Stockwatch: an AIM share now going up through the gears

This share has doubled in value since analyst Edmond Jackson tipped it last year, and he believes this company transformed will remain highly rated by the market.

7th November 2025 11:59

by Edmond Jackson from interactive investor

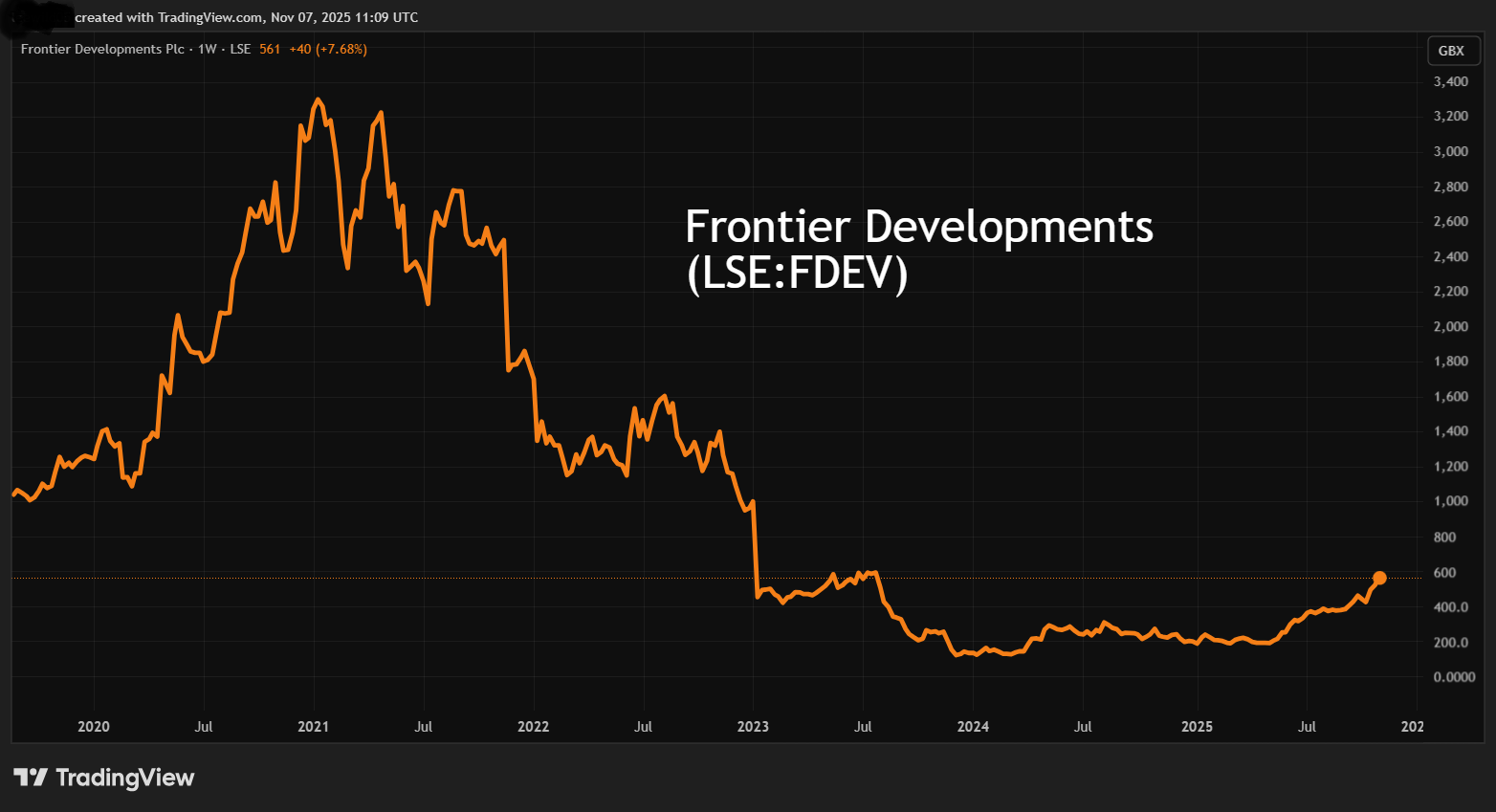

Does a bullish bowl-type chart in video games developer Frontier Developments (LSE:FDEV) indicate further upside, or are the shares getting frothy amid excitement over the latest launch of Jurassic World Evolution 3?

