Stockwatch: can an activist investor improve this FTSE 100 share?

As investors are attracted to some blue-chip shares after significant falls, analyst Edmond Jackson reveals whether he thinks they’re now worth buying.

13th February 2026 11:11

by Edmond Jackson from interactive investor

What to make of reports that New York-based Elliott Management has accumulated a “significant” stake in London Stock Exchange Group (LSE:LSEG)?

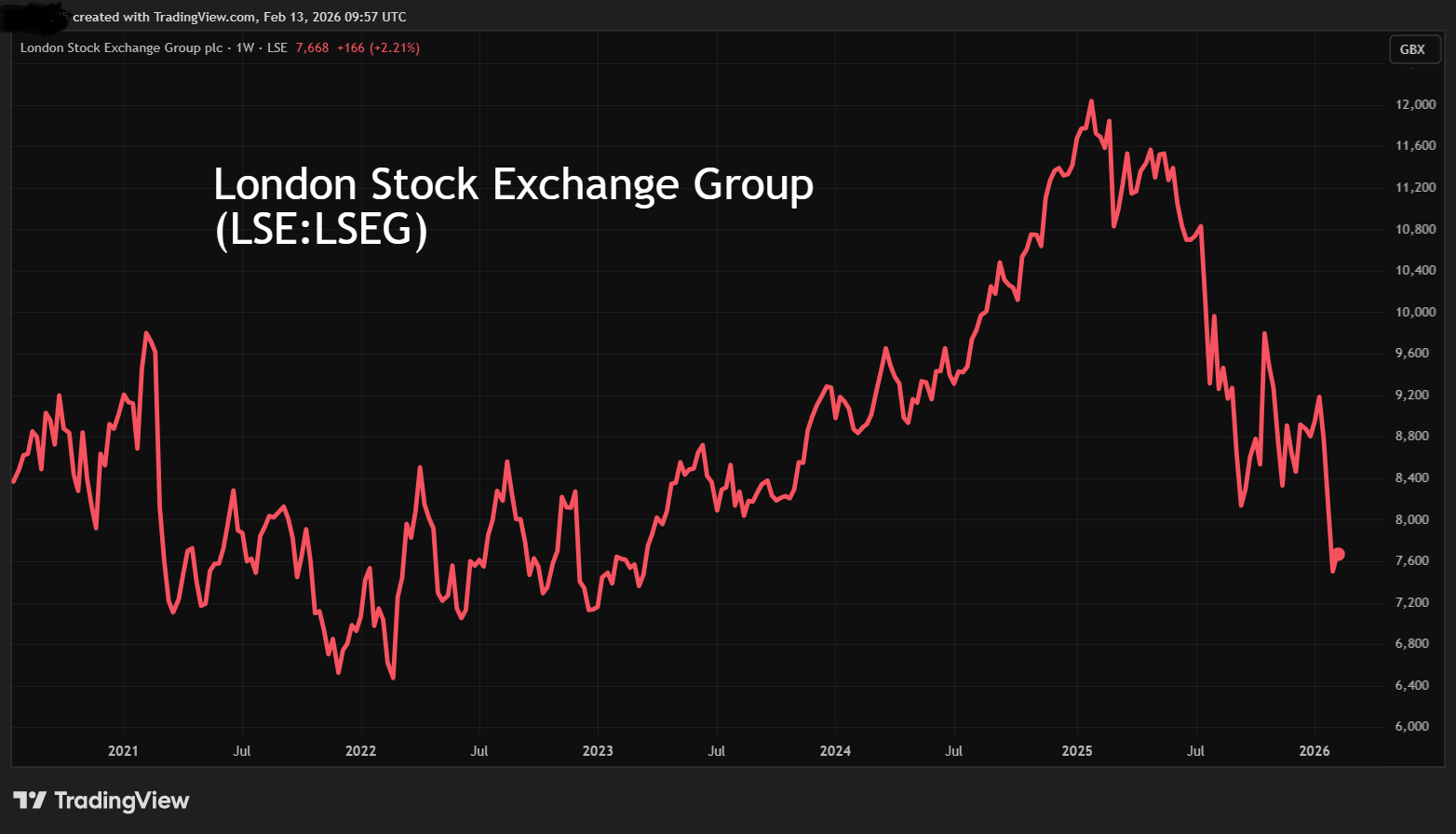

Since the revelation last Wednesday, the shares are already up 5% from a four-year low, including a 2% gain yesterday despite the market being taken down by Wall Street.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Source: TradingView. Past performance is not a guide to future performance.

