AIM shares round-up: Greatland Resources, Kitwave, Judges Scientific

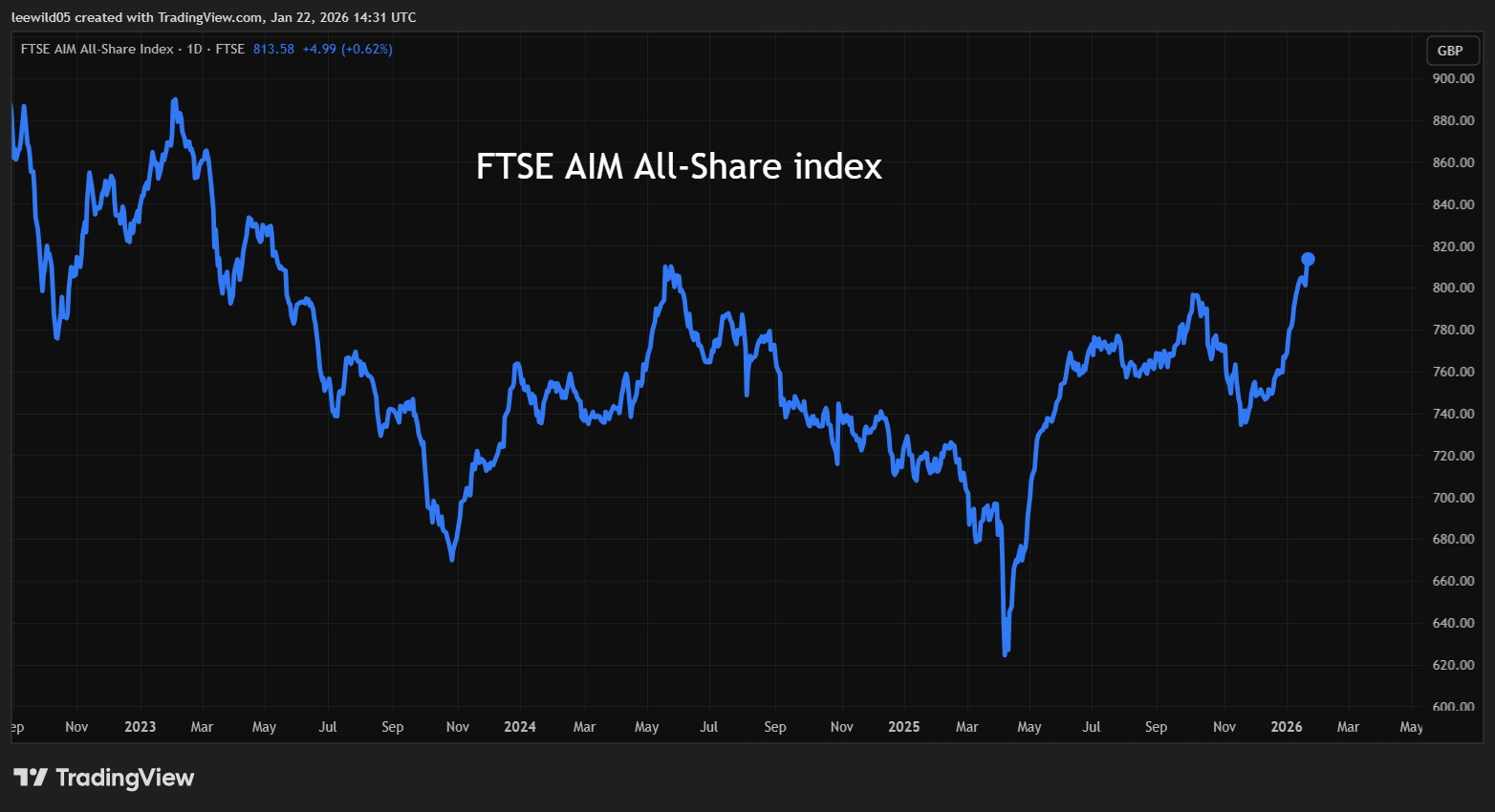

As the AIM market reaches levels not seen since before the summer of 2023, City writer Graeme Evans examines the latest significant price movements.

22nd January 2026 15:00

by Graeme Evans from interactive investor

Rare weakness for heavyweight Greatland Resources Ltd (LSE:GGP) today failed to stop the London market’s index of 100 leading AIM companies from trading at its highest level since May 2023.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Strong demand for Jet2 Ordinary Shares (LSE:JET2), Boohoo (Debenhams Group (LSE:DEBS)) and Filtronic (LSE:FTC) helped the FTSE AIM 100 index to lift another 0.7% to 3,878, extending the benchmark’s rise to 11% since November and 6% this year.

Source: TradingView. Past performance is not a guide to future performance.