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

I engaged Frontier several times after a 96% plunge, its shares showing a classic boom/bust pattern around Covid, floating at 127p in mid-2013, peaking above 3,300p, then ceding it all.

In November 2023 at 147p, I wondered if a median performance level could exist for the business, somewhere between exceptional demand for games during Covid, and its aftermath. That the shares rose to 245p by September 2024 when I rated “buy” shows how video gaming can attract speculation given it may only take a few publishing successes to transform finances.

At this point, Viking Global Investors had accumulated a 5% stake and Frontier was heralding “the strongest-ever release of games to launch over three years”. The shares did, however, just bump along sideways until later May, below the market radar given all the volatility over US tariffs.

A trigger then came from a 28 May update citing near-flat annual revenue at around £90 million, albeit ahead of expectations. An 11 June full-year update then said three games alone – Planet Coaster, Planet Zoo and Jurassic World Evolution – had generated 77% of total revenue versus 62% previously, cash was up 44% to £42.5 million, and a £10 million buyback was under way.

It helped propel the shares, which continue to appeal to momentum buyers on the basis that a “bowl” implies roughly an 800p target after adjusting for their steep fall:

Source: TradingView. Past performance is not a guide to future performance.

Highly anticipated game release is music to investors’ ears

Presently valued at £208 million with the shares around 560p, there’s an aspect of leverage here, with Frontier revealing its £50-65 JWE 3 had sold more than 500,000 units within two weeks of its 21 October launch, generating higher revenue than its predecessor. There was also the tease of a sequel to Planet Zoo, its top-selling game that achieved 5.5 million sales and £145 million revenue by 31 October 2025, for release in the May 2027 year.

It does, however, show a risk of volatility when much depends on the reception of a few key games. Last September’s annual results also showed how cost variables were axiomatic to a rise in adjusted operating profit from £4.6 million to £13.2 million, the most significant being a £28.2 million reduction in amortisation and impairment charges to £19.7 million. Capitalised development costs also rose 7% to £28.3 million, or 58% of cash expenditure, the overall research and development expense down 53% to £32.0 million.

This makes it quite tricky to appreciate the real magnitude of profit change, especially in a context where consensus forecasts have shown a halving in net profit (blamed significantly on tax changes) to around £8 million in both the current year and 12 months to May 2027. Earnings per share (EPS) targeted in a low to mid-20p range gives a forward price/earnings (PE) ratio of around 25x. There is no dividend.

At least the annual cash flow statement backed a sense of profitability, with net inflow from operations up 31% to £41.5 million. “Cash is a fact” versus ambiguity of profit.

Frontier Developments - financial summary

Year end 31 May

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 21.4 | 37.4 | 34.2 | 89.7 | 76.1 | 90.7 | 114 | 105 | 89.3 | 90.6 |

| Operating margin (%) | 5.8 | 20.9 | 8.2 | 21.6 | 21.8 | 22.0 | 1.4 | -25.4 | -31.8 | 14.0 |

| Operating profit (£m) | 1.2 | 7.8 | 2.8 | 19.4 | 16.6 | 19.9 | 1.5 | -26.6 | -28.4 | 12.7 |

| Net profit (£m) | 1.4 | 7.7 | 3.6 | 18.0 | 15.9 | 21.6 | 9.6 | -20.9 | -21.5 | 16.4 |

| Reported EPS (p) | 4.1 | 22.4 | 9.1 | 44.7 | 39.4 | 53.3 | 23.7 | -53.6 | -55.6 | 40.7 |

| Normalised EPS (p) | 4.1 | 22.4 | 9.1 | 44.7 | 39.4 | 53.3 | 35.6 | -23.4 | -24.7 | 40.7 |

| Return on total capital (%) | 5.1 | 23.5 | 5.0 | 25.6 | 13.0 | 13.9 | 1.1 | -22.4 | -28.4 | 10.9 |

| Operating cashflow/share (p) | -3.6 | 13.5 | 25.9 | 81.5 | 80.4 | 96.3 | 101 | 123 | 81.9 | 103 |

