Budget 2018: What it might mean for share prices

29th October 2018 17:02

by Lee Wild from interactive investor

In a long Budget speech, Lee Wild picks out some interesting measures announced by chancellor Philip Hammond.

The chancellor stood up with less than an hour left of the trading day in London and wrapped up his Budget after the closing bell rang. That means little time for traders to react to this year's plan.

When Hammond began speaking, the FTSE 100 traded at 7,049, up 110 points on the day. The index closed at 7,034, and up a few points in post-close futures trading.

Given the awkward timing for markets, and while there didn't appear to be much to shift markets dramatically, one might expect traders to be combing through the detail overnight in time for the open on Tuesday morning.

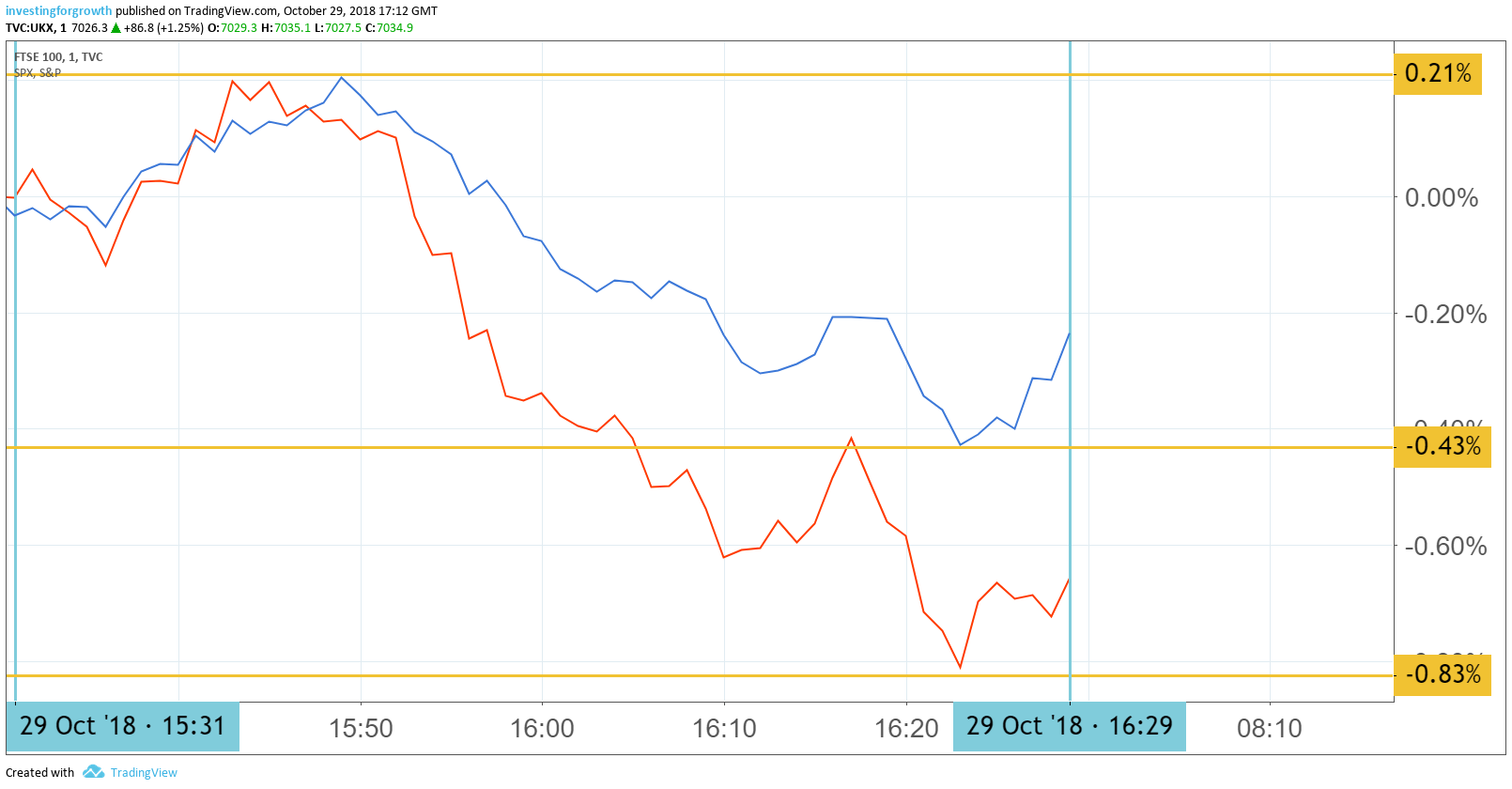

A look at the chart below, showing the FTSE 100 in blue versus the S&P 500 in red, indicates the London index largely reacting to movement in the US rather than on any major UK policy shift.

Source: TradingView Past performance is not a guide to future performance

Here's a look at some of the measures announced today which might nudge stock prices.

Events worldwide constantly remind us of threats to Britain's security, so there's an extra £1 billion for the Ministry of Defence across 2018-19 and 2019-20. The money's earmarked for cyber, anti-submarine warfare and the nuclear deterrent.

It sounds a lot, but for an industry like defence, this is small beer. BAE Systems, Ultra Electronics, Chemring and others are unlikely to move much on this.

Hammond has decided that the Private Finance Initiative (PFI) and its successor PF2 are "inflexible and overly complex". Private finance initiatives are also a "significant risk" to government. PF2 will no longer be used for new projects.

Watch for a response from Britain's outsourcers – Capita, Serco , G4S, Interserve and MITIE .

Policy aimed at boosting the UK's housebuilding industry is typically good news for firms like Taylor Wimpey, Persimmon and Barratt Developments. This year, the chancellor has extended first-time buyers relief in England and Northern Ireland so that all qualifying shared ownership property purchasers can benefit, backdated to 22 November 2017. The Help to Buy scheme is also extended for two years to March 2023.

Hammond wants to do his bit to help the oil and gas industry recover from the 2014 oil price crash, although the price of Brent crude is already at a multi-year high! Still, the government is maintaining headline tax rates at their current level. Good news for Faroe Petroleum and chums.

A freeze on duties on beer, cider and spirits should cheer the pub chains including JD Wetherspoon, Greene King and Marston's.

However, while a 4.9% increase in the National Living Wage from £7.83 to £8.21 next April puts money in people's pockets, it is a further cost for employers at a time when operating expenses have been rising rapidly. Pubs and the high street retailers like Next and Marks & Spencer can absorb it, but it is a further squeeze on profits.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.