Our experts analyse the major talking points for investors and share their investment ideas for the future.

These articles are provided for information purposes only. The content is not intended to be a personal recommendation. The value of your investments, and the income derived from them, may go down as well as up. If in doubt, please seek advice from a qualified investment adviser.

After three years of significant gains, the big question is whether major global stock markets can make it four in a row. Among the talking points will be the AI bubble and its possible consequences. Elevated valuations, especially among high-flying technology companies, have so far been justified by strong quarterly results.

Will that continue? Interest rates are expected to move lower through 2026, providing a boost to share prices, but any disruption to the downward trend will not be well received.

There’ll be a big focus on politics too. It’ll be all eyes on the US midterm elections in November when voters could trigger a shift in political control. We might also see an end to the war in Ukraine.

However, with tensions in Russia, China, the Middle East and elsewhere very much alive, gold could break more records in 2026.

Ceri Jones

Jonathan Mondillo

Edmond Jackson

Robert Stephens

Craig Rickman

Victoria Scholar

Rodney Hobson

Rodney Hobson

Rodney Hobson

Rodney Hobson

Graeme Evans

Rodney Hobson

Graeme Evans

John Ficenec

Graeme Evans

Richard Hunter

Graeme Evans

Keith Bowman

Kyle Caldwell

Dave Baxter

Lee Wild

Lee Wild

Graeme Evans

Cherry Reynard

Graeme Evans

Graeme Evans

David Prosser

Beth Brearley

Jennifer Hill

Robert Stephens

Andrew Hore

Edmond Jackson

Edmond Jackson

Rodney Hobson

Morningstar

Richard Beddard

Graeme Evans

Graeme Evans

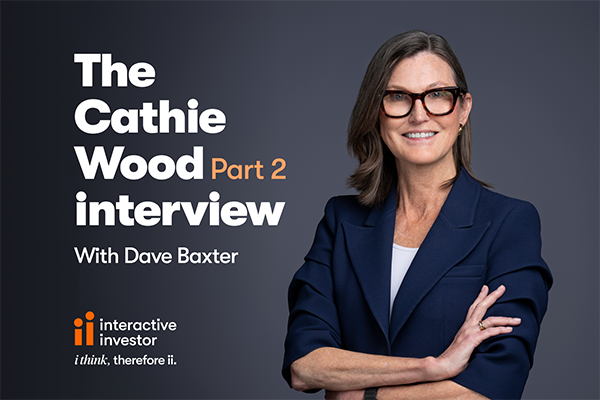

Dave Baxter

Graeme Evans

Graeme Evans

Kyle Caldwell

Kyle Caldwell

Kyle Caldwell

the interactive investor team

Kyle Caldwell

Dave Baxter

Dave Baxter

Dave Baxter

Kyle Caldwell

the interactive investor team

Kyle Caldwell

Dave Baxter

Dave Baxter

Dave Baxter

Join ii Community - the free social trading network built for ii customers.

Connect, compare portfolios, and talk strategy with like-minded investors. Whether you’re after expert insights from our award-winning journalists or want to swap ideas in private groups, this is your space to stay sharp, informed, and inspired.