Interest rates held as inflation threat persists

The Bank of England left things unchanged at today’s meeting, with new interactive investor research finding retirement savers flag price rises as their biggest challenge.

18th September 2025 14:25

by Craig Rickman from interactive investor

The news that UK inflation had remained sticky at 3.8% in August made the Bank of England’s interest rate decision today all but a formality.

After reducing the Bank Rate by 0.25 percentage points to 4% early last month, the Monetary Policy Committee (MPC) left things unchanged at its September meeting, as widely expected.

Policymakers voted by a majority of seven to two to maintain interest rates at their current level with the dissenters preferring to cut the Bank Rate to 3.75%. The committee has continued its cautious approach to loosening monetary policy, wary of the ongoing threat posed by elevated price rises.

While the MPC takes into account several factors when deciding what to do with interest rates, controlling the pace of price rises is its core task. In today’s meeting notes, policymakers projected the consumer prices index (CPI), the UK’s main measure of inflation, to remain around its current level for the rest of this year, temporarily spiking to 4% in September. Price rises are expected to remain above the Bank’s 2% target until spring 2027, casting doubt on when the next rate cut will arrive.

- 10 hottest ISA shares, funds and trusts: week ended 12 September 2025

- Retirement case study: how I manage a £2.5m SIPP and ISA portfolio

George Brown, senior economist at Schroders, said that although markets reckon rates will resume their downward trajectory next year, he’s doubtful this will materialise, suggesting that they could even head in the opposite direction.

“The balance of risks is drifting towards renewed tightening given persistent domestic inflationary pressures. We continue to expect rates to remain on hold this year and next, but we can’t rule out the possibility that the Bank’s next move will be up, rather than down,” he explained.

Rising cost of living the biggest challenge for retirement savers

Inflation poses a silent threat to our money, eating away at its buying power, and it can be particularly pernicious over long periods of time. Not only does high inflation harm how quickly our money grows in “real terms” but rising costs that aren’t matched with increased wages will reduce our disposable incomes, giving us less scope to save money for the future.

