield contrast between the two, however, Currys is on 11.7x, easing to 10.5x if April 2027 forecasts are realistic, and a near 2% yield; versus mid-teens’ PEs for AO and no yield. The shorting of AO similarly expired last year though.

Revenue stories contrast somewhat given that Currys derives 42% from the Nordics, where the story has radically improved from a bugbear to “accelerating recovery” with interim sales up 7% at constant currency versus the UK up 6%. AO, meanwhile, shed its German operations to be primarily UK-driven.

I therefore tend to continue to favour Currys, although rate AO at least a “hold” given a 14% rise in first-half revenue to 30 September, and 10% pre-tax profit advance.

Stock pickers are in clover?

These examples and their often sharply contrasting long/short views make UK retail fascinating to decipher.

Investors often bemoan short sellers, but I see them as usefully flagging risk - for me to decide on - and potentially over-sold situations. Regulators are set to eliminate transparency of what the likes of Marshall Wace are up to, more’s the pity.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.