A big factor in AIM’s strong recent performance has been the doubling in value of Greatland Resources to £4.5 billion, which compares with the next biggest AIM stock in Jet2 at £2.4 billion.

The company continues to be a popular pick for retail investors, having first come to attention due to Greatland Gold’s 2018 discovery of the world-class Havieron deposit.

Havieron was advanced under a joint venture between Greatland and Newcrest Mining and then Newmont Corporation. A transformational deal in 2024 saw Greatland acquire ownership of Newmont’s flagship Telfer gold-copper mine, which is located 45km west of the Havieron project and which has produced more than 15 million ounce (Moz) of gold since 1977.

The $450 million (£335 million) consolidation, which turned Greatland from developer to producer, involved the largest equity raising by a mining company on a London stock exchange since 2017.

An oversubscribed listing on the Australia stock exchange and a separate offer to UK retail investors followed last year before a feasibility study published in early December confirmed Havieron’s world-class quality.

Greatland said the findings set the pathway for Havieron’s development into a long-life, low cost, leading Australian gold-copper mine that will integrate with the existing infrastructure at Telfer.

Managing director Shaun Day, who has led Greatland since 2021, added: “We approach this development phase with an exceptionally strong balance sheet, substantial ongoing production from Telfer and new corporate debt finance commitments.”

In a further update today, Greatland reported promising results from the second quarter of Telfer’s record drilling programme. Day said the findings strongly supported the potential for a multi-year Telfer life of mine extension from both open pit and underground opportunities.

The shares fell today in line with the rest of the gold mining sector as the de-escalation of the Greenland row meant the price of the precious metal settled at $4,825 an ounce.

The price remains up 11% so far this year as gold continues to show its worth when geopolitical risks intensify. UBS Global Wealth Management today reiterated its $5,000 target, with upside risks to $5,400 if tensions resurface.

The biggest rise in today’s AIM 100 session was by wholesale business Kitwave Group (LSE:KITW) after its board backed a £251 million takeover involving private equity firm OEM Capital Advisers.

- Why I’m happy to buy shares at record highs

- Stockwatch: director buying and new update hint at upside here

The deal price of 295p is a 33% premium to Wednesday night’s close but below June’s level of 331p. Kitwave, which dates back to 1987 following the acquisition of a single-site confectionery wholesale business based in North Shields, now has 37 depots serving independent convenience retailers, leisure outlets, vending machine operators and foodservice providers.

Interim results published today showed revenues up 20.9% to a record £802.7 million, representing a 1% decline on a like-for-like basis. The gross margin rose 0.6% to 22.9% as pre-tax profits held firm at £22.4 million in the six months to 31 October.

Another company heading for the AIM exit door is Young & Co's Brewery Class A (LSE:YNGA) after it announced plans to move to the main market of the London Stock Exchange.

Chief executive Simon Dodd said: “Over the last two decades, AIM has provided a highly supportive environment for Young’s, helping us to realise our growth ambitions and secure vital funding, especially during the difficult period of the pandemic.

“We are very proud of the growth we have achieved and believe a move to the main market is a natural and exciting next step for Young's, and one that will open the door to a wider group of investors.”

The company, whose shares endured a tough second half of 2025 before a recovery in market value to £310 million, announced the move alongside a strong festive trading update.

It said like-for-like sales for the three-weeks to 5 January jumped by 11.2% against a very strong prior year comparator. Across the six weeks of the festive period, it recorded its highest-ever sales in one day as well as multiple other records.

Shares rose 42p to 854p, which compares with broker Peel Hunt’s 1,400p price target.

It said: “Young’s continues to grow like-for-like volumes, a trend that should persist, particularly if competitors raise prices by more, reduce operating hours, cut staffing and service levels, or close.

“Profit upside might also benefit from potential business rate reductions, but this is not assumed in our forecasts. Given the progress the company is making and the proposed move to the main market, we believe institutions should use the current low valuation as a buying opportunity.”

- 20 top small-cap share tips for 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The AIM 100 fallers board was led by Judges Scientific (LSE:JDG), which fell 620p to 5,120p after it reported no let-up in the trading conditions that will mean 2025 earnings are 6% below current market forecasts. It also starts 2026 with a lower-than-desired order book.

The company, which acquires and develops companies in the scientific instrumentation sector, has been impacted by uncertainties around US federal funding for scientific research.

It has taken action to reduce its cost base, as well as to improve its subsidiaries' geographic expansion, market penetration and new product launches.

Berenberg adjusted its price target to 5,600p from 7,900p but maintained its Buy rating, although the bank acknowledges that shares are likely to be weak in the near term.

Its forecast for earnings per share in 2026 is 44% below the recent peak in 2023, which Berenberg said gave an indication of the recovery potential as markets stabilise.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.