The world's top 10 dividend-paying companies

The top 10 companies contributed 10% of all global dividends, roughly the same proportion since 2013.

27th August 2019 11:29

by Tom Bailey from interactive investor

The top 10 companies contributed 10% of all global dividends, roughly the same proportion since 2013.

Companies around the world handed out a collective $513.8 billion in the second quarter of 2019, marking a new record, according to Janus Henderson's Global Dividend Index.

While a slowing global economy was a drag on the overall growth of dividend payments, underlying growth still came in at a 4.6%. At the same time, several countries and regions still managed to produce record payments.

But, who are the world's biggest dividend-paying businesses?

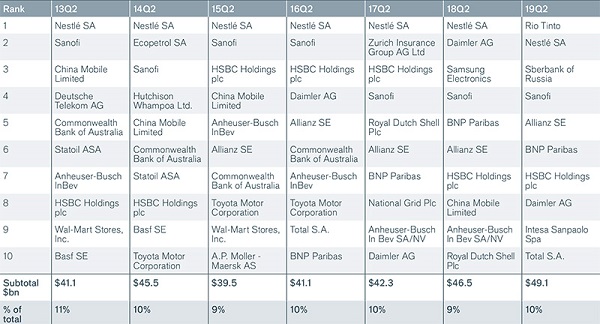

The top 10 companies contributed 10% of all global dividends, roughly in line with each second quarter since 2013. In total, the top 10 payers handed out $49.1 billion, the highest gross figure on record.

The companies on the list of top payers, however, was slightly less in keeping with historical norms.

Historically, Nestlé (XETRA:NESR) has been the highest payer in the second quarter. In 2019, however, dual-listed miner Rio Tinto (LSE:RIO) was able to clinch the first spot as a result of a large special dividend paid for by the disposal proceeds of some of its copper and coal assets.

This was the first time that Rio Tinto had been among the top 10 payers for the second quarter. As a result, Nestlé came in at number two.

Another new entrant for the first time was Russia's Sberbank (LSE:SBER). The company has been a reasonably reliable dividend payer over the 10 years. However, as we recently noted, the past five years has seen much greater dividend focus from the bank's management team. The second quarter saw it considerably increase its payments, propelling it to the third place among the top 10 payers.

For the most part, however, familiar European companies continued to dominate the top 10. European companies historically pay out most of their dividends in the second quarter of each year.

For example, Sanofi (EURONEXT:SAN), the French multinational pharmaceutical company, kept its position in fourth place, as it has done for every second quarter since 2017. Allianz (XETRA:ALV) came in at fifth place, one place higher than it has been in the past two years.

Daimler AG (XETRA:DAI) and BNP Paribas (XETRA:BNPH) also maintained positions in the top 10, as they both have done since 2016.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.