Tech’s riding the AI boom, but these stocks have fallen on their SaaS

The big software-as-a-service names are having their worst January in years. So, Russell Burns decided to comb the industry for opportunities.

23rd January 2026 09:15

by Russell Burns from Finimize

- AI has been dividing tech into winners and losers. And that’s pushed memory companies toward the front of the pack and software-as-a-service names to the rear

- The SaaS industry has historically delivered chunky returns on investment and justified its sweeter valuations with strong recurring revenue, high margins, and sticky customers. But now AI is disrupting the whole business model

- A sell-off has brought valuations down, but they could have further to fall.

The AI boom hasn’t been good for everyone – not even in tech. Sure, the market’s rally has been rewarding the companies that help make it run, but it’s been broadly punishing others.

And if you look at two tech subgroups, you can see the divide really clearly. Memory makers Micron Technology Inc (NASDAQ:MU), Samsung Electronics Co Ltd DR (LSE:SMSN), SK Hynix, and Western Digital Corp (NASDAQ:WDC) have been flying, as demand for high-bandwidth chips and dynamic random access memory (DRAM) fuels order growth.

But it’s been a very different story for the market’s software-as-a-service (SaaS) names. Stocks like Salesforce Inc (NYSE:CRM), Adobe Inc (NASDAQ:ADBE), SAP SE (XETRA:SAP), Workday Inc Class A (NASDAQ:WDAY), Docusign Inc (NASDAQ:DOCU), and ServiceNow Inc (NYSE:NOW) are having their worst January in years, as investors question whether their business models can hold up in an AI world.

Last week, I wrote about some of the key memory chip players. So this week, I decided to see if I could turn up any opportunities in SaaS.

What’s gone wrong for the software subscription crowd?

Your typical SaaS business model looks like this:

- Strong recurring revenue that makes future cash flows predictable

- Wider gross margins (often 70% to 80% for mature SaaS firms) that turn most of the revenues into pure profit

- Strong customer retention and growth, giving it sticky products and pricing power.

Together, those features usually justify high valuations and give you attractive returns on investment.

