What I’d do with this stock amid takeover bid report

Rodney Hobson examines a company with a story that beats anything in a Hollywood script.

17th September 2025 07:29

by Rodney Hobson from interactive investor

They say that fact is stranger than fiction and what has happened over the past few months at media and entertainment company Warner Bros. Discovery Inc Ordinary Shares - Class A (NASDAQ:WBD) beats anything in a Hollywood script. Even the Barbie film that Warner launched last year seems realistic by comparison.

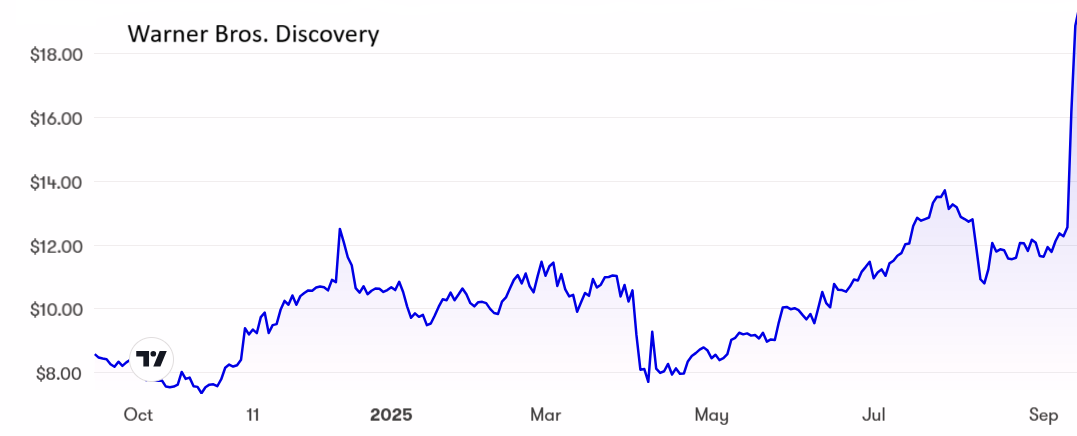

Warner looked down and out last November after a torrid year despite the apparent initial success of the Barbie movie. The company was lossmaking with no sign of a turnaround. Suddenly, it all changed.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Warner bounced back into profit in the second quarter thanks to increased revenue and a halving of costs. At last the company seemed to know where it was going and what it wanted to do. Rather surprisingly, the much better figures were greeted with an immediate 7.4% fall in the share price.

By the time the figures were released Warner had decided to split into two separate quoted companies after a long period of mergers and consolidation in the sector, culminating in the $43 billion (£31.5 billion) merger of Warner-Media and Discovery only three years ago. Even in Hollywood, bigger is not necessarily better.

Streaming and studios will comprise Warner Bros Television, Warner Bros Motion Picture Group, DC Studios, HBO, HBO Max and the film and television libraries. In a reflection of how the film industry has chopped and changed and gone round in circles, it will go back to being called Warner Bros.

Discovery Global will absorb television brands including CNN, TNT Sports and Discovery, as well as digital products such as the Discovery+ streaming service.

Source: interactive investor. Past performance is not a guide to future performance.

Now it seems that there are some in the entertainment business who believe that bigger really is better. Only a month after Skydance completed its takeover of Paramount Global on gaining regulatory approval of the deal, the newly created Paramount Skydance Corp Ordinary Shares - Class B (NASDAQ:PSKY) is reported to be putting together a bid for the entire existing Warner operation to create a blockbuster group.

Paramount already had a sprawling empire with a global distribution network and a film and TV library before adding Skydance’s production and technological functions. It is all part of a trend in the industry to restructure to cope with declining viewing figures for traditional television amid the onslaught from streaming services.

Details have not yet emerged but The Wall Street Journal says the unspecified offer will be mainly in cash. This would not require a magic wand, as Paramount’s chair and chief executive, David Ellison, is reported to have the support of his father, Larry Ellison, the co-founder of Oracle Corp (NYSE:ORCL) and possibly the richest man in the world with a fortune worth nearly $400 billion. They don’t write better scripts than that in the movies.

- ii view: Oracle shares soar on huge customer demand

- Stockwatch: four key reasons this bull market could continue

Paramount’s motive would be to get hold of Warner’s studio and streaming unit before the proposed break-up of Warner sets up a bidding war for what would be a more manageable and affordable business to absorb. Warner has already hinted that it could sell a 20% stake in the studios and streaming business before it was listed.

Warner shares had already edged up from a low below $8 in April to around $12 before the WSJ report sent them soaring to $19. Oddly, Paramount shares also rose, from $10 soon after its own merger to $19. Shares in companies launching bids normally slip back on fears that they are paying too big a premium, but in this case investors decided that a massive combined company would have more clout in a competitive sector.

Hobson’s choice: my sell recommendation on Warner last November looked good for several months, but the bid rumours have turned the situation on its head.

Normally I would be inclined to hold on to any target company in case a higher bid emerged but investors should remember that no bid has yet been revealed and a bidding war for Warner looks unlikely. The downside looks horrendous while the upside is limited.

The sell recommendation remains, but now investors will get a far better price. Paramount also looks overpriced and rates a sell. Consider buying back if Paramount ditches its rumoured bid and the shares fall back to previous levels.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.