Mind the gap: the areas where fund selection matters

Saltydog Investor looks at how laggard portfolios have fared against the leading lights.

21st January 2026 09:25

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog was founded more than 15 years ago and our objective has not changed.

We provide data-led insights designed to help our members improve the performance of their investments.

Each week, we publish reports highlighting the best- and worst-performing sectors, along with a shortlist of the leading funds within each sector.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

We also run a couple of demonstration portfolios, which show how we are positioning some of our own money. We do not claim to cover every fund available, but our analysis includes most UK-domiciled funds offered by the main investment platforms.

Funds are first sorted into their Investment Association (IA) sectors.

These are then combined into our own Saltydog groups, based on historic volatility.

The least volatile sectors sit in the “Safe Haven” group, followed by “Slow Ahead” and “Steady as She Goes”. The most volatile equity sectors are split between the two “Full Steam Ahead” groups.

Specialist sectors are reported separately.

These groupings are designed to help our members manage the overall volatility of their portfolios.

Sector returns

Our primary focus is on sector performance. We believe that sustained sector trends tend to reflect underlying macroeconomic conditions and investor sentiment.

- Investment outlook: expert opinion, analysis and ideas

- Funds and trusts four pros are buying and selling: Q1 2026

As a general principle, we promote selecting sectors first and then deciding which fund to invest in.

However, by concentrating on sectors and only ever looking at the leading funds, it’s easy to lose sight of how wide the performance spread can be within a single sector.