This is not actually a disclosed stake above 3.0%, although despite a 40% de-rating over the last 12 months, LSEG is a £37 billion company, hence, it would require a position of well over £1 billion.

Given a range of media reports, I rather suspect a connected person enlightened the market this way; not unhelpfully to an investor if having completed their buying.

A big-time trader trying their luck?

New York-based Elliott has a reputation for taking stakes in companies then pushing for improvements. Perhaps they sense how London has been losing status among global stock markets, especially to the US, not helped by persistent redemption of UK equities by fund managers, and with flotations having been largely superseded by private equity.

Perhaps Elliott empathises with US elements to LSEG, for example a US CEO since 2018 and a partnership with Microsoft Corp (NASDAQ:MSFT) since late 2022.

It still intrigues me to consider exactly what they can achieve in dialogue with management, at least in terms of a classic activist investor remit. This usually involves an aspect of strategic change and pressure for greater shareholder returns. LSEG has during the last 12 months splurged more than £500 million on buybacks at significantly higher prices, commencing at 11,910p.

I’m inclined to believe the crux here is whether Elliott has indeed perceived value, which is what its presence here highlights to investors, or otherwise that headwinds for LSEG are significantly out of managers’ control and specifics of data services seem best left to them.

De-rating has similarities with Relx

LSEG has already undertaken a strategic pivot towards data and analytics, initially seven years ago, and it’s been five year since the acquisition of Refinitiv completed. This is one of the world’s largest providers of financial markets data and infrastructure, serving more than 40,000 institutions in over 190 countries. In 2024, it contributed nearly half of group revenue, although at the 2025 interim stage was only growing 5.1% organically, whereas it was the markets division that stood out, up 10.7%. For 2024, annual subscription growth also declined to 5.8% from 6.3% due to competition.

Is Elliott really going to prod LSEG to unwind its massive bet that appears to be souring somewhat – at least for the share’s valuation?

As I explained in a 3 February study of RELX (LSE:REL), the problem is not so much data being fundamentally ex-growth, or about to be decimated by artifical intelligence (AI), it is these shares being well overvalued arithmetically at their highs. Fears about AI start-ups are quite the straw that broke the camel’s back.

When LSEG traded above 12,000p a year ago, this represented 29x the recent consensus for normalised earnings per share (EPS) outcome in 2025. Admittedly, if proven, that would represent a 43% advance on 2024, and 2022 did show a 35% advance after the integration of Refinitiv. But otherwise, EPS growth has blipped around single and modest double-digit rates and as yet is targeted at 10% for 2026. Arithmetically, the same as Relx, growth was starkly overvalued and expectations overblown.

- ii view: Relx attempts to reassure on outlook for 2026

- Insider: directors pounce after software stock slump

As a moral for trusting consensus predictions, and how you can have better objectivity outside any inner circle, remarkably last July, the median price target among 22 analysts following LSEG was 12,850p. The shares are now 41% below that. At 9,260p, 18 of the 22 rated LSEG a “strong buy”, two a “buy” and two a “hold”.

In my book, this does not necessarily make LSEG an even better buy; more like the tide has retreated exposing enough people naked. It was very high risk assuming an underlying momentum case. Instead, a conservative sense of how market values “mean-revert” over time has been affirmed.

Bosses of Relx and LSEG reiterate “strong” growth in the various dynamics, although for revenue – especially pertinent when a growth-type price/earnings (PE) of 20x or higher applies – such growth rates within the divisions are typically high single-digit.

Investors have been attracted to these shares after big de-rates – Elliott in LSEG, Relx up 2% yesterday after it sought to reassure investors over AI when explaining 2025 annual results – but the essential question with fresh money is whether shares now trade more in line with fair value than at a discount.

This is somewhat separate to the story where it looks fair for bosses to point out that emerging and future AI rivals are not necessarily going to destroy the business, and that AI is already central to it. LSEG continues to declare various partnerships such as a new collaboration with OpenAI last December, enabling ChatGPT users and enterprise customers to access LSEG’s market data and news. You decide whether this is “holding friends close and enemies closer still”.

