Why investors should be interested in this region

As some investors become wary of US valuations, Kepler analysts make the case for the Continent, and share trust ideas.

23rd January 2026 14:04

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Josef Licsauer

This article marks the third outing for a format Alan Ray and I have come to enjoy more than we probably should. We first used it back in 2023 and returned to it again in 2025 to give our views on Japan. But this time round, we are taking the same approach but turning it squarely towards Europe.

Alan is our in-house authority on the region. I, by contrast, covered European equities a long time ago and have gradually lost the day-to-day familiarity you need to be truly expert. Markets move, structures change and narratives evolve, and keeping on top of Europe requires constant immersion.

That is precisely why Europe is worth revisiting now. After many years out of favour, the region’s outlook has begun to shift in ways that feel more structural than cyclical. Defence spending is rising sharply, and Germany has loosened its long-standing fiscal constraints, both moves that could have significant implications for European spending and broader economic growth. These are meaningful departures from the status quo, with potentially far-reaching implications for growth, capital allocation and corporate behaviour. And from a market perspective, European valuations remain attractive against markets like the US, presenting diversification opportunities for investors.

At the same time, risks remain: tariffs, supply-chain disruption, demographics and public debt all continue to shape the investment landscape. This is not a region for indiscriminate exposure, but one where selectivity matters more than ever.

That is where we think this format comes in. By stepping back, challenging assumptions and interrogating where returns have come from, and where they might come from next, we aim to bring clarity to why investors should be interested in Europe. And with that, there is only one place to start.

When we talk about ‘Europe’ as an investment destination, which markets does it encompass, and how should investors think about Pan European versus ex-UK exposure?

Alan Ray

You have raised an important fundamental question here, Joe, and one that some readers may not be cognisant of. When we refer to ‘Europe’, we are essentially referring to the block of countries in Europe that are deemed ‘developed markets’. This is not the same thing as the EU, and indeed quite a few EU members are classified, in stock market terms, as emerging markets.

Poland is one of the largest economies in Europe, but its stock market does not meet the stringent criteria to be classified as a developed market. Greece and Hungary are two other examples. We are also including some non-EU countries, such as Norway and Switzerland. So even if we were hoping for a cohesive, growth-orientated strategy from the EU to fuel our investments, the investment universe isn’t the same thing anyway.

We drilled into this in some detail a couple of years ago , but whereas I’ve often been quick to dismiss European economics as ‘dispiriting’, that’s quite unfair on several countries, notably some of the Nordics, that have achieved very good long-term economic growth, not dissimilar to the US. An active fund manager can find plenty of opportunities that are more correlated to strong economies than the overall average implies.

You asked about ‘Pan-European’, which means Europe including the UK, and ‘Europe-ex UK’. These are fund and index labels rather than political or economic blocs. When we, as investment trust investors, refer to ‘Europe’, we are most likely referring to ‘ex-UK’. Do the following thought experiment. Do you naturally think of a UK fund as a ‘single country fund’ in the same way you would a China fund, for example? I’ll bet the answer is no, and there’s a good reason for that, which isn’t just an emotional response. It’s our home market, and overwhelmingly, investors are investing to eventually spend their profits in pounds sterling. I think that this is the reason that investors opt for European funds that are ‘ex-UK’. It doesn’t mean there isn’t an investment logic to ‘Pan-European’, and European Opportunities Trust (LSE:EOT) is a long-term proponent of this strategy, but I think the desire to have a transparent and separate exposure to the UK home market trumps that logic for many investors.

To complicate matters further, it’s quite likely that a US investor who is ‘allocating to Europe’ is thinking about that in a Pan-European sense. They are just as likely to be buying shares in BP (LSE:BP.) as they are in TotalEnergies SE (EURONEXT:TTE), for example. So, if readers listen to Bloomberg radio, they should expect that much of the commentary referring to ‘Europe’ includes the UK.

So, basically, ‘Europe’ means a lot of different things in investment, and it’s important to understand the context.

JL: Having defined the European investment universe, how have investors been allocating to it? Are we seeing inflows?