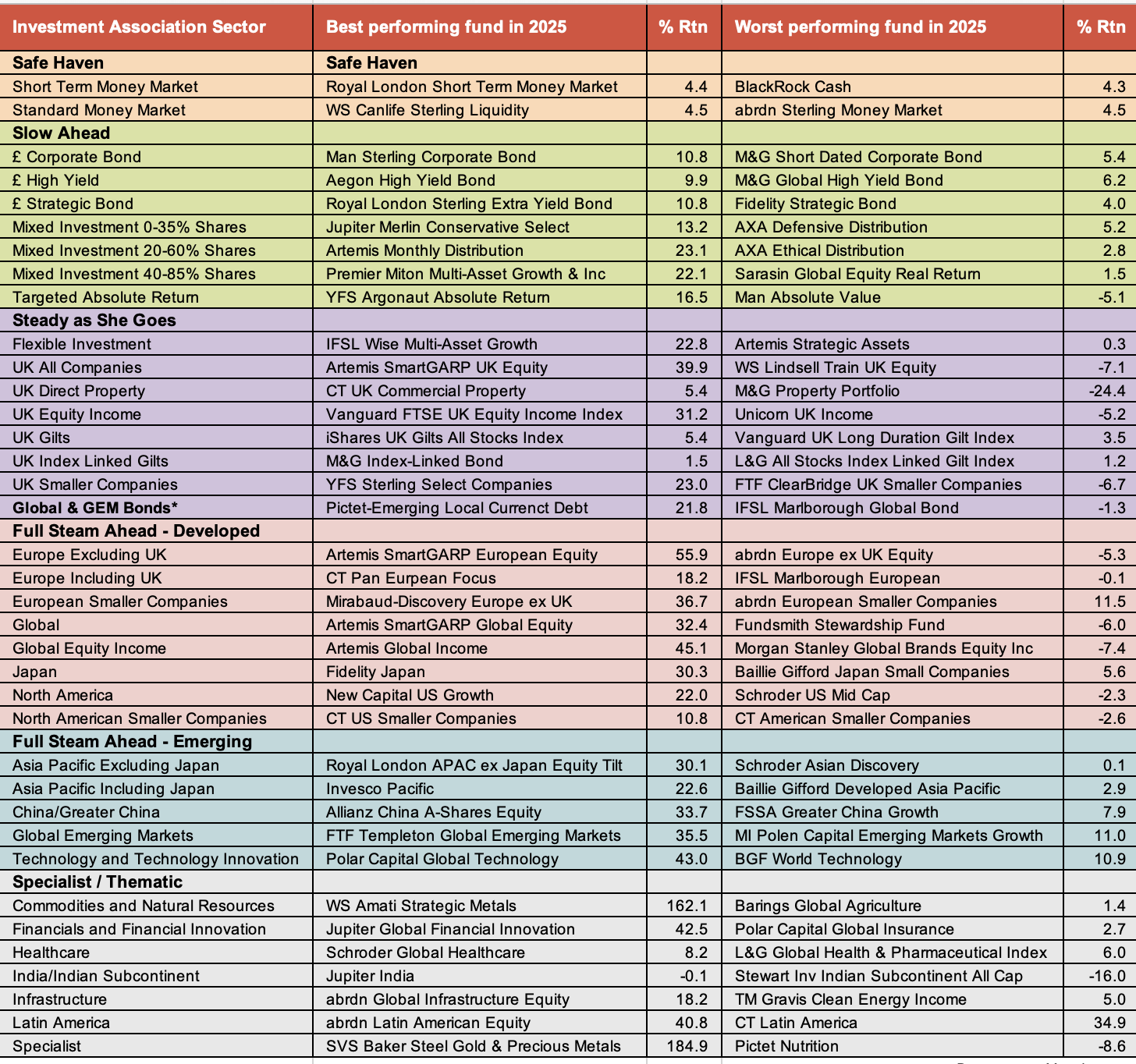

To address that, we have reviewed our data for 2025 and identified the best- and worst-performing fund in each sector.

Data source: Morningstar. Past performance is not a guide to future performance.

(*There are a small number of bond sectors where we track only one or two funds. These have been combined into a single Global & Global Emerging Market Bonds sector.)

The table makes for some striking reading. Below, we look at the results one Saltydog group at a time.

Safe Haven

The Safe Haven group contains just two sectors: Short Term Money Market and Standard Money Market. Both are governed by strict rules around credit quality, duration, and liquidity, which keeps volatility low but also limits the differences in performance between funds.

As a result, the gap between the best and worst funds in these sectors remained narrow again in 2025.

Slow Ahead

The variance in performance was much more noticeable in the Slow Ahead group, which includes the bond and mixed-asset sectors.

The strongest returns came from funds in the Mixed Investment sectors, where exposure to equities helped drive gains during periods of market strength, but also made them more vulnerable when markets turned.

The best-performing fund, Artemis Monthly Distribution I Acc, rose by 23.1%.

Somewhat ironically, the worst-performing fund in this group came from the Targeted Absolute Return sector. Man Absolute Value Profl CX £ Acc fell by 5.1%.

- Fund Focus: the ‘good’ funds that had a bad year

- The big question for 2026: has AI caused a stock market bubble?

Steady as She Goes

The Steady as She Goes group showed a broader range of outcomes.

The leading fund over the year was the Artemis SmartGARP UK Equity I Acc GBP fund, up 39.9%, from the UK All Companies sector. However, the WS Lindsell Train UK Equity Acc fund, from the same sector, ended the year down 7.1%.

Full Steam Ahead – Developed

There was an even larger variance in the Full Steam Ahead – Developed group.

The best-performing fund over the year was Artemis SmartGARP European Eq I Acc GBP with a 55.9% annual return. The abrdn Europe ex UK Equity A Acc fund, also from the Europe Excluding UK sector, fell by 5.3%.

The worst-performing fund in this group was the Morgan Stanley Global Brands Equity Income I Acc fund, from the Global Equity Income sector, with an annual loss of 7.4%.

Full Steam Ahead – Emerging

The leading funds from each of the five sectors in this group all made returns of more than 20%, and the best, Polar Capital Global Tech I GBP Hdg Inc rose by 43.0%.

Even the worst fund in this group, Schroder Asian Discovery Z Acc, went up, albeit only by 0.1%.

- The FTSE 100 has broken 10,000: which active funds are beating it?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Specialist/Thematic

These sectors showed some of the widest performance spreads of all.

The standout fund over the year was SVS Baker Steel Gold & Precious Metals B Acc, up 184.9%, along with other gold-focused funds in the Specialist sector.

The WS Amati Strategic Metals B Acc fund, from the Commodities & Natural Resources sector, was also in the mix, up 162.1%.

Final thoughts

Many of the top-performing funds will be familiar to Saltydog members.

They have appeared regularly in our weekly shortlists and, in some cases, continue to feature in our demonstration portfolios. The weaker performers provide a timely reminder that sector labels alone do not tell the whole story.

Even within the same IA sector, outcomes can vary dramatically.

It is also clear that although funds from the more volatile groups can deliver better returns, there tends to be more variation within these sectors.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.