Five property trusts offering either value or income

We discuss the compromises between yield, value and security in the property sectors.

12th June 2020 15:24

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

We discuss the compromises between yield, value and security in the property sectors.

Thomas McMahon, senior analyst at Kepler Trust Intelligence.

Pick your poison

Commercial property investors have experienced a wildly volatile few months and the outlook is still extremely uncertain too, thanks to the government response to the coronavirus outbreak. Many investment companies have cut or cancelled their dividends; and the pace and scope of the lockdown lifting will affect how quickly and to what extent their rental income recovers. As a result, they sit on wide discounts to NAV. On the other hand, other areas of the property market have seen limited or no effect. Some of these alternative sectors have seen their share prices fall and rise dramatically, close to their pre-crisis valuations.

To us it seems that investors have a tough balancing act to perform. In the generalist REITs, we think the steady subsiding of the epidemic and loosening of economic restrictions mean potential opportunities in the discounts. However taking advantage of these opportunities means accepting the risk of short-term dividend cuts and plenty of uncertainty around government policy. On the other hand, some of the alternative areas offer much more secure dividends, but on a portfolio level and based on share prices they offer very little valuation cushion.

Commercial property

Generalist commercial property investment companies and REITs invest in the retail, office and industrial sub-sectors, sometimes supplementing this with investments in alternatives (leisure, showrooms, petrol stations, etc).

Their share prices have taken a battering in 2020 as the outlook for all these areas has been negatively impacted by the effects of the coronavirus. However, assessing the value in the discounts that have subsequently opened up is extremely hard.

NAVs are usually updated quarterly, which means that the most recent numbers, in reality, reflect very little of the impact of the COVID-19 lockdown. We will not get an updated picture until mid-July, when most end-June NAVs will be reported.

Even so, there are more fundamental problems in assessing the value in these portfolios. Transactions have been extremely thin on the ground thanks to the lockdown, both because of buyer wariness but also for various practical reasons to do with being able to visit properties.

As a result, valuers have applied material uncertainty clauses to their most recent valuations (end-March for the most part).

By the end of June, while there will certainly have been an increase in activity, valuers still may not be able to give a good guide to market prices.

The future for retail and office space, in particular, will still look very cloudy at the end of June, given that lockdown restrictions will likely have been only partly lifted.

The essential problem is that property is valued based off the rent that can be demanded for it. In the short term that has – in some cases – been nothing. In the medium term, it could be much lower than before the crisis. Rental collection was reasonable in Q1 2020 across the generalist property trusts, but Q2 rental collection is expected to be well below 100%.

The question is how long this reduced rental collection will last, and what levels of rent can be demanded in the crisis recovery period. At the moment some tenants (especially retailers) simply cannot pay, as they are not earning anything.

Others may well take the opportunity to withhold payment, even though their business is still operating to some extent.

Furthermore, in the current situation, tenants who can pay are in an extremely strong position with regard to rent renegotiations. With so much uncertainty about the UK’s path out of lockdown, it would make good business sense to not commit cash to pay rents which you might not be wanting to pay if the government makes it difficult (or even impossible) for you to return to your rented property.

All this means the rent which landlords can collect in the coming quarters is in question; as is the rent they will be able to demand in the medium to long term.

For example, a few weeks ago the government was talking as if the operating capacity of the London underground will only be 20% of its pre-crisis levels – in perpetuity. If this were true, this would have a dramatic impact on demand for central London office and retail space.

Social distancing rules as they currently stand will make much of the hospitality and leisure industry defunct, and the bricks and mortar shopping experience even more miserable than usual, with consequent huge impact on the rent that can be demanded for properties in the sector.

On the other hand, were the government to relax its two metre guidance for distancing at work, to one metre, this would dramatically alter the number of workers who could be accommodated in offices; making restaurants and pubs viable again. Recent indications are that this outcome is likely, in at least some contexts, once infection rates are lower.

Any investor in commercial property therefore has to accept a large amount of uncertainty regarding the level of income that can be earned for the foreseeable future, and thus regarding the valuation of their portfolios.

