ii investment performance review 2025

From Trump tariffs, and fears of an AI bubble, to rate cuts and soaring precious metals, we share the numbers for 2025.

16th January 2026 11:07

Market round-up

2025 was a strong year for global markets, with insatiable risk appetite driving a broad market rally and leading to several markets hitting all-time highs, with investors seemingly shrugging off any obstacles thrown their way.

Heading into 2025, investors expected strong US outperformance to persist on the prospect of deregulation and tax cuts. However, tariffs introduced on ‘Liberation Day’ by the Trump administration meant investors had to grapple with the economic impacts of that instead. Global markets sold off sharply in response, although they quickly recovered, as the Trump administration hit pause on tariff implementation to allow for negotiations, and then continued to soar when tariff levels were lower than feared and corporate earnings continued to be solid.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Precious metals saw significant returns in 2025 as the S&P GSCI Precious Metals Index rose 57.05%, with gold and silver posting strong returns as investors sought out safe-haven assets amid economic and geopolitical uncertainty. Silver’s rally (122.21%) was even stronger than that of gold’s (53.64%) as it was amplified by industrial demand. Emerging markets (EM) were a key beneficiary of higher metal prices and a weaker US dollar as they outperformed global equities.

Continuing the theme of recent years, artificial intelligence (AI) remained a key focus for investors as Communication Services and IT continued to outperform. However, the market became more selective as investors began to question the gargantuan scale of spending and the ability to deliver earnings. This broadened returns beyond mega-cap AI-exposed technology stocks, with only two of the Magnificent Seven outperforming global equities in 2025.

Inflation also continued to be a key theme and remained elevated in 2025, particularly in the UK and the US. UK inflation rose sharply over the summer due to higher employer national insurance contributions and rising food, energy and travel costs, before moderating later in the year as services inflation slowed and the labour market softened. While the Bank of England cut rates four times during the year, it maintained a cautious approach, stressing that policy remained restrictive amid persistent inflation risks.

- Investment outlook: expert opinion, analysis and ideas

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

US inflation rose early in 2025 before moderating later in the year after proving more resilient than expected. Fears of a tariff-driven inflation spike did not materialise, with limited pass-through to prices, while easing services and shelter inflation and a softening labour market allowed the Federal Reserve to begin cutting rates, underscoring its policy independence.

All returns are quoted on a sterling basis unless otherwise stated.

