Shares for the future: upgrade makes this stock compelling

A higher score bumps this company three places up analyst Richard Beddard’s list to fourth spot. Here’s why he likes the business so much.

23rd January 2026 15:00

by Richard Beddard from interactive investor

This year I have put doubts about the chasm between executive pay and centre staff aside, and raised Hollywood Bowl Group (LSE:BOWL)’s score. It’s still early days for the tenpin bowling centre operator, but its expansion in Canada is promising.

Hollywood Bowl runs the UK’s and Canada’s biggest bowling centre chains, the eponymous Hollywood Bowl and Splitsville in Canada.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

A bowling centre is an entertainment hub built around a bowling alley. Bowling brings in only about 45% of revenue at Hollywood Bowl centres. Most of the remainder is roughly equally split between food and drink, and amusements.

The company also earns a modest income from the supply and installation of bowling equipment in Canada and indoor mini-golf at some of its UK locations.

Mini-golf was introduced as a standalone concept just before the pandemic, but it was not as profitable as the company hoped. Much of the investment has been written off, and the company has refocused on bowling.

Despite this misadventure, the company has thrived, earning 14% average return on capital over the last nine years and achieving 82% cash conversion despite two pandemic years when it could not operate efficiently.

This performance has been achieved by locating centres in prime locations adjacent to cinemas and eateries and keeping costs low, allowing a family of four to bowl for less than £26 even at peak times.

Efficiencies come in many forms. The company describes itself as an anchor tenant, preferred by landlords in retail and leisure parks because of its strong track record. Tenpin bowling centres tend not to locate close to rivals, so Hollywood Bowl is often the automatic choice for customers.

It has attracted more customers by focusing on family entertainment rather than the strict preferences of sporting bowlers. Customers can wear their own shoes, for example, and the pins are set by low-maintenance and reliable “pins on strings” machines.

- Stockwatch: a secure choice for income plus option for growth

- Why I’m happy to buy shares at record highs

Centre staff are youthful and consequently low-wage. Pricing is dynamic, like the airlines, and screens marketing food and drink change to match the customer profile (families during the day, adults in the evening).

Investment splurge

Revenue increased 9% in the year to September 2025 because the company opened seven new centres, a big acceleration, and eked out a little more income from existing ones.

Fewer people bowled due to unseasonably good weather in the spring and because money was a bit tighter, but bowlers spent considerably more per game. Spending on amusements was particularly strong due to new cashless “tap and pay” machines.

Annual profit declined 9%, though. The company explains that increases in the National Minimum and Living Wage and employer National Insurance Contributions contributed most to the cost increases.

It has also delivered a surge in investment, catching up with maintenance and refurbishment delayed over the pandemic, and establishing itself in Canada following the acquisition of its first centres there in 2022. This has temporarily depressed cash flow, as well as profit.

Well-oiled operations

Stephen Burns, chief executive since 2014, has nurtured Hollywood Bowl’s well-oiled operations. The failed mini-golf experiment, the growth of the bowling centre estate, and the Canadian acquisition and expansion have all been self-funded.

The company’s experienced chief financial officer steps down in February to take a non-board role as chief executive of the Canadian Business. Although this is being presented as a good career move, it probably also recognises the importance of Canada to Hollywood Bowl’s ambitions.

- Investment outlook: expert opinion, analysis and ideas

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The map of UK Hollywood Bowl locations looks quite full, but the company reckons it will be operating 18 more UK centres by 2035, taking the total to 95. This implies a slowdown to about two additional centres a year. In 2025, it opened five and closed none.

Canada must take up the slack. There, it had 15 centres at the end of 2025, up from five centres acquired in 2022, and Hollywood Bowl plans 20 more by 2045, taking the total to 35.

Rapid growth in Canada is encouraging but the more youthful Splitsville Chain is not as profitable as the UK operation.

Of profit...

Although Canada is huge, most of the population is concentrated in a few regions, and Hollywood Bowl says there are similarities with the UK a decade or so ago. Bad weather keeps people indoors sometimes, Canada has no large tenpin bowling chains, and most of the independents are set up for sport rather than entertainment.

The Canadian business contributed 11% of Hollywood Bowl’s EBITDA (profit before interest, tax, depreciation and amortisation), from 15% of total revenue. The Canadian profit margin is lower than the UK’s because it is a more youthful business, and it is different in some respects.

The Canadian business also owns Striker, which is a bowling equipment supplier and installer. This is a lower margin business, but useful while Hollywood Bowl is spending so much on refurbishment and new centres there. At the Splitsville bowling centres, Canadians spend more on food, which is the most labour-intensive element of the business. Food earns lower margins too.

- Investment outlook: expert opinion, analysis and ideas

- Where to invest in Q1 2026? Four experts have their say

But Hollywood Bowl is also expanding from a smaller base in Canada, so the proportion of centres in their first year of operation is higher. Proportionally more money is being spent on refurbishment, kitting out new stores, and establishing a corporate function there.

Hollywood Bowl expects the EBITDA margin gap to narrow now that it has exported many of the operational and management innovations that delivered high profitability in the UK.

Canada also brings novel opportunities, principally because there is so much space. Hollywood Bowl acquired “Stoked” a multi-activity centre in 2024. In addition to bowling and arcades, it offers go-karting, a high rope course, and zip-line. The company is planning to use learnings from operating Stoked to open another multi-activity centre.

