ii winter portfolios 2018: Consistent shares deliver huge profit

7th December 2018 17:09

by Lee Wild from interactive investor

Markets are volatile again, but interactive investor's consistent basket of five shares turned a significant profit in just one month while the benchmark index tumbled. Lee Wild explains how.

This year's interactive investor Winter Portfolios launched following a significant sell-off in October, and the wider market registered further losses in November. It certainly wasn't plain-sailing for our winter winners, but our consistent basket of shares just delivered one of the best monthly performances of any winter portfolio in five years.

Yes, markets are volatile this time, but that our five consistent stocks, which have put in solid performances year in year out, did so well is no surprise. The criteria for making our consistent portfolio is that each constituent must have risen between the end of October and end of April every year for at least the past decade.

Owning these five during the past 10 winter periods only would have generated an average annual return of 19%. The FTSE 350 benchmark index managed just 4.5%.

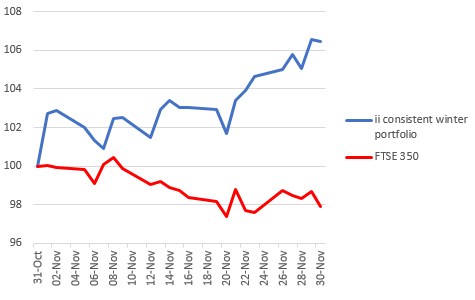

In November – the first month of the 2018-19 winter investing strategy – the interactive investor Consistent Winter Portfolio returned 6.6% compared with a 2.1% decline for the FTSE 350 benchmark index.

interactive investor Consistent Winter Portfolio

Source: interactive investor Past performance is not a guide to future performance

Infrastructure products firm Hill & Smith has averaged an annual return of 18% over the past 10 winters, and it was the star performer in November.

Ironically, it was a weather-related profits warning that torpedoed the previously high-flying motorway barriers manufacturer back in August. But strong structural growth drivers remain at work, and buyers chased the shares up 20.8% over the month.

Pub owners have struggled for years as drinkers desert their locals in favour of alternatives. Greene King shares have been in decline, too, but there is an anomaly here whereby the pub chain and brewer typically does well in the winter.

In just one month its share price surged 13.8% to a four-month high. Richard Hunter, interactive investor's head of markets, said following last month's half-year results:

"Careful balance sheet management and the tailwinds of good summer weather and the World Cup have left Greene King in a strong position. The current yield of 6.5% is punchy in a low interest rate environment and the yield has become something of a guarantee from Greene King over the years."

Industry giant InterContinental Hotels Group rose more than 2% during the month and Croda International - the speciality chemicals blue-chip that's risen in each of the past 14 winter periods - added 1.2%.

Only fly in the ointment was kitchen supplier Howden Joinery. Despite starting the strategy strongly, the shares have drifted back. Still, they're modestly valued and expected to deliver high single-digit profit growth in each of the next three years.

Past performance certainly suggests the possibility of a rebound at some point. Howden shares have risen in each of the past 10 years, generating an average annual return of 22%.

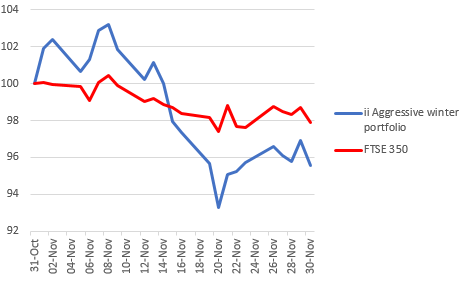

interactive investor Aggressive Winter Portfolio

Source: interactive investor Past performance is not a guide to future performance

The interactive investor Aggressive Winter Portfolio comes with extra risk, but carries the potential for greater reward. The average annual return for this years’ five constituents is a mouth-watering 28%.

That extra risk was exposed in the first month of the portfolio, with some of the high beta stocks falling foul of the wider market downturn.

Once the numbers are put through the wringer, the portfolio was down 4.4% in one month versus the 2.1% decline for the benchmark.

Main culprit was equipment rental giant Ashtead The US focused appeared to be bouncing back from an early sell-off in line with the markets, but gains made over the past couple of years continue to unwind. Above £24 in September, the shares ended November down 9% on the month below £18.

Heat treatment engineer Bodycote is another top performer that's coming off the boil. Up an average of 25% each year of the past decade, it ended November down 7.5%. Concerns around the automotive and industrials business are behind the sell-off, but analysts still think the shares are over 800p, implying upside over the next six months.

Property website Rightmove was down 3%. City experts are divided - JP Morgan argues that potential is already priced in, while UBS believes there's 10% upside from current levels. If history is anything to go by, Rightmove is capable of double-digit returns over the winter months.

Elsewhere, winter star JD Sports Fashion has made a weak start to the six-month strategy. However, the tracksuits and trainers chain was slow out of the blocks last year before ending with big gains, so do not write it off yet.

Workspace provider and former bid target IWG was the only 'aggressive' constituent to end the first month with a profit. It added 1% for the month, but had been up over 11% within the first week of the strategy following a confident third-quarter update.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.