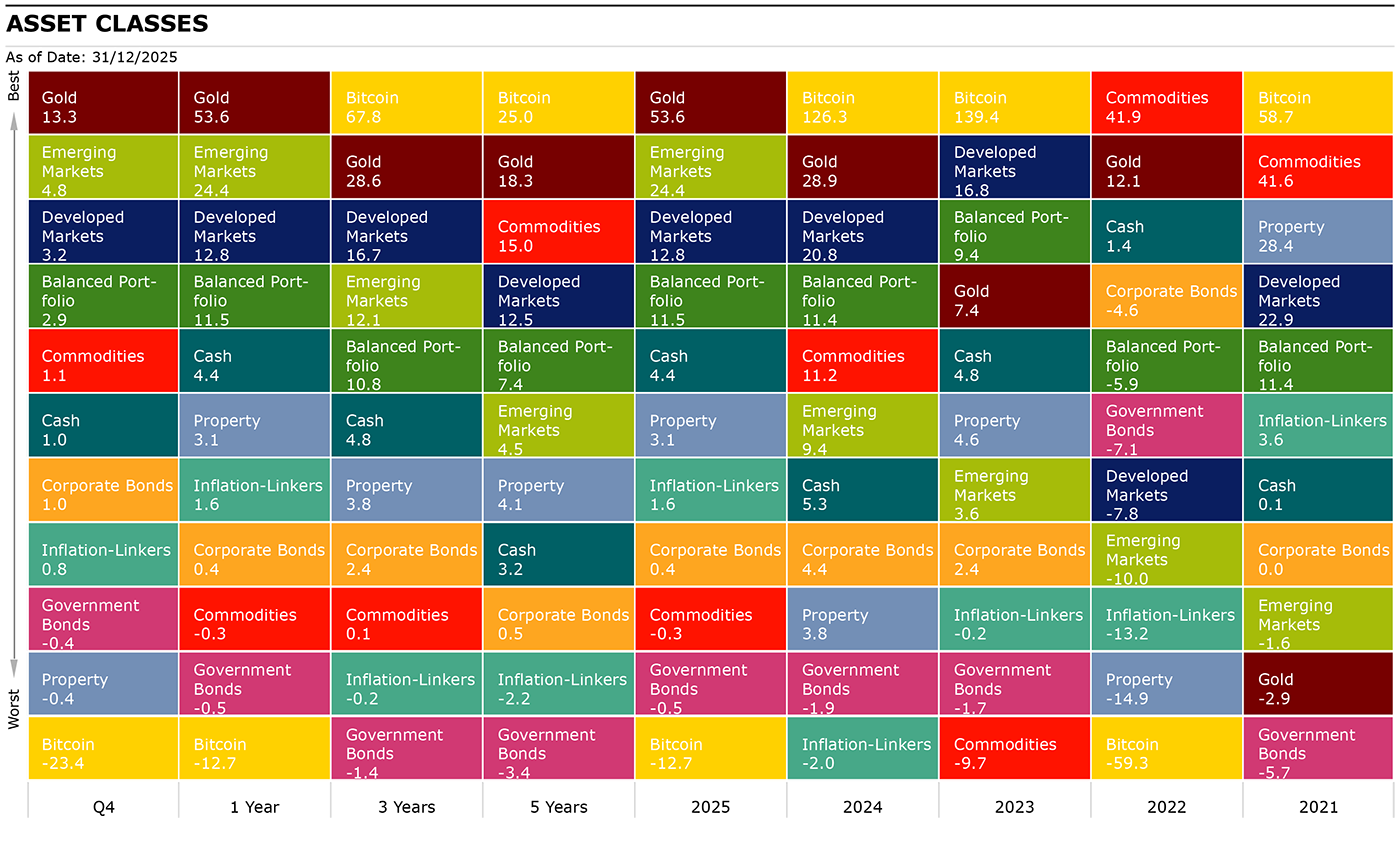

Source: Morningstar as of 31st December 2025. Total Returns in GBP. Developed Markets: MSCI World, Emerging Markets: MSCI EM, Corporate Bonds: Bloomberg Global Aggregate Corporate, Commodities: S&P GSCI, Property: FTSE EPRA Nareit Developed, Inflation-Linkers: Bloomberg Global Inflation Linked, Government Bonds: Bloomberg Global Treasury, Bitcoin: S&P Bitcoin, Balanced Portfolio: FTSE UK Private Investor Balanced, Cash: SONIA Lending Rate, Gold : LBMA Gold Price.

Equities

Global equities rose 13.91% in 2025, down from 19.59% in 2024 as emerging markets (24.37%) outperformed developed markets (12.75%) for the first time since 2020.

The S&P 500 rose 9.76% for the year, however it underperformed against global peers for the first time since 2017. Communications Services (24.03%) led all sectors in the US, as Alphabet Inc Class A (NASDAQ:GOOGL) (54.36%) benefited from the AI tailwind, while Warner Bros. Discovery Inc Ordinary Shares - Class A (NASDAQ:WBD) (153.88%) share price rose due to a takeover announcement by Netflix Inc (NASDAQ:NFLX) and subsequent interest by Paramount Skydance Corp Ordinary Shares - Class B (NASDAQ:PSKY). Electronic Arts Inc (NASDAQ:EA)’ (30.53%) share price soared as after it was announced that it will be taken private. Other outperforming sectors include IT (15.29%) and Industrials (10.71%), while Real Estate (-4.94%), Consumer Staples (-3.98%) and Consumer Discretionary (-1.46%) were the notable laggards in the US.

