Stockwatch: onwards and upwards for this company

Already a very successful tip for analyst Edmond Jackson, he thinks the business has ‘encouraging commercial momentum’, which will be reflected in the share price.

27th January 2026 11:25

by Edmond Jackson from interactive investor

It is an unusual trait for a small-cap contractor, yet Costain Group (LSE:COST) is rewarding investors with an insight into how it has commercial momentum.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

This has led to the forward price/earnings (PE) ratio improving from single figures to over 11x, helped by a steadily improving operating margin, and an update yesterday benefited dividend prospects. An agreement has been struck with pension fund trustees to near-permanently suspend “dividend parity” (of pension contributions) enabling improvement in the payout from a scant 2% or so currently.

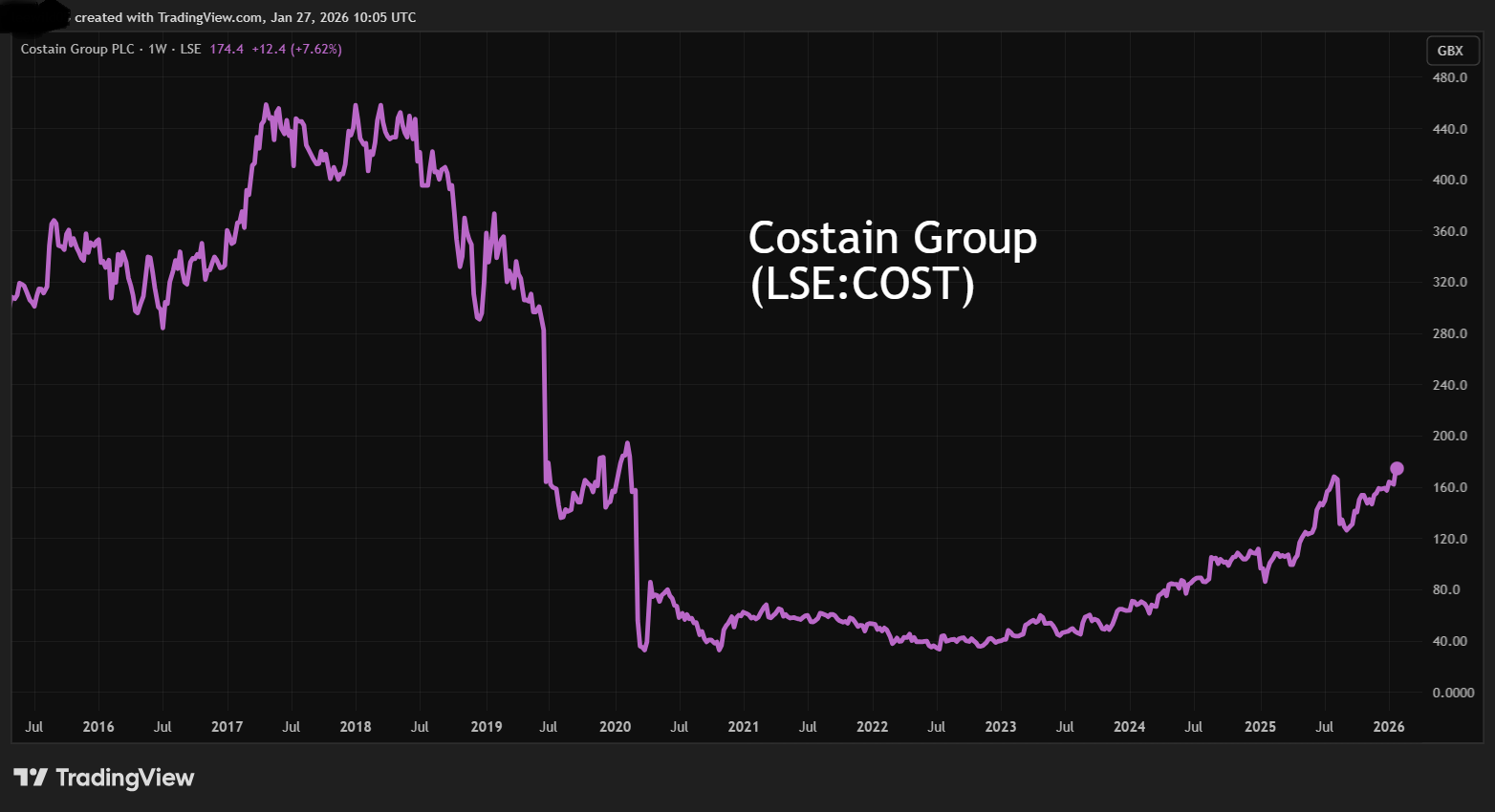

A 7% rise in the shares to 174p means the long-term chart now has quite a “bowl” feature, potentially attracting momentum buyers after a 2018-20 collapse from over 400p to below 40p:

Source: TradingView. Past performance is not a guide to future performance.