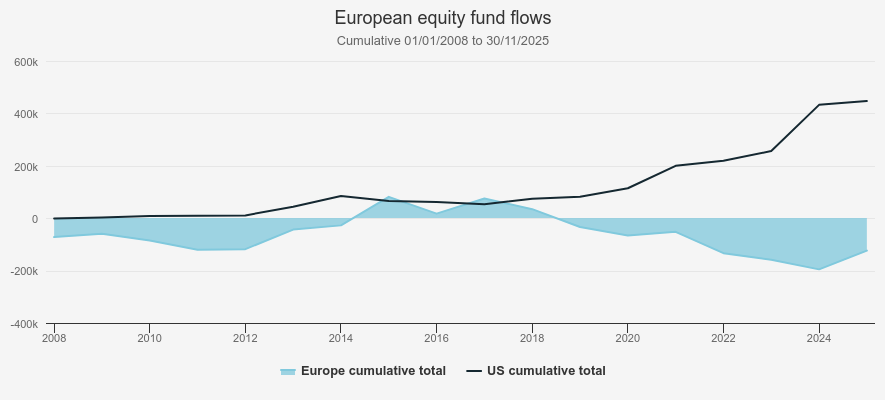

AR: Fund flows are a very good way to put a number on investor sentiment. And of course, at a very basic level, share prices go up when there are more buyers, or more highly motivated buyers, than sellers. Europe saw positive fund flows in 2024 and 2025, and this is a very good sign of more positive sentiment. But let’s look at that in a longer-term context.

The chart below goes back to the beginning of 2008 and shows cumulative fund flows into all the European and US equity funds on Morningstar’s database, which is a very large sample size involving hundreds of billions of dollars of assets under management. The 2008 start date is chosen simply because that’s the extent of Morningstar’s data, but it’s a good moment as it lands in the financial crisis and can be seen as the start point of a long-term cycle.

The data is cumulative, so an upward slope indicates more money flowing in, and vice versa. One could also read the slope as an indicator of positive sentiment. One very fundamental point that emerges from this is that investors have withdrawn far more money than they have put into Europe since 2008.

EUROPEAN AND US FUND FLOWS

Source: Morningstar

In contrast, investors have steadily put more money into the US. It’s not hard to see how US companies can rely on the stock market as a source of capital in a way that European businesses cannot. Fund flows show a meaningful shift into Europe in the short term. But the US has flatlined rather than fallen, which suggests that investors aren’t selling the US, merely allocating any new capital elsewhere, which is less dramatic but still a very big deal. For investors who worry that recent positive fund flows into Europe mean they have ‘missed it’, the long-term trend says that sentiment is a long way off irrational exuberance levels. It would take a much longer trend before European companies could see local stock markets as a predictable source of new capital for investment in their businesses, but it does mean that there is momentum in European stock markets. I think we can conclude that fund flows hint, but don’t confirm, a longer-term flow into Europe, and while the sums are large enough to have moved markets, they haven’t yet reversed a long-term pattern of investor indifference.

JL: As flows return to Europe, attention inevitably turns to where that capital is going. In the US, investors often focus on the Magnificent Seven; in Europe, by contrast, there is often talk of ‘GRANOLAS’. What companies make up this group, and have they become as dominant in European markets as the Magnificent Seven are in the US?

AR: The short answer is that this is a group of 11 companies, and the pedant’s version of the acronym is GRANNNOLASS, to include all 11 in the acronym. Some of these are in classic global growth sectors such as technology, e.g. ASML Holding NV (EURONEXT:ASML) or SAP SE (XETRA:SAP), and healthcare, e.g. AstraZeneca (LSE:AZN) or Novo Nordisk AS ADR (NYSE:NVO), but others have a more uniquely European flavour, such as luxury goods specialist Lvmh Moet Hennessy Louis Vuitton SE (EURONEXT:MC) or cosmetics brand L'Oreal SA (EURONEXT:OR). The linking theme of these businesses is that they are seen as Europe’s ‘global champions’, i.e. businesses rooted in Europe but with true global presence and therefore somewhat uncorrelated to their local economy. And, yes, just like the Magnificent Seven they have grown to be a significant part of the overall index and to be influential on the performance and thought processes of European fund managers.

It’s not right to say that every specialist European fund manager thinks like this, but it is helpful to know that the ‘global champions’ idea is part of the culture of investing in Europe. Essentially, the answer to ‘why Europe?’ over many years has been ‘Europe has many world-beating companies that are more correlated to global growth than to local markets’. To give just two examples, investors like LVMH because they can own a company headquartered and listed in a more rigorously governed developed market while benefiting from emerging markets growth trends, with more disposable income for luxury goods from Europe, and as you can imagine, it’s been a bit of a roller coaster recently. Dutch business ASML has a huge market share in its niche, specialist equipment for semiconductor manufacturers. It’s a good example of a business that has a lower profile than US technology businesses. The managers of Fidelity European Trust Ord (LSE:FEV) have noted that one of the reasons European technology businesses often trade at lower valuations is simply that they aren’t consumer facing and so have a lower profile. The thinking goes that ASML, or SAP, another of the GRANOLAS , aren’t household names and so are subject to less speculative investment than, say, the Magnificent Seven.

Europe’s global champions, exemplified by the GRANOLAS, are a very important aspect of investing in Europe, and one which I think will endure, but in the shorter-term other factors have come into play, which we’ll look at in answering some of your other questions.

JL: The European market has performed strongly of late. What’s been driving returns?

