Stockwatch: a view on Burberry and the luxury goods sector

After a strong rally and a fresh set of results from the FTSE 100 fashion firm, analyst Edmond Jackson gives his assessment of the shares and wider industry.

14th November 2025 12:07

by Edmond Jackson from interactive investor

The Burberry logo on a building in Mayfair, London, this month. Photo: Peter Dazeley/Getty Images.

“Luxury” is an investment conundrum. People most affluent may continue to spend, free from pressures affecting the middle classes.

- Learn with ii: Inheriting an ISA | Can I Transfer an ISA to Someone Else? | Open a Stocks & Shares ISA

For example, and despite economic uncertainties, the global champagne market is predicted to grow 64% to $13,260 million (£10,076 million) over the next 10 years amid a shift in consumer preferences towards luxury drinks, also a rise of celebratory beverages. Major champagne houses are increasing their capacity and English sparkling wine is a success story, with some vineyards commanding near £50 a bottle.

A week ago, Barclays Research turned modestly positive on Europe’s luxury goods industry after better-than-expected third-quarter earnings implied a wave of analyst downgrades may finally be coming to an end.

I’ve mentioned generally that it may only need profit warnings or downgrades to stabilise for this to happen, although I think we also need to respect the context of a share’s valuation. Has either it, or a sector, fallen to a level where it’s possible to consider a “margin of safety” in terms of price/earnings (PE), dividend yield or asset value? If so, scope for a mean-reversion upwards then arises, the chief question being timing.

- ii Tech Focus: stock crash, AMD, Coreweave, Nvidia

- Outlook for 2026: why more records could be broken

As for recommendations, Moncler SpA (MTA:MONC), a €15.9 billion (£14.0 billion) Italian luxury outerwear maker with global sales, is Barclays only “overweight” rating. This is despite third-quarter sales easing 1% at constant currency to €615.6 billion and the first nine months flat at €1.84 billion. It met Barclays’ criterion given that results were better than expected, and indeed an uptrend in the shares from €46.20 mid-August has strengthened with a rise from €52.0 on results day to around €59.4 currently.

Yet the five-year chart is volatile-sideways, hardly the behaviour of a growth share despite a trailing PE near 26x and a 2.2% yield:

Source: TradingView. Past performance is not a guide to future performance.