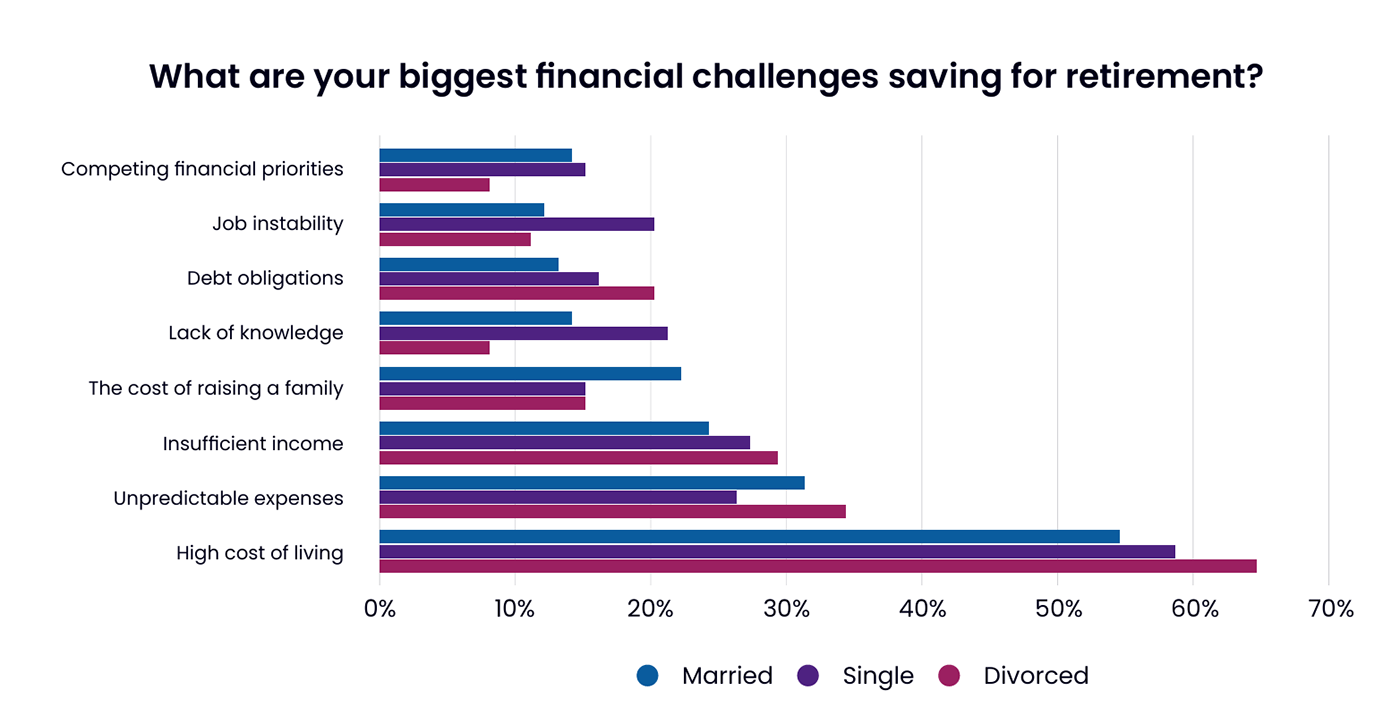

Consumer understanding of the punishing impact of inflation is laid bare in our Great British Retirement Survey 2025. Surveying 9,000 people across the UK, we asked respondents: “What are your biggest financial challenges saving for retirement?”

By far the most popular answer was the high cost of living, with unpredictable expenses also flagged as a key concern. Inflation may have eased from the punishing double-digit heights we endured a few years ago, but CPI has sped up again in the past 12 months and is currently almost twice as high as the Bank of England’s 2% target.

“I’m terrified,” said one GBRS survey respondent. “Having spent the bulk of my adult life as a single mother in low-income jobs, I now have a good wage, but also a huge mortgage and live in a wildly expensive city.”

With households strapped with higher mortgage and rental costs and more expensive grocery and utility bills than they were before the rate-hiking cycle kicked off in December 2021, our finances are being squeezed.

And the effects aren’t being distributed equally across all sections of society. The Office for National Statistics (ONS) last month calculated the inflation figures for specific UK household groups between April and June 2025, finding that some cohorts are feeling the pinch more than others. Annual inflation for low-income households rose by 4.1% during the three-month measured period, versus 3.8% for high-income households. When it comes to tenure type, private-renter households had the highest annual inflation rate of 4.5%, reflecting soaring rental costs.

Saving rates on the slide

In response to the Bank cutting interest rates five times since August 2024, the amount we can earn on our cash savings is on a downward path. For a period, the average savings rates outstripped inflation, meaning your money could hold its value in “real terms” without risk to its nominal value.

But with CPI proving stubborn and savings rates on the slide, this is no longer the case, and while accounts that pay north of 4% are available, you may need to shop around to find them.

Average savings across various account types

Average savings rates | Dec-21 | Sep-22 | Sep-23 | Sep-24 | Aug-25 | Sep-25 |

Easy access | 0.20% | 0.85% | 2.96% | 3.08% | 2.68% | 2.60% |

Notice account | 0.54% | 1.41% | 4.14% | 4.23% | 3.63% | 3.53% |

Easy access ISA | 0.26% | 0.92% | 3.04% | 3.29% | 2.90% | 2.82% |

Notice ISA | 0.37% | 1.21% | 3.89% | 4.08% | 3.49% | 3.37% |

| Source: Moneyfactscompare.co.uk |

In any case, unless you have plans for the money within the next five years or wish to retain it as a cushion to cope with any unexpected or emergency costs, keeping your money in cash may not be the best approach.

Many people might not feel comfortable with the value of their savings rising and falling, but history tells us that investing in the stock markets offers a better chance of beating inflation than cash.

