How will portfolios look post-pandemic?

We assess the outlook for dividends in one investment trust sector.

19th March 2021 16:35

by Thomas McMahon from interactive investor

We assess the outlook for dividends in one investment trust sector.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Few sectors have been as affected by the pandemic as real estate. While many of the effects of the past year will recede into memory as old habits return, there will be long-lasting effects on our use of commercial property ,which have important investment ramifications.

As we discuss below, there will be an adjustment phase as managers adapt to this new environment, and we think the average portfolio will look very different in a few years’ time than it did before the pandemic. Some managers are ahead of the game, while others will have to do more manoeuvring.

However, we believe commercial property will continue to offer a good way to generate a decent yield on investment with exposure to economic growth and relatively low NAV volatility.

Meanwhile, the generalist trusts sit on extremely wide discounts. With the UK equity market having started to price in a UK recovery, UK commercial property has lagged. Given commercial property is economically sensitive, there could be an opportunity for discount players if they can navigate the structural issues in some sectors that we outline below.

Market performance review

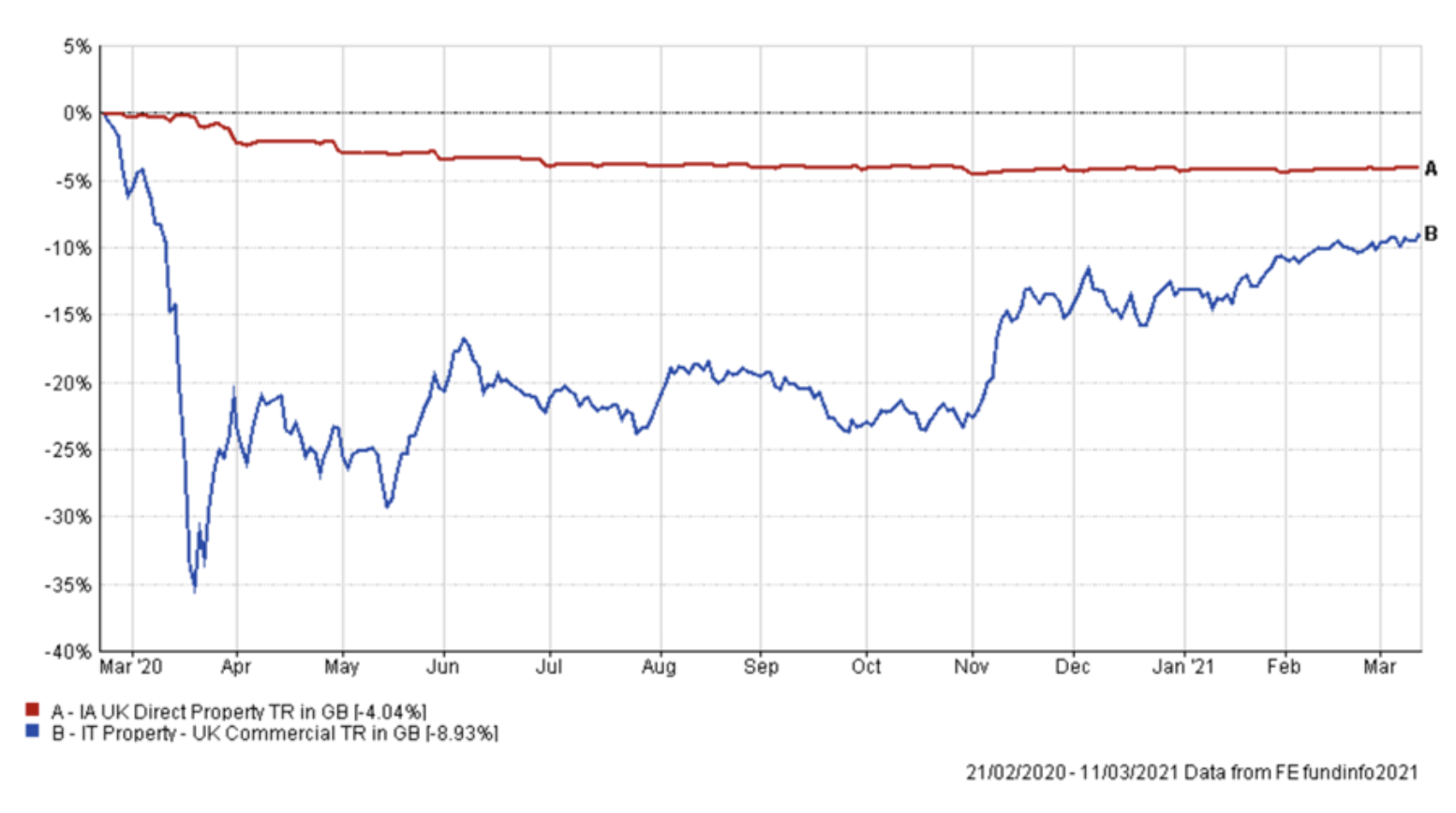

The period since the pandemic began has not been great for investors in UK commercial property – at least in the generalist portfolios. On a total-return basis, as of the time of writing, the open-ended sector is down around 4% since the initial sell-off began on 22 February 2020. The closed-ended sector is down circa 9% on a share price total return basis. Global equity markets, on the other hand, are well above their pre-crisis peaks, although the FTSE All-Share, one of the weaker global markets for most of the period, is still down around 4%.

Share price performance

The shallower decline for the open-ended funds over the period partly reflects the fact that they have been shuttered for most of the period. Under FCA rules, if there is material uncertainty around the valuation of at least 20% of a fund’s holdings, it has to suspend redemptions. With RICS applying a material uncertainty clause to the valuations of most commercial property last summer, all funds had to close and not all have as yet reopened. Investors who wished to exit the closed-ended funds during this period could do so, albeit at a significant discount to NAV. We think this optionality is a critical advantage the closed-ended structure offers. Even if the discount taken on exit would have been painful, investors could have made back those losses with a good equity strategy pretty quickly, while those that needed an income would have been able to find products offering that income.