Yet Microsoft has an incentive to grow its 4% equity stake that has reverted to around its 7,500p entry price in 2022. The objective was a 10-year strategic partnership for next-generation data, analytics and cloud infrastructure solutions. Last October, it was announced that LSEG and Microsoft were taking this a step further, enabling licensed data to be used in customers’ AI-based workflows.

AI rivals could yet take the edge off growth that can still look pricey in strictly arithmetic terms. LSEG’s data is non-proprietary; it does not have a moat. Yet the LCH clearing business owned by LSEG does enjoy a natural monopoly.

While Relx at around 2,100p trades on around 15x expected EPS for 2026, at 7,600p LSEG is on a 16.7x PE implying a PEG (PE/growth) near 1.7x. Probably too short term a view to judge well, but hardly screaming value in earnings terms.

The six-year table does, however, show LSEG consistently achieving free cash flow per share more than 50% higher than EPS, which some analysts may argue as more relevant to a PE view. It explains why last November a £500 million buyback programme was superseded by a new £1 billion programme and such announcements constitute majority news flow.

London Stock Exchange Group - financial summary

Year-end 31 Dec

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£m) | 2,314 | 2,030 | 6,535 | 7,743 | 8,379 | 8,858 |

| Operating margin (%) | 31.2 | 27.0 | 16.2 | 18.1 | 16.3 | 16.4 |

| Operating profit (£m) | 722 | 549 | 1,060 | 1,401 | 1,365 | 1,453 |

| Net profit (£m) | 417 | 421 | 3,129 | 1,302 | 761 | 685 |

| Reported earnings/share (p) | 118 | 82.8 | 85.2 | 141 | 138 | 128 |

| Normalised earnings/share (p) | 170 | 157 | 178 | 241 | 261 | 288 |

| Operating cashflow/share (p) | 237 | 275 | 481 | 489 | 534 | 635 |

| Capital expenditure/share (p) | 55.2 | 55.4 | 122 | 173 | 197 | 188 |

| Free cashflow/share (p) | 182 | 219 | 359 | 316 | 337 | 446 |

| Dividend/share (p) | 70.0 | 75.0 | 95.0 | 107 | 115 | 130 |

| Covered by earnings (x) | 1.7 | 1.1 | 0.9 | 1.3 | 1.2 | 1.0 |

| Return on capital (%) | 11.8 | 8.9 | 2.9 | 3.6 | 3.8 | 4.0 |

| Cash (£m) | 1,574 | 1,877 | 2,665 | 3,435 | 3,580 | 3,475 |

| Net debt (£m) | 694 | 263 | 5,704 | 5,388 | 6,119 | 6,490 |

| Net assets/share (p) | 987 | 1,055 | 4,241 | 4,689 | 4,399 | 4,330 |

Source: company accounts.

In yield terms, however, it only means around 2% assuming dividends are heading towards 150p per share and better - good growth in percentage terms at nearly 10% and with near 3x earnings cover. But 2% is not exactly a prop should the story deteriorate, and compares with a more meaningful 3.5% for Relx.

LSEG also has much lower returns on capital employed and equity - around 5% at best - compared with Relx at 35% and 55% respectively.

Both Relx and LSEG are up this morning – initially 4% to 2,136p and 1% to 7,600p – affirming my conclusion on Relx about how the extent of the drop means some chart technical buying is likely.

Three LSEG directors buy substantial shares

The CFO added £531,000 of LSEG shares at 9,340p last April – with hindsight, a miss-read towards the all-time high – and in August, a new non-executive director bought £141,000 worth at 9,413p and the CEO from 2018 bought £188,040 at 9,402p. Then, in September, the CFO bought another £386,913 worth at 2,274p.

Mind you, in 2024 the CFO was paid around £4.5 million and the CEO £8 million, making their buying relatively modest.

- Stockwatch: have equity bulls become complacent?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Overall, I’m inclined to wait to see what Elliott may say, or “parties close to the matter” leak next to the press, which obviously could be construed well if Elliott has finished its buying. If that were to coincide with well-received results later this month, the shares could rise.

I’m therefore going to conclude with a “buy” stance at around 7,600p, if more a near-term technical call than one based on conviction of value. That assumes markets do not suffer inflationary worries (watch out for US data) and/or US/Iran hostilities kick off.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.