Autumn Budget 2025: UK stock market reaction

A version of the Budget leaked just before the chancellor stood up caused a brief moment of panic, but stocks have responded strongly to Reeves’ second Budget. Lee Wild runs through the big winners.

26th November 2025 15:04

by Lee Wild from interactive investor

It’s almost three months since Chancellor Rachel Reeves confirmed she would announce her second Budget on 26 November. But in a bizarre turn of events, the Office for Budget Responsibility (OBR) mistakenly published its growth forecast and key details of this fiscal event more than half-an-hour early.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Having suddenly risen 23 points to 9,651, the FTSE 100 turned tail at 11:48, dropping like a stone to 9,593 by the time the chancellor stood up at 12:35. However, the market clearly liked what Reeves had to say. When she sat down at 13:39, the FTSE 100 was trading at 9,670, its highest since early last week. By mid-afternoon, it had edged up further to 9,695.

Source: TradingView. Past performance is not a guide to future performance.

There were big gains for most gambling stocks. Entain (LSE:ENT) led the way, with the Ladbrokes owner rallying over 12% from its pre-Budget low at 700p. No change to betting taxes on horseracing was welcome news. But Gala Bingo firm Rank Group (The) (LSE:RNK) was the biggest winner in the sector, surging 22% from its intraday low of 101p to a post-Budget peak of 123.60p. Investors are clearly excited by the abolition of bingo duty from its current 10% rate from April next year.

But there was bad news for Evoke (LSE:EVOK), which slumped following an increase in remote gaming duty from 21% to 40%. Extra taxes paid by companies including the owner of William Hill, 888 and Mr Green brands is estimated to raise £1.1 billion by 2029-30.

Speculation about changes to the ISA allowance proved accurate, with a £12,000 limit on the cash element triggering a rush of share buying in the financial sector. From April 2027, anyone making use of their full annual ISA allowance of £20,000 must invest £8,000 in the stock market. Over 65s keep the full cash allowance.

Investors decided this was good news for ISA providers like Aberdeen Group (LSE:ABDN), AJ Bell (LSE:AJB) and St James's Place (LSE:STJ).

Housebuilders, which had slumped by as much as 4% halfway through the chancellor’s speech, staged a partial recovery. Taylor Wimpey (LSE:TW.), Persimmon (LSE:PSN), Berkeley Group Holdings (The) (LSE:BKG) and Vistry Group (LSE:VTY) were among those recouping a chunk of their early losses.

There was no news on abolishing stamp duty on properties under £500,000, and OBR forecasts for household disposable income and inflation are unhelpful. However, and despite a small downgrade, the OBR still expects an increase in property transactions from less than 1.1 million in 2024 to around 1.3 million in 2029.

- Cash ISA limit cut to £12,000 in bid to boost UK stock market

- Sector Screener: two FTSE 100 property stocks with upside potential

Banks were among beneficiaries of the chancellor’s decision not to increase taxes on the sector. Rumours had focused on a possible rise in the current 3% tax surcharge on bank profits over £100 million. Removing this overhang let lenders like Lloyds Banking Group (LSE:LLOY), Barclays (LSE:BARC) and NatWest Group (LSE:NWG) move sharply higher.

Buyers also placed orders for shares in pub owners like Mitchells & Butlers (LSE:MAB) and Wetherspoon (J D) (LSE:JDW). Put under enormous pressure by increases in the minimum wage, National Insurance employer contributions and rising costs elsewhere, the chancellor made no mention of alcohol duty in her speech today.

However, despite a relief rally, the OBR’s forecasts included an estimate that while alcohol duty receipts will decline by 5.1% to £12 billion in 2025-26, they will rise by an average 3.4% each year to reach £14 billion by 2030-31.

- Uranium: industry dynamics investors should know

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

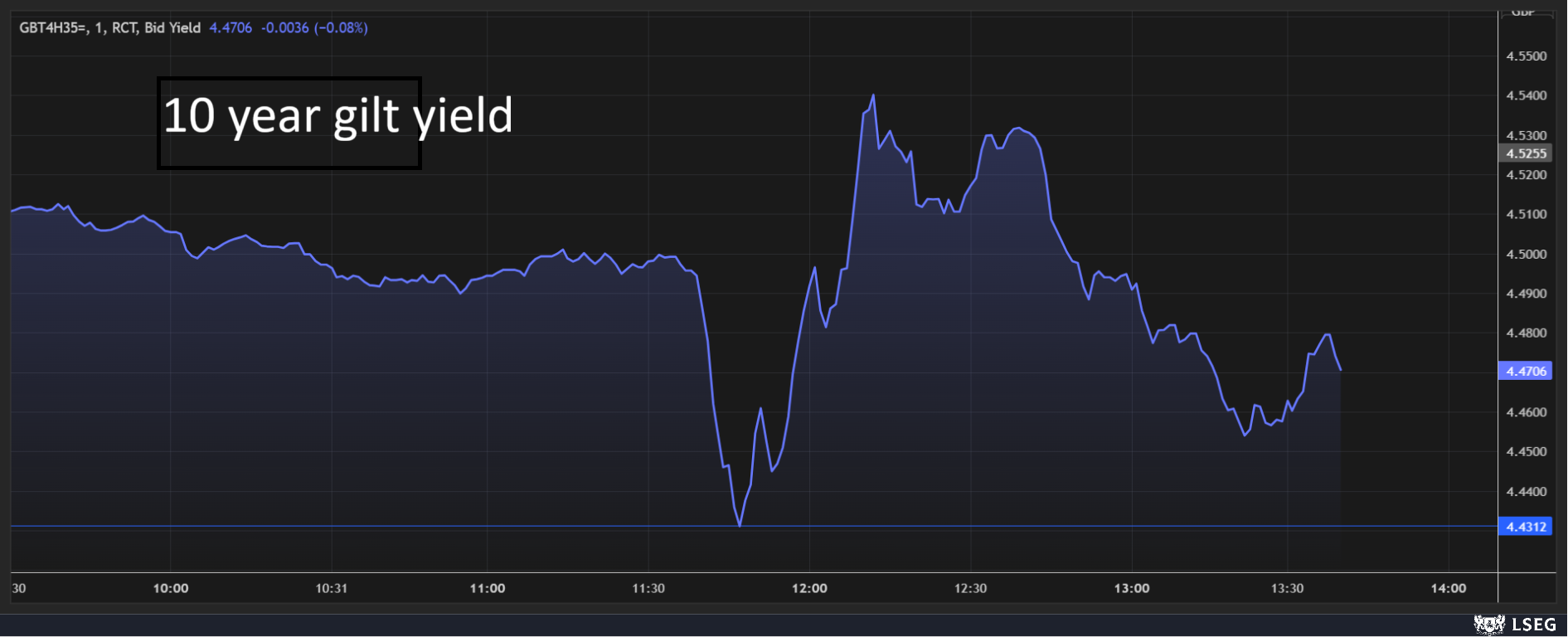

And the bond market appears to welcome Reeves’ package of measures. They heard that she’s meeting her stability rule a year early, more than doubling financial headroom to £21.7 billion.

“Before taking into account the policy changes announced today, the chancellor was still on course to meet her primary fiscal target of covering all day-to-day spending with tax revenue in 2029-30 with £4 billion to spare,” said Andrew Wishart, economist at Berenberg.

“While that was a reduction of the £9.9 billion headroom the chancellor had previously, it stands in stark contrast to the widespread prediction that she would fall short by some £10-20 billion.”

Source: Refinitiv. 10-year gilt yield. Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.