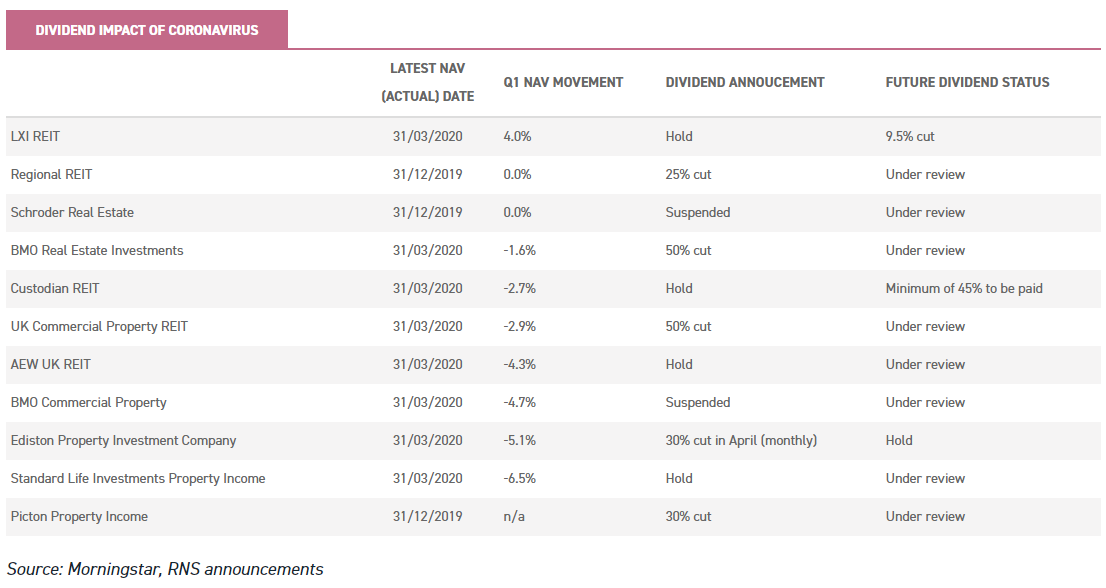

In the table below we illustrate what each commercial property trust and REIT did with its dividend for the quarter ending 31 March (note: two pay monthly dividends) and the guidance it has given for the quarter ending 30 June.

Source: Morningstar, RNS announcements

There is limited correlation between the most recent dividend cuts (and future guidance) and sector exposure.

Of the four trusts with the highest exposure to the more resilient industrials sector, two held their dividends in Q1 and two halved them. However, retail does appear to be the worst affected segment: three of the four trusts with the least exposure to retail held their dividend; and of these LXI has sufficient confidence to guide for a cut of only 10% in Q2. On the other hand, three of the four trusts that are most exposed to retail have cut or suspended their dividend, with Custodian the exception.

What is the future for retail and offices?

We think retail exposure is likely to be a key driver of valuations in the medium term, once a more regular stream of transactions is under way.

As highlighted above, however, we think the medium to long-term outcomes are highly uncertain, with much depending on the pace of government policy easing.

A further complication is the difference in outlook, within the retail sub-sector, between retail warehouses and high street retail.

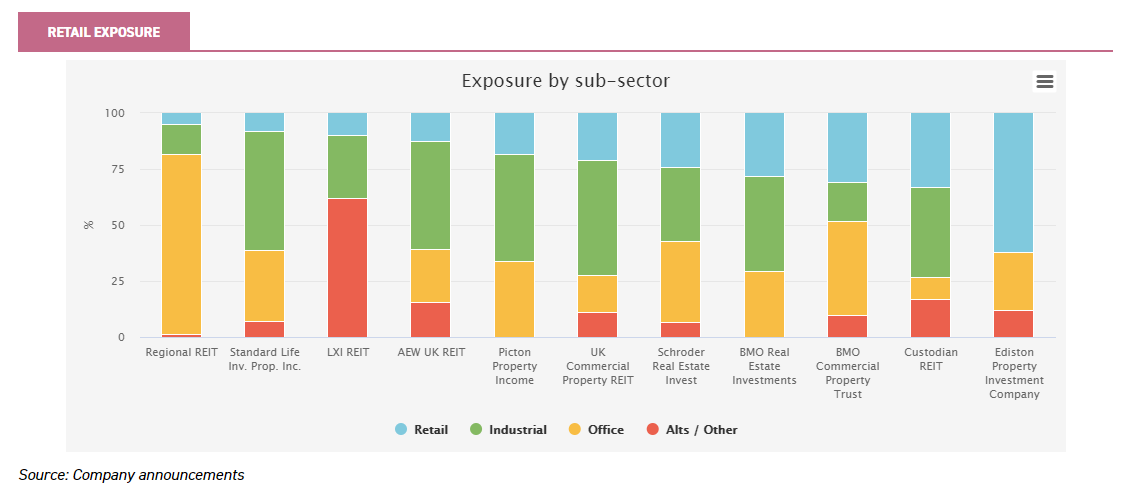

Retail warehouses and out of town shopping parks could be more in tune with socially distanced shopping and may better suit car drivers, which could be crucial factors, in the coming months at least. The below chart shows the sector breakdown of the generalist trusts, with the lowest exposure to retail on the left.

