FTSE 100 above 10,000: time to open your first stocks & shares ISA?

You’ve seen the headlines about the UK stock market breaking above 10,000. We weigh up whether it’s a good time to start investing.

19th February 2026 10:51

by Nina Kelly from interactive investor

With the FTSE 100 index of UK shares recently surging past the 10,000 level, rates on cash savings falling in the wake of Bank of England interest rate cuts, and new year resolutions to ‘start investing’ spurring you on, you could well be considering coming out of cash and investing your money in a tax-free stocks & shares ISA for the first time.

More people are taking the plunge these days, but not because the UK stock market has reached a five-digit milestone. The FTSE 100 – or any stock market – will perpetually move up and down, and short-term moves are more pertinent to day traders (usually professionals) than millions of everyday investors who focus on the long term.

- Learn with ii: Stocks & Shares ISA Explained | ISA Investment Ideas | Transfer an ISA to ii

Unless you are particularly lucky or skilled at timing trades, it’s usually the amount of time that your money is invested in the stock market (rather than your market timing) that delivers the kind of returns that make investing so attractive.

This is in part due to the powerful effect of re-investing dividends (the income paid out by some companies whether you own them as a single share or in a basket of shares known as a fund) and compounding (when investment returns themselves generate returns).

The table below illustrates how compound interest helps an investment of £100 each month grow over 10 years. It’s important to stress that the 5% growth per year is not guaranteed, and that this figure could be higher or lower.

End of year | Total investments | Interest | Accrued interest | Pot size |

1 | £1,200 | £33 | £33 | £1,233 |

2 | £2,400 | £96.8 | £129.09 | £2,529 |

5 | £6,000 | £305.37 | £828.94 | £6,828.94 |

10 | £12,000 | £731.92 | £3,592.93 | £15,592.93 |

Note: assumes 5% growth a year, net of fees. Source: interactive investor.

Number crunching

A 2020 study from British asset manager Schroders, for example, shows that even when the FTSE 100 barely moved over a period of 20 years, starting at 6,930 points on 31 December 1999 and reaching 7,542 points on 31 December 2019, a mere 600-point difference – you still earned an acceptable return on your investments if you re-invested company dividends. An annual 4% a year return, according to Schroders’ calculations, was made despite several “big” events in markets during that 20-year period, including the dot-com crash and the global financial crisis. Remember, that the return on cash savings in the 10 years to 2019 was less than 1%.