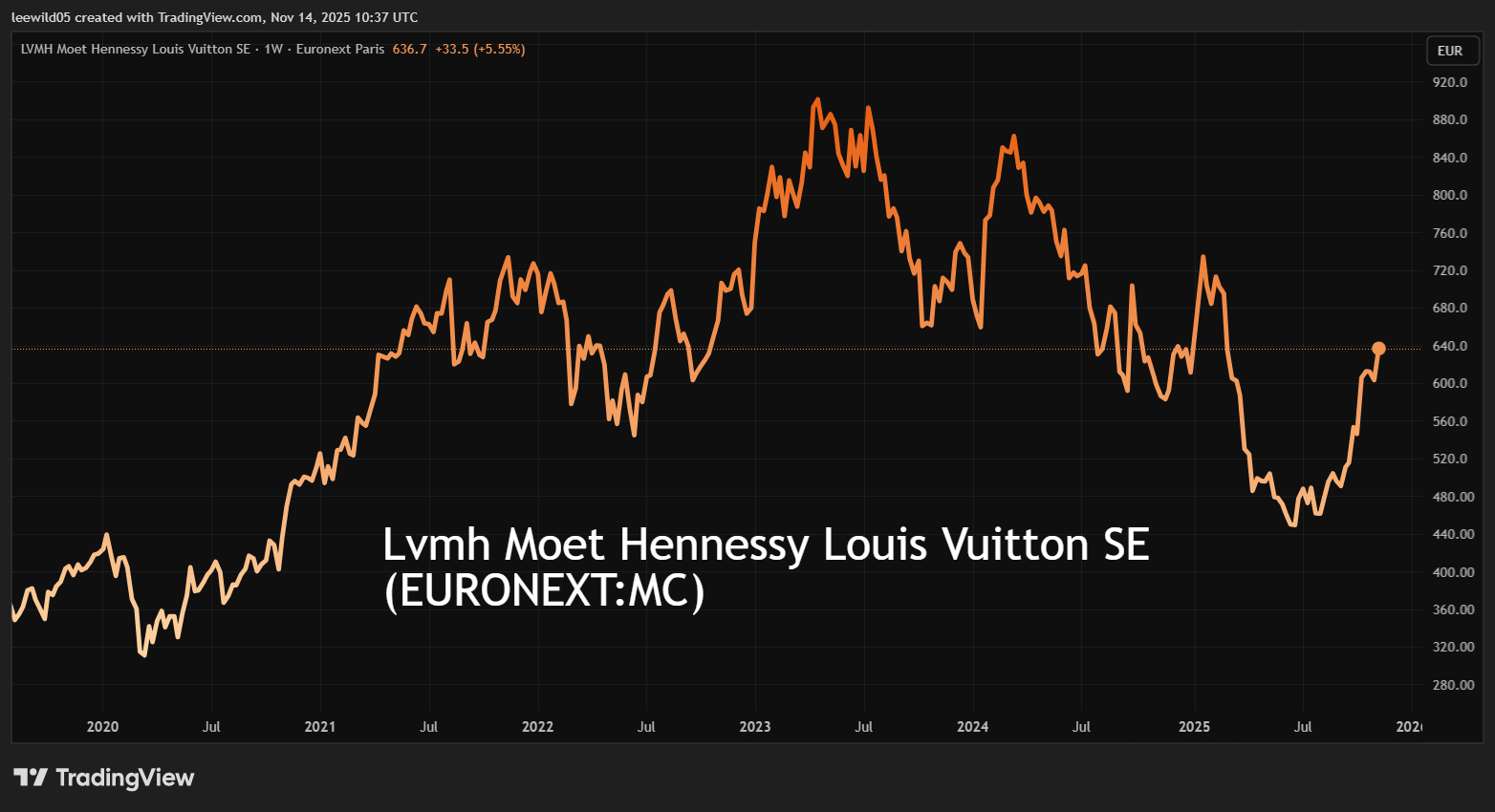

Such a rating is similar to Lvmh Moet Hennessy Louis Vuitton SE (EURONEXT:MC) on a 29.4x PE and 2.0% yield, and a stock which also rallied from mid-August but in a sideways-volatile context:

Source: TradingView. Past performance is not a guide to future performance.

A decent prospect for ‘luxury’ in 2026?

Barclays argues that the sector is supported by resilient demand from US consumers and early evidence that China’s market is not deteriorating. This is similar to a point I’ve made on the US consumer economy: increasingly polarised between affluent consumers’ spending, confidence buoyed by US equities at record highs, while middle to lower-income groups struggle.

So, Moncler is given a €61 price target and favoured because it has benefited less than peers in the sector rebound from August. It could also show sequential growth in the fourth quarter after October started well. US expansion is key, with stores projected to rise 4-5% annually over the next three years, helping justify a two-year forward PE near 21x, a 5% discount to its 10-year average.

This to me feels like a broker perspective with attention on comparative share performance, where the key question is whether a “growth” rating is justified. If not, then you would want a bigger price/value disparity.

Is spending on luxury clothing and accessories really so preserved? I would think a fair element relates to an aspirational middle-class element. If there is a downturn, and with AI encroaching on professionals’ jobs, I doubt it.