AR: We’ve already set the scene by looking at fund flows, our proxy for investor sentiment, and the GRANOLAS, which help define the investment culture. European equities have performed very respectably for quite some time, led by the GRANOLAS, but haven’t received much attention until more recently. Instead, all eyes have been on the extraordinary performance of the US market. What has changed more recently is that first, investors have begun to worry about very high valuations in the US and second, investors have also started to worry about the US’s reliability as an investment destination. I’m going to trust that our readers can fill in the details of why investors might think the latter, and the main point I’d make is that you don’t have to agree in order to acknowledge it as a factor in other investors’ behaviour. These are ‘push’ factors causing investors to look elsewhere.

This has coincided with some strong pull ‘factors’ for Europe. The first is that European equities are much cheaper than their US equivalents, and if the objective is to reduce exposure to high valuations, there is an obvious appeal. The second is that Europe’s ailing economic powerhouse, Germany, is embarking on a stimulus package focused on infrastructure, as well as a significant rise in defence spending. This has created a head of steam behind the share prices of many European companies expected to benefit from one or the other, or both. Germany is less indebted than many other countries, so this spending plan hasn’t yet unsettled bond markets, and Germany has much lower bond yields than the US or UK, for example. In simple terms, this indicates that the bond market is willing to lend it the money for these programmes.

This has combined with some signals that the domestic economy of Europe is improving. We already discussed the complications around the term ‘Europe’, so it’s important to read that statement as a simplification, but more positive signals have resulted in more money flowing into domestic European plays, with banks and defence stocks the best examples, along with things like engineering companies, rather than the ‘global champions’ that are the staples of many portfolios. This is the biggest reason why, as we’ll come on to, there has been such divergent performance between different funds and investment trusts in the last couple of years.

JL: How should investors think about style in Europe today, looking across quality, growth and value investing, but also considering exposure to market cap?

AR: Although European equities have performed very strongly since 2024, it’s been a period where active managers’ performance has diverged greatly. As you know, Joe, we did quite a bit of work to find the killer chart that says, ‘this is the style that has worked best in Europe’, and it was impossible. The reality is that over the last five years there have been some huge swings between value and growth, as well as size, i.e. small vs large cap, domestic vs global businesses, as well as some of the biggest names in the index going through violent swings in their share prices that were more company- than macro-specific, with healthcare giant Novo Nordisk being the exemplar. Overlay on top of that the effects of the pandemic still working through the system, and interest rates moving up rapidly, inflation spiking and then interest rates edging lower in fits and starts. This is a different and much more complex picture than the US, where you’ve either owned the Magnificent Seven and outperformed, or you haven’t, which I, of course, know is another simplification, and one that many US fund managers would rail against!

Like the US though, managers with an explicit focus on ‘quality growth’ have had a tough time and I think that’s partly because investors are willing to accept more speculative growth stories at the expense of the reliable compounding businesses that quality growth managers favour, and partly because the market worries that AI might expose the ‘wide moats’ of some quality businesses as being more easily crossed than was previously thought. I don’t think it’s a coincidence thatThe European Smaller Companies Trust PLC (LSE:ESCT), which doesn’t take a single style approach and looks at value, growth, mature growth, turnarounds, recovery, and so on, absorbed its competitorEuropean Assets last year. EAT had a rigorous ‘quality growth’ strategy that had been successful for many years, but in the last five years, had not been able to weather the choppy conditions so well. ESCT on the other hand has been able to carve out a performance record that beats both the small and large cap indices, which is of course a testament to the manager, but also demonstrates that European equities is a big enough universe that a small cap manager really is able to find under-researched, undervalued companies that operate in niches that are not so dependent on the short-term economic weather. The most sought-after ‘idiosyncratic returns’, if you like.

Equally,BlackRock Greater Europe Ord (LSE:BRGE) has a very strong long-term track record built around a quality growth discipline, but recently added a more value-orientated manager to the team in recognition that valuation has become more important. The trust is sticking to its focus on quality but accepts that some parts of ‘growth’ have become more speculative and susceptible to revision. And Baillie Gifford European Growth Ord (LSE:BGEU)has had a difficult time with its growth strategy post-2022, but has seen this come roaring back in the last year with really strong performance — another sign of how quickly European markets have been changing course. One of the great success stories of this period is JPMorgan European Growth & Income Ord (LSE:JEGI). The process the team use looks at factors like quality and value, but also at a stock’s momentum, which is based on how market forecasts of earnings growth change over time. This has helped them navigate away from some of the more speculative growth stories and towards the improving picture for domestic companies. Notably, they were very early to start building their position in banks, which have been one of the standout sectors.

It's also been a great period recently for specialist value investors, and although the investment trust sector doesn’t have one of those for Europe, on our sister site Expert Investor, we take a look at how Schroder European Recovery Z Acc has benefited from the surge in interest in more domestic stocks in Europe lately.

