A share to buy the dip plus a value stock for income seekers

This heavyweight player in a competitive but lucrative sector has already been a successful share tip for analyst Rodney Hobson, but there could be further opportunities.

5th November 2025 07:51

by Rodney Hobson from interactive investor

Slim pickings have meant fatter figures at drug maker Eli Lilly and Co (NYSE:LLY). Well done to anyone who had a nibble at the bottom, but do remember that this could be as good as it gets for the time being.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The battle of the lucrative market for slimming drugs has clearly intensified, with newspaper columnists falling over themselves to write of their experiences with pills or injections such as Zepbound, Ozempic and Wegovy. Even the occasional adverse feature seems to prove that there is no such thing as bad publicity.

Lilly is the heavyweight among drug companies, and more prescriptions are being written for its Zepbound slimming drug than for the Wegovy obesity drug made by Danish rival Novo Nordisk AS ADR (NYSE:NVO)in the biggest and highly competitive market that is the United States.

In fact, Lilly’s obesity drugs now account for almost 58% of a market projected to reach $150 billion over the next five years. Third-quarter revenue for Zepbound and also Lilly’s diabetes drug Mounjaro both beat analysts’ expectations (they’re both brand names for the drug tirzepatide - Zepbound when prescribed for weight loss and Mounjaro for diabetes), helping total sales to reach $17.6 billion, well ahead of forecasts for little over $16 billion. Lilly edged up full-year guidance from $63 billion to $63.5 billion, but another quarter like the third one will easily cause an overshoot.

Net income multiplied from just under $1 billion in the previous third quarter to nearly $5.6 billion. Profits for the year so far have doubled.

Lilly has been affected by turmoil within the pharmaceutical industry caused by US President Donald Trump’s decree that Americans should pay no more for their treatments than patients in other rich countries. This had forced Lilly to reduce US prices by 15% but it sold 60% more products, taking total sales there up to $11.3 billion.

Revenue in the rest of the world shot up 74% to $6.3 billion, thanks mainly to increased volumes of Mounjaro – and also a hefty price rise for private patients in the UK to move into line with the rest of Europe.

- Stockwatch: how much notice should we take of Warren Buffett?

- 10 hottest ISA shares, funds and trusts: week ended 31 October 2025

There could, admittedly, be a considerable cost to come. All drugs have side effects as well as benefits and there have already been reported reactions claiming that weight loss and diabetes drugs cause pancreatitis, with a small handful of cases proving fatal. However, there is no firm evidence that the drugs were the cause and, in any case, it will take years to gather sufficient evidence to mount the seemingly inevitable class action on behalf of alleged victims.

Meanwhile, as with all weight loss programmes including diets, there is always the likelihood that those benefiting put weight back on once they stop the treatment, which will mean a recurring round of lucrative sales of obesity drugs for years to come.

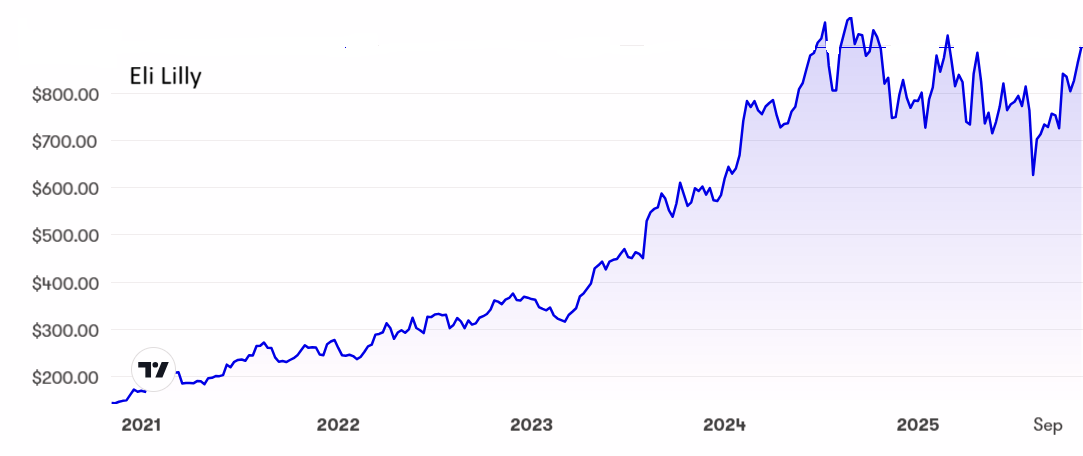

Lilly shares have gained since the figures were released but are still below the peak of $950 set in August last year and were as low as $625 in August this year. At the current level around $900 the price/earnings (PE) ratio is pretty hefty at 42 and the yield is meagre at 0.67%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: In July I told Lilly shareholders to stay in at $770, so following that advice has left them well ahead. I also said that if the floor around $760 failed to hold then buy anywhere below $730. I must admit I expected the floor to stay firm, but the fall was great news for buyers, who almost immediately had great chances to get in even more cheaply than I suggested. The advice now is similar: hold if you are in, buy on weakness, say below $850.

- ii Tech Focus: Nvidia, Microsoft, Strive Inc, AMD, Airbnb

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

At the same time, I said that Pfizer Inc (NYSE:PFE), then under $25, was unlikely to soar but with a comparatively low PE and high yield was looking quite cheap. The shares are now $24.34 with a yield approaching 7%. They remain a buy as a value stock for income seekers.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.