Source: Company announcements

The guidelines that tenants of retail and office properties will be working under are still unclear and likely to change over time; so it is hard to be sure what level of demand there will be and at what rents.

Companies may require less office space, but at the same time may need greater space per head of worker. Parking could become more important and facilities such as showers and gyms less important, depending on where new practices settle. Offices on the outskirts of cities could become more popular as they can be reached by car. Retailers may want larger premises, to allow more space per customer.

Sites with parking may be preferred, or sites that can have air conditioning installed. Until the direction of policy becomes clear, the long-term demand for space will be subdued; but we do think there is a future for commercial property, something which it may have been hard to believe at times during the peak of the crisis.

We also suspect that the ultimate ‘new normal’ will look suspiciously like the old one, with only a modest reduction in demand, offset somewhat by a limited supply of high-quality sites which have both flexibility and the amenities that customers are demanding.

What are share prices discounting?

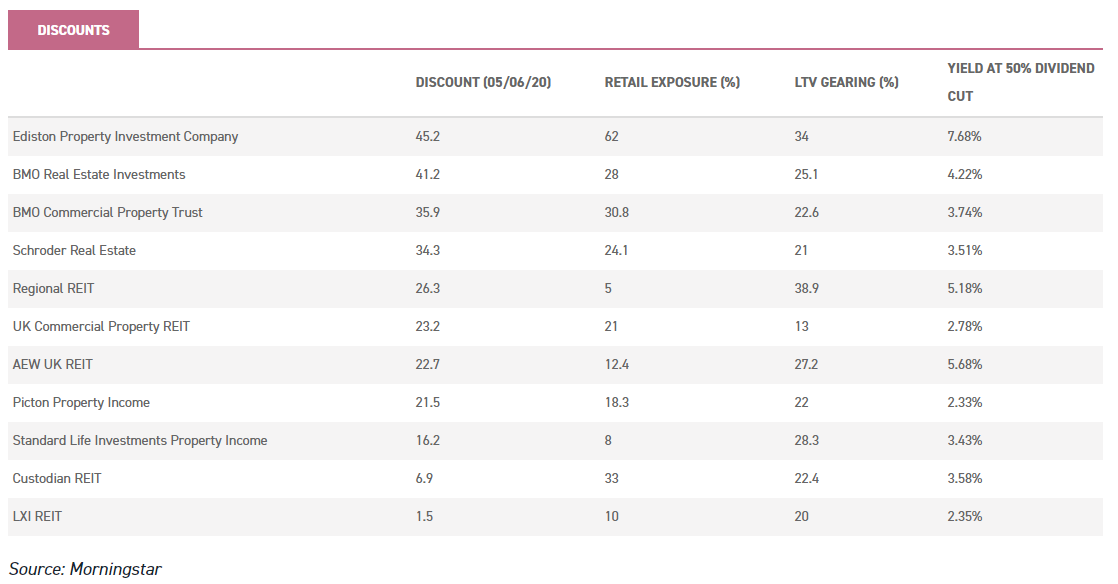

So, do the share price discounts to reported NAVs in the sector reflect all this uncertainty? The below table shows the discounts of the generalist trusts.

We have included the two major risk factors of retail exposure and gearing. We have then assumed a 50% cut to the last pre-crisis dividend, annualised (in line with the greatest cuts made so far), and shown the yield under this assumption.

To us BMO Real Estate Investments (LSE:BREI) stands out as potentially interesting. BREI has been bold in already taking a 50% cut for Q1 2020 despite reasonably strong rental collection.

The retail exposure is not excessive, gearing is moderate, and the portfolio is favourably biased to prime locations; yet it trades on a c. 40% discount (having come in from almost 50% in the past couple of weeks).

As a smaller trust it is less liquid, which may have affected the discount, and we think investors may not have recognised how much the trust has reduced its retail exposure over the past few years. In fact, if you write down the value of BREI’s retail exposure to zero, and write down the value of its offices by 20%, then the trust is trading on an 11% premium to this reworked NAV. [Of the rest of the sector, only one other trust (Regional REIT) is trading on a premium after this exercise.]

