Funds and investment trusts to fit your personality

4th April 2023 12:04

by Kyle Caldwell from interactive investor

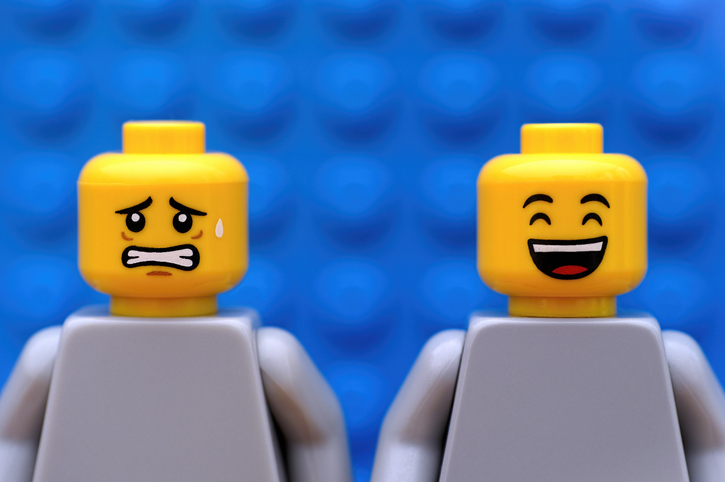

From thrill-seekers and pessimists, to contrarians and the sustainability-focused, Kyle Caldwell shares ideas to suit different investors.

Whether you are looking to maximise your ISA allowance this side of the tax year (you only have until the end of tomorrow), or you are an early bird investor ready for the start of the new tax year (6 April), an approach that could help align investments to your risk tolerance is to consider funds that closely match your personality type.

As well as weighing up how much risk you can stomach, also consider what you want to achieve and how long you are planning to invest for. Doing so, will help narrow your focus and make decision-making easier.

- Invest with ii: Open an ISA | Top ISA Funds | Transfer an ISA to ii

Hands-off

For investors who want to be as hands-off as possible, multi-asset funds are worth considering, as they provide diversification through owning both shares and bonds. Some of these funds also own other assets, such as property and commodities.

To keep costs down, which is one thing a DIY investor can control, you could consider passively managed multi-asset funds, such as Vanguard’s LifeStrategy range, which is comprised of five different funds. Each fund has a different equity weighting, ranging from 20% to 100%, so it caters to different risk appetites.

Passive funds that track well-known stock market indices, such as the MSCI World, S&P 500 and FTSE All-Share, could also be considered core hands-off options.

- Nine last-minute investment trust bargains for your ISA

- Three golden rules to become a better fund investor

- Watch our video: Day in the life of a fund manager: M&G’s Eva Sun-Wai

Also providing one-stop shop solutions are three multi-manager investment trusts: F&C Investment Trust (LSE:FCIT), Alliance Trust (LSE:ATST), and Witan (LSE:WTAN). Each one mainly invests in equities, but they are highly diversified in terms of countries and sectors.

For those investors who are hands-off, it is important to not simply buy and forget. By reviewing investments regularly, perhaps every six months, you can ensure that they are performing in line with your expectations. If they aren’t, try and understand why and then look to make changes if appropriate.

Pessimist

If you are a glass half-empty type of person, you may be more concerned than others about the risks of your investments suffering losses.

Almost by definition, investing involves some element of risk. If there were no possibility of losing some (or all) of your money, there would be no chance of achieving a return greater than what you can get from a savings account.

While most people think about risk as losing money, academic finance defines risk as volatility. In the simplest terms, this means how much the price of an investment fluctuates over a given period of time.

The good news is that investors can manage risk – such as by investing for the long term, being diversified, and drip-feeding money into the market rather than investing a lump sum all at once.

Risk can also be managed by selecting funds on the lower-risk end of the scale. Defensive fund choices to consider include multi-asset funds in the Mixed Investment 0-35% Shares and Mixed Investment 20-60% Shares sectors.

- How many funds should I own in my stocks and shares ISA?

- ‘High risk? I don’t see it that way’: the investment secrets of an ISA millionaire

There’s also a small number of wealth preservation investment trusts, which seek to protect capital when stock markets fall notably. Three trusts that have a strong track record in achieving this are Ruffer Investment Company (LSE:RICA), Capital Gearing (LSE:CGT), and Personal Assets (LSE:PNL). Each trust invests in a variety of defensive assets, including small weightings to gold, which is viewed as a safe haven in times of uncertainty.