The AIC UK Commercial Property sector as represented in the graph above is a bit of a muddle, consisting of a patchwork of trusts with very different strategies. The AIC has acknowledged this in deciding to split out the logistics specialists trusts from the generalists trusts in future. The average sector performance is flattered by the presence of REITs such as Tritax Big Box (LSE:BBOX) and Urban Warehouse REIT, which invest in the industrials sector which has been a very strong performer. In fact, on a weighted average basis, the share price total return of the generalist trusts is down almost 19%, with these trusts now trading on an average discount of c. 20%.

The poor overall returns for generalist trusts have been due to their exposure to certain troubled areas of the market. The pandemic has caused an extreme divergence in performance between sectors such as retail and leisure, which have been unable to trade for much of the past year, and industrials and logistics, which have been open and in the latter case benefiting from a change in shopping habits which will likely have long-term ramifications. One way of illustrating this is to look at the yields now achievable on those sectors. Savills now reports that the gap between the highest yielding and lowest yielding sub-sectors in the UK prime commercial property market is the largest ever recorded. There is a gap of 400bps between the 7.5% yields being achieved by leisure parks and the 3.5% yields of West End offices. This is considerably wider than the peak gap of 300bps after the 2008 financial crisis, although Savills note it was the same two sectors involved.

Does this represent an opportunity? Savills note the peak yield for the leisure sector in 2009 was 8.75% and it was already 200 basis points lower just a year later. Leisure parks and cinemas seem like candidates for a rebound to us this time too. We note that cinema attendances in the UK have actually been fairly stable in recent years and were 176m in 2019 compared to 173.5m in 2009. This does represent a per capita fall, given the growth in the population over the past decade is more than 1.4%, but this is not a picture of an industry in terminal decline, and we would expect the attractions of a home entertainment system to have worn a bit thin for most people by the time the lockdown is lifted.

