Why these two UK funds are now in our portfolio

Harder to benefit from buoyant global financial markets, Saltydog analyst did this as the pound rose.

4th November 2019 13:19

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Harder to benefit from buoyant global financial markets, Saltydog analyst did this as the pound rose.

Most sectors fall as pound strengthens in October

The markets survived Halloween and when we woke up on the 1st November we were still in the EU, despite the best efforts of Boris Johnson and his government. On the whole, October was a reasonable month for global markets with most of the key stock market indices making gains.

In the US, the S&P500 went up 2% and the Nasdaq made 3.7%. The French and German markets also went up, with the Paris CAC40 gaining 0.9% and the German DAX rising by 3.5%.

The best return from the major developed markets came from Japan, where the Nikkei 225 went up by 5.4%.

In the emerging markets the Shanghai Composite gained 0.8%, the Brazilian Ibovespa went up by 2.4%, the Indian Sensex made 3.8%, and the Russian RTSI beat them all, rallying 6.7%.

Unfortunately for UK investors our FTSE 100 index fell by 2.2%. The main problem that this index had last month was the strengthening of the pound against the US dollar and other currencies. The FTSE 100 contains many large international companies with significant overseas exposure. When sterling strengthens this devalues any assets or income valued in foreign currency. During October the pound went from $1.23 to $1.29, a gain of over 5%.

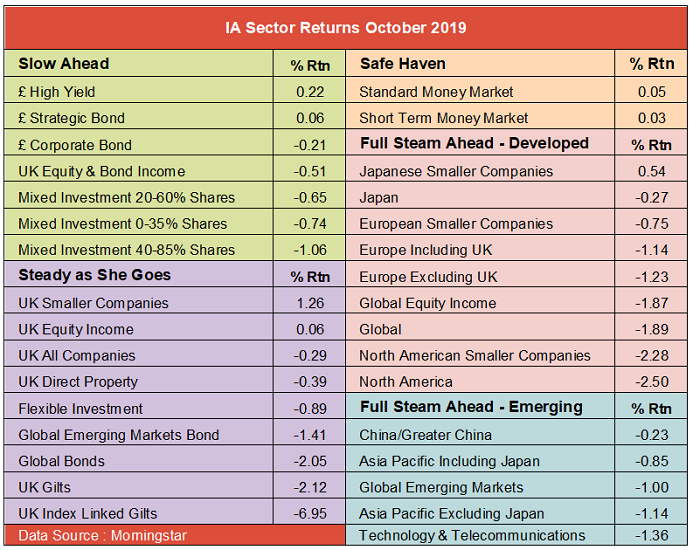

Not only did the currency movement affect the FTSE 100, it would also have made it very difficult for UK investors to benefit from the general rise in global markets. Any gains that funds investing abroad may have made in their local currency would have been wiped out when converted back into sterling. This can clearly be seen in the average returns for the Investment Association sectors in October.

Nearly all of the sectors made losses.

The only sector investing overseas that managed to make a profit in October was Japanese Smaller Companies, which went up by 0.5%. This was an impressive performance when you consider that during this period the pound strengthened by 5.2% compared with the Japanese yen. The underlying assets would have had to go up by 5.7% when valued in their local currency.

The best performing sector was UK Smaller Companies, which went up by nearly 1.3%. Funds in this sector can invest in smaller UK companies, which are less affected by currency movements.

In our demonstration portfolios we started reducing our exposure to global funds in August and began concentrating more on UK funds. In September, we invested in the Franklin UK Mid Cap fund and we later added the Franklin UK Smaller Companies fund.

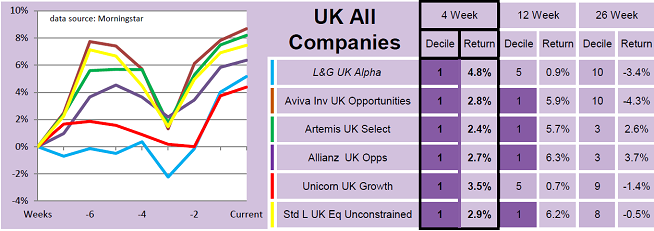

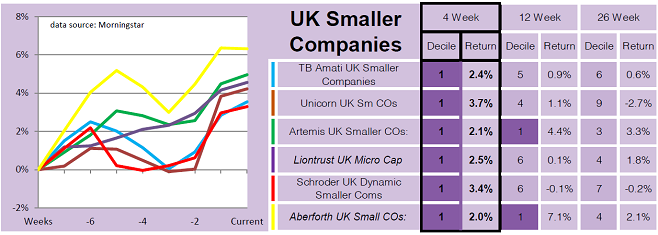

Last week we invested in the Allianz UK Opportunities fund and the Artemis UK Smaller Companies fund.

The Allianz UK Opportunities fund is from the UK All Companies sector. It was in our table showing the leading funds over the last four weeks, and is one of the few funds from this sector that's in decile one over four and 12 weeks that has also made gains over 26 weeks.

The Artemis UK Smaller Companies fund, from the UK Smaller Companies sector, is in decile one over four and 12 weeks and also looks reasonably good over 26 weeks.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.