Share Sleuth: the new holding I’ve picked to reduce my cash pile

With more than £10,500 cash in the Share Sleuth portfolio, Richard Beddard is looking to top up an existing holding or introduce a new name. Here, he explains how he decided which company to buy.

9th May 2024 10:01

by Richard Beddard from interactive investor

After a series of disposals and with more than £10,500 cash in the Share Sleuth portfolio, I was very reluctant to sell any more shares when I sat down to think about trading on Thursday 2 May.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Three-way die roll

Unfortunately, as I wrote last month, my Decision Engine, which recommends trades, is keener for me to sell than buy.

The algorithms it uses are documented in the guide linked at the bottom of this page. Generally, they encourage me to add shares that I have scored most highly.

But there are a number of rules that stop me adding more of a high -scoring share. If we look at the top 15 shares, many of the high-scoring shares are unavailable.

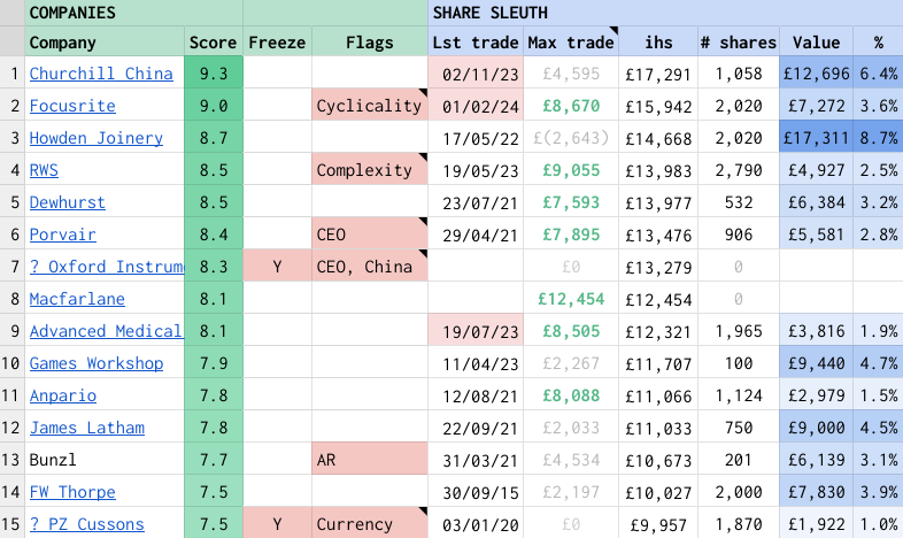

To show why, I am sharing a screenshot of part of the actual Decision Engine spreadsheet in all its gory complexity - as of last Thursday. Although simplicity is my watchword, I do not always achieve as much of it as I want!

Source: Richard Beddard. Top 15 shares in the Decision Engine ranked by Score.

The Max trade column in the middle of the screenshot contains the Decision Engine’s recommended trade. Greyed-out trades are unavailable because the maximum trade size is less than the portfolio’s minimum trade size, which is 2.5% of the portfolio (£4,994).

The minimum trade size discourages me from wasting time with trades of little consequence. It knocks eight of the top 15 shares out of contention.

The maximum trade is based on the ideal holding size. Because Churchill China (LSE:CHH) has a very high score of 9.3, it has a big ideal holding size (£17,291) but the value of the holding is big too (£12,696). The difference is only £4,595, which is a smidgen less than the minimum trade size (£4,994).

I might be prepared to bend that rule, but the “last trade”column on the left of the Max trade column shows that I traded the shares last November, less than nine months ago. To guard against overconfidence, I prefer not to trade a share more than once a year.

Third-ranked Howden Joinery Group (LSE:HWDN) is out of contention because the value of Share Sleuth’s holding is greater than the ideal holding size, so the suggested trade is negative (and too small to bother with).

