Why this income portfolio is thriving

This investment trust portfolio built to provide regular income has achieved what it was set up to do.

3rd June 2019 10:30

by Holly Black from interactive investor

This investment trust portfolio built to provide regular income has achieved what it was set up to do.

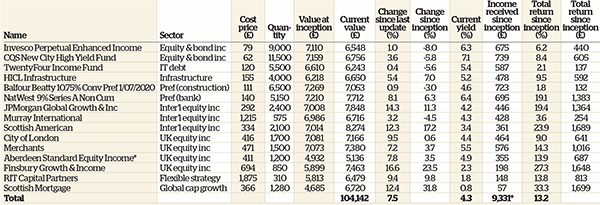

A rally in global stock markets has helped our sister website Money Observer's regular income-focused investment trust portfolio recover from the market volatility at the end of 2018 – every holding has been in the black over the past four months.

Portfolio manager James Brumwell says of the period:

"It has not quite been a case of picking any stock and making money, but it has not been far off ."

The portfolio has largely tracked the market, he says, and has risen in value by 7.5% since our previous update in January.

Steady income

More importantly, considering this portfolio's remit to provide regular income, dividend payments have remained steady. We have now collected £9,331 in income since inception on 1 April 2017.

Among the main providers of that income is the Invesco Perpetual Enhanced Income (LSE:IPE), which yields a meaty 6.3%. However, this trust is the worst performer in terms of capital growth since we launched the portfolio, its value having fallen by 8% since then. The trust invests in government and corporate bonds in the UK, the US and other countries.

The trust's capital losses have been disappointing, but Brumwell is happy to keep it in the portfolio because he acknowledges that it would be hard to replace the holding with anything else that could deliver the same yield without taking on more risk.

The trust produces around £450 of income a year, and capital losses incurred so far have effectively wiped out a year's worth of income. Despite that, though, once dividends are taken into account, the trust has produced a total return of 6.2%.

Also among the weakest performers are CQS New City High Yield (LSE:NCYF), which yields an impressive 7.1% but is down 5.8% in capital terms since inception, and TwentyFour Income (LSE:TFIF), which yields 5.4% but is down 5.6%.

At the other end of the spectrum, Finsbury Growth & Income (LSE:FGT) has produced a stellar 16.6% return since our last update in February.

Brumwell says the trust has "been on a roll" since February and he has been tempted to increase his exposure to it. This trust, run by renowned buy-and-hold investor Nick Train, invests in big brands such as Burberry (LSE:BRBY) and Heineken (EURONEXT:HEIA).

However, Brumwell says:

"If you look at a performance chart for the past few months, the trust has rocketed up in a straight line, and I don’t like to buy things that have done that."

The trust is one of the lowest yielders of the pack, but it was added to the portfolio to boost growth, something it has undoubtedly done: it has returned 23.5% since the portfolio's inception. Only Scottish Mortgage (LSE:SMT) has produced a stronger return over the period (31.8%).

JPMorgan Global Growth & Income (LSE:JPGI) and Income has been another standout performer since the previous update, having gained 14.4% over the period. The trust was boosted by having almost 60% of its assets in US equities, including shares in tech giants Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL), which have performed exceptionally well for some time except during the volatility at the end of 2018.

JPMorgan Global Growth and Income's board linked its payout to its net asset value a couple of years ago. Brumwell says this raised the possibility of a dividend cut after the market sell-off in December 2018, but the subsequent rally has enabled the trust to maintain its payout. It currently yields 4.3%. "I like the way [the trust] manages its dividend, and it has proved to be a fairly solid investment," says Brumwell.

Low rates good news for preference shares

Interest rates are always on the minds of income investors such as Brumwell. He says: "Since we started this portfolio there has been a lot of 'will they, won't they' on interest rates. We have seen two small rises in the UK, but the US Federal Reserve seemed to misjudge its last rate rise and now there is even talk about rate cuts."

A cut would be a boon for equities such as National Westminster Bank (LSE:NWBD) preference shares, as these "are completely exposed to interest rates" and suffer capital losses when the base rate rises because their yield becomes less attractive.

If interest rates climbed to 3%, for example, the 6.3% yield the shares currently produce would seem less impressive than when interest rates are near zero. This also applies to Balfour Beatty (LSE:BBY) preference shares.

So far we have pocketed more than £695 of income from the NatWest shares, generating a total return of 19%. Only two holdings in the portfolio have produced a higher income since launch, New City and Balfour Beatty, which have paid out £739 and £723 respectively.

There have been no changes to the portfolio at this update because "there is no need". Brumwell says that if there is a change to interest rates or any progress on Brexit – which he "had assumed would be all done and dusted by now" – he will probably have to react, but for now it’s a case of wait and see. "I'm happy at the moment, as the portfolio has done exactly what it was required to do. We have had some capital growth and the yield has edged up a bit too," he says.

Portfolio has thrived on a steady income stream;

Notes: Data to 29 April 2019. *Includes income from previous holdings.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.