UK equities saw strong performance in 2025 as the FTSE All-Share index rose 24.02% and all sectors posted 20%+ returns except Technology (-20.75%), Consumer Discretionary (5.89%) and Consumer Staples (6.68%). The leading sectors were Telecoms (49.55%), Financials (38.80%) and Basic Materials (37.06%), which benefited from rising commodity prices, particularly precious metals.

European equities rose 26.18% for the year, a much-welcomed result given a lacklustre 2024 where MSCI Europe ex UK Index rose just 1.94%. Financials (57.05%) led all sectors as interest rates remained supportive of margins (despite interest rate cuts), credit conditions held up and stronger than expected and economic growth improved confidence. Utilities rose 45.55% due to rising demand and Industrials rose 33.42% due to tailwinds in electrification and automation, and a renewed interest in European defence. The lagging sectors were Healthcare (8.50%), Consumer Discretionary (9.05%), Materials (12.84%) and Communication Services (12.94%), albeit they still saw positive returns for the year.

In Japan, the TOPIX Index saw a broad market rally as it returned 17.13%. All sectors saw positive returns in 2025 as corporate reforms continued, and the market reacted positively to the election of Sanae Takaichi as prime minister. Takaichi has committed to increase fiscal spending to support the Japanese economy. The best-performing sectors were Steel & Non-Ferrous (57.30%), Banks (35.58%), Construction & Materials (33.12%), Energy Resources (32.47%) and Real Estate (32.37%), while Raw Materials & Chemicals (1.58%), Pharmaceuticals (2.54%), Foods (4.35%) and Auto & Transport Equipment (6.02%) lagged relatively.

Emerging markets (24.37%) were a standout in 2025 with EMs generally benefiting from a weaker US dollar and rising commodity prices, with a notable beneficiary being Brazil, which rose 39.41%, with rate cut expectations also providing a boost. In addition, sentiment was lifted by trade talk progress between the US and China (22.14%) post-Liberation Day.

Elsewhere, Taiwan (29.48%) and South Korea (86.08%) were beneficiaries of the AI tailwind with the election of Lee Jae-myung as president in South Korea providing a further positive sentiment for the country. Lee’s policies include corporate governance reforms similar to those seen in Japan.

India was a notable underperformer in 2025 as it fell 4.45% on growth concerns, which was further exacerbated by the US imposing a punishing level of tariffs of 50% on Indian goods. From a sector perspective, Materials (51.30%), IT (43.63%), Communication Services (27.83%) and Industrials (26.33%) led in EM, while Consumer Staples (-0.79%), Healthcare (4.49%), Utilities (5.07%) and Energy (8.64%) detracted from EM returns.

| Q4 (%) | 1 year | 3 years | 5 years | |

| FTSE All-Share | 6.38 | 24.02 | 13.58 | 11.71 |

| FTSE 100 | 6.86 | 25.82 | 14.20 | 13.05 |

| FTSE 250 | 2.94 | 12.97 | 9.69 | 4.97 |

| FTSE Small Cap | 4.56 | 14.43 | 10.56 | 7.52 |

| Europe Ex UK | 6.07 | 26.18 | 13.88 | 9.76 |

| S&P 500 | 2.75 | 9.76 | 18.51 | 14.80 |

| Asia Pacific Ex Japan | 3.65 | 20.64 | 11.07 | 4.53 |

| TOPIX Japan | 2.62 | 17.13 | 13.42 | 7.37 |

| Emerging Markets | 4.82 | 24.37 | 12.14 | 4.53 |

| Brazil | 7.11 | 39.41 | 7.66 | 5.98 |

| China | -7.30 | 22.14 | 7.55 | -2.88 |

| India | 4.88 | -4.45 | 7.23 | 10.24 |

| World | 3.21 | 12.75 | 16.74 | 12.51 |

| MSCI ACWI | 3.39 | 13.91 | 16.25 | 11.55 |

| World Growth | 2.87 | 12.79 | 23.18 | 12.74 |

| World Value | 3.43 | 12.47 | 10.32 | 11.71 |

Source: Morningstar as of 31 December 2025. Total Returns in GBP. MSCI ACWI World Indexes. Past performance is not a guide to future performance.