Seventh-ranked Oxford Instruments (LSE:OXIG) has a greyed-out maximum trade of £0 even though it is not yet a constituent of the portfolio. That’s because I have frozen trading in the share pending a re-evaluation. This is indicated by a “Y” in the Freeze column and a “?” next to its name. The same is true of PZ Cussons (LSE:PZC), ranked 15.

The Flags column next to the Freeze column contains a prompt, so I can recall why I froze a share, or if I have not yet frozen it, what might cause me to.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Shares for the future: FTSE 100 quality does not come cheap

Oxford Instruments has a new chief executive. I rated his predecessor, and I want to read the new one’s first annual report to see if the company’s strategy has changed. The investment also bears an element of geopolitical risk because Oxford Instruments makes technology that is already subject to export restrictions to China.

That leaves the trades highlighted in green in the “max trade” column. Focusrite (LSE:TUNE) is out of contention because I last added shares in February.

Fourth-ranked RWS Holdings (LSE:RWS) is, therefore, the first contender for further investment. The Decision Engine is telling me I can add up to £9,055 worth of shares, but there is a note in the Flag column reminding me that I may have underestimated the complexity of the translation business in my evaluation last February.

Re-reading that article, I think I described the risks quite well. RWS has paid a high price for a number of technology-focused translation and content management businesses in its attempt to stay relevant. Now it is paying a high price to knit them together. However, my scores may have been too bullish.

- NatWest retail share offer latest

- Making the most of your tax breaks in 2024

- Stockwatch: a buying opportunity soon in this Magnificent Seven stock?

Maybe it would be better to add shares in Dewhurst Group (LSE:DWHT), Porvair (LSE:PRV) or Macfarlane Group (LSE:MACF), which have only slightly lower scores than RWS.

Porvair, the maker of filters and laboratory equipment is, to my mind, the highest-quality business of the three (the other two achieve more of their lofty scores partly because the shares look cheap).

But Ben Stocks, Porvair’s longstanding chief executive, is retiring early next year. He is the architect of its successful buy and build strategy. One of the factors I score is the experience of the people running the business and we do not know who his replacement will be. I hope for an internal appointment in these situations, but we will have to wait and see.

Lift component manufacturer and distributor Dewhurst is slightly more highly ranked, but protective packaging distributor Macfarlane would be a new addition to the portfolio. It is a three-way die roll and I have rolled the die because I do not like keeping more than 5% of the portfolio in cash.

Die rolled

I slept on the decision. Then, on Friday 3 May, I added 3,533 Macfarlane shares to the portfolio.

The actual price, quoted by a broker, was a shade over 140p, which cost £5005.43 after deducting £10 in lieu of fees and £24.85 in lieu of stamp duty.

What I would have sold

The Decision Engine would have me reduce or eliminate Share Sleuth’s holdings in many of the portfolio’s best performers because the shares look so expensive.

In the firing line are Jet2 Ordinary Shares (LSE:JET2), Goodwin (LSE:GDWN), 4imprint Group (LSE:FOUR), Cohort (LSE:CHRT), Bloomsbury Publishing (LSE:BMY), Tristel (LSE:TSTL) and Garmin Ltd (NYSE:GRMN).

The holding in XP Power Ltd (LSE:XPP) is also under threat, although in its case it is the quality of the business not the share price, that looks questionable.

Maybe next month my attention will turn back to these shares.