Hollywood Bowl has increased the number of centres it operates by 70% since it floated in 2016, while earning more from each centre. Over the next 10 years, the strategy anticipates just under 50% more centres. Particularly if the Canadian centres remain less profitable than the UK, profit may not grow as quickly. That is, if Hollywood Bowl does not pull another rabbit out of its hat, Canada-style.

And people

Although I have difficulty reconciling the company’s low wage bill with executive pay, the chief executive earned 74x median pay in 2025, Hollywood Bowl explains that it is a gateway employer. Many of its centre employees are in their first jobs, some will go on to earn higher salaries at Hollywood Bowl.

In 2025, a record 61% of UK management appointments were internal promotions, graduates of the company’s management training schemes. The opportunity for a career, it says, explains why it has “relatively low” employee turnover rates than similar businesses.

Although Hollywood Bowl does not disclose the employee turnover rate, customer satisfaction scores indicate team members on the alley floor are doing a good job too. Hollywood Bowl’s UK Customer Net Promoter Score in 2025 was 71, which is high in comparison to other companies and Hollywood Bowl’s history of positive scores.

An employee at the 75th percentile (25% of employees earn more than they do, 75% less) earns considerably more than the median, showing attractive pay is more widely distributed than the board, unlike at some other retail and hospitality businesses.

The loss of centre managers is considered a principal risk. In 2025, they received 21% of their base pay in bonuses and I expect they are remunerated well.

Scoring Hollywood Bowl:

I think Hollywood Bowl is a concoction of under-appreciated capabilities. From technology to relationships with staff and landlords, individually they might not stand out, but together they are quite compelling.

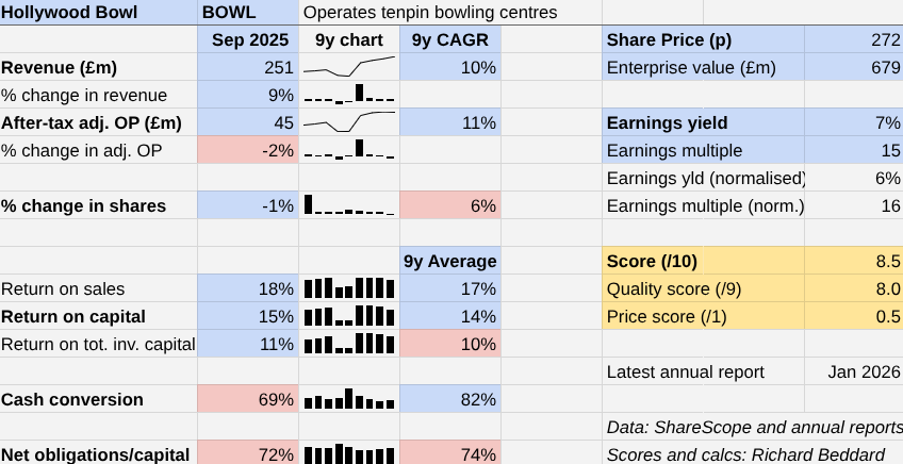

Hollywood Bowl | BOWL | Operates tenpin bowling centres | 22/01/2026 | 8.5/10 |

How capably has Hollywood Bowl made money? | 3.0 | |||

Under consistent management Hollywood Bowl has grown revenue and profit at low double digit CAGRs over the last nine years, by rolling out its family friendly format in prime locations in retail and leisure parks. It is low-cost entertainment that generates high returns on capital and cash flows. | ||||

How big are the risks? | 2.0 | |||

The company has substantial lease obligations, but these only proved troublesome in the pandemic when landlords shared the burden. To augment UK growth, Hollywood Bowl diversified into crazy golf, which felt short. Early signs from Canada are promising, but growth in the next decade may slow. | ||||

How fair and coherent is its strategy? | 3.0 | |||

Refurbishments ensure centres are up to date. Canada brings growth outside the UK, profitability should improve as UK practices take hold and the estate grows and matures. A strong focus on training, development and promotion has resulted in a customer focused culture. CEO pay is high relative to median pay. | ||||

How low (high) is the share price compared to normalised profit? | 0.5 | |||

Low. A share price of 272p values the enterprise at £679 million, about 16 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.9 | 9.8% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.5 | 7.1% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Hollywood Bowl | Operates tenpin bowling centres | 8.5 | 8.0 | 0.5 | 7.0% |

5 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.6 | 6.3% | |

6 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.5 | 6.1% | |

7 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 6.0% | |

8 | Renew | Maintains and improves road, rail, water, and energy infrastructure | 7.5 | 0.5 | 5.9% | |

9 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | |

10 | Auto Trader | Online marketplace for motor vehicles | 7.0 | 0.5 | 5.1% | |

11 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

12 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 0.9 | 4.8% | |

13 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.2 | 4.7% | |

14 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.1 | 4.2% | |

15 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.5 | 4.0% | |

16 | Volution | Manufacturer of ventilation products | 8.5 | -1.5 | 4.0% | |

17 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

18 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

19 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -1.0 | 4.0% | |

20 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.9 | 3.8% | |

21 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.7 | 3.6% | |

22 | Judges Scientific | Manufactures scientific instruments | 7.0 | -0.2 | 3.6% | |

23 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.2 | 3.5% | |

24 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.3 | 3.4% | |

25 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.8 | 3.3% | |

26 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -2.2 | 2.7% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.9 | 2.5% | |

28 | Tristel | Manufactures hospital disinfectant | 8.0 | -2.1 | 2.5% | |

29 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.8 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -2.2 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Hollywood Bowl and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine and Share Sleuth, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.