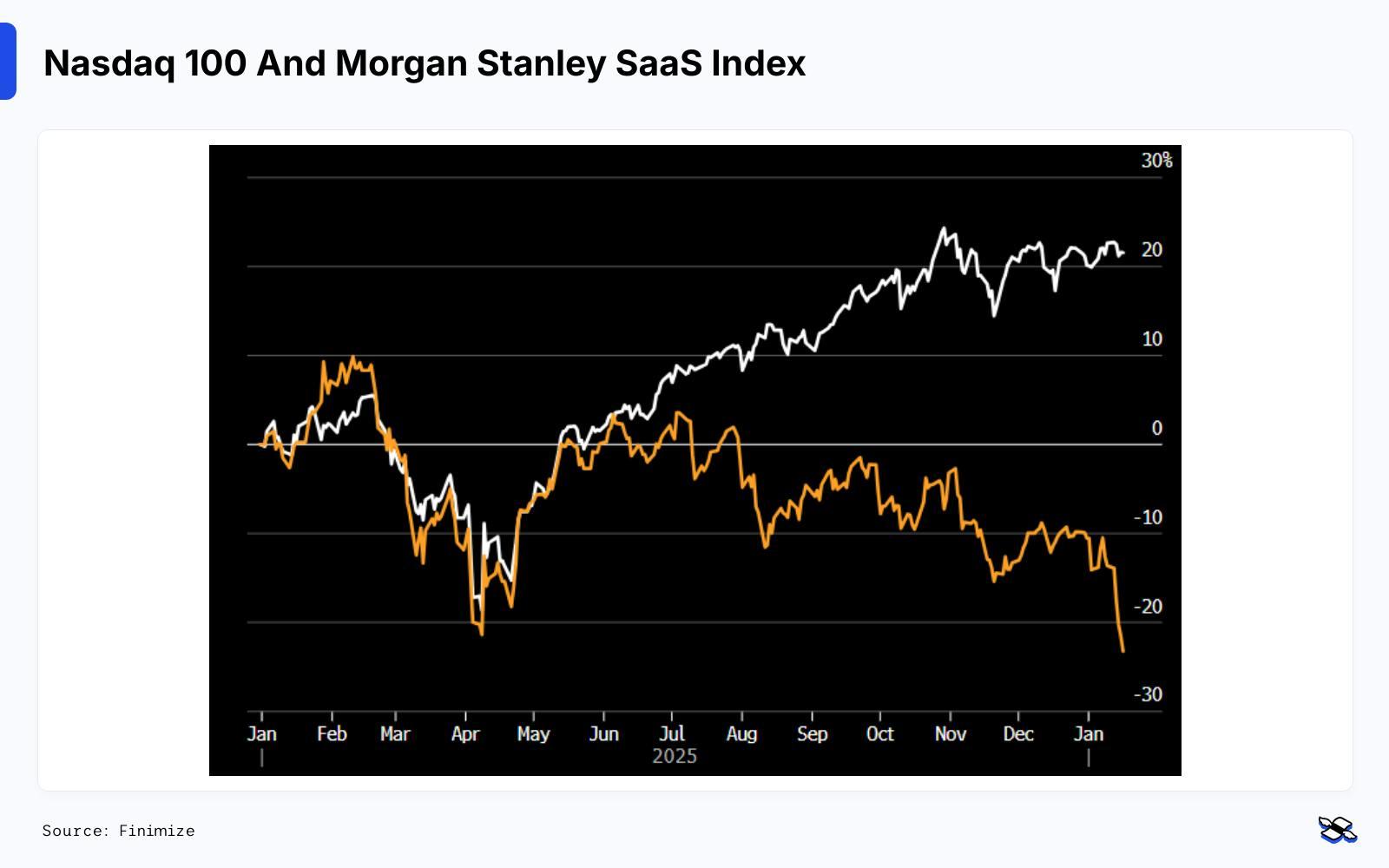

At the start of last year, the consensus view was that SAAS companies would roll out their own AI features and accelerate growth. But that hasn’t really played out the way folks had hoped. Adoption has been slow, results have been a letdown, and growth rates have been slow. Investors started to realize that AI could actually undermine these companies’ high-growth premium and headed for the exits.

The stock performance of the Nasdaq 100 (white) and Morgan Stanley’s software-as-a-service index (orange). Source: Bloomberg. Past performance is not a guide to future performance.

No one expected AI to stand still, and its capabilities are advancing rapidly. Just last week, it gave SaaS firms a fresh jolt. Anthropic released a new AI tool, framed as a “research preview” that can turn screenshots into spreadsheets or produce draft reports from scattered notes. The market reaction was swift: double-digit declines for Salesforce, Adobe, and TurboTax owner Intuit Inc (NASDAQ:INTU).

For AI models to justify the massive sums being invested, revenues will have to come from somewhere – and one of the most obvious sources is SaaS’s customers.

So, what’s the opportunity here?

This turmoil underlines a core risk in tech investing: rapid innovation can erode competitive advantages that once seemed impenetrable. That’s why it can sometimes pay to take a diversified approach – through specialist tech funds, broader exchange-traded funds (ETFs), or even the Finimize portfolio.

As an analyst team, we’ve spotted several AI winners early – namely, NVIDIA Corp (NASDAQ:NVDA), Nebius Group NV Shs Class-A- (NASDAQ:NBIS), and Softbank, plus certain nuclear firms, AI infrastructure plays, and Chinese upstarts. And we’ve body-swerved SaaS companies.