| Capex/share (p) | 1.0 | 2.3 | 46.0 | 42.9 | 53.8 | 81.2 | 95.4 | 111 | 78.7 | 76.3 |

| Free cashflow/share (p) | -4.6 | 11.2 | -20.1 | 38.6 | 26.6 | 15.1 | 5.6 | 12.0 | 3.2 | 26.8 |

| Cash (£m) | 8.6 | 12.6 | 24.1 | 35.3 | 45.8 | 42.4 | 38.7 | 28.3 | 29.5 | 42.5 |

| Net debt (£m) | -8.6 | -12.6 | -24.1 | -35.3 | -22.2 | -20.3 | -18.0 | -9.0 | -8.2 | -23.0 |

| Net assets (£m) | 22.8 | 31.3 | 55.3 | 74.2 | 96.7 | 113 | 118 | 96.0 | 76.8 | 95.2 |

| Net assets/share (p) | 66.8 | 91.4 | 143 | 192 | 249 | 288 | 300 | 243 | 195 | 241 |

Source: historic company REFS and company accounts.

Affirming a strategic re-set after losses of 2023-24

Bulls appear captivated by a sense that Frontier’s best years now lie ahead and this share is likely to sustain a big valuation – around 25x recently projected earnings but which could get stretched like popular tech shares can be.

A couple of truly blockbuster games could see EPS back in the region of 50p, bringing the PE down to 16x at 800p a share. Obviously, that might not last, and momentum traders sell once growth in games revenue slows; but if Frontier’s team have their formula broadly right for the times, the next two years could go very well.

It still makes the crux issue for judging this share – games appeal – tricky to decipher for non-gamers. The notion of spending time glued to a screen, running my own dinosaur park, makes my eyes glaze over. It was easy to feel similar, though, towards miniature war-games sold by Games Workshop Group (LSE:GAW), whose shares halved after Covid but have since been in a bull market and, at around 15,600p, trade on a forward PE above 28x.

As a similar “cult” share, GAW exhibits a more consistent earnings growth record than Frontier, although a fall expected this financial year (likewise to May 2026) means that like Frontier it does not qualify for the PE-to-growth (PEG) ratio.

Source: TradingView. Past performance is not a guide to future performance.

In an all-time context, GAW has also shown a long-term bull market rather than the extent of collapse and ‘bowl’ chart pattern we see in the likes of Frontier, reflecting how GAW’s earnings are relatively more consistent than a video games publisher.

My experience of following games publishers quite lightly was influenced by Eidos in the mid-1990s, which boomed and slumped. Short sellers argued for zero value, but they got their fingers burned both with its recovery and takeover by Square Enix in 2009. While these are “people businesses” where talent is key and can move on, I recognise a case for keeping Frontier salted away in an ISA or SIPP. On a five to 10-year view, it could go the same way as Eidos.

Meanwhile, employee reviews of working at the Cambridge-based company are somewhat mixed – problems dealing with management being a concern – although the worst seemed a few years ago before a re-set.

- Stockwatch: how much notice should we take of Warren Buffett?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

A fundamental aspect has involved resuming creative management simulation (CMS) games, where the player is pro-actively building and managing, say, a theme park environment, which is potentially addictive.

Buy the elusive drop

Understandably, yesterday’s announcement and an anticipatory share price rise reflects how Frontier is going up the gears – for what counts as a successful video games publisher. Its numbers now become a more serious watch.

Given that JWE 3 is something of a verdict on the re-set, the current goodwill sentiment looks likely to persist, and with the chart affirming a (somewhat rugged) bowl pattern that investors crave. With AI seemingly grossly overvalued and cyclical-type shares still at risk from stagflation, a story like this – with its own legs – has focused appeal.

Will the price come back though? It did modestly from yesterday’s high over 580p, but that also coincided with weakness in US tech shares spilling over to the wider market here. On Friday morning it holds at around 560p despite a near 2% drop in the Nasdaq index. If markets are entering a more general re-trace, however, and as this positive surprise-of-the-month wears off, volatility to the downside is possible. Yet continued bumper revenue for JWE 3 could be reported.

On a medium- to longer-term view, I therefore retain a “buy” stance on the basis that JWE 3 signals a creative company transformed, one which the market seems likely to rate highly until the inevitable games publisher setback – which could be years away though.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.