Share Sleuth performance

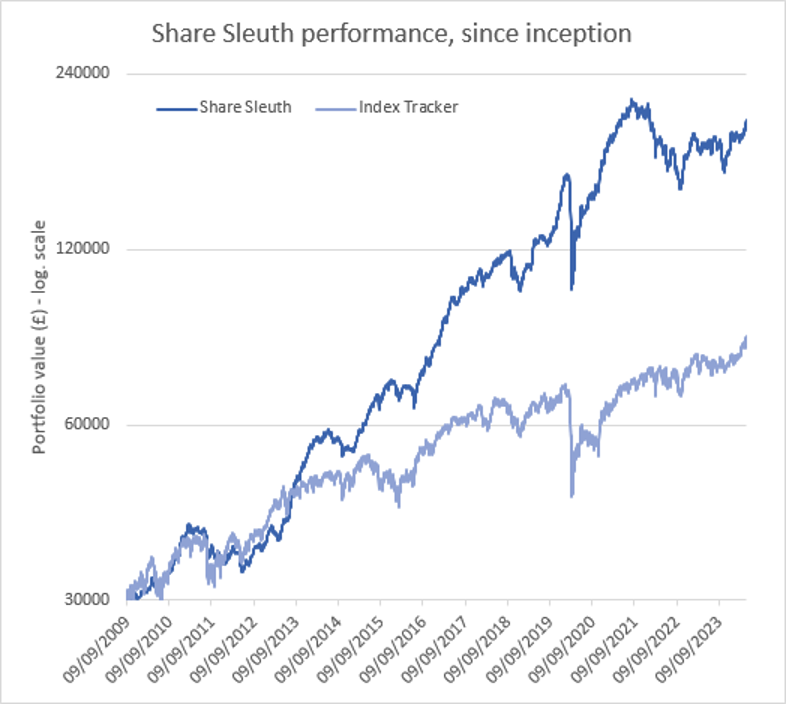

At the close on Friday 3 May, Share Sleuth was worth £198,576, 562% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £85,024, an increase of 183%.

Past performance is not a guide to future performance.

After dividends paid during the month from Thorpe (F W) (LSE:TFW), Garmin, Goodwin, PZ Cussons, Quartix Technologies (LSE:QTX), Renishaw (LSE:RSW), and Tristel, Share Sleuth’s cash pile is £5,531.

The minimum trade size, 2.5% of the portfolio’s value, is £4,884.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 5,531 | ||||

Shares | 193,044 | ||||

Since 9 September 2009 | 30,000 | 198,576 | 562 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 3,840 | -15 |

ANP | Anpario | 1,124 | 4,057 | 2,979 | -27 |

BMY | Bloomsbury | 845 | 3,203 | 4,479 | 40 |

BNZL | Bunzl | 201 | 4,714 | 6,243 | 32 |

CHH | Churchill China | 1,058 | 12,223 | 12,432 | 2 |

CHRT | Cohort | 1,600 | 3,747 | 13,024 | 248 |

CLBS | Celebrus | 1,528 | 3,509 | 3,209 | -9 |

DWHT | Dewhurst | 532 | 1,754 | 6,251 | 256 |

FOUR | 4Imprint | 116 | 2,251 | 7,053 | 213 |

GAW | Games Workshop | 100 | 4,571 | 9,480 | 107 |

GDWN | Goodwin | 266 | 6,646 | 18,407 | 177 |

GRMN | Garmin | 53 | 4,413 | 7,009 | 59 |

HWDN | Howden Joinery | 2,020 | 12,718 | 17,614 | 38 |

JET2 | Jet2 | 456 | 250 | 6,384 | 2,454 |

LTHM | James Latham | 750 | 9,235 | 9,038 | -2 |

MACF | Macfarlane | 3,533 | 5,005 | 5,017 | 0 |

PRV | Porvair | 906 | 4,999 | 5,545 | 11 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,967 | -49 |

QTX | Quartix | 3,285 | 7,296 | 4,845 | -34 |

RSW | Renishaw | 234 | 6,227 | 9,746 | 57 |

RWS | RWS | 2,790 | 9,199 | 4,916 | -47 |

SOLI | Solid State | 356 | 1,028 | 4,895 | 376 |

TET | Treatt | 763 | 1,082 | 3,662 | 238 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,790 | 253 |

TSTL | Tristel | 750 | 268 | 3,469 | 1,193 |

TUNE | Focusrite | 2,020 | 14,128 | 7,373 | -48 |

VCT | Victrex | 292 | 6,432 | 3,720 | -42 |

XPP | XP Power | 240 | 4,589 | 2,659 | -42 |

Notes

3 May 2024: Added new holding in Macfarlane

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £198,576 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £85,024 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 3 May 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio except Tristel and XP Power.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.