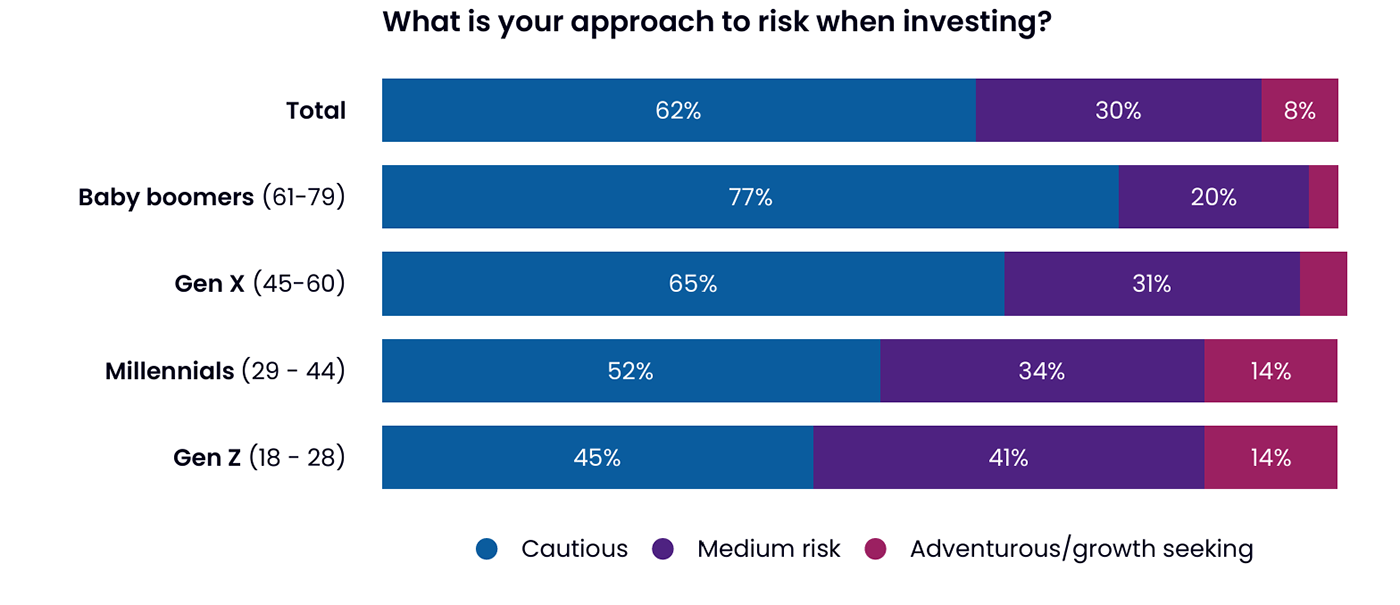

Still, it’s clear that many people favour a low-risk approach, as further data from our new retirement report uncovered.

We asked about Britons’ preferred tolerance for investing risk. Almost two-thirds (62%) of respondents described themselves as cautious, 30% felt that they were medium risk, while only 8% were growth seekers. In terms of age groups, Baby Boomers (aged 61 to 79) were the most cautious – unsurprising as retirees tend to have less propensity to take on and bear investment risk. Gen Z (aged 18 to 28) have the greatest appetite for risk, although we should note that almost half (45%) favour caution over more adventure.

