The shares Nick Train says are undervalued compared to rivals

18th July 2023 10:42

by Sam Benstead from interactive investor

The star stock picker highlights eight companies he believes are cheap and due a recovery.

Nick Train is not a value investor, but he argues that his portfolio is cheap.

The stock picker, who runs the UK share portfolios Lindsell Train UK Equity and Finsbury Growth & Income, is known for picking high-quality companies, with established brands that can keep growing profits. He has always been happy to pay a premium price for such shares.

But in his latest note to investors, Train says his portfolio is undervalued compared with similar international companies. He also says that the UK market as a whole is extremely cheap compared to other major stock markets.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

Train puts the FTSE All-Share index at a price-to-earnings (P/E) ratio of 10, compared with 18 for the US-dominated MSCI World index. This means that for every £10 invested in the UK they are getting £1 of earnings from their portfolio, but the same amount would cost £18 if they were to buy a global tracker fund.

“This divergence has widened so far in 2023, with the S&P 500 [the index of America’s largest 500 companies] delivering a return of 11% in the first half of the year in sterling, while the FTSE All-Share has managed just 2.6%,” he said.

Train said he was cautious of these headline figures, as “one person’s ostensibly low valuation” is another’s “moribund value trap”.

“In other words, markets can stay frustratingly cheap for a very long time,” he said.

- Where to invest in Q3 2023? Four experts have their say

- Why Terry Smith sold Amazon, and how his portfolio is performing

But he argues that his companies are “outstanding” and priced cheaper, on a P/E basis, than American rivals.

“Now, of course these pairs are not exact ‘like-for-likes'; just as Sage (LSE:SGE) is not an exact comparator for Intuit (NASDAQ:INTU). But it is not contentious, in my opinion, to argue that Burberry, Diageo, Experian, Fever-Tree, Hargreaves Lansdown, London Stock Exchange Group, RELX, Schroders and Unilever have been outstanding businesses, at least in the past.

“Certainly, they all meet the only post hoc definition of outstanding that really matters – owning their shares for long periods has made investors lots of money. Perhaps they are not as outstanding as the comparators I have chosen – the US is indeed home to some amazing companies.”

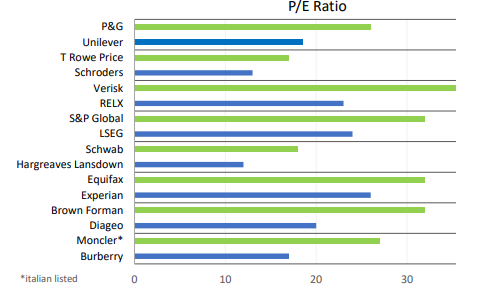

He says that this relative undervaluation means that there must be at least the possibility that our holdings could become more valuable, if they continue to make good business progress. The table below shows the shares that Train owns and their P/E ratio compared to international rivals. He singles out Unilever, Schroders, RELX, London Stock Exchange, Hargreaves Lansdown, Experian, Diageo and Burberry as being undervalued.

Source: Lindsell Train, July 2023.

It is not just Train who believes that lower starting valuations should trigger greater future returns. Ian Lance, co-manager of the Temple Bar (LSE:TMPL) investment trust, says that many studies have shown that there is ultimately an inverse correlation between starting valuation and subsequent investment returns.

“Generally speaking, lower starting valuations result in higher subsequent returns and vice versa. Unless one believes that the US can continue to get more expensive for the foreseeable future, this is not a sustainable source of returns. In fact, we believe a much more likely outcome is a mean reversion in relative valuations, which would suggest that returns from non-US equities are likely to exceed that of the US in the future,” he said.

- Should you invest in Baillie Gifford funds or investment trusts?

- What to own alongside Fundsmith or a low-cost global tracker fund

Lindsell Train UK Equity is on interactive investor’s Super 60 investment ideas list. Dzmitry Lipksi, head of funds research at ii, says: “We believe a key strength lies in Train’s deep understanding of company strategies and his ability to see through the noise and buy stocks that are best placed to defend their businesses over the long term.

“The stock-specific and unconstrained nature of the approach has resulted in sizeable sector and market-cap deviations from the FTSE All-Share index and peers. Investors must be comfortable with periods of short-term volatility.”

Since launch in 2006, it has returned 416% compared with 147% for the FTSE All-Share index. Recent performance has been disappointing, however, with the strategy up 17% over three years compared with 29% for its benchmark.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.