Prime yields (%) ordered by 12m widening

| Jan-20 | Jan-21 | Widening (PP) | |

|---|---|---|---|

| Leisure parks | 5.75 | 7.5 | 1.75 |

| High street retail | 5.5 | 6.75 | 1.25 |

| Shopping centres | 6 | 7 | 1 |

| Regional pubs (RPI) | 4.5 | 5.25 | 0.75 |

| Offices M25 | 5 | 5.5 | 0.5 |

| Retail warehouse (Open A1) | 6.25 | 6.5 | 0.25 |

| Provincial offices | 4.75 | 5 | 0.25 |

| London leased (core) hotels | 3.75 | 4 | 0.25 |

| Retail warehouse (Restricted) | 6.5 | 6.5 | 0 |

| City offices | 4 | 4 | 0 |

| West end offices | 3.5 | 3.5 | 0 |

| Foodstores (OMR) | 4.75 | 4.5 | -0.25 |

| Industrial multi-lets | 4 | 3.75 | -0.25 |

| Ind/Distribution (OMR) | 4.25 | 3.75 | -0.5 |

Source: Savills research, as of 28/02/2021

We think there is less chance of a swift rebound in the retail sector. This is home to two of the highest-yielding sub-sectors, both of which have seen some of the largest moves out in yields over the past year: shopping centres and high street retail. We think it is fair to say not a single manager in the sector is positive on the outlook for the sector – certainly of those we have spoken to. The one bright spot is the retail warehouse sub-sector, which looks likely to be relatively resilient. We discuss this more under conclusions below. On the other hand, industrials, and food stores (i.e. supermarkets) have seen their yields tighten over the past year. Demand from tenants is set to remain strong in both cases, while supermarkets tend to sign long-dated leases with rents linked to inflation, and long-dated income continues to be in high demand.

