Stockwatch: an outlook for sectors and stocks in 2026

Plenty of opportunities may present themselves in the year ahead, believes analyst Edmond Jackson. Potential inflection points may arise where you least expect them.

2nd January 2026 08:17

by Edmond Jackson from interactive investor

Given US stocks trade on a trailing price/earnings (PE) multiple of 29x versus a 10-year average of 18.7x, plus a dubious outlook for continental European economies, I am inclined towards taking a “devil you know” approach to the UK market.

A dilemma is that we have a Labour government in tax creep mode on both businesses and consumers, redistributing money in the form of benefits and public sector pay rises. Maybe this helps aggregate demand, but it’s not clear how employment and confidence will pan out.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

If seeking international exposure, there are also means to achieve this via FTSE 100 shares, with even Japan a possibility. But beware that if US equities do mean-revert, there is unlikely to be many places to hide.

Sectors perceived negatively can still surprise on the upside

Positive surprises can occur if negative sentiment has dumped a stock to a chart low – and preferably a discount to investment yardsticks – which creates an inflection point the moment there’s any remotely positive news.

We saw this with Marston's (LSE:MARS) in November when the pubs group cited like-for-like Christmas bookings up 11%, helped by format conversions, with optimism about 2026 due to “a robust calendar of demand-driving events” including the 2026 World Cup.

This countered a 5 November update from Wetherspoon (J D) (LSE:JDW) where, despite like-for-like sales up 3.7%, the chair was characteristically gloomy about government policy “and as a result, slightly more cautious in outlook for the remainder of the year”.

Marston’s shares have settled up 18% at around 59p, still slightly less than 0.5x tangible book value if explained by 153% net gearing. Despite pub costs sounding bad for operators and consumers alike, and unless there is a recession, then Marston’s marketing formula stands a decent chance of attracting business. Steady debt repayment ought to help narrow the discount to assets, hence I rate the shares a strong “hold”.

Similarly, Frasers Group (LSE:FRAS) was sold down to 630p mid-December, recovering 6% by year-end, coinciding with an intent to buy back more shares. I incline towards “buy”.

- The UK stock market outlook for 2026

- Investment outlook: expert opinion, analysis and ideas

- The tariff playbook: why I’m sticking with UK markets in 2026

Online fashion group Boohoo Group, which nowadays includes Debenhams Group (LSE:DEBS), saw its shares nearly treble from 10p late November, settling back at 20p, as a result of proclaiming “a significant turnaround”. But mind how consensus still expects net losses near £15 million in the year to February 2027, and it is hard to argue with traders banking a turn. I think there needs to be more proof to get involved.

These examples usefully show how sectors under the cosh – retail especially, as we await Christmas period trading statements – can generate opportunities for alert traders.

