Why classy Renishaw's shares get a perfect eight

12th October 2018 14:19

by Richard Beddard from interactive investor

Another leap in revenue and profit reminds us what a good business this is, but also of its occasional setbacks. Companies analyst Richard Beddard believes it should probably be a core holding for long-term investors.

Every year I approach Renishaw's annual report with a sense of optimism. To my mind it is what companies should be like: Profitable, adaptable, resilient, and equitable. Admittedly, the shares aren't cheap - but they aren't crazy expensive either.

As usual I'm scoring Renishaw according to the five criteria I have just mentioned. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

Renishaw boasts there are not many modern planes, trains or automobiles in the world that have not been touched by its products, but it might add a vast number of other things we rely on from smartphones to surgical robots.

The company designs and manufactures the sensors, probes, gauges and software used to automate and calibrate machine tools, control industrial robots, and inspect the components they make. It also manufactures additive manufacturing machines, so-called 3D printers, potentially a big growth opportunity.

- Invest with ii: Open a Trading Account | Cashback Offers | Free Regular Investing

Metrology, the division that manufactures machine tools and 3D printers is the biggest division by far. It earns 94% of the company’s revenue and very close to 100% of the profit, but Renishaw has been incubating a Healthcare division for many years, and in 2018 it made a profit for the first time. Healthcare uses technologies developed in Metrology: Additive manufacturing machines make surgical and dental implants and devices, and surgical robots incorporate Renishaw sensors.

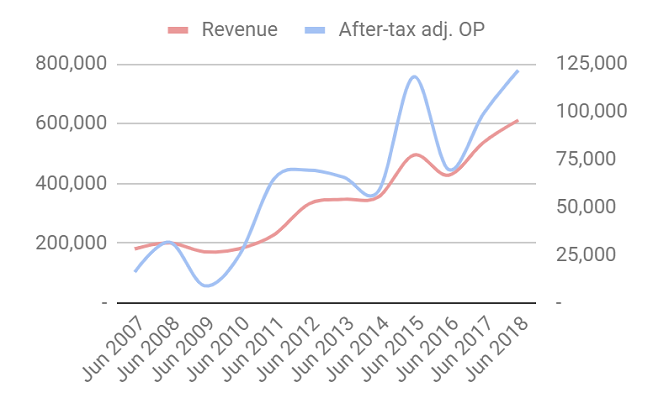

In the year to June 2018, Renishaw says it grew across the board, resulting in another leap in revenue and profit:

Source: interactive investor Past performance is not a guide to future performance

No doubt buoyed by a relatively weak pound, it is currently experiencing favourable conditions around the World. Exports account for 95% of revenue.

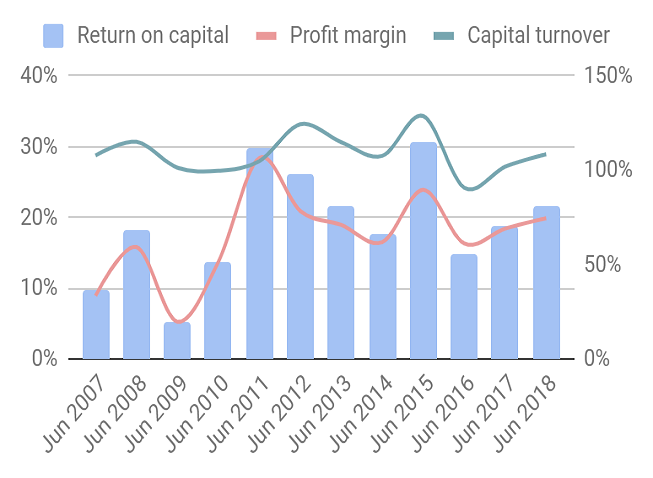

Despite rapid growth as factories automate and demand ever closer tolerances in the components they manufacture, the charts above and below show that profitability varies substantially around the average for the last 11 years of 20% return on capital. That is an impressive number, especially as it includes the financial crisis. Then, Renishaw's return on capital fell to 5%, but I think it is more resilient now.

Source: interactive investor Past performance is not a guide to future performance

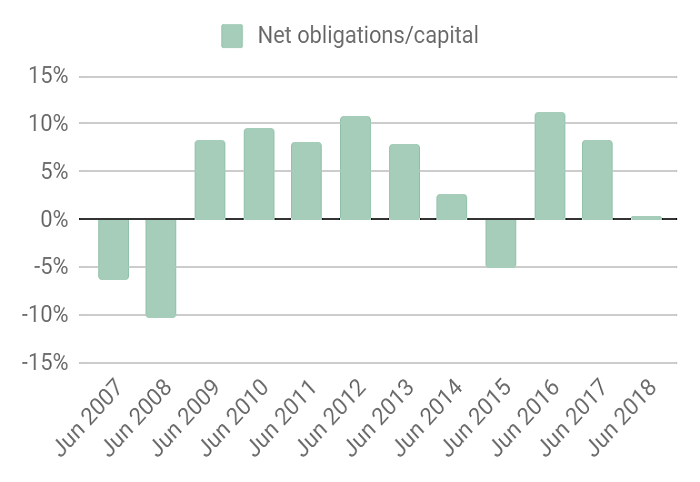

Despite high levels of investment and capital expenditure to support this growth, Renishaw has financed it from its own somewhat erratic cash flow, which has kept debt and other financial obligations at very modest levels:

Source: interactive investor Past performance is not a guide to future performance

This is how Renishaw does it...

