Final FTSE 100 and stock market summary of 2019

Despite a downbeat end to the year, December was good for UK stocks. Could 2020 be a winner too?

31st December 2019 11:33

by Lee Wild from interactive investor

Despite a downbeat end to the year, December was a good one for UK stocks. Could 2020 be a winner too?

The FTSE 100’s 11-day winning streak in December came to an end yesterday, and 2019 ended with a disappointing second day of losses today.

After adding hundreds of points since the General Election on 12th December, the FTSE 100 dropped 68 points on Monday and another 44 points on New Year’s Eve.

Two of this year’s star stocks - Ocado (LSE:OCDO) and JD Sports Fashion (LSE:JD.) – ended 2019 with gains of over 1%, but volatile NMC Health (LSE:NMC) fell. It was joined by Next (LSE:NXT), AstraZeneca (LSE:AZN), Sainsbury’s (LSE:SBRY) and GlaxoSmithKline (LSE:GSK), all down 1% or more. Lloyds Banking Group (LSE:LLOY) shares were close behind.

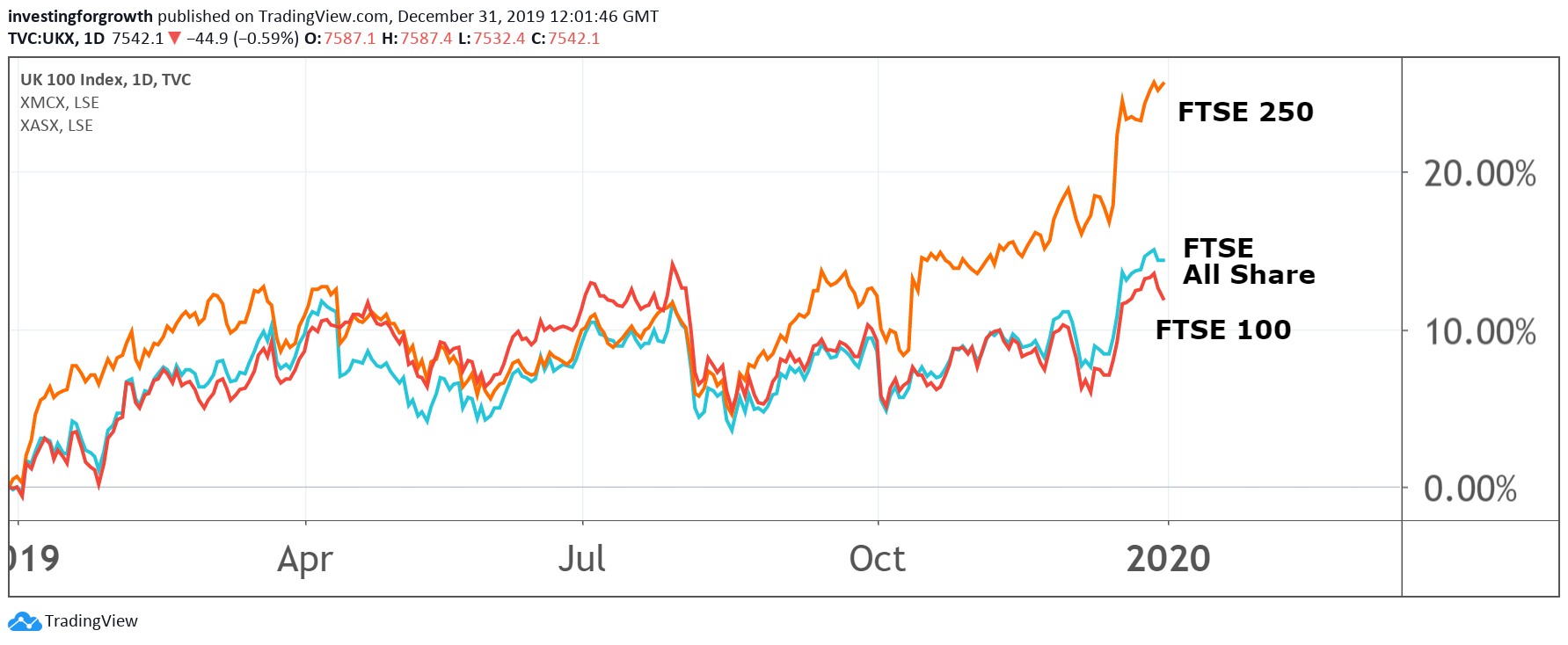

Source: TradingView Past performance is not a guide to future performance

Still, the blue-chip index added almost 200 points, or 2.7% for the month of December. It also ended more than 400 points, or 5.8%, above its low for the month registered on 5th December.

And that means the key indices have had a solid 2019. The FTSE 100 ended the year up 12%, the FTSE 250 index up 25%, helped by a late post-election surge, and the AIM All-Share added 11.6%, again, helped by a boom in demand for unloved UK domestic stocks prior to the election.

The FTSE 100 now sits within striking distance of the current record high of 7,903.50 and the magic 8,000 mark. Plenty of market watchers think we’ll see a print of 8,000 or more in 2020, and so do you, according to our recent poll of investors.

- Here’s where you think the FTSE 100 will finish in 2020

- Five AIM share tips for 2020

- UK share tips: Six ‘value’ stocks for 2020

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

It might be that it happens quite quickly, and it is true that the considerable Conservative Party majority does at least give certainty to the UK’s political direction.

Hope is that billions of pounds of investment from government – as part of their election pledges – and from both UK and overseas investors will benefit the economy.

- These indices can rally in 2020, but will FTSE 100 top 8,000?

- interactive investor's experts share their best ideas for 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

That said, it is inevitable that financial markets will suffer an attack of nerves on more than one occasion in 2020, first perhaps as the UK leaves the European Union at the end of January, then as politicians try to hammer out a trade deal before the post-Brexit transition period expires on 31 December 2020 – the cliff edge!

Whatever happens in 2020, it will not be dull.

Be sure to follow events as they unfold and find tips on how to play key investment themes, on the interactive investor news hub, via our range of award-winning newsletters, and on the interactive investor YouTube channel.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.