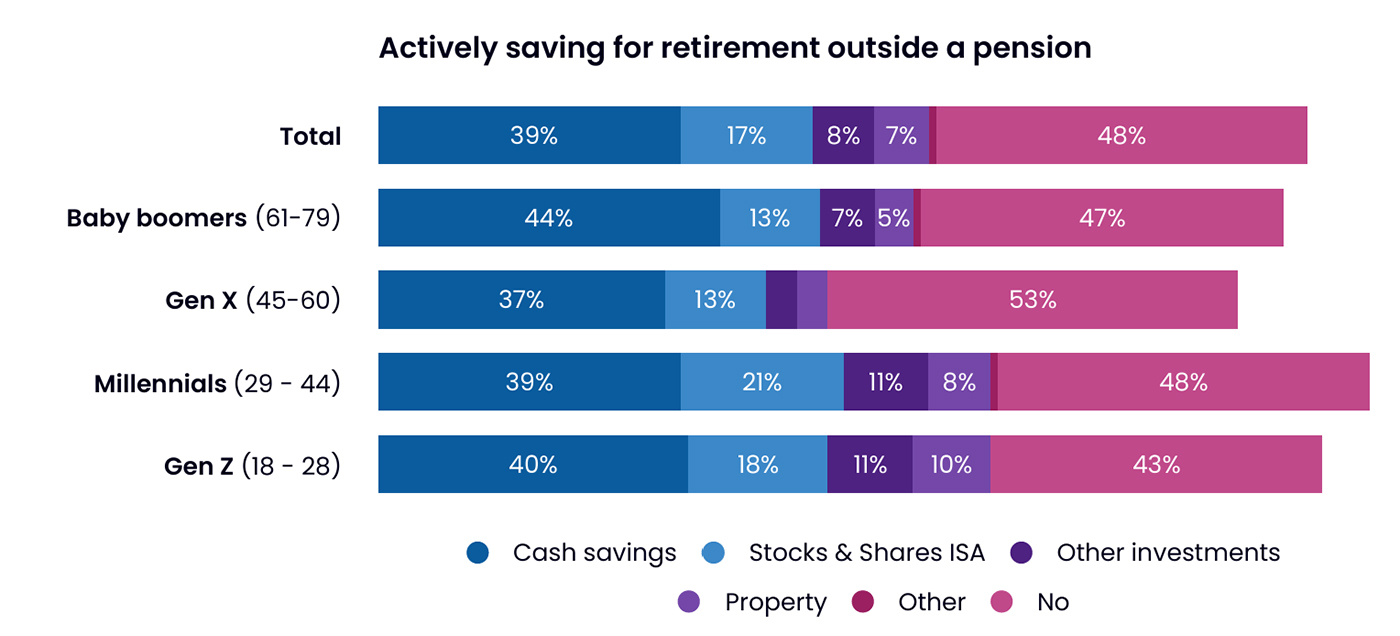

It may therefore come as little surprise to learn that when it comes to saving for retirement outside a pension, cash savings are the most popular vehicle, with 39% of respondents using this approach. By contrast, only 17% invest in a stocks & shares individual savings account (ISA), despite some savers not planning to access the money for three or four decades.

ISA subscriptions surge

Shielding your income and growth from tax is a crucial tactic when seeking to lessen the impact of inflation, as HMRC won’t grab a slice of the money you make. With ISAs any gains, dividends and interest are tax free.

The importance of keeping tax bills low when looking to build wealth is reaching the ears of consumers. Roughly £103 billion was pumped into adult ISAs in the 2023-24 tax year, a massive £31.4 billion uptick on the previous year. And in line with the findings from our retirement report, the cash version proved the most popular, with subscriptions rising 67% to £69.5 billion. Stocks and shares ISA subscriptions rose too but by a lower amount, growing 11% to £31.1 billion.

Cash has an important role to play in any balanced investment portfolio, helping to meet short-term needs such as big-ticket purchases and providing some dry powder to capitalise on stock buying opportunities. But the security and certainty offered by cash and cash-like instruments such as money market funds comes with a trade-off; the reduced potential for growth can act as a drag on portfolio performance, potentially stymying how quickly your pot grows.

- Four pension pitfalls and how to tackle them

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

For this reason, it’s vital to not only use ISAs where possible but also choose the right type for the specific goal you’re aiming to achieve.

Investors with less risk appetite may be concerned about significant losses when investing in the stock market, however, there are ways to soften the ups and downs. Making sure you spread your money across different asset types in various corners of the world is one way to reduce investment volatility. The key is to find a level of risk that you’re personally comfortable with.

If you need some help selecting appropriate investments to give your ISA a better chance of beating inflation, then our Managed ISA could provide the solution. Before you open an account, you'll answer a few questions to match you to one of 10 investment portfolios to find the one that best suits you and the level of risk you're happy with.

Something useful to know is that if you feel a different type of ISA than the one you have currently is more appropriate, you can transfer your current holdings without affecting this year’s £20,000 allowance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.