While the 2025 full-year update did not raise guidance for adjusted operating profit of £46.4 million, substantive contracts are involved, such as utilities services at Sellafield and controls services with EDF Energy, and decommissioning a nuclear power station in Wales. Costain is also being swapped in for Morgan Sindall on the £800 million Eastern Highways Alliance framework (with three other contractors involved on the most lucrative section).

Yesterday’s update did not quantify the order book or backlog (work in progress) but concluded: “Given the strong market environment, substantial contract wins, the continued expansion of existing framework contracts and high levels of bidding activity, the group remains confident of further progress in 2026 and a step change in performance in 2027 and beyond.”

It is radically different from a 2018-21 crisis period when projects such as a gas compressor for National Grid and an A465 road construction job for the Welsh government resulted in £95 million exceptional charges in 2020, and £100 million raised at 60p per share (with dilution implying scant chance of a return to highs above 400p).

- Shares for the future: upgrade makes this stock compelling

- Investment outlook: expert opinion, analysis and ideas

The financial summary table shows lowest year-end cash as £124 million in 2022, and the update cites £191 million net cash (Costain has no debt only around £23 million leases) ahead of consensus for £171 million. But I would mind how a business like this may be contractually obliged to have a substantive cash buffer (or simply to be competitive when tendering) to cover eventualities.

Do not therefore assume that together with a now well-funded pension scheme, the bulk of this cash can be returned to shareholders, despite guidance for £20 million to be returned via buybacks (4% of market cap) in 2026.

Costain Group - financial summary

year end 31 Dec

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 1,684 | 1,464 | 1,156 | 978 | 1,135 | 1,421 | 1,332 | 1,251 |

| Operating margin (%) | 2.8 | 3.0 | -0.3 | -9.4 | -0.8 | 2.5 | 2.0 | 2.5 |

| Operating profit (£m) | 47.5 | 43.4 | -2.9 | -91.8 | -9.5 | 34.9 | 26.8 | 31.1 |

| Net profit (£m) | 33 | 33 | -2.9 | -78.0 | -5.8 | 25.9 | 22.1 | 30.6 |

| Reported EPS (p) | 27.1 | 26.8 | -2.4 | -36.7 | -2.1 | 9.4 | 7.8 | 11.1 |

| Normalised EPS (p) | 27.1 | 35.2 | 16.1 | -31.2 | -2.1 | 9.8 | 8.5 | 11.1 |

| Operating cashflow/share (p) | 42.8 | -39.2 | -26.5 | -22.1 | 10.7 | 5.1 | 19.7 | 15.5 |

| Capex/share (p) | 1.7 | 1.1 | 5.7 | 1.9 | 0.8 | 0.2 | 0.0 | 3.3 |

| Free cashflow/share (p) | 41.1 | -40.3 | -32.2 | -24.0 | 9.9 | 4.9 | 19.7 | 12.2 |

| Ordinary dividend per share (p) | 12.4 | 13.4 | 3.4 | 0.0 | 0.0 | 0.0 | 1.2 | 2.4 |

| Covered by earnings (x) | 2.2 | 2.0 | -0.7 | 0.0 | 0.0 | 0.0 | 6.5 | 4.6 |

| Return on total capital (%) | 19.8 | 17.5 | -1.3 | -41.1 | -3.8 | 14.9 | 11.4 | 12.4 |

| Cash (£m) | 249 | 189 | 181 | 151 | 159 | 124 | 164 | 159 |

| Net debt (£m) | -178 | -119 | -34.9 | -70.8 | -93.2 | -94.3 | -140 | -133 |

| Net assets/share (p) | 129 | 151 | 129 | 56.9 | 72.4 | 76.8 | 79.3 | 87.7 |

Source: historic company REFS and company accounts.

