Morrisons and Amazon: Retail's newest BFFs

Extending its relationship with the world's biggest retailer is shrewd business by Morrisons' CEO.

13th June 2019 12:29

by Graeme Evans from interactive investor

Extending its relationship with the world's biggest retailer is shrewd business by Morrisons' CEO.

The quiet revolution at Morrisons (LSE:MRW) under chief executive David Potts continues to impress after the supermarket chain extended its partnership with online giant Amazon (NASDAQ:AMZN).

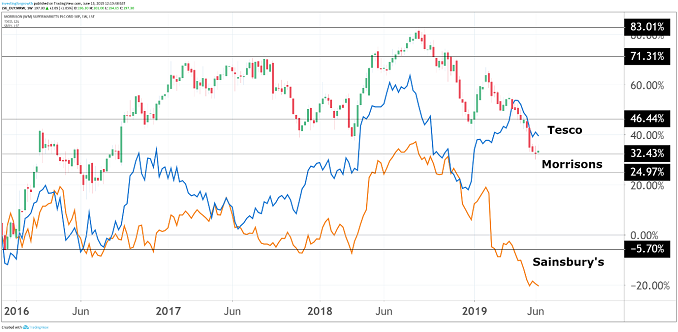

Whereas its rivals have looked to grow through consolidation - with Tesco (LSE:TSCO) buying Booker and Sainsbury's (LSE:SBRY) trying to merge with Asda - Morrisons has been focused on the retailing basics and pursuing capital light growth opportunities such as today's tie-up with Amazon.

Under the agreement, the ultra-fast same-day delivery of Morrisons products to Amazon Prime Now customers will expand from four cities to a further five including Glasgow, Newcastle and Liverpool. The orders are picked at a local Morrisons store, and delivered by Amazon.

Morrisons will become a retailer on the Prime Now website and app - through 'Morrisons at Amazon' - and continue as a wholesaler for all Amazon's other UK grocery offers.

Source: TradingView Past performance is not a guide to future performance

The move, which extends a three-year partnership between the two companies, comes a month after Potts agreed to end the supermarket's exclusive digital partnership with Ocado (LSE:OCDO), leaving it free to pursue other "more profitable growth" opportunities.

The Amazon deal looks to be another shrewd piece of business by Potts, who since 2015 has improved customer satisfaction and stock availability in stores and accelerated the growth of the wholesale offer through deals with the likes of McColl's (LSE:MCLS) and Amazon.

The partnership will inevitably heighten market speculation about the possibility of a much deeper relationship between the two parties.

In a note headed "Going Deeper into the Jungle", analysts at Jefferies examined the potential for Amazon to become a more meaningful driver of Morrisons' volumes.

They wrote:

"While we believe Amazon currently represents a relatively small wholesale channel for Morrisons, this news suggests a deeper commitment between the two. In time this should represent a more volume accretive relationship for Morrisons."

It will also reignite talk that Amazon may look to buy Morrisons outright, having moved into bricks-and-mortar retailing with its purchase of Whole Foods in 2017. Fears of disruption in the UK grocery sector have been growing ever since, fuelled by reports in recent months that Amazon has been a heavy buyer of warehouse space in the UK.

- Tesco shares: Reasons to be cheerful

- Why Tesco shares are worth much more than this

- The Week Ahead: Five high-profile names report

Shares in Morrisons were 1% higher today at 197.6p, having fallen by 15% over the past year due to competitive market conditions. The team at Jefferies think there's still potential for the share price to revisit the multi-year high of 269p achieved last summer.

Clive Black, retail analyst at house broker Shore Capital, said today's announcement represented efficient use of existing warehouse space and in-store picking capability.

He added:

"We also see potential significance in Amazon's commitment to grow its grocery business in the UK and the further deepening of its involvement with Morrisons."

With Morrisons close to Amazon and Tesco still dominant, it's hard not to see Sainsbury's boss Mike Coupe as increasingly isolated. At annual results last month, he pledged investment in supermarkets and in online sales in the wake of the Asda deal collapse, but there was no Plan B that investors had wanted after a poor year for the share price.

At Tesco, where Dave Lewis has almost completed a five-year turnaround, investors will find out more on Tuesday about how management plans to target "untapped value opportunities".

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.