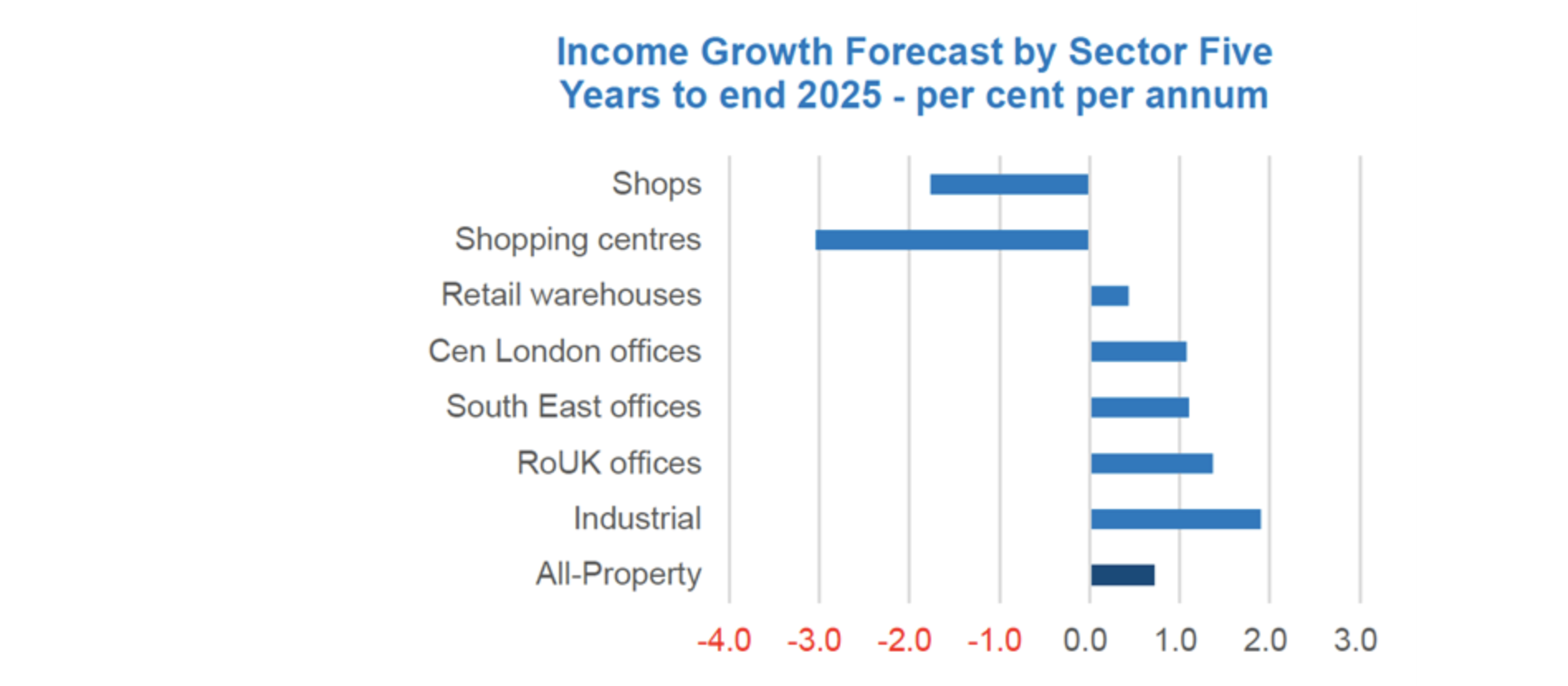

Much ink has been spilt on explaining the trend to online retailing, so we will spare our readers another run through that. However, what we find notable is that managers do not report finding valuations overstretched in the logistics sub-sector for the most part. The consensus is there is more to come, with good income growth possible in this part of the market. Indeed, industrials are notably the only sector BMO Real Estate Partners (BMOREP) forecast to grow their income in line with the BoE’s 2% inflation target (see table below). However, managers do talk of having to become more selective. We believe the issue is that supply cannot easily keep pace with demand – it is harder for an economy to produce more distribution hubs than it is for Coca-Cola to increase production. Yields are therefore likely to be lower in this sector on a forward-looking basis, but with better prospects for income stability and growth.

Income growth forecasts by sector

Source: BMOREP, as of September 2020

Sector review: performance and dividends

With the majority of the sector having reported their December NAV, we show below NAV and share price total returns for the 2020 calendar year plus current discounts (to those December NAVs). We have split out the generalist trusts from the sector specialists. LXI REIT was the best performer, with valuations aided by the fact that 96% of its leases are linked to inflation, with an average time to the first break of 21 years. AEW UK REIT also stands out for generating a positive NAV total return, although this is thanks to its high dividend of 2p a quarter, which was uncovered for the final quarter of the year. The worst performer on that basis was Ediston Property Investment Company (LSE:EPIC). EPIC is around 80% invested in retail warehouses. Although it managed to maintain its dividend at 70% of the pre-crisis levels through the pandemic, and that dividend is fully covered, with the board looking at increasing it. That said, the value of its retail-heavy portfolio has fallen significantly over the year. EPIC entered the year on a discount, and this plus the continued payment of dividends means its investors have not done as poorly on a share price basis as some other sector members.