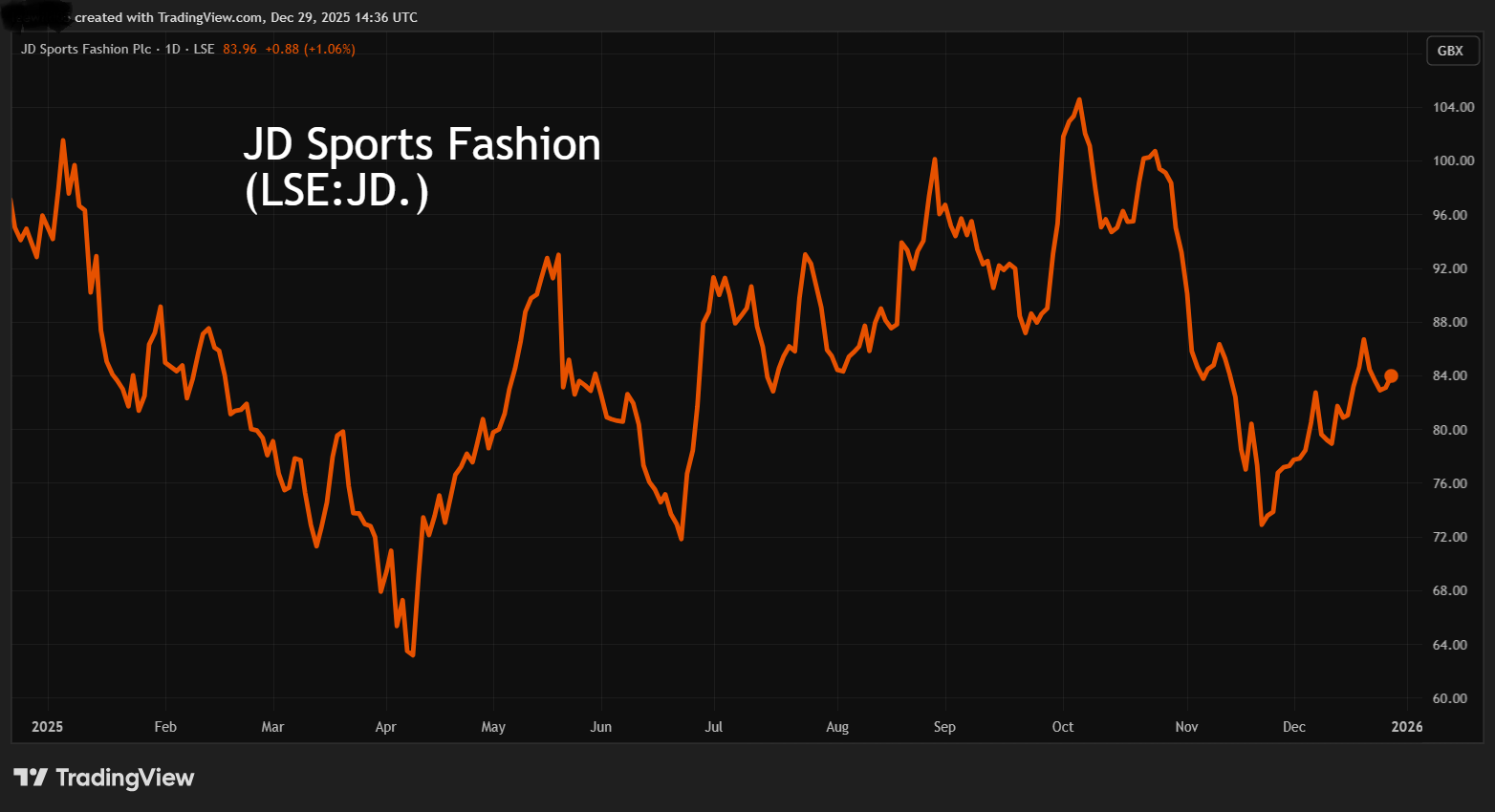

JD Sports Fashion (LSE:JD.) is another example to watch after its shares fell to 73p following a 20 November update that guided profit for the year to 31 January 2026 to the lower end of expectations.

Yet the price has since climbed to 83p in a sense [of how] a PE below 7x has scope to mean-revert upwards along with earnings, hence a long-term “buy” stance looks justified.

Source: TradingView. Past performance is not a guide to future performance.

A better medium-term investment?

The above retail examples can seem frustratingly obvious in hindsight and lack conviction lest US/UK consumer spending festers.

I therefore question if price comparison group Moneysupermarket.com Mony Group (LSE:MONY) might be approaching an inflection point. Since the mid-July interims, its shares have fallen from 220p to 183p, seemingly amid concern that profit could be at the low end of expectations.

Yet consensus is for 19% earnings per share (EPS) growth for 2025 moderating to 6%, implying 1.4x cover for a yield looking like 7.4%. A 3 December update affirmed that business was “in line”, albeit a mixed performance.

This share is not going to repeat its bull run from around 50p post the 2008 crisis to over 400p by mid-2019, but a challenged consumer environment ought to manifest opportunities, and a 3 December update said “we anticipate easing headwinds”.

If a 6% yield is more appropriate to the risks, then it implies a 225p target, hence “buy”.

Source: TradingView. Past performance is not a guide to future performance.

Turnaround potential in hard-hit advertising market

Notably, WPP (LSE:WPP) shows signs of bottoming out after a long decline from 1,850p in early 2017 to 270p in early November and currently 327p. With an ex-president of Microsoft Western Europe as CEO, who is not cautious at promoting her turnaround plan to the media, the disclosed short position has nearly halved in five weeks to 4.4%.