Sectors/Style

Both value and growth rallied in 2025 with global growth rising 12.79%, just pipping global value’s 12.47%.

All sectors saw positive returns in 2025 at the global level, led by Communication Services (23.50%), Materials (22.76%), Financials (19.74%) and IT (17.67%), while the Consumer Staples (1.07%), Consumer Discretionary (1.98%), Energy (5.88%) and Healthcare (6.77%) lagged.

From a size perspective, global large-caps led the way delivering 14.49% growth for the year, while small (11.47%) and mid-caps (10.73%) lagged comparatively, albeit still delivering double-digit returns for the year. However, there are notable regional differences. In Europe, mid-caps (34.02%) outperformed small (25.96%) and large caps (24.55%), and Japan also saw mid-caps (20.27%) outperform small (18.42%) and large caps (15.46%).

| Q4 (%) | 1 year | 3 years | 5 years | |

| Consumer Discretionary | -0.46 | 1.98 | 15.03 | 5.16 |

| Healthcare | 9.94 | 6.77 | 2.40 | 6.12 |

| Industrials | 1.89 | 16.96 | 15.41 | 12.01 |

| Information Technology | 2.98 | 17.67 | 30.96 | 17.51 |

| Materials | 6.56 | 22.76 | 6.71 | 6.98 |

| Utilities | 2.33 | 14.96 | 7.44 | 8.14 |

| Consumer Staples | 1.21 | 1.07 | 1.17 | 4.08 |

| Financials | 5.03 | 19.74 | 18.21 | 16.05 |

| Energy | 2.68 | 5.88 | 2.76 | 17.42 |

| Communication Services | 3.42 | 23.50 | 29.06 | 11.71 |

Source: Morningstar as of 31 December 2025. Total Returns in GBP. MSCI ACWI World Indexes. Past performance is not a guide to future performance.

Fixed Income

The Bloomberg Global Aggregate Index rose 0.72% for the year with risky assets leading the way. Global high yield (4.34%) outperformed investment grade and global corporates (0.45%) outperformed global treasuries (-0.54%). Global credit outperformed as spreads were tight reflecting solid fundamentals as the worries over the Liberation Day tariffs faded.

In the UK, corporates (6.79%) outperformed gilts (5.03%) and outpaced their global counterparts. In fixed income, EM debt was a notable performer in fixed income as it saw a 13.27% return for the year, as measured by iShares JPMorgan $ EM Corp Bd ETF $ Dist GBP (LSE:EMCP) (sterling hedged).

In the UK, inflation remain elevated but did fall in the latter half of 2025, which coupled with a weakening labour market allowed the Bank of England to cut its base rate from 4.75% to 3.75%. Two-year gilt yields fell from 4.38% to 3.71%, while 5-year gilt yields fell by a lesser extent, from 4.57% to 4.48% in 2025.

In the US, concerns about debt sustainability and inflation were overshadowed in the latter half of the year by economic concerns, as the US showed signs of a weakening labour market, which ultimately led to the Federal Reserve to cut its key rate three times from 4.25% - 4.50% to 3.50% - 3.75%. US 2-year treasury yields fell from 4.26% to 3.48% and US 10-year Treasury yields also fell, from 4.57% to 4.17% in 2025.

In Europe, long-term yields rose on fiscal concerns as Germany announced an increase in spending on infrastructure and defence in effort to stimulate the economy and in response to Russian aggression, while in France, long-term yields increased due to political instability as multiple governments failed to pass budget cuts to tackle debt concerns. Over 2025, government 10-year yields in Germany rose from 2.38% to 2.86%, while in France 10-year government yields rose from 3.23% to 3.56%.