2020 performance: generalists

| NAV TOTAL RETURN | SP TOTAL RETURN | DISCOUNT (CURRENT) | |

|---|---|---|---|

| LXI REIT (LSE:LXI) | 9.17 | -10.97 | 2.17 |

| AEW UK REIT (LSE:AEWU) | 7.41 | -13.32 | -12.65 |

| UK Commercial Property REIT (LSE:UKCM) | 0.7 | -19.72 | -17.67 |

| BMO Real Estate Investments (LSE:BREI) | 0.38 | -22.55 | -22.12 |

| Custodian REIT (LSE:CREI) | -1.02 | -18.61 | -3.31 |

| Schroder Real Estate Invest (LSE:SREI) | -2.25 | -26.46 | -29.52 |

| Standard Life Inv. Prop. Inc. (LSE:SLI) | -3.25 | -29.81 | -24.34 |

| Regional REIT (LSE:RGL) | -3.41 | -20.73 | -19.23 |

| BMO Commercial Property Trust (LSE:BCPT) | -8.08 | -28.34 | -40.07 |

| Ediston Property Investment Company (LSE:EPIC) | -8.21 | -15.17 | -20.2 |

Source: Morningstar

Generally speaking, the sector specialists performed better than the generalists. Logistics and industrials and long-dated income remained in demand, while the healthcare and social housing sector benefitted from having sources of income uncorrelated to the health of the economy – although the care homes REITs did see their discounts widen out dramatically at the start of the crisis. We think the care home REITs, Target, and Impact, look attractive as a form of long-dated bond proxy. Their income is linked to inflation and leases signed with care providers are generally long-dated.

2020 performance: specialists

| SECTOR SPECIALISTS | NAV TOTAL RETURN | SP TOTAL RETURN | DISCOUNT (CURRENT) |

|---|---|---|---|

| Supermarket Income REIT (LSE:SUPR) | 13.9 | 2.61 | 5.33 |

| Tritax Big Box (LSE:BBOX) | 3.71 | 18.11 | 17.98 |

| Urban Logistics REIT (LSE:SHED) | 2.81 | 3.33 | 1.72 |

| Warehouse REIT (LSE:WHR) | 17.78 | 13.69 | 9.89 |

| Property - UK Residential | |||

| Civitas Social Housing (LSE:CSH) | 5.71 | 20.81 | -0.02 |

| GCP Student Living (LSE:DIGS) | 0.14 | -25.3 | -10.83 |

| Ground Rents Income Fund (LSE:GRIO) | 3.37 | -16.41 | -40.82 |

| Home REIT (LSE:HOME) | 11.15 | ||

| KCR Residential REIT (LSE:KCR) | -7.96 | -51.55 | -46.63 |

| PRS REIT (LSE:PRSR) | 6.63 | -12.16 | -9.04 |

| Residential Secure Income (LSE:RESI) | 5.63 | -3.88 | -13.25 |

| Triple Point Social Housing REIT (LSE:SOHO) | 5.05 | 30.64 | 0.6 |

| Property - UK Healthcare | |||

| Impact Healthcare REIT (LSE:IHR) | 10.36 | 7.23 | 1.84 |

| Target Healthcare REIT (LSE:THRL) | 6.53 | 4.29 | 2.7 |

Source: Morningstar

One trend we are seeing is for generalist managers to raise their weighting to alternatives, which includes some of the areas these specialists invest in. In particular, student housing is one sub-sector seen as attractive. UK Commercial Property REIT (LSE:UKCM), for example, has signed two forward funding agreements for student accommodation, one in Exeter, one in Edinburgh. The student property funds had a rough 2020, with universities closed for some of the time and fewer overseas students booking for 2021/2022. However, unlike in the retail sector, this looks like being a temporary state of affairs. Two structural reasons seem to be supporting student housing: first, there is a modernization of student accommodation going on – students expect more than they did 20 years ago – and secondly, the market structure is more compartmentalised. Even if the number of students, or the number of overseas students, was to decline, this would inordinately affect certain locations. We believe the best universities in the best locations will remain in high demand. UKCM has been able to agree net initial yields of over 5% for their two developments, which, turning to the table from Savills above, looks highly attractive, with the sub-sectors on higher yields seemingly much more structurally challenged.

Indeed, we think it likely the commercial property trust of the coming decade will have a high weighting to industrials – maybe over 50% will become the norm – along with a sizeable weighting to what have until now been considered ‘alternatives’, with student housing among them. Data centres, healthcare and residential are other sub-sectors of interest to a number of managers, which seem to have more secure fundamentals than retail. They may even seem more secure than offices in the short term, as that sector is cyclical in nature and the overall footage required is likely to shrink as more companies move to flexible working after the pandemic. They also potentially offer higher yields than industrials which seem likely to remain in high demand. For that reason, we think leisure is likely to feature too, notwithstanding the issues during the pandemic.

