A trio of trusts focused on micro-caps

A Kepler analyst examines the outlook for the smallest part of the UK market and highlights investment trust opportunities that could deliver long-term growth.

12th April 2024 13:56

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Another week has gone by with another doomsday prediction for the UK stock market, this time with predictions that small-caps could all be gone by 2028. This was premised on the extrapolation of the current trend of companies either de-listing or being targets of takeovers leading to the market size falling to zero before the end of the decade. While this may seem like an alarming statement, it did come with the caveat that the opposite could happen, and the market could proliferate should the right action be taken.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Either way, it has again ignited conversation about the lower end of the UK stock market and what the future may hold. Here, we look into the investment opportunity at the lowest end of the market-cap spectrum, the micro-caps, to discuss what this somewhat forgotten-about asset class offers to investors and what could lie in store for its future.

What’s smaller than small?

As the name suggests, micro-caps are those companies that are at the lowest end of the market-cap spectrum. The definition of what classifies a micro-cap rather than just a small-cap varies, though consensus varies around companies whose market capitalisations are in the bottom 1% to 3% of the whole market. The MSCI UK Micro Cap Index which focuses on the space, includes approximately 400 companies, of which the largest (as of 29/03/2024) is £430 million, with a mean average size of around £96 million. However, there are several investment trusts that focus primarily on micro-caps, which typically invest below this. They invest from as low as circa £20 million market cap up to a maximum of £150 million at the time of initial investment, though often holdings are allowed to grow if the investment thesis holds.

As a result of this low capitalisation, the trusts focusing on the space need to be conscious of their own asset base. The average NAV of the trusts in the AIC UK Smaller Companies sector is £319 million, according to JPMorgan Cazenove as of 04/04/2024. If a theoretically average trust were to put 3% of its portfolio into the average company in the MSCI UK Micro Cap Index, it would mean the trust would own circa 10% of the share capital of the company. This would allow them to exert significant influence but would also have implications for the ability to sell such a large position without having to take a haircut.

At present, the trusts focused purely on micro-caps have assets of between £43 million and £65 million, meaning this is yet to be an issue of note, though it does present challenges for open-ended funds to invest in the space, given the potential for inflows to necessitate taking larger and larger positions, enhancing the attraction of investment trusts, in our opinion.

Micro managing?

Micro-caps have advantages from both fundamental and investing standpoints. One of the key fundamental advantages of small businesses is that they are nimble and flexible, which allows them to adapt quickly to changing market conditions. This can be a weakness of larger organisations, which take a long time to make decisions. Smaller companies often have quite flat structures meaning the time taken for a a solution to be found for a problem may be shorter. We think this is one of the key reasons why smaller companies are able to deliver higher growth than their larger peers over time. This operational efficiency can have its drawbacks though. With a slimmer organisational structure, the decisions of a small number of individuals can have an outsized impact on the company’s prospects. Should these calls prove incorrect, it can cause trouble for the business. This key man risk is still present in larger companies, although there is the potential for this to have a larger impact with smaller firms.

The smaller the company, the more focused their product or service offering tends to be, with micro-cap companies often having just one or two business lines. This means that micro-caps are more likely to operate in market niches, which further supports their high growth potential. However, this can create exposure to idiosyncratic factors such as losing a single contract, or from a big player entering the space and making for an uncompetitive environment. From an investing point of view, a number of micro-caps have unproven, pre-profit business models such as pharma companies working on new drugs which have binary outcomes. As such, this can add to the higher volatility often present in the micro cap space.

Other market-based factors that increase the appeal of micro-caps are that they are very under-researched, with very little analyst coverage, and therefore weak price discovery. As such, there are significant alpha opportunities for those who can identify the undiscovered gems in the universe. If successfully found, these firms often have long growth runways as their business develops, potentially progressing from micro-cap to mid or even large caps. Should this happen, they can return many multiples of any amount invested.

As a result of the under-researched market, the micro-cap space lends itself well to active managers. Not only can they commit the time to analyse the universe, but they can take large positions and deploy a private equity style approach, including taking seats on the board and using their large shareholding to instigate change. However, the downside of this is illiquidity which can contribute to volatility as well as making exiting positions challenging. One potential opportunity for exiting a position though is through M&A, which has been increasingly prevalent in recent years, hence the concerns over the size of the index. This could come from private equity or other corporates seeking to add a micro-cap’s expertise or products into their own offering and can deliver excellent returns to existing investors.

What is going on in the micro-cap market?