| Q4 | 1 year | 3 years | 5 years | |

| Global Aggregate | 0.33 | 0.72 | 0.18 | -1.83 |

| Global Government | -0.35 | -0.54 | -1.36 | -3.41 |

| UK Gilts | 3.10 | 5.03 | 1.73 | -5.33 |

| Global Corporate | 0.99 | 0.45 | 2.39 | 0.48 |

| Sterling Corporate | 2.53 | 6.79 | 5.68 | -1.20 |

| EURO Corporate | 0.29 | 8.80 | 4.67 | -0.71 |

| Global Inflation Linked | 0.83 | 1.60 | -0.22 | -2.23 |

| UK Inflation Linked | 3.48 | 1.35 | -2.31 | -8.68 |

| Global High Yield | 2.34 | 4.34 | 7.66 | 4.57 |

Source: Morningstar as of 31st December 2025. Total Returns in GBP. Global Aggregate: Bloomberg Global Aggregate, Global Government: Bloomberg Global Treasury, UK Gilts: FTSE Act UK Conventional Gilts All Stocks. Global Corporate: Bloomberg Global Corporate, Sterling Corporate: ICE BofA Sterling Non-Gilt, Euro Corporate: Markit iBoxx EUR, Global High Yield: Bloomberg Global High Yield, Global Inflation Linked: Bloomberg Global Inflation Linked, UK Inflation Linked: Bloomberg Global Inflation Linked UK. Past performance is not a guide to future performance.

Alternatives

The S&P GSCI was broadly flat (-0.26%) in 2025 with polarising performance between different commodity sectors as Precious Metals (57.05%), Industrial Metals (20.48%) and Livestock (18.04%) saw double-digit returns, while Agriculture (-14.66%) and Energy (-11.66%) saw double-digit losses.

Within Precious Metals, gold rose 53.64%, driven by central bank purchases and investors seeking out safe havens amid global tensions, economic uncertainty and rate cut expectations. Silver was another standout as it rose 122.21% for the year, boosted by strong industrial demand on top of the macro factors that also benefited gold.

Energy fell as crude oil (-24.09%) prices declined on expectations that tariffs could slow global economic growth in the first half of 2025 and on announcements of increased production targets by OPEC+. Natural gas and petroleum fell 26.20% and 10.34% respectively in 2025.

| Q4 (%) | 1 year | 3 years | 5 years | |

| Global REITs | -0.41 | 3.08 | 3.83 | 4.11 |

| UK REITs | 5.51 | 11.10 | 2.79 | -0.94 |

| Gold | 13.27 | 53.64 | 28.58 | 18.28 |

| Global Infrastructure | 2.46 | 14.14 | 10.45 | 11.33 |

| Global Natural Resources | 6.98 | 20.73 | 3.44 | 11.68 |

| Volatility | -8.09 | -19.77 | -14.87 | -7.76 |

| Cash | 1.01 | 4.37 | 4.81 | 3.16 |

| Commodity | 1.06 | -0.26 | 0.06 | 15.02 |

| Brent crude oil | -7.76 | -24.09 | -14.12 | 3.61 |

| Energy | -4.95 | -11.66 | -4.02 | 18.11 |

| Bitcoin | -23.41 | -12.72 | 67.83 | 24.98 |

Source: Morningstar as of 31st December 2025. Total Returns in GBP. Global REITS: FTSE EPRA Nareit Developed, UK REITs: FTSE EPRA Nareit UK, Gold: LBMA Gold Price AM, Oil: Oil Price Brent Crude, Global Infrastructure: S&P Global Infrastructure, Natural Resources: S&P Global Natural Resources, Commodities: S&P GSCI , Energy : S&P GSCI,Volatility: CBOE Market Volatility (VIX), Cash: SONIA Lending Rate, Bitcoin: S&P Bitcoin. Past performance is not a guide to future performance.

Most-traded shares on the ii platform in 2025

Most-bought shares on ii platform in 2025

| NVIDIA Corp (NASDAQ:NVDA) |

| Rolls-Royce Holdings (LSE:RR.) |

| Legal & General Group (LSE:LGEN) |

| Tesla Inc (NASDAQ:TSLA) |

| BP (LSE:BP.) |

Most-sold shares on ii platform in 2025

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.