We have updated our note on BREI this week. UK Commercial Property REIT (LSE:UKCM) and Picton Property Income (LSE:PCTN) also look interesting to us as safer plays. They trade on more modest discounts, but with very low levels of retail exposure and low levels of gearing. Having rebased their dividends early, we think their discounts could prove to be reasonable value.

Source: Morningstar

Alternatives

It will take some time for reliable valuations and a direction of travel to become clear in the mainstream commercial property sectors. However the alternative REITs sector, in some cases, offers far more secure dividends and values with much less uncertainty. On the other hand, this sector sometimes comes along with higher valuations, leading to discount risk and less opportunity for capital gains. Below we give a brief survey of the key sub-sectors and the outlook for yields and discounts.

Healthcare

Within the healthcare sub-sector, PHP has very safe rental income, paid by GP practices, pharmacists and other healthcare operators. As much as 90% of the income is government-backed, and the most recent rental collection numbers, for Q2 2020, were 98%.

We would therefore expect the company to be able to maintain its planned quarterly dividend of 1.475p per share, having paid the first in January. This would amount to an annualised yield of 3.85% on the current share price of 153p (as of 04/06/2020).

This is paltry compared to what is available elsewhere, with investors having to accept a lower yield to compensate for the security. The trust’s NAV was last updated in December 2019, and the shares currently trade on an 46% premium to that valuation, limiting the prospects for capital growth and increasing discount risk. The portfolio is highly geared, with a loan to value of 45% as of the end of March.

The two care home REITs, on the other hand, offer much more attractive yields with less discount risk. A few weeks ago we emailed our subscribers highlighting the wide discount on Impact Healthcare (LSE:IHR) – at that time it stood at 17.5%, prompted by political attention switching to the impact of coronavirus on care homes.

As attention has moved elsewhere, or at least as the epidemic has started to wane, the discount has come in, but at 6.8% (on the offer price) it is still interesting in our view, especially given the yield on offer. Impact received 100% of its rental income in Q1 and paid a dividend 2% up on last year, as planned.

The key issues for care homes have been the increased costs of keeping residents safe; a reduced number of occupants, due to either fatalities or families not wishing to place members in homes at this time; and staffing pressures as workers have been forced to self-isolate, reducing the numbers of staff available.

As the epidemic has tailed off, however, these pressures have abated, and as of April IHR reports that its occupancy rate has fallen by just 4%.

The pressures may return, of course, but as of now IHR looks on course to maintain its planned 6.29p dividend. Admittedly there is a wide spread on the shares, which means that for buyers the yield would be 6.4%.

But it is notable that the yield is practically ungeared, with the company having gross loan to value gearing of just 6.8%, offering it more room for manoeuvre in the future.

Target Healthcare (LSE:THRL) is a larger REIT with a narrower spread. Unlike IHR, it reports on how many cases of COVID-19 have been identified among its residents (just 5% as of 21 April).

While we think there is some risk this metric could spike further, as care homes and hospitals have been major sources of infection, we are encouraged by the subsiding of the epidemic overall.

Furthermore, should there be a second wave (by no means a certainty) we would hope that care homes would be better placed to protect residents this time round. THRL maintained its dividend in Q1 2020, and the annualised 6.68p would amount to a yield of 6.1%. It trades on a small premium of 2%.

Social Housing

In the social housing sub-sector, Civitas Social Housing (LSE:CSH) and Triple Point Income (LSE:TPVC) also benefit from government-backed revenues. Civitas achieved 100% dividend cover in the first quarter of calendar 2020, and has set an increased dividend target of 5.4p (up from 5.3p) for the current financial year.

Civitas and Triple Point lease properties to housing associations and specialist care providers, which have had to incur extra costs to keep residents safe. However, the average age of a tenant on Civitas’ portfolio is 32, well below the age at which the disease poses substantial risks.

Civitas notes that one representative care provider in the market reported 3% of its tenants as being in the high risk groups, but this measure may vary across different property portfolios. Civitas’ 5.4p dividend amounts to a yield of 4.9% on the current share price.

Triple Point also received 100% of rents in Q1 (and in April) and is also raising its dividend for this financial year. The projected 5.18p is 1.7% up on last year’s payout and amounts to a yield of 5.4% at the current share price.

To us it certainly seems that the social housing trusts are in a much stronger position than the generalist property trusts regarding their dividends, and the valuations of their properties are unlikely to take the same kind of hit.

