AIM star AB Dynamics upgraded again

It's generated fantastic returns for loyal shareholders, but could do much more, according to analysts.

2nd October 2019 15:09

by Graeme Evans from interactive investor

It's generated fantastic returns for loyal shareholders, but could do much more, according to analysts.

AB Dynamics (LSE:ABDP), whose technology is used to test and develop the cars of the future, polished its gold-plated reputation on AIM today with an update that also highlighted a potential opportunity for new investors to jump aboard.

The Wiltshire-based company said profits for the year to August 31 will exceed market expectations, with trading conditions still benefiting from "significant tailwinds" around the development of self-driving cars and new car assessment regulations.

Analysts said evidence that AB was performing better than expected highlighted a buying opportunity after weakness in the company's share price over recent weeks.

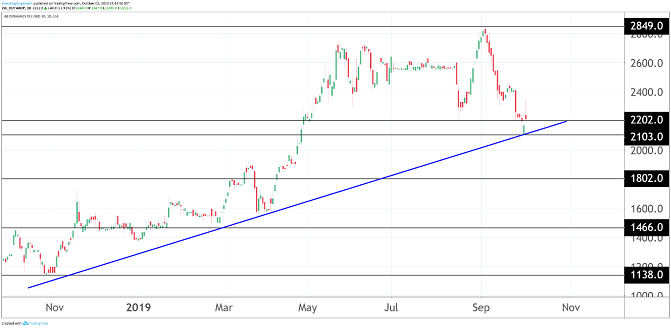

Today's upgrade helped shares to rally 3% to 2,218p, but the AIM 100-listed stock is still some way short of the 2,816p seen at the start of last month. The sell-off coincided with the acquisition of California-based Dynamic Research, which AB hopes will improve access to the growing US market for driver assistance systems and autonomous vehicle testing.

While shares trade with a lofty price/earnings (PE) multiple of 28x, Liberum said that AB was a high-quality business with a strong margin, cash flow and attractive market position. The broker increased its price target to 3,125p from 3,085p previously, while house broker Cantor Fitzgerald reiterated its 'buy' recommendation and price target of 3,200p.

That would represent a doubling on the share price seen at the end of 2018, when we named AB as one of our six speculative share tips for the year ahead.

Source: TradingView Past performance is not a guide to future performance

Having handsomely rewarded investors since listing on AIM at just 86p back in 2013, it's no surprise to find the company is again in the running for a stack of awards at next week's AIM Awards. The shortlist includes potential recognition for founder Anthony Best, who retains a 26% stake in the company and is still involved with the business.

According to our AIM expert Andrew Hore, AB Dynamics is also the frontrunner to be named as Company of the Year, alongside competition from Boohoo (LSE:BOO), James Halstead (LSE:JHD) and YouGov (LSE:YOU).

It's certainly been a significant year for the company, which raised £45.1 million in May after placing shares at 2,200p. Some of the proceeds went towards the Dynamic Research deal, while it has just opened an office near Detroit at the heart of the US automotive industry and where the country's biggest three manufacturers are headquartered.

The aim is to become a world-leading specialist in automotive test systems, with its products being used extensively in the development and proving of driverless vehicles. Its robots, for example, can help to develop the control algorithms that will enable engineers to create, test and refine self-driving software.

Founded in 1982 as a vehicle engineering consultancy, AB's clients include the top 25 global vehicle manufacturers, European laboratories and numerous government test authorities. Having grown half-year profits by 95% to £6.4 million, the market thinks annual results in November will show a surplus of £12.6 million,

Liberum today increased its 2019 profits forecast by 5.5% and by 1.5% for the year after. They added:

"We think that all the trends - trading, operational and strategic - remain positive and that forecasts are prudently set in the context of strong market growth."

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.