As is well-known, the UK market is particularly cheap at the moment, both versus its own history and versus global peers. Smaller companies within the UK are even cheaper still, with the most attractive valuations being at the lower end of the market-cap spectrum. The managers of Aberforth Smaller Companies Ord (LSE:ASL) can invest in companies across the small and mid-cap space, as long as they are listed on the Numis Smaller Companies ex IT Index. Their numbers show that the smaller smalls are cheap versus larger small-caps. Those below £600 million market cap had an average value in EV/EBITDA terms of 7.8x versus 10.3x for those above £600 million, as of 31/10/2023. This means the smaller end of the small-cap index is trading at a 24% discount. Fears over the country’s economic woes may be a significant reason behind the weakness in smaller companies as they are typically more exposed to the domestic economy therefore often more at risk in a recession. However, there has also been a reduction in the number of investors willing and able to invest in the micro-cap area of the market specifically, due to liquidity concerns post-GFC.

We think there may be another structural reason behind the weakness in smaller companies, particularly micro caps. The continued rise of passive investing is not supportive of smaller companies. There are very few ETFs or index funds focused on the lower end of the market-cap spectrum, and even those that do, often don’t offer much exposure. Small and micro caps lack the liquidity necessary for passives to invest at size (and often have higher bid/offer spreads too which increase trading costs substantially). Synthetic models using derivatives also can’t really work, as there isn’t a liquid market in them, and so passives largely focus on the FTSE 250 or above. One passive that does theoretically invest in small caps is the iShares UK Small Cap ETF, which currently holds a FTSE 100 stock and has over two-thirds of the portfolio in companies over £2bn in assets. These are more than 20x the average micro cap company. As such, passive investing is unlikely to provide much support to the micro cap market and if the increasing prevalence of passive continues, it means that micro caps are unlikely to benefit as much from a revival in the UK, should sentiment return.

However, despite these factors, we believe micro caps still have a positive outlook. This is because micro-cap returns can often be very idiosyncratic and individual companies can deliver exceptional returns even when the macro is weak because of their small size. Being so small, micro caps have the ability to make fairly fundamental changes with limited relative difficulty. This can dramatically change their fortunes, whether by capturing market share or cutting costs to come back to profitability. As such, a micro cap can quickly turnaround its business if the right steps are taken, despite broader economic headwinds. One example of this is Crestchic, which earned micro-cap specialist Rockwood Strategic Ord (LSE:RKW)a 4.8x return on their investment in late 2019 when they helped restructure the business by selling a loss-making division before accepting a takeover bid from Aggreko just three years later. These strong returns are not untypical of the micro-cap sector, though we believe that good active management is required to identify them.