Dividends and discounts

As we wrote in our last sector report in June 2020, discounts seemed to have been driven by the weighting to retail and the gearing at the peak of the crisis. Most trusts cut their dividends by around 50% in response to the first lockdown. In the last few months, those dividends being partly restored has in some cases been a key driver of share prices. Investors may be taking such a move as an indication of an improving outlook, but we think property investors are primarily motivated by yield, and discount players have had other targets in the post-pandemic period. We show below where the generalist trusts discounts stand in relation to their pre-pandemic pay-out and the current outlook, based on board commentary where given. It is notable that most trusts are covering their current dividends, despite seeing rent collection below pre-pandemic levels. Clearly, the current unknown is whether the release of lockdown will happen as quickly as intended, how quickly shopping and restaurant dining will recover and how retailers and restauranteurs will cope financially with the effects of this prolonged period of closure. Therefore, for the trusts with the higher weighting to retail, there has to be more uncertainty.

Dividends and yields of generalist trusts

| DIVIDEND STATUS | DIVIDEND OUTLOOK | Yield | |

|---|---|---|---|

| AEW UK REIT | held at pre-pandemic levels | uncovered, subject to review | 9.8% |

| Regional REIT | 25% cut | to be maintained this FY | 8.2% |

| Ediston Property Investment Company | 70% of pre-pandemic | looking to increase | 6.4% |

| BMO Commercial Property Trust | 70% of pre-pandemic levels | board monitoring | 6.0% |

| Standard Life Inv. Prop. Inc. | 60% of pre-pandemic level | consider next quarter | 5.4% |

| Custodian REIT | 75% of pre-pandemic levels | aim to maintain at current level FY22 | 5.3% |

| LXI REIT | held at pre-pandemic levels | 4.3% higher target for next year | 4.8% |

| BMO Real Estate Investments | 67% of pre-pandemic levels | board monitoring | 4.4% |

| Schroder Real Estate Invest | 81% of pre-pandemic levels | fully covered, progressive policy | 3.9% |

| Picton Property Income (LSE:PCTN) | 91% of pre-pandemic levels | 122% covered | 3.7% |

| UK Commercial Property REIT | 50% of pre-pandemic level | top up expected at end of FY | 2.6% |