Even if the uncertainty clauses have been applied by the surveyors (due to a lack of comparable transactions), the long-term future of the sector has not been brought into question by the crisis, as it has been for retail and office property.

In the past, the sector has had to deal with investigations by the regulator into both the standard of housing and the financial soundness of its business model – the main issue being the mismatch between the long leases held by housing associations and the shorter contracts they use in order to provide services.

While these issues will be returned to, in due course, clearly the short and medium-term focus is likely to be on handling the pandemic. This may even play into the social housing trusts’ hands, as Triple Point alluded to in a recent regulatory news announcement: private housing associations offer an alternative to care homes for many, as well as more individual living conditions, which are safer from a virus transmission point of view.

Residential Secure Income (LSE:RESI) was always insulated from the regulatory issues in the social housing sub-sector, by the fact that it invests principally in retirement homes and shared ownership housing.

However these privately backed sources of rent no longer seem advantageous, in our view, as we head into an inevitable recession.

That said, the pension income of retirement home residents should be less affected by the coming reduction in economic activity, and rent collection was 99% in Q1 (and in April too).

While RESI has managed to maintain its dividend, the slower pace of expansion that the pandemic has forced on the trust means that it no longer expects to achieve full dividend cover this year. It is for that reason, we suspect, as well as its privately backed rents, that RESI is on the widest discount in the sector: 14%, resulting in a yield of 5.5%, the highest of the three trusts.

Logistics

We recently highlighted the stronger fundamentals behind the industrials sub-sector, specifically logistics, in a strategy note and also in our note on Tritax Big Box (LSE:BBOX), which we will not re-rehearse here. In fact, we highlighted BBOX as an opportunity when it was trading on a 24% discount, which has since come in to just 2.3%.

The main issue for investors in this sub-sector is a related point: valuations. It has become widely recognised that retailing is shifting online and that distribution properties will benefit from this trend.

As a result, the yields available on industrial sites in the market are now less attractive. However, the financial health of the underlying tenants also needs to be considered.

As we discussed in our recent note, yield compression means that BBOX is now focussing on augmenting its core portfolio of big box distribution sites with land and early-stage developments, largely pre-let, which offer the prospect of greater returns and are smaller nodes in the same distribution networks.

Around 50% of the rent from these sites comes from tenants considered defensive in the current environment – for example Amazon (NASDAQ:AMZN), the supermarkets and delivery firms. This still leaves half the portfolio requiring an easing of lockdown rules in order to operate at full strength, and as a result the board has cut the trust’s dividend by 10% and left future distributions under review.

The 6.25p (annualised level) implied by the last payment would give a yield of 4.4% on the current share price. We expect BBOX to be less affected by the crisis in the long term, and in our opinion the lower yield and discount reflects that.

Urban Logistics REIT (LSE:SHED) focuses on last mile distribution centres. It is offering a 5.4% yield off a narrow discount of 2.3%. The yield premium over BBOX likely reflects the riskier nature of the smaller properties SHED focuses on.

SHED pays semi-annual dividends, and the interim will not be announced until November. It is net long cash after a large equity raising in 2019. Warehouse REIT (LSE:WHR) maintained its dividend for Q1 2020 and guided for the same level of payout in the 2021 financial year: 6.2p, at a 5.4% yield. This is only possible, though, thanks to significant gearing, with an LTV of 40%. The urban warehouses that WHR invests in are 50% let to tenants with online sales or distribution. Like SHED it should benefit from the trend to online sales, which has been given a boost by the current crisis. Investors are well aware of that, however, judging by the 4.6% premium.

Conclusions

Generalist UK commercial property trusts face an uncertain outlook. However, we think that there could be value in some of the discounts, particularly if the epidemic continues to subside so rapidly. In this sector we think BMO Real Estate Investments is an interesting deep discount play, with UKCM and Picton also interesting as safer plays thanks to their gearing and lower retail exposure.

However, for those looking for a secure income, at the current time we think Triple Point and Civitas offer an attractive combination of yield and valuation security.

The logistics sector looks like an interesting place to invest for a lower but more secure yield. At the same time, valuations on these underlying portfolios, and their prices relative to NAV, are not in any sense offering deep value; and in the long run maintaining dividends could require further gearing or moving up the risk curve.

Given the delicate balancing act these trusts have to perform, income investors might want to diversify their risks by maintaining exposure to both cheap generalists and expensive specialists, until there is further clarity on the way forward for the economy.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.