The killer question is, as it always is with stock markets, what’s next? Should we be overweight value? Or small caps? What we can say is that European equities are still trading at attractive valuations, that despite a very good showing from the aforementioned ESCT, European smaller companies haven’t yet seen much of the fund flows we looked at earlier, and the economic picture is mixed but improving. And, crucially, German bond yields have stayed low, which lends weight to the spending plans it has. But I’ve already skipped ahead and noticed you are about to ask about politics, and so I’ll conclude by saying that I think investors should always keep in mind that Europe is not the dynamic, entrepreneurial economy that the US is, and over the long haul, it’s very likely that the ‘global champions’ thesis will reassert itself.

JL: Now onto politics. With defence spending, industrial policy, energy security and reshoring all rising up the agenda, is Europe becoming more policy-driven than stock-specific?

AR: Ha ha. The question we all dread. I will again put my trust in readers and do my best to stay neutral, and hope they forgive me if I fail. I mentioned ‘push’ and ‘pull’ factors above, and I think another ‘pull’ is that investors are thinking that the US’s very blunt rhetoric directed at Europe might a) have a point and b) have an impact. Defence spending is the most obvious example. European defence stocks have performed incredibly strongly in the last two years, and that performance is not really based on any great increase in current earnings, but on a general expectation of things to come. But it’s one thing for European countries to say they will increase defence spending; it’s quite another thing for them to implement the accompanying tax rises and cuts to welfare to pay for them. Defence spending is being portrayed as an ‘industrial strategy’, which is a nice thought with some truth, but the growth pay-offs are unlikely to cover all the bills. Does Europe have the political willpower for that? This is something investors should keep a close and cynical eye on, and I feel comfortable in the neutrality of that statement!

You are right that Europe does have a leading role in energy transition, and the US’s withdrawal from the race leaves an open goal for Europe to grow its many leading engineering and technology businesses in this space. The ‘energy transition’ itself is, we must acknowledge, a politicised topic and therefore again, it will pay investors to keep an eye on how conducive Europe remains, but there is certainly a large and diverse set of companies involved in the process right now. Overall though, investing in the expectation of cohesive policies across Europe that will stimulate growth is probably wishful thinking and the best and simplest thing to say is that whereas yes, Europe has some very positive policies that can benefit certain sectors, as an investor one would be better over the long-term to stick to the notion that Europe is big enough to be home to many great companies, even if their home economies and politics may not be especially positive for investors. Yes, Europe is having a moment where politics has aligned with some positive investment ideas, but treat this as a bonus rather than as a permanent change. If Europe can outperform this expectation, so much the better.

JL: Thanks, Alan. Having covered a lot of ground already, I’d like to round off this piece with one more question: How should investors think about Europe today?

AR: I’m sure that investors hoping that Europe will reshape itself as a more dynamic economy that resembles the US will be disappointed. I’m one of those who does hope, and if we briefly go ‘Pan European’, then of course I’d love to see some policies and deregulation that would accelerate growth to pay for all the things we as Europeans want. But let’s not forget, many people in Europe have a very good quality of life, and why should we as investors expect them to be more like the US?

That said, this is a fast-changing world, and so it is perhaps not as fanciful as it was five years ago to think change will come. But serious changes take years, decades really, to pay off. So although tactically, focusing on the GRANOLAS hasn’t been the best way to play Europe in the last year or two, overall I think this is an important concept to hold on to longer-term: whatever one’s view of the economic and political performance of Europe, it has a large, highly-educated population and is more than capable of hosting a variety of leading companies, be those niche small caps or global mega-caps, that can compete on the world stage.

Final thoughts

JL: Looking across Europe today, it is clear to me that the region’s revival is real but nuanced. Positive fund flows, attractive valuations and sector-specific tailwinds, from German fiscal stimulus to rising defence spending, have driven momentum in certain parts of the market. At the same time, Europe remains structurally diverse: the performance of the GRANOLAS, domestic cyclicals and specialist small caps illustrates that opportunities are dispersed and outcomes uneven. As Alan highlights, these dynamics underscore the importance of distinguishing between short-term sentiment and the long-term strength of European businesses.

Europe is unlikely to become a US-style growth engine, and political and macro factors will continue to create divergences across sectors and countries. But it doesn’t need to. The region’s deep talent pool, high-quality corporate governance and global competitiveness mean it can host a wide range of investible companies, from long-duration quality growth names to undervalued domestic plays and niche small caps.

The takeaway for investors is that careful stock selection and a clear understanding of the market’s structure remain crucial. For investors willing to look past headline noise and focus on fundamentals, Europe offers a landscape of enduring opportunity, where thoughtful positioning can deliver durable, long-term returns, particularly as investors seek to diversify from lofty valuations in the US and capture more attractively priced opportunities beyond its shores.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.