Stockopedia: 10 micro-cap value plays with momentum behind them

Investors are bullish on riskier growth stocks. This strategy can help spot possible picks.

3rd February 2021 15:21

by Ben Hobson from Stockopedia

Investors are bullish on riskier growth stocks. This strategy can help spot possible picks.

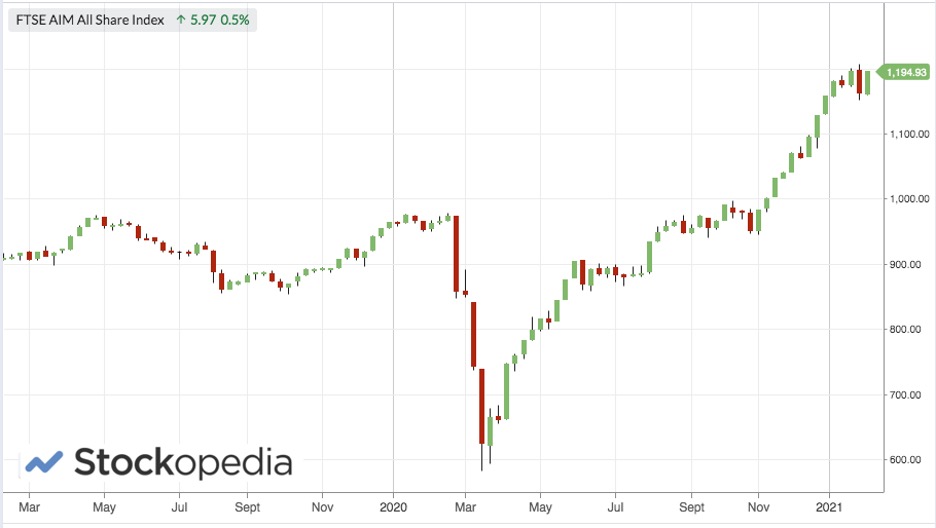

One of the trends that has persisted since the dramatic collapse in market prices nearly a year ago is the relentless march of small-cap stocks. AIM - traditionally home to smaller, faster-moving companies - has roared ahead in recent months, suggesting that investors are bullish on riskier growth shares. But what kind of strategy can help you find them?

Source: Stockopedia. Alternative Investment Market All Share Index, February 2019 - February 2021

One of the challenges of understanding the risks and opportunities of smaller shares is that they tend to suffer from a lack of coverage from analysts. With few experts following them, it can be tricky to know which companies have a genuine ability to outperform. But while this is a problem for some investors, it also represents an opportunity for those prepared to roll up their sleeves and do a little digging themselves.

A good barometer of sentiment in small-caps is a strategy originally devised by the American fund manager and well-respected quantitative, or ‘quant’, investor, James O’Shaughnessy. Back in 2006, in his book Predicting the Markets of Tomorrow, O’Shaughnessy set out the case for investing in small-caps with a strong blend of attractive value and strong price momentum.

He called this approach Tiny Titans, and it has been a notably strong tactic in recent years.

- Top of the markets: smaller companies continue to outperform

- Cheap UK shares at massive discount to US peers

The strategy looks for micro-caps that are cheap based on their price-to-sales (P/S) ratios (which have to be less than 1x). O’Shaughnessy argued the P/S was a harder ratio for management to manipulate than other valuation measures.

He then looked for the highest one-year relative price strength to find which of his basket of cheap stocks were breaking out.

O’Shaughnessy’s views on measuring value have changed in recent years, leading him to assess stocks against a range of valuation ratios, rather than relying on just one. But Tiny Titans remains a powerful approach nonetheless.

Stockopedia’s modelling of the strategy in the UK has found it to be a consistently strong performer - with an annualised return of 21% over the past eight years and 18.2% over the past year.

It’s worth remembering that while the performance is solid, this is not supposed to be a portfolio-building strategy because the stocks it picks up can be very volatile. But it can be a source of interesting ideas. Here are some of the stocks currently passing the rules:

Name | Mkt cap (£m) | Stock rank | Price to sales ratio | Relative price strength (1y) | Sector |

24.8 | 99 | 0.62 | +171.5 | Consumer Cyclicals | |

59 | 82 | 0.53 | +156 | Healthcare | |

26.2 | 99 | 0.73 | +131.8 | Basic Materials | |

35 | 52 | 0.35 | +130.6 | Utilities | |

30.7 | 36 | -9.26 | +87.7 | Financials | |

107.2 | 98 | 0.93 | +82.5 | Consumer Cyclicals | |

66.6 | 94 | 0.32 | +82.5 | Industrials | |

41.8 | 57 | 0.74 | +77.1 | Consumer Defensives | |

76.7 | 96 | 0.99 | +68.9 | Consumer Cyclicals | |

53.9 | 91 | 0.48 | +59.3 | Telecoms |

The stock rank in this table is an indication of the overall exposure of each share to a blend of quality, value and momentum measures (the higher the better).

- The shares a small-company star investor has been buying and selling

- Are you saving enough for retirement? Our calculator can help you find out

These micro-caps all appear potentially cheaply priced based on the P/S ratio but have seen strong momentum in their shares over the past year.

Notable names here include Tandem, the bicycle and sports equipment distributor; Totally, the healthcare services firm; Robinson, the packaging group and Yu, a gas and electricity supplier.

As always with smaller stocks, it’s essential to tread carefully and research them carefully. They can be unpredictable and prone to volatile moves. Plus, because the main measure of value is the P/S ratio, these sorts of firms may not have any earnings or broker forecasts.

This micro-cap value and momentum strategy has performed very well over the past year because it’s attuned to the prevailing bullish sentiment and popularity of potentially fast-growing companies. While this is one of the riskiest areas of the market to invest in, O’Shaughnessy’s research shows that it can be profitable for those who can navigate it successfully.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.