Thrill-seeker

For investors who are prepared to be adventurous there’s plenty of choice, with scores of funds targeting high long-term returns from specific sectors of the economy.

There are numerous themes, but the main ones include cloud computing, robotics and automation, the adoption of electric cars, and clean energy. Both active and passive funds invest in these areas.

A broader theme that will pique the interest of any thrill-seeker is technology. Funds and investment trusts that invest in this sector have produced eye-catching returns over the past decade. However, more recently, returns have come off the boil, with interest rate rises causing sky-high valuations to come back down to earth.

Over the past decade (to 29 March), Allianz Technology Trust (LSE:ATT) and Polar Capital Technology (LSE:PCT) have returned 484.5% and 367.5%, while over the past year, the respective losses are 21.9% and 13.5%.

- Should investors be building a new strategy for the next decade?

- Three years on from Covid crash: key lessons, best and worst funds

- Watch our video: Day in the life of a fund manager: abrdn’s Thomas Moore

Another thrill-seeking option is Scottish Mortgage (LSE:SMT), which invests in firms with a technological edge over competitors. The types of companies that Scottish Mortgage invests in - high-growth, including a third of the portfolio in more speculative unlisted companies - have been firmly out of favour for the past 12 to 18 months. This is due to interest rate rises, which have devalued the expected future earnings of growth companies.

However, long-term returns remain strong, up 323.5%. This comfortably outpaces the average global trust, up 201.1% over the same period. Due to the way it invests, Scottish Mortgage is an adventurous option. For this reason, it is best considered a satellite holding in a well-diversified portfolio.

Other adventurous options to consider are emerging market and frontier market funds, which invest in faster-growing, but less economically mature, economies.

Contrarian

For investors who like to go against the crowd, UK smaller company funds offer the chance to ‘buy low’.

In 2022, it was a memorable year for this part of the market, but for all the wrong reasons. Stagnant economic growth, high inflation, and interest rate rises led investors to reduce risk, which caused share prices and valuations to slump for smaller company shares, due to them being more domestically focused than the mega-caps in the FTSE 100 index.

The good news is that such a sell-off, while severe in 2022, was driven by sentiment rather than by most companies across the sector performing poorly operationally. Right now presents an opportunity to take advantage of knock-down prices.

As ever, there’s the danger of buying too early. Until inflation is brought under control, further interest rate rises cannot be ruled out, which would likely continue to hurt the smaller company part of the market.

- The ‘unique’ investment that protects against inflation

- Fund and investment trust ideas to play a small-cap comeback

For UK smaller company fund and investment trust ideas, check out our recent analysis of the sector.

On the whole, there’s no shortage of investment trust discount opportunities at the moment. In response to stock market turbulence, average discounts across the investment trust sector widened dramatically in 2022, from around 2% at the start of the year to 16% by the middle of October. The average equity investment trust discount remains around that level.

A recent article named nine of the biggest bargains available among large and popular investment trusts. The bargains are: Scottish Mortgage, Baillie Gifford US Growth (LSE:USA), HgCapital Trust (LSE:HGT), Pantheon International (LSE:PIN), HarbourVest Global Private Equity (LSE:HVPE), RIT Capital Partners (LSE:RCP), International Public Partnerships (LSE:INPP), Warehouse REIT (LSE:WHR), and Bankers (LSE:BNKR).

Investing in what matters most to you

The world of sustainable investing is a minefield for investors to navigate. However, while the terminology can confuse, the fundamental principle of sustainable investing (or however it is labelled or described) is supporting businesses ‘doing good’. While the interpretation of this comes in many forms, one common approach is to invest in businesses making a positive impact on environmental and social problems.

Sustainable funds don’t just exist to meet investors’ expectations on returns – vital though that may be. They also have a responsibility to engage with the firms they invest in, challenging them on issues that matter to investors. Be wary of fund firms that do not give examples of how they engage meaningfully with companies.

To help investors navigate the confusing technical jargon, interactive investor launched the sustainable investments long listin September 2019, which contains more than 200 socially responsible and environmental funds, investment trusts and ETFs available on our platform. We also launched ACE 40, a rated list of sustainable funds for retail investors wanting to better align their investments with their personal values.

There is also our Sustainable Growth portfolio, which is designed to give investors an idea about how they can build their own diversified ethical portfolio.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.