Similar issues apply to FTSE 100-listed Burberry

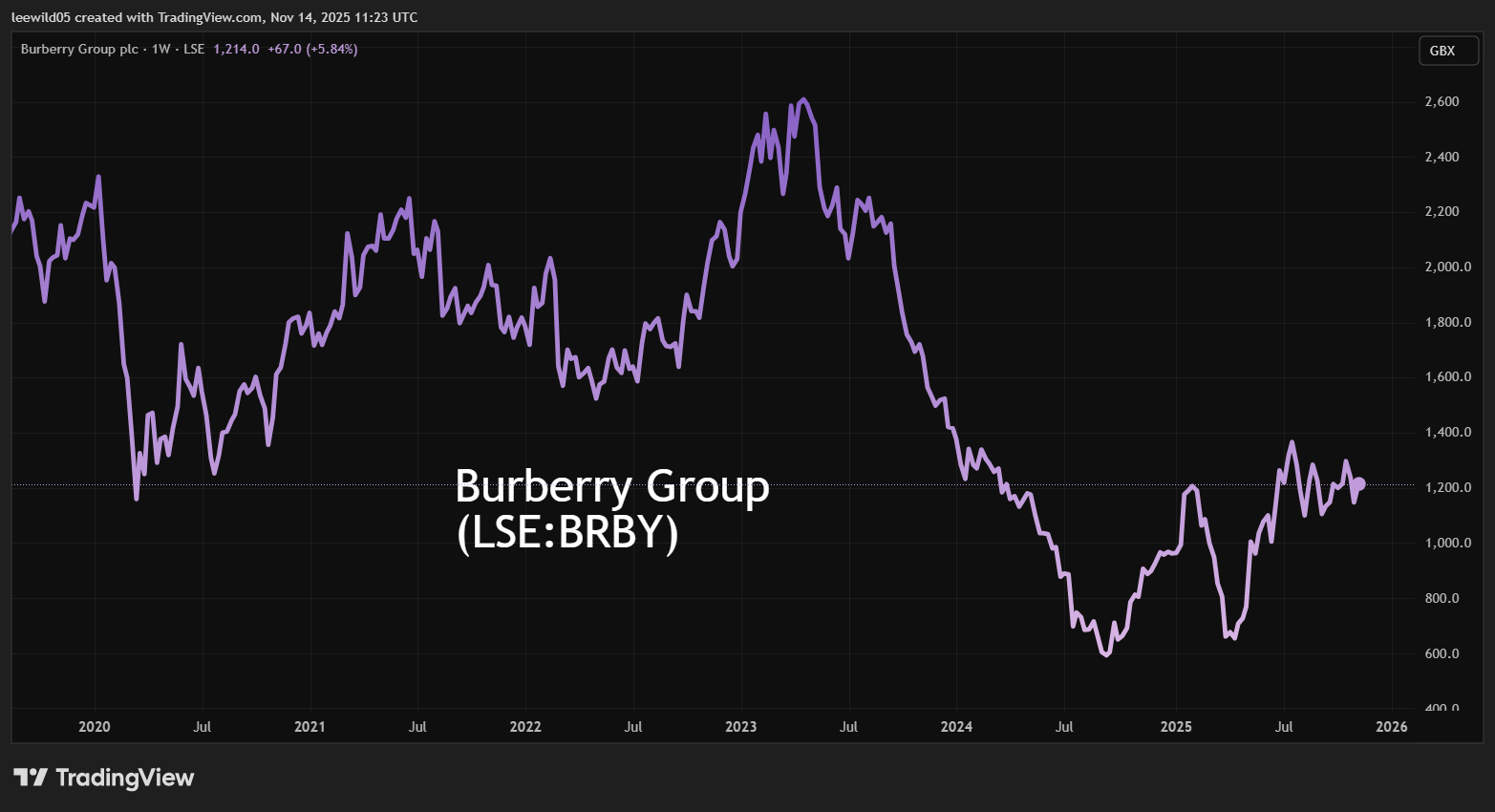

Compare how I was cautious towards Burberry Group (LSE:BRBY) in September 2024 with a “hold” stance at around 700p, when luxury goods shares bounced that month. Ten months ago, however, it related to a Chinese stimulus package that surprised markets with its size.

Barclays currently suggests Burberry could benefit from positive read-across trends among peer companies.

I acknowledge it’s starting to appear that a new American CEO from July 2024 is getting results. However, as with the European luxury multinationals, a rich valuation is awkward for value-conscious investors. What extent - if at all - should you respect “brand value” separately from what the assets show they can generate by way of income and cash flow?

- Pressure on Burberry to maintain this positive momentum

- Stockwatch: a FTSE 100 recovery buy or falling growth star?

Perhaps quite a few shareholders hung on amid volatility over the last 10 years or so – through a 2023-24 slide – in the hope a luxury giant would snap up Burberry as a prestige brand.

Trickiness calling this sector is shown by Burberry rallying to 1,235p by early last February, then falling as low as 630p in early April when President Donald Trump shot massive tariffs from the hip. Burberry then rebounded to 1,370p by early July but has since traded volatile-sideways. Indeed, yesterday it jumped 7% to 1,360p in morning reaction to interim results but closed down 2% at 1,228p – twice the FTSE 100 fall – as if showing how “luxury” is high beta in financial jargon, and more volatile than the market.

Source: TradingView. Past performance is not a guide to future performance.