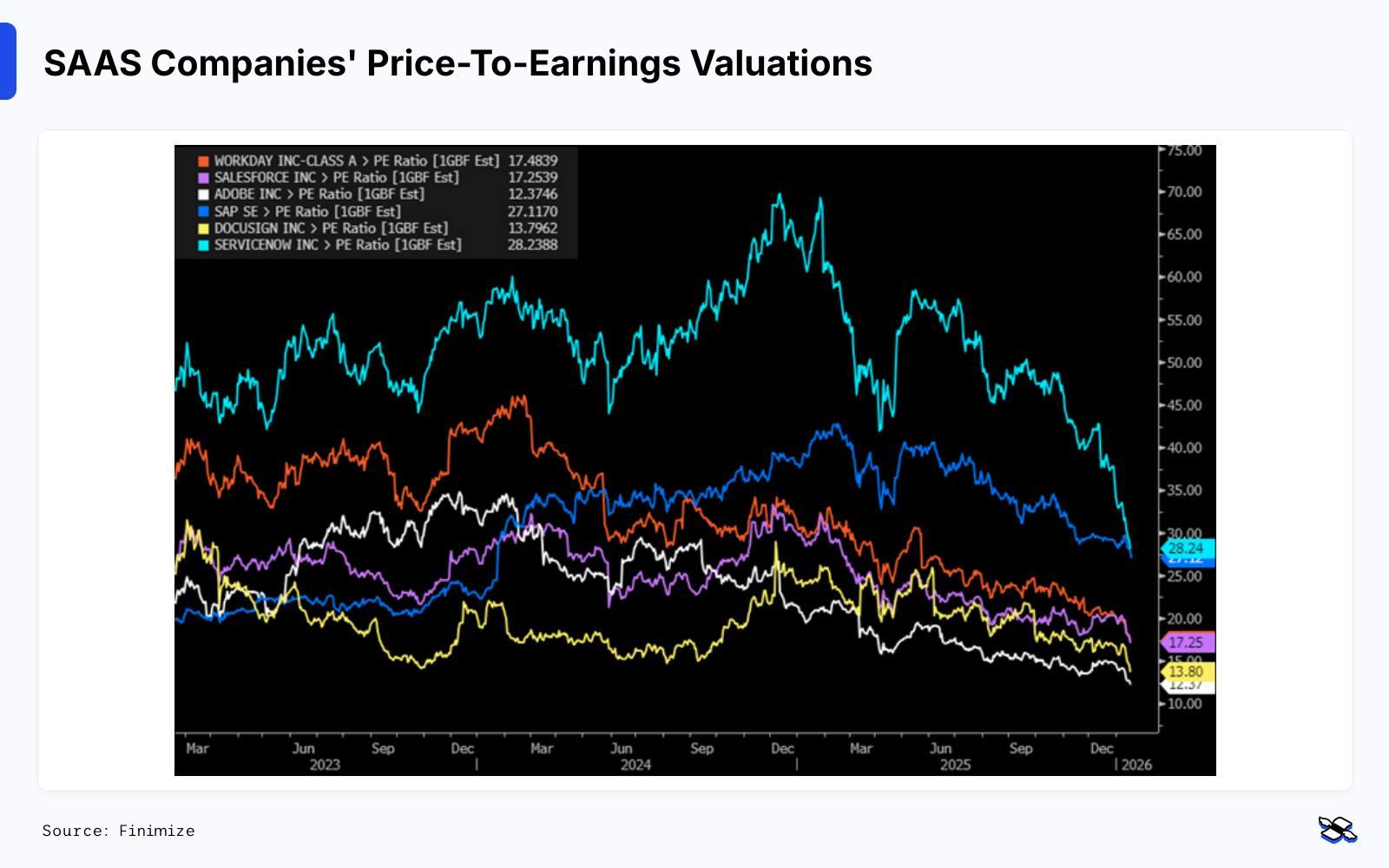

That said, the reset in valuations has created potential opportunities. Buying quality companies on the cheap can be a successful investing strategy. Valuation multiples have already shrunk as lower growth estimates got priced in.

The 12-month forward price-to-earnings valuations of a few key SaaS companies: Workday (red), Salesforce (purple), Adobe (white), SAP (blue), DocuSign (yellow), ServiceNow (light blue). Source: Bloomberg. Past performance is not a guide to future performance.

Investors do tend to overreact to news. And with algorithmic decision-making playing a bigger role in the market, stock prices can swing too far in either direction as sentiment changes. The key question now is whether people have now priced in too much pessimism – or not enough.