Investment trust options

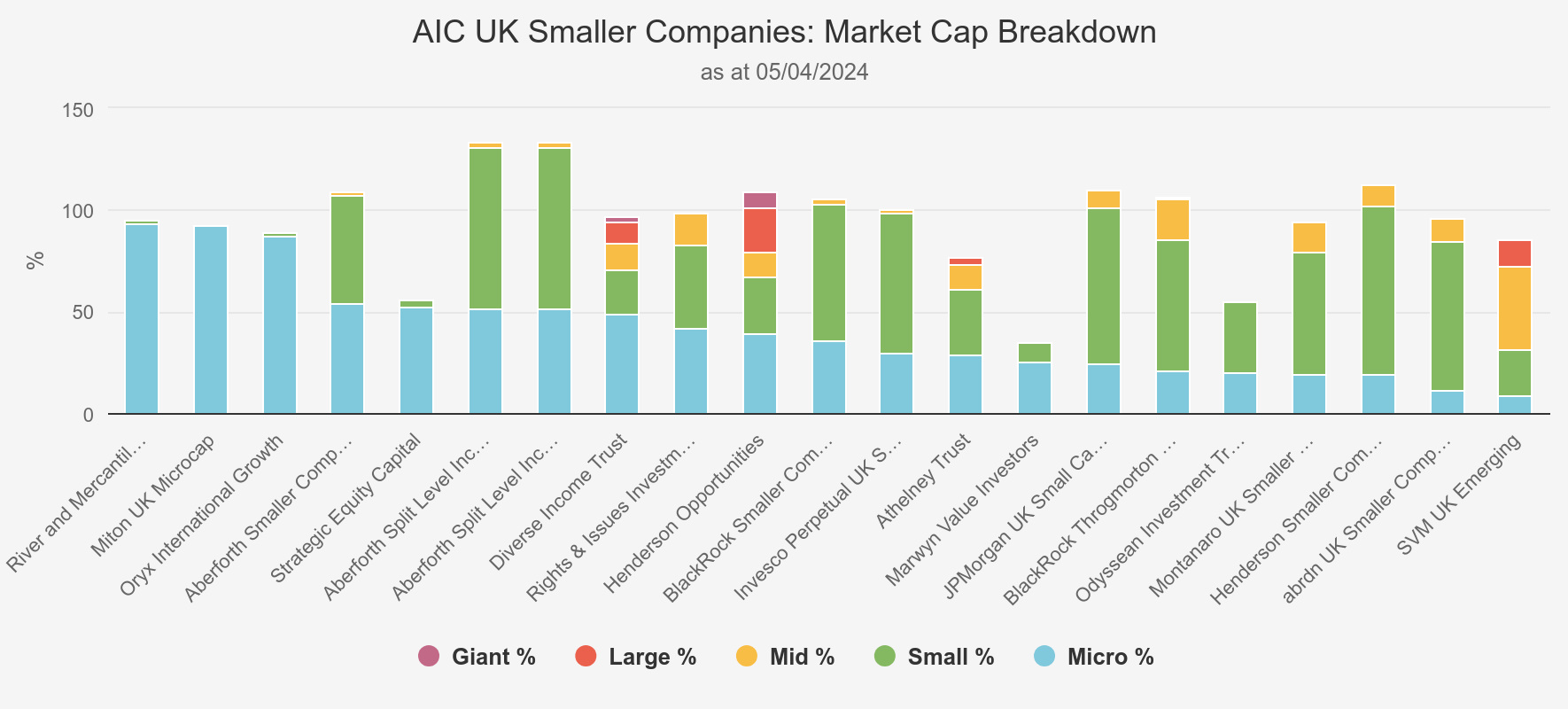

The AIC UK Smaller Companies sector is very populous, with 24 trusts at present, and while a number invest in micro caps, there are several specialists that operate exclusively in them, each offering contrasting approaches. We have listed the trusts below with their market-cap weightings. We note that weightings may not total 100% due to cash and gearing levels. Micro cap exposure is in blue.

SECTOR MARKET-CAP BREAKDOWN

Source: Morningstar.

While not listed in the table due to Morningstar data, the aforementioned RKW is one of the few trusts specialising in micro-caps. We understand that the entire portfolio would qualify as micro-cap under Morningstar’s classification, with an average market cap of £96 million, as of 31/03/2024 and the smallest holding with a market cap of just £8 million. Manager Richard Staveley has a value-orientated strategy, looking to exploit the lack of research to find the extreme price inefficiencies in the space. He takes a private equity approach, looking to take large position sizes in companies and instigating change if he feels it can benefit the business. As such, the portfolio is highly concentrated at just 19 holdings as of 29/12/2023. As a result, if these ideas do pay off, they can cause significant jumps in performance. This has led to significant returns over the past few years, with the NAV up 106.2% over the past five years to 04/04/2024, versus the FTSE Small Cap ex ITs Index which returned 33.9% over the same period. As such, we believe RKW offers investors the opportunity to deliver significant returns even when the market is not in their favour.

River and Mercantile UK Micro Cap Ord (LSE:RMMC)is also heavily exposed to companies at the bottom end of the market, although manager George Ensor has a strong growth bias in contrast to RKW. He looks for companies operating in market niches where big players are unlikely to enter and then rides these up as the growth comes through. He initially focusses on firms below £100 million market cap though will allow positions to run beyond this, often taking profits on the way up. The trust has a unique structure to ensure the manager can continue to invest in firms of this size, where it returns capital to investors should assets grow materially above £100 million in net assets. Partly as a result of the growth headwind, RMMC is currently trading at a significant discount of 18.5%, which we think could offer an attractive entry point to the trust and add to long-term returns.

Miton UK Microcap Ord (LSE:MINI) in contrast offers more core exposure to UK micro-caps. Managers Gervais Williams and Martin Turner have a diverse portfolio, currently holding circa 140 companies, which has led to a lack of a style bias to growth or value. The managers look for idiosyncratic stocks on unjustifiably low valuations on a bottom-up basis. They argue the negative sentiment shown to the UK stock market has made this the best investing opportunity in 30 years. The trust itself is also trading at a significant discount to NAV of circa 14%. This is over one standard deviation wider than the five-year average. As a result, we believe MINI offers investors more broad exposure to UK micro-caps which is available at a particularly attractive discount at this juncture.

Conclusion

Over the long term, micro-caps have delivered on their ability to provide long-term growth opportunities. However, acute weakness in the UK market stemming from negative sentiment and a weak economy has caused them to fall back in the past few years. Despite this, there are reasons to believe they could recover, and investment trusts could arguably provide an excellent vehicle for investors to take advantage of this, due to their fixed pool of capital negating the liquidity issues and allowing managers to take an active approach to the idiosyncratic space. With several of these trusts available at very wide discounts, this could prove a very attractive entry point over the long term.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.