Source: company announcements

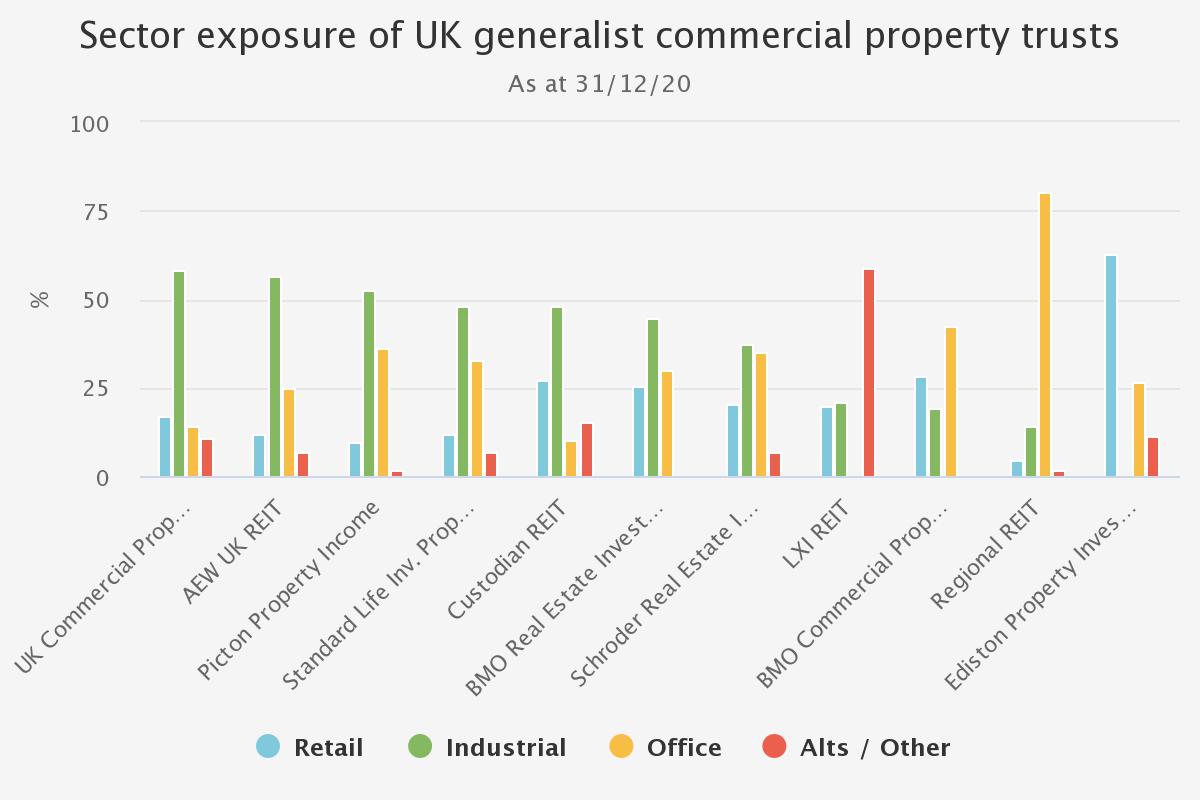

Below we show the current sector weights of the generalists. The weighting to industrials has crept up for a number of trusts since our last review, both due to investment decisions and falls in market values in other sectors. The trusts are ordered by their exposure to industrials, with supermarkets included within alternatives when they are separately broken out.

Sector exposure

Source: company announcements

Finally, we show our ‘risk checklist’. This includes retail exposure and LTV gearing. We have included the yield too as we think it speaks to how investors price risks and the compensation they require, and we show the current discount (as at 10/03/2021).

Risk checklist vs discount

| RETAIL % | LTV GEARING % | YIELD % | DISCOUNT % | |

|---|---|---|---|---|

| BMO Commercial Property Trust | 28.5 | 22.6 | 6 | 40.6 |

| Schroder Real Estate Invest | 20.6 | 32 | 3.9 | 31.2 |

| Standard Life Inv. Prop. Inc. | 12 | 18.6 | 5.4 | 25.7 |

| BMO Real Estate Investments | 25.4 | 25.1 | 4.4 | 22.6 |

| Ediston Property Investment Company | 62.7 | 36.5 | 6.4 | 20.2 |

| Regional REIT | 4.3 | 39.3 | 8.2 | 19.2 |

| UK Commercial Property REIT | 17 | 13 | 2.6 | 18.1 |

| AEW UK REIT | 11.9 | 20.6 | 9.8 | 12.6 |

| Picton Property Income | 9.7 | 21.3 | 3.7 | 9.4 |

| Custodian REIT | 27 | 24 | 5.3 | 3.3 |

| LXI REIT | 20 | 30 | 4.8 | -2.2 |

Source: Morningstar

Conclusions and outlook

Looking at the table above, BCPT looks to us like a potentially interesting deep value play. While the outlook for retail is undoubtedly poor, BCPT’s allocation is largely through St Christopher’s Place in Oxford Street and Wimbledon Broadway. In the former case, we think central London will continue to be a premier leisure and retail destination for both UK and overseas visitors, while Wimbledon is a wealthy commuter suburb with plenty of redevelopment planned and possible in future. While we believe the retail sector will shrink, most of BCPT’s exposure is in locations that are likely to survive, and maybe even thrive. That said, this exposure bears with it risks from a slower reopening than hoped, risks that a weak economic environment may persist after the lockdowns, risks that travel will be slow to return and risks of a shift to turnover rents being perceived negatively by investors. However, the discount is 41%, and substantially higher than the rest of the sector. Meanwhile, there is a 6% yield annualising the current payment, which was covered in the last quarter, and the gearing is modest compared to the peer group.

