Markets recovering, but we’re still holding significant levels of cash

13th December 2021 15:06

by Douglas Chadwick from ii contributor

Although the market downturn in response to the Omicron variant was relatively short-lived, Saltydog analyst is wary of further falls.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Most of the major stock markets around the world went down in November. The main reason was the spread of the Omicron variant of the Covid-19 virus and concerns that countries might be forced back into lockdown. Scientists were worried that it could spread faster than the Delta variant and they are still not really sure how effective current vaccines will be.

Last week, the World Health Organization reported that this latest version, which was first discovered in South Africa, has now been detected in 57 countries.

Stock market indices 2021

| Index | Country | 1 Jan to 31 March | 1 April to 30 June | 1 July to 30 Sept | Oct 2021 | Nov 2021 | 1 to 11 Dec |

| FTSE 100 | UK | 3.9% | 4.8% | 0.7% | 2.1% | -2.5% | 3.3% |

| FTSE 250 | UK | 5.0% | 4.0% | 2.9% | 0.3% | -2.5% | 1.8% |

| Dow Jones Ind Ave | US | 7.8% | 4.6% | -1.9% | 5.8% | -3.7% | 4.3% |

| S&P 500 | US | 5.8% | 8.2% | 0.2% | 6.9% | -0.8% | 3.2% |

| Nasdaq | US | 2.8% | 9.5% | -0.4% | 7.3% | 0.3% | 0.6% |

| DAX | Germany | 9.4% | 3.5% | -1.7% | 2.8% | -3.8% | 3.5% |

| CAC40 | France | 9.3% | 7.3% | 0.2% | 4.8% | -1.6% | 4.0% |

| Nikkei 225 | Japan | 6.3% | -1.3% | 2.3% | -1.9% | -3.7% | 2.2% |

| Hang Seng | Hong Kong | 4.2% | 1.6% | -14.8% | 3.3% | -7.5% | 2.2% |

| Shanghai Composite | China | -0.9% | 4.3% | -0.6% | -0.6% | 0.5% | 2.9% |

| Sensex | India | 3.7% | 6.0% | 12.7% | 0.3% | -3.8% | 3.0% |

| Ibovespa | Brazil | -2.0% | 8.7% | -12.5% | -6.7% | -1.5% | 5.7% |

| RTSI | Russia | 6.5% | 12.0% | 7.5% | 3.7% | -10.7% | 13.3% |

Data source: Morningstar. Past performance is not a guide to future performance.

Fortunately, it looks as though the market downturn was relatively short-lived. December has started well, and the FTSE 100 is already up 3.3%, more than making up for the loss in November. Most of the other major indices have also rebounded and are ahead of where they were at the end of October.

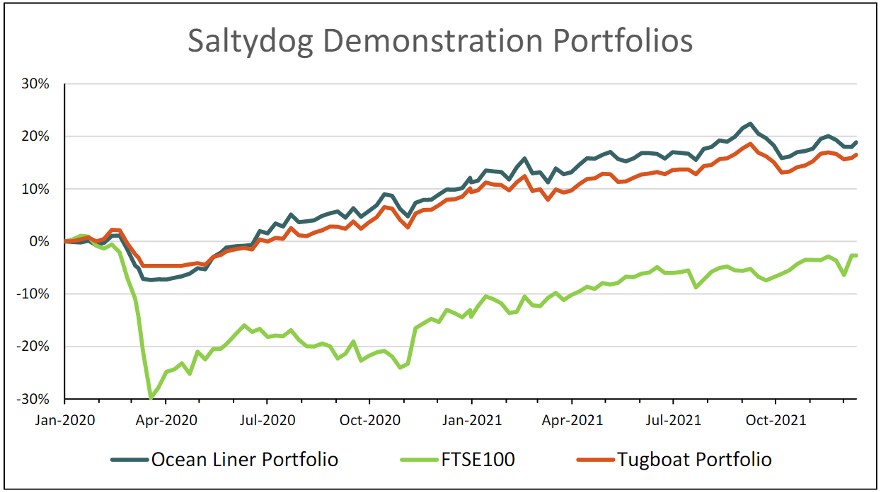

The Saltydog portfolios have also stopped going down and are on the up again.

Past performance is not a guide to future performance.

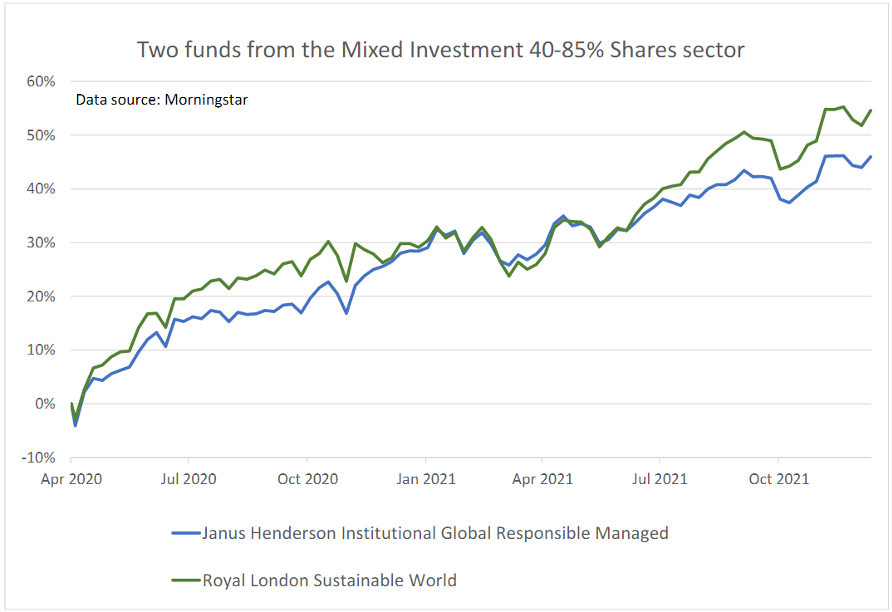

Our largest holdings are still in funds from the Mixed Investment 40-85% Shares sector. One of the funds, Janus Henderson Global Responsible Managed, has been in the portfolio since April 2020. We actively manage the portfolios and usually only hold funds for a few months, so this one is a bit of an exception. We are also invested in the Royal London Sustainable World fund, which we bought in April 2020 but then sold in May 2021. We went back into it in July. Although there have been a few hiccups along the way, these funds have performed remarkably well for us.

Past performance is not a guide to future performance.

Both portfolios also hold the UBS US Growth fund, a Technology fund (either AXA Framlington Global Technology or L&G Global Technology Index), and the Pictet-Clean Energy fund.

Our most recent acquisitions have been a couple of funds from the UK Index-Linked Gilts sector, the L&G All Stocks Gilt Index and the M&G Index-Linked Bond.

- Should investors be CIRCUMSPECT in 2022?

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

We are currently holding significant amounts of cash, around 30% in the Ocean Liner and 40% in the Tugboat. This should protect us if markets fall again, and also gives us the ability to take advantage of any buying opportunities when they arise.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.