April’s plunge did appear overdone in the sense that the US represents less than 22% of group sales; China is more significant at over 25%. Yet the US is a strategic priority as part of the Burberry Forward turnaround plan. It’s frustrating that when you scour updates for what sense US sales could be affected by US tariffs, there is no guidance, whereas Dr. Martens Ordinary Shares (LSE:DOCS), for example, previously said that existing US inventory mitigated the effect. In fairness to Burberry, who knows what Trump will do next?

But I feel this is one issue among many, making it hard to regard Burberry as a conviction “buy” when its rating still seems big.

- Share Sleuth: how this trio of trades came to pass

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

If consensus is fair, the last financial year’s slump into losses recovers net profit to around £70 million in the March 2026 year and near £150 million in 2027, with normalised earnings per share (EPS) around 19p and 40p respectively. The latter implies a 31x PE with the shares up 1.5% near 1,250p in early dealings today.

Or, if we reckon Burberry can reasonably achieve a median 75p EPS, then the PE falls below 17x. You could say a 1.8x price/sales ratio is reasonable if margins can improve, where the latest results show initiatives starting to work.

Burberry Group - financial summary

Year-end 30 March

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 2,720 | 2,633 | 2,344 | 2,826 | 3,094 | 2,968 | 2,426 |

| Operating margin (%) | 16.1 | 7.2 | 22.2 | 19.2 | 21.2 | 14.1 | -0.1 |

| Operating profit (£m) | 437 | 189 | 521 | 543 | 657 | 418 | -3.0 |

| Net profit (£m) | 339 | 122 | 376 | 396 | 490 | 270 | -75.0 |

| Reported EPS (p) | 81.7 | 29.8 | 92.7 | 97.8 | 126 | 73.7 | -21.0 |

| Normalised EPS (p) | 85.2 | 103 | 58.7 | 91.6 | 120 | 78.4 | -2.2 |

| Return on total capital (%) | 25.8 | 7.4 | 18.6 | 18.8 | 23.0 | 16.6 | -0.1 |

| Operating cashflow/share (p) | 99.1 | 111 | 146 | 173 | 193 | 138 | 120 |

| Capex/share (p) | 26.6 | 36.4 | 28.3 | 39.8 | 46.1 | 56.8 | 42.2 |

| Free cashflow/share (p) | 72.5 | 75.1 | 118 | 133 | 147 | 81.4 | 77.8 |

| Dividend per share (p) | 42.5 | 11.3 | 42.5 | 47.0 | 61.0 | 61.0 | 0.0 |

| Covered by earnings (x) | 1.9 | 2.6 | 2.2 | 2.1 | 2.1 | 1.2 | 0.0 |

| Cash (£m) | 875 | 929 | 1,261 | 1,222 | 1,026 | 441 | 813 |

| Net debt (£m) | -837 | 538 | 101 | 179 | 460 | 1,154 | 1,111 |

| Net assets/share (p) | 354 | 300 | 384 | 407 | 405 | 320 | 254 |

Source: company accounts.

That presumably accords with Barclays’ sense to favour a share that is better priced relative to its sector, and I concur that those who bought Burberry for recovery at some point, say, this year, probably should hold on. The strategic aim is to recover annual revenue of £3 billion in the March 2023 year, while re-building margins that have collapsed from around 20% in the last two financial years.

If anything like EPS of 120p can be achieved again, the PE falls to 10x and, yes, a bidder could be interested at a much higher price.

How to assess appeal for Burberry’s refreshed ranges?

This is also a crux matter and, admittedly, I’m compromised to figure why anyone would pay £1,000 for a Burberry patterned bikini or £1,300 for a tote bag. The latest update does, however, cite strong sales of outerwear, scarves and accessories, albeit leatherwear is challenged despite an improvement between the first and second quarters.

There are also poor Trustpilot reviews. With less than 500 of them, it could reasonably represent issues which any business could suffer - things occasionally go wrong and people complain. But if Burberry is a premium company, I would prefer to see something like 90% on five stars versus 10% on one star, rather than predominantly one star. As the CEO says, the turnaround is still in its early stages.

Barclays’ caution on the sector, with it warning how recovery remains fragile, accords with the CEO also admitting that “the macroeconomic environment remains uncertain”.

A “hold” stance therefore remains justified.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.