The nine trusts issuing new shares to meet demand

A handful of investment trusts have been able to print new shares while others struggle on wide discounts.

5th April 2024 13:50

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Easter is a time for optimism, and there are plenty of signs of new life to be seen in the investment trust sector, if you know where to look.