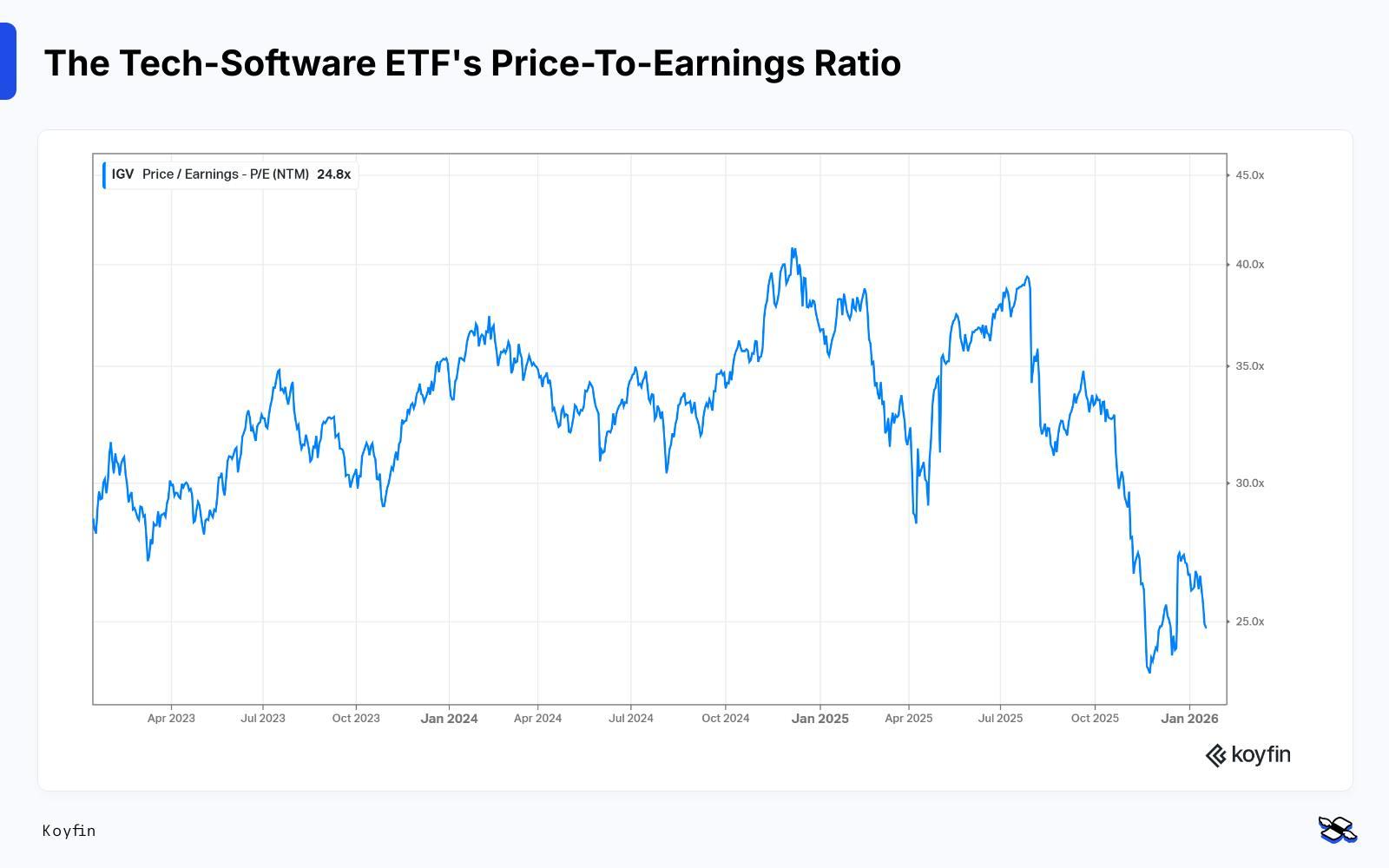

There’s no pure SaaS ETF, but a US listed one comes close. Its heavy weightings in Microsoft Corp (NASDAQ:MSFT), Palantir Technologies Inc Ordinary Shares - Class A (NASDAQ:PLTR), Oracle Corp (NYSE:ORCL), and AppLovin Corp Ordinary Shares - Class A (NASDAQ:APP) make it an imperfect proxy, but the overlap has still dragged the fund down about 20% since October. Its valuation has fallen, in turn, to a three-year low, at 29x earnings.

The iShares Expanded Tech-Software Sector ETF’s price-to-earnings ratio, based on 12 months forward earnings. Source: Koyfin.

It’s also worth remembering that SaaS firms don’t all move as one. Each company has its own business model, competitive advantages, AI strategies, products, and positioning. Many cater to blue-chip clients who are unlikely to move sensitive workflows to generic AI tools – the potential regulatory risk and the friction of replacing long-embedded software are too great. These companies earned their SaaS status for a reason. That’s why companies like SAP and Workday may prove more resilient than Adobe, where regulatory barriers around images and videos are likely lower than those protecting sensitive data.

All of that makes SaaS better suited to selective stock picking than blanket exposure. It also makes it a strong candidate for a deeper Finimize research drop.

Russell Burns is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.