Adaptable: How will it make more money?

Score: 2

It has the best kind of strategy. It is disarmingly straightforward but very difficult to clone. Will Lee, the company's new chief executive, sums it up in one sentence in the annual report:

"Our strategy is fundamentally based on long-term investments in patented and innovative products and processes, high-quality manufacturing, and the provision of excellent local support to our customers in all our markets around the globe."

The company started collecting patents when its co-founder, the current chairman David McMurtry, invented the Touch Trigger Probe in the early 1970's. It spends about 15% of revenue, £84 million in 2018, on research and development and says patent and intellectual property generation is paramount.

Its current research and development priorities include faster additive manufacturing systems to accelerate adoption by manufacturers producing goods as well as prototyping them, high resolution position feedback systems to meet the needs of high precision electronics manufacturers, and simplified software. One of the factors correlated with increasing automation is the gradually de-skilling of the labour force, which requires simpler software.

This is a kind of winner takes a lot strategy. Once you have the intellectual property, and offices around the world, it is very difficult for rivals to match you - especially if the firm keeps investing big profits in getting better. I think there is more to it than that though.

Renishaw is horizontally and vertically integrated. It uses its own tools to make the machine tools it sells to customers, experience which feeds the product development and improvement cycle. Renishaw has a very self-sufficient culture, which is important because customers often demand tools at short notice. Renishaw can meet their expectations because it controls much of the supply chain.

Resilient: What could go wrong?

Score: 2

Profitability does vary though. Renishaw experienced big swings when factories stopped investing during the Great Financial Crisis, and as smartphone manufacturers gear up production ahead of new launches and then relax until the next big launch. Trading levels remain, according to the company's risk management report, the number one risk because its order book is typically only worth about one month's revenue. If demand falls, Renishaw experiences it pretty abruptly.

Making judgements about the future is always risky, but I think Renishaw will be more resilient in future. Companies like XPP that supply the semiconductor and electronics markets are saying these markets are becoming less cyclical as electronics become more ubiquitous. Renishaw has also expanded the product range and end markets it serves, but probably most importantly it has changed who it does business with.

During the credit crunch Renishaw supplied machine manufacturers. Now it chiefly supplies their customers, component manufacturers, who can retrofit Renishaw machine tools to machines that did not originally use them.

Because capital equipment (i.e. big machines) are expensive, manufacturers tend to cut investment during recessions and make do with older machines. Demand for probes, gauges, sensors and position encoders though, will probably remain more consistent as manufacturers maintain existing machinery, and seek performance improvements by upgrading machines rather than buying new ones.

Renishaw says supplying the end-user has also given it a deeper understanding of their requirements, feeding into the all-important product development cycle.

Equitable: Will we all benefit?

Score: 2

Having discovered the 5% Club two weeks ago, when I noted Cohort membership of the group of businesses that aspires to have 5% of staff on training schemes, I'm delighted to report Renishaw qualifies (I don't know if it is a member).

Despite being an advocate of automation, it is a big employer. With nearly 5,000 people on the payroll, salaries are its most significant cost. The strategy section of the annual report starts with a section entitled "people" and all of the non-financial key performance statistics apart from one on greenhouse gas emissions, are people stats tracking employee turnover, the number of apprentices, the number of people in training, and working time lost to injuries.

Renishaw compares very well to the industry averages it quotes, and although 8% staff turnover is historically high, unemployment is at a historic low so perhaps Renishaw is facing heightened competition for staff.

Board pay is high by my standards, but not by the standards of Renishaw's peers. I think it is unlikely the company is being run to fill the director's pockets with short term bonuses. Nothing about the strategy indicates it and McMurtry's shareholding is perhaps more important. It is worth 2,000 times his salary. Co-founder John Deere is also an executive director. His shareholding is worth 1,500 times his salary.

There is tremendous experience on the main board, and two subsidiary boards. Four executives joined in the 1970s (i.e. forty or more years ago, give or take), six joined in the 1980's, two in the 1990s, one in the 2000's and two in the 2010s. CEO Will Lee joined in 1996 as a graduate and the two men appointed to the lesser “executive board” in 2018 joined the company in the 1980s.

Renishaw's use of internal talent is another demonstration of self-reliance, and executive and employee loyalty probably speaks volumes about the company's culture.

Cheap: Is the firm's valuation modest?

Score: -1

Renishaw shares trade on a multiple of 25 times profit in 2018, adjusted for many things including debt.

That valuation stretches credibility even for the strongest business, but I'm not going to overrule my scoring system: A business that scores a perfect 8 can even receive a negative score for valuation and still score 7 overall, the minimum needed for me to recommend it as a long-term investment.

Renishaw scores 7, and receives the equivalent of a Paul Hollywood handshake from me.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard owns shares in Renishaw.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.