A poor fourth quarter could already be well anticipated, hence if the group can at least stabilise to avoid further downgrades then the sense of a 5.5x PE and 7.3% prospective yield might gain credence rather than be seen as a red light. I last rated WPP “hold”, yet it starts to look like a “buy” unless the international economy disappoints.

It will be worth monitoring other marketing services groups for potential inflection points.

Source: TradingView. Past performance is not a guide to future performance.

Oil compromised by lower Chinese demand

You might usually think that a major Middle East conflict and sanctions on Russia would conspire for oil & gas shares as a defensive investment – given their propensity to track the commodity price. Yet as I noted in my last piece, US President Donald Trump has at least wrested the Hamas/Israel conflict into a ceasefire, and what if something similar pans out in Ukraine?

Such a traditional view of how oil markets are affected, including OPEC production, has, however, been superseded by lower Chinese demand due to the popularity of electric vehicles. While China remains the world’s largest oil importer, its demand is declining for the first time in 20 years after consumption doubled from 2005 to 2024. OPEC is now a more long-term influence.

- Watch our ii expert tips’ videos for 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This has had an especially significant effect on small to mid-cap oil & gas companies as tuckaway shares for capital growth. For example, the acquisitions strategy at mid cap Harbour Energy (LSE:HBR) can be seen as risky, which a firm-to-rising oil price might offset. This share has declined from over 600p in 2021 to 196p currently, where it ostensibly offers a yield of over 10% but is not fully covered by expected earnings. With a “hold” stance for now, I find it intriguing to watch for an inflection point if oil can at least stabilise.

Holding BP (LSE:BP.) or Shell (LSE:SHEL) has required buying the market’s early April drop on surprise US tariffs, to enjoy circa respectively 25% and 15% gains before dividends. Otherwise, their annual trend has been sideways-volatile, which I rather expect to continue, hence “hold” at 425p and 2,700p respectively.

Can BAT and Imperial Brands maintain bull run?

Unethical they may be, yet firm uptrends since early 2024 affirm smoking as a defensive investment of choice. Confidence appears to be rising that tobacco alternatives are being marketed successfully, thus mitigating fears of revenue decline. And despite advances of 45% to 4,156p for British American Tobacco (LSE:BATS) and 22% to 3,114p for Imperial Brands (LSE:IMB), yields of 5.9% and 5.4% respectively appear fair enough. They show how a high yet reliable dividend yield can aid a re-rating, although my sense to favour British American Tobacco in recent years has been motivated by its progress in vaping.

Firm charts and the challenge to achieve defensive yet diversified portfolios lead me to think it premature to call tops here, so both rate “hold”.

Fund managers may remain attracted to the big smoking stocks for reliable income, which also help private investors get international exposure.

Does Nigel Farage’s plum job promoting gold imply a top?

In times when the gold market gets frothy, popular examples manifest as possible contrarian indicators. It could be gold pawn parties or “gold bought and sold here” street signs. I cannot resist thinking that controversy over Nigel Farage for his reported £400,000 a year role promoting a gold bullion dealer implies this market is assuredly euphoric.

I have made a case for Greatland Resources Ltd (LSE:GGP) GGP and feel that might temper to “hold” at 525p, but will likely draw in my horns in terms of advocating further miners.

Source: TradingView. Past performance is not a guide to future performance.

Japan for international diversification?

Last but not least, Japan is interesting for an exchange rate of 210 yen to the pound versus around 130 in 2019-20. Does this currency trend mean-revert from around this level, like it has consistently on four occasions in the last 35 years? If so, then it adds to why Japan could be a better means to diversify than a classic international fund exposed to US risks.

Admittedly, Japanese equity valuations are less compelling than October 2022 when the market’s trailing PE was 12.5x. However, 16.3x currently is better than the US and even the UK.

This market has risen 50% since last April yet may still be in catch-up mode after decades of deflation, with various efficiency reforms helping Japanese equities converge towards global average ratings.

Possible investment trusts to consider include Baillie Gifford Japan Ord (LSE:BGFD). At 888p, it targets industry disruptors with a relatively focused portfolio of 62 holdings, the top 10 accounting for 45%. Schroder Japan Trust Ord (LSE:SJG) at 312p is similarly focused and prioritises mis-valuation, achieving a near 14% annualised return over five years versus 9% for the index. Schroders’ superior record justifies the “buy” stance if choosing between the two.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.