Retail investors urged to check fees and save money

Only one in 10 check fees when comparing investment platforms, according to new research from interactive investor.

5th February 2026 09:54

- Fees can make a big difference to investors’ investment pots over time, but only 10% of investors say they ‘always’ check fees when comparing investment platforms

- interactive investor is urging investors to ‘dare to compare’ to see if they could be saving money and be more in control of their financial future

- interactive investor’s ISA and SIPP calculators compare ii’s fees to Hargreaves Lansdown’s new fees, following Hargreaves Lansdown’s decision to reprice from 1 March

Fees are one of the core things investors can control when it comes to investing, yet only one in 10 (10%) investors will always check fees when comparing different investment platforms, reveals new research* from interactive investor (ii), the UK’s leading flat-fee investment platform. Though this is low, it seems investors are becoming more cost-conscious, as this is an uptick from 7% a year ago.

interactive investor’s same research found that only 40% of investors are certain that they know exactly what they are paying in investment platform fees – compared to 37% last year.

Many investors are still in the dark on fees, but want transparency

In this research, almost one third of investors (32%) said they want more transparent fees, and 43% of investors stated that they are more likely to move for lower fees.

interactive investor recently updated and simplified its fee structure. Its flat-fee charging structure makes it a proud industry outlier, where using complex percentage-based charging structures is the norm. Percentage-based investment platform charging can also eat into investors’ pots over time, and this isn’t always easy to see.

Camilla Esmund, senior manager at interactive investor, comments: “While it’s encouraging to see that more investors are starting to check the costs associated with their investments, the vast majority are still in the dark and therefore unaware that they might be paying over the odds. Over the years, these charges could be eating into their money when it should be benefiting from the long-term magic of compounding.

“Unfortunately, comparing investment platform fees often still creates confusion for consumers when what they really need is clarity. The need for clarity is necessary whatever we are buying or consuming; the investment world should be no different. At interactive investor, we’ve made our transparent pricing even more straight-forward and better value. We now have simple three price plans which give you access to all our accounts and tools, and everything you need to build financial resilience for you and your family, under one trusted roof. You know what you’re paying, and you’re firmly in the driver’s seat of your financial future.”

interactive investor customers have also shared their experiences, noting that flat fee pricing is much clearer to understand. interactive investor customer Nick, explained: “My ISA was with HL (Hargreaves Lansdown). I found the percentage charges challenging to translate into a monthly figure. I really liked the look of ii and I’m really happy with the fees since changing to them – it was obvious.”

The stealthy impact of percentage fees in action

New pricing announced by Hargreaves Lansdown (which comes into effect 1 March) has put the significance of choosing a platform with the right fees more firmly in the spotlight.

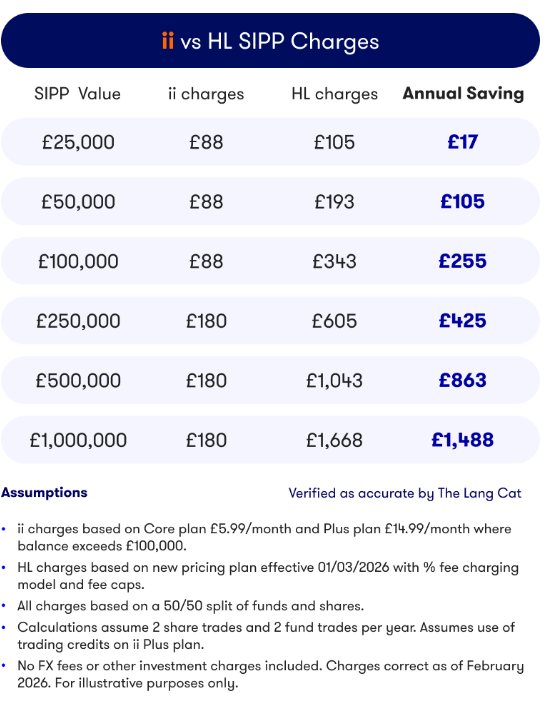

Below, interactive investor has broken down what you can save with interactive investor’s monthly flat-fee, versus the new pricing at Hargreaves Lansdown when it comes to your Self-InvestedPersonal Pension (SIPP).

Source: interactive investor

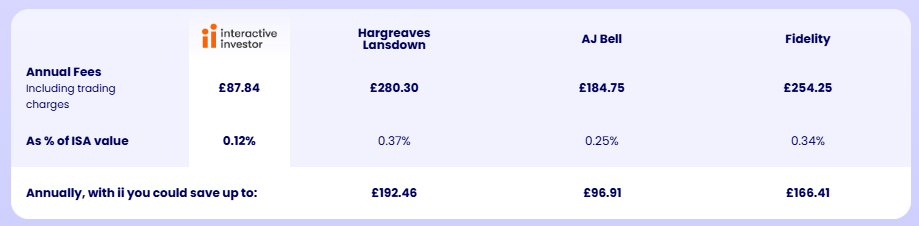

ISA investors can check how much they would pay in fees across a variety of providers with ii’s ISA comparison calculator. For example, someone who has £75,000 in their Stocks & Shares ISA could save £192 in the long run compared to Hargreaves Lansdown**.

Since Hargreaves Lansdown’s announcement of its new pricing, interactive investor has already seen an almost 200% increase in transfer ins from Hargreaves Lansdown (across SIPPs/ISAs/General Investment Accounts)***.

The power of consolidating

It’s worth noting that though these comparisons only contain single products. Almost one third of investors (31%) would move to have investments in one place, and with interactive investor, you have access to a Stocks & Shares ISA, General Investment Account, and Personal Pension (SIPP) all within the same monthly flat-fee. With interactive investor’s Plus and Premium plans, investors can also get their whole family onboard – through free Junior ISAs and fee-free accounts for their family members.

Camilla Esmund, senior manager, interactive investor, says: “You shouldn’t have to spend a lot of time trying to understand what you’re paying in fees. That’s why our price plans are simple, fixed, and completely transparent. You can have everything you need in one place for you and your family, making it easier to manage, too.”

*This survey was conducted by Censuswide, polling 1,000 UK adults who hold investment products including S&S ISAs with a balance of at least £20,000, and aged 18+. It was conducted from 16/01/26-20/01/26.

**Comparison disclosure: We compared yearly charges of an ii ISA with other ISA providers. Results are based on published ISA charges as at 01/02/2026 for AJ Bell & Fidelity. Hargreaves Lansdown charges based on new pricing plan effective 01/03/2026. Verified as accurate by The Lang Cat.

Assumptions: 50% of ISA investments held in funds and 50% in equities, 2 equity and 2 fund trades per year, 12 regular equity and 12 regular fund trades per year. Other trading behaviours will result in different charges than those shown. This comparison covers a single year and does not account for investment growth or the impact of inflation over time. To ensure a fair comparison, fund manager charges have not been included. The information provided is for illustrative purposes only. For precise charges, we recommend contacting the ISA provider directly.

***Transfers compare the week 26/01/26-02/02/26 to the week prior.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.