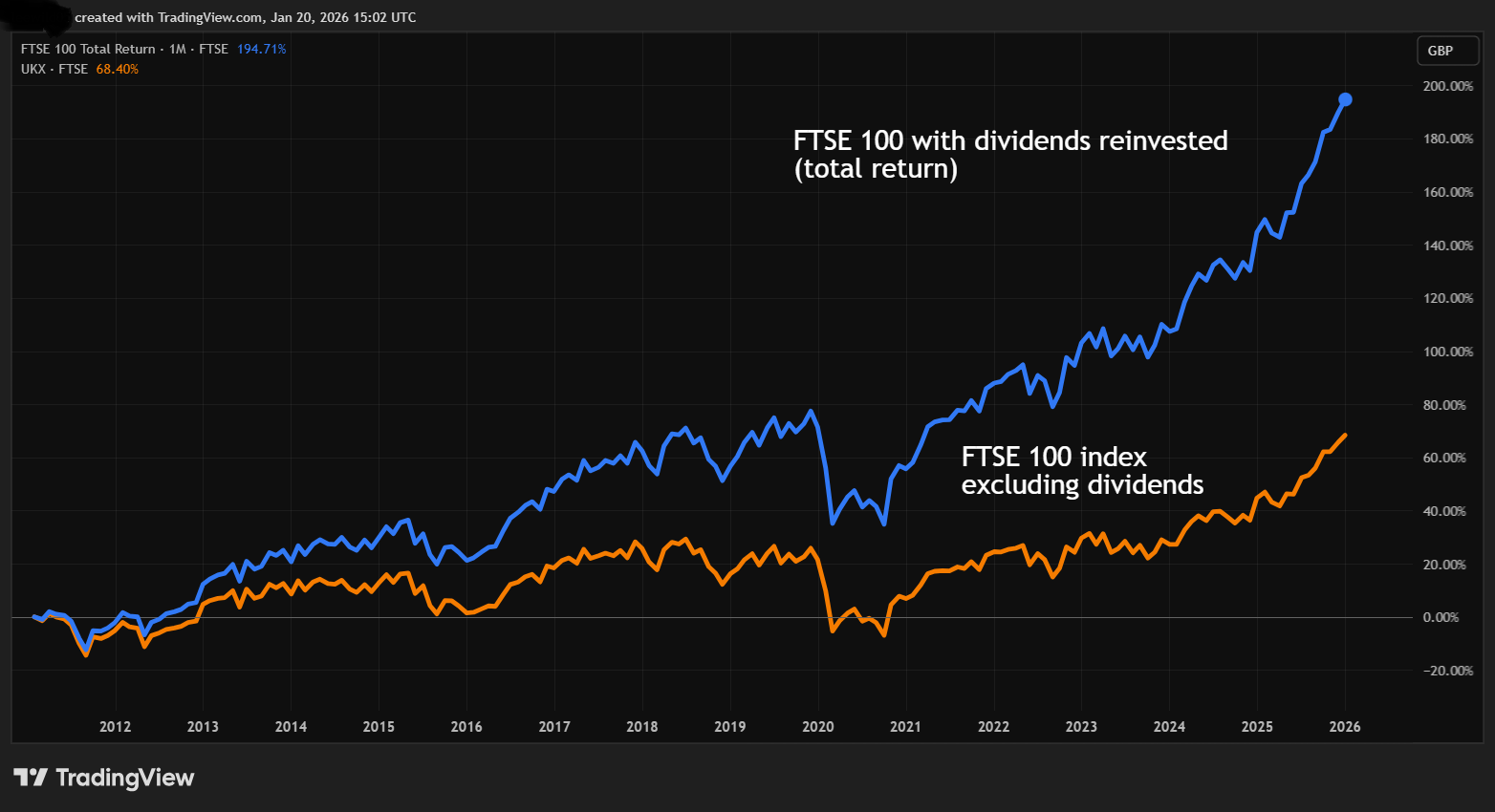

The chart below also shows that in the past 15 years, the return on the FTSE 100 index would have been 195% had you reinvested your dividends. Without the dividends, the gain would be a much more modest 68%.

Source: TradingView. Past performance is not a guide to future performance.

So, if you are a novice investor seeking to grow your wealth, the important thing is to get started with a diversified investment, invest regularly and reinvest your dividends, rather than worrying too much about timing your entry, market-moving events, or the level of the FTSE 100.

Lump sum investing vs regular investing

Over the long term, interactive investor data shows that the return from lump sum investing slightly trumps that of regular investing, but there’s not much in it, so if you don’t have a lump sum to commit, don’t let that put you off.

If you are ready to invest a lump sum and markets are high, dripping that money into the market may provide peace of mind. However, there is also the risk that share prices might continue to rise. If they fall just after you have invested a lump sum, the option is to wait for markets to recover their value. Investors should have at least a five-year time frame and between three and six months of cash savings for emergencies. This avoids having to sell your investments at an inopportune moment.

- My first five years as an ISA investor

- What are Quick-start Funds?

- How much help do you need when investing?

Stock market recoveries might take a few weeks, months, or more, but as we’ve said before, rising and falling stock markets are an unavoidable part of the investing cycle. And through history, stock markets have always bounced back over time. Falling markets can be your friend too, offering the chance to buy shares more cheaply.

If you opt for regular monthly investing – which is free on interactive investor – this process helps smooth the volatility inherent in investing, since some months your money will be buying more shares when the market falls (investments become cheaper) and fewer shares when the market rises (investments become more expensive). This is known as pound-cost averaging to use investing terminology.

Again, the longer you stay invested, the greater the chance of growing your wealth.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.