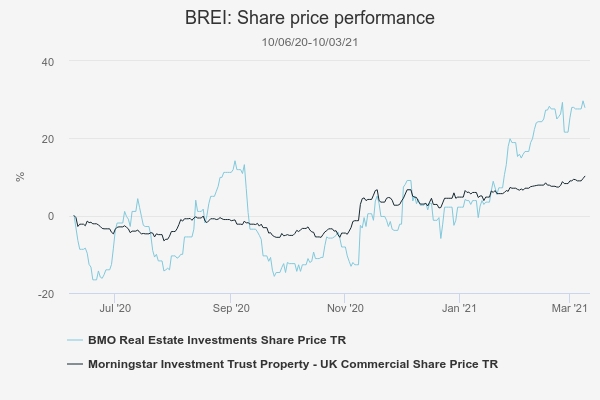

Using analysis of the same metrics referred to above, we highlighted BREI as a potential recovery play in our last sector review in June 2020. The shares are up 28% on a total return basis since then, compared to 10.2% for the AIC UK Commercial Property average.

Performance

Source: Morningstar

The dividend was restored to 80% of the pre-pandemic level in November, which we think has contributed to the sharp rally in the shares since. As we discussed in our recent note, manager Peter Lowe has been refashioning the portfolio away from retail for some time. There is still some work to do here, he tells us, and although he acknowledges the increasingly tight pricing in the logistics sector, he thinks it is still an attractive place to invest if the stock and the price is right, so the portfolio is likely to evolve more in that direction.

Discounts seem to be driven by two things currently: the dividend, and the exposure to retail. On the first metric BREI is in a strong position, on the latter it still has a high weighing overall, even if very little is now in the troubled sub-sectors, but most is in retail warehouses. In our view, the market has not made the distinction between sub-sectors and has written down retail wholesale, so as the economy normalises there could be scope for further discount tightening to come.

We also highlighted UK Commercial Property (UKCM) as a much safer play thanks to its low gearing and low retail exposure. The board were cautious in cutting the dividend by 50% as the crisis hit and have been slow to bring it back up. It is still around 50% of the pre-crisis levels, although we understand a top-up payment is likely at the year-end. Again, things have played out pretty much as would be expected. UKCM has performed more solidly in the bear market, but its shares have been slow to respond to the reflationary, vaccine rotation in markets. The low level of gearing has not helped by holding back the NAV, but we think UKCM is actually in a very strong position for the long-term. The high levels of cash and low gearing mean Will Fulton has a lot of options to take advantage of any dislocations in the market. Meanwhile, UKCM was fairly far on in a transformation programme before the crisis hit, with very little retail exposure and over 50% in industrials. Will has also forward funded two student accommodation investments which will bring in a yield over 5%, as discussed above, and which means the portfolio is exposed to another sector with relatively robust prospects.

Future demand for property trusts will depend on their ability to generate a good yield. We note that both BMO Real Estate Partners and Aberdeen Standard forecast total returns from the property market as a whole of c. 4% over the next three years, which is unexciting. However, BMOREP’s forecasts make clear that essentially all of this is income return, and for those who need an income, we think this is an attractive enough yield, if they can be comfortable there are no further significant falls to come to the NAV. We have seen industrials, in particular, logistics, grow as a percentage of the sector’s holdings over the crisis period, and we expect this trend to continue. The prospects for income growth and solid structural trends in the economy are key supports. We also think managers will increasingly be turning to alternatives in order to boost the income and to find sectors that do not face structural headwinds.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.