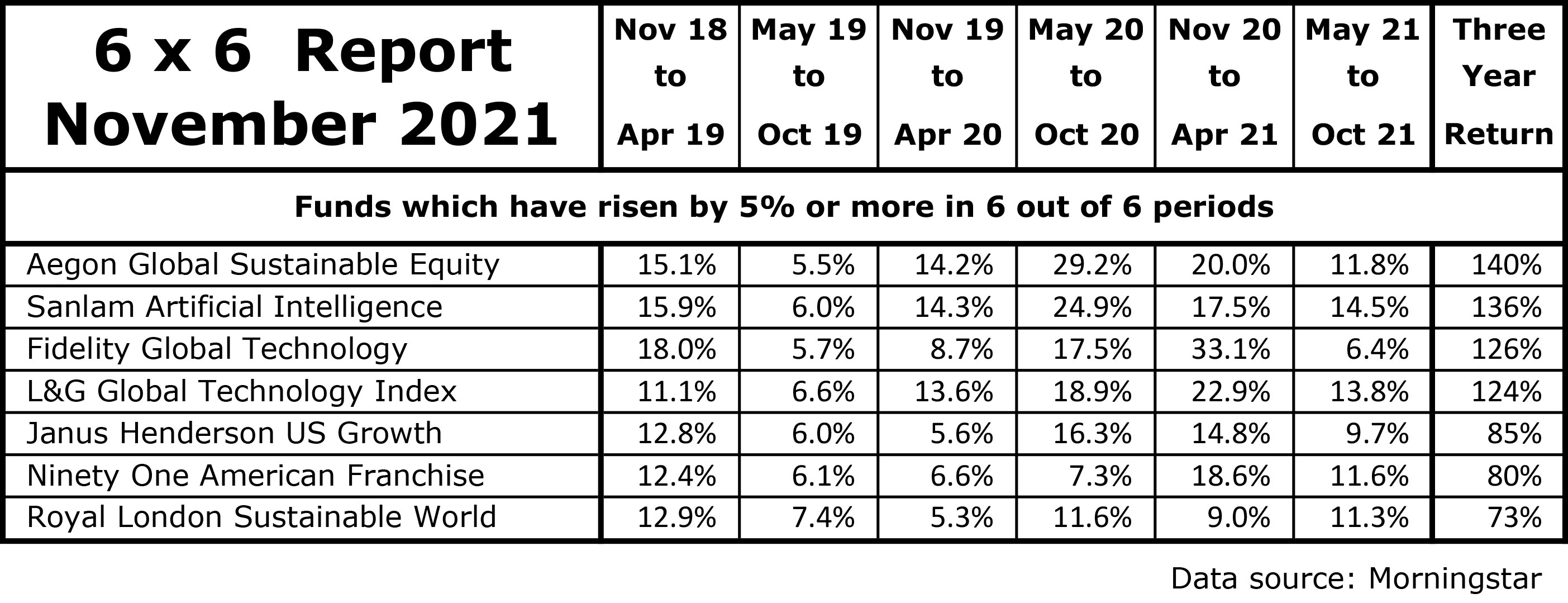

Seven outstanding funds over the past three years

15th November 2021 14:15

by Douglas Chadwick from ii contributor

Saltydog runs its latest quarterly report that looks for consistent performers.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In May 2019, we ran our first ‘6 x 6’ report. We usually focus on the short term, from one week up to six months, but on this occasion we modified our algorithms to look at the performance of funds in a different way that is more long term.

For our 6 x 6 report, we went searching for funds that had regularly achieved a 5% gain in consecutive six-month periods over the last three years.

The first time we ran the report there were a small number of funds that had managed to achieve this for all six periods, and nearly 40 that had missed out only once. The list consisted of many familiar funds that featured regularly in our normal Saltydog analysis, and they were predominantly from the Technology, Global, and North American sectors.

Since then, we have been updating the report every three months.

- How Saltydog invests: a guide to its momentum approach

- Are growth, value and quality labels misleading?

- Get £100 cashback when you switch to an ii ISA in November. Terms apply

In August this year, there were eight funds that had managed to beat our 5% target return in each six-month period over the last three years, and in our latest report there are seven.

Past performance is not a guide to future performance

At the top of the list is a fund that was not in August’s shortlist, the Aegon Global Sustainable Equity fund from the Global sector, which has gone up by 140% in three years.

Next is the Sanlam Artificial Intelligence fund, which used to be called the Smith & Williamson Artificial Intelligence fund. This is the only fund that has gone up by 5% or more in every six-month period over the last four years. It was in August’s shortlist, as was Fidelity Global Technology and L&G Global Technology Index.

- Five consistent funds that have doubled in three years

- Top-performing fund, investment trust and ETF data: November 2021

At the bottom of the table is a fund that has not been in the list before. Royal London Sustainable World is from the Mixed Investment 40-85% hares sector and regularly features in our demonstration portfolios. It is currently our largest holding, so we hope this run of form continues.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.