How far can the valuation multiple improve?

A year ago, I rated Costain a “buy” at 96p on an apparent forward PE of 7x and buybacks manifesting. I liked the industry context of a Labour government more inclined – at least less likely to compromise – on infrastructure projects as a means to economic growth. What left-wing economists used to term “public works” nowadays must involve the private sector. Costain is also well-positioned serving water industry upgrades.

But in line with my caution about how a strong cash balance is vital for competitiveness, I am sceptical of stripping out, say, £100 million of this to derive a “normalised” PE still in single figures than around 11x, according to consensus for 2026. It is possible to argue that such a cash buffer should certainly be taken into account for return on capital employed, which anyway looks to have improved to a respectable 13%.

The share’s rally strengthened from mid-year after an update conveyed a sense of onwards and upwards and as the government published its 10-year infrastructure strategy with a £725 billion programme across transport, energy, housing and public services.

- Where to invest in Q1 2026? Four experts have their say

- Insider: directors invest £850k in AIM fintech firm

Thus, last August at 131p I retained my “buy” stance in due respect of Costain’s underlying commercial momentum, despite its shares having dropped in reaction to interim results showing HS2 rail revenue delayed. Perhaps this was a useful reminder how infrastructure contractors are never free of such risk even though good management can mitigate it.

On the positive side, it also showed how important it is to judge the overall direction of travel rather than dismiss contractors as uninvestable due to low margins and project risk. The challenge seems to be to exploit low PE’s that inevitably arise but not get greedy and assume that a mid-teen multiple is sustainable over the long term.

Last October’s Sellafield contract has aided the rerating

Costain was selected as Sellafield’s utilities delivery partner with a contract value up to £1 billion based on an initial nine years with an option to extend by a further six years.

Mind you, it is tricky to discern what operating margin is achievable despite the first half of 2025 showing an improvement to 3.1% on a reported basis, versus 2.5% previously (see table above). This latest update cites an adjusted operating margin exceeding 4.5% during 2025, aiding expectations of an end of year cash beat.

Costain has anyway been working with Sellafield since 2005, the total revenue value of the partnership being worth “up to £2.9 billion”, hence this £1 billion element is an expansion of work rather than a new relationship.

Its financial upshot looks to be an annual revenue boost of around £110 million and operating profit of £3.4 million over each of nine years. It implies an 11% improvement on 2024 operating profit, hence it is difficult to reckon to what extent a 23% uplift in consensus 2025 net profit relates to Sellafield. The market curiously only (so far) expects a 6% increase in net profit during 2026 when expansion of Sellafield work should kick in.

Yet on 10 December a non-executive director since April 2022 bought nearly £10,000 worth of shares at 157p, as if confident in the direction of travel.

Will this result in a material dividend yield?

The update cited a near-doubling in the dividend this year based on policy for 3.0x earnings cover. Consensus expects a 43% hike in the 2025 dividend to 3.4p then only a 22% advance to 4.2p in 2026, as if the balance of forecasts has yet to reflect guidance.

A notional 6p per share payout would accord to 2.5x cover on the consensus for 2026 normalised earnings per share (EPS) of 15.0p, but would still only be a 3.5% yield based on a 174p share price.

- 10 hottest ISA shares, funds and trusts

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

So, while the dividend and buyback news are a welcome indicator of Costain’s improving financial health, earning power is likely to remain key to perception of value.

The financial summary table also shows a volatile record on cash flow per share (what truly matters for dividends) despite recovering from 2018-20 woes, but is mostly well ahead of EPS.

Harder now to define a margin of safety

When I rated the shares a “buy” a year ago, they were trading around net asset value, with last June’s balance sheet showing 20% intangibles. At 174p, the price looks nearly twice net assets, not that it is a key benchmark, but you have to assume Costain is past having any major disruption to earnings.

A conservative investor would therefore adjust their stance at this point to “hold”.

Yet, all-considered, Costain has encouraging commercial momentum – able to withstand UK political instability, say if Labour loses Manchester’s by-election this spring – and its finances should continue to improve. Such trends look to have multi-year potential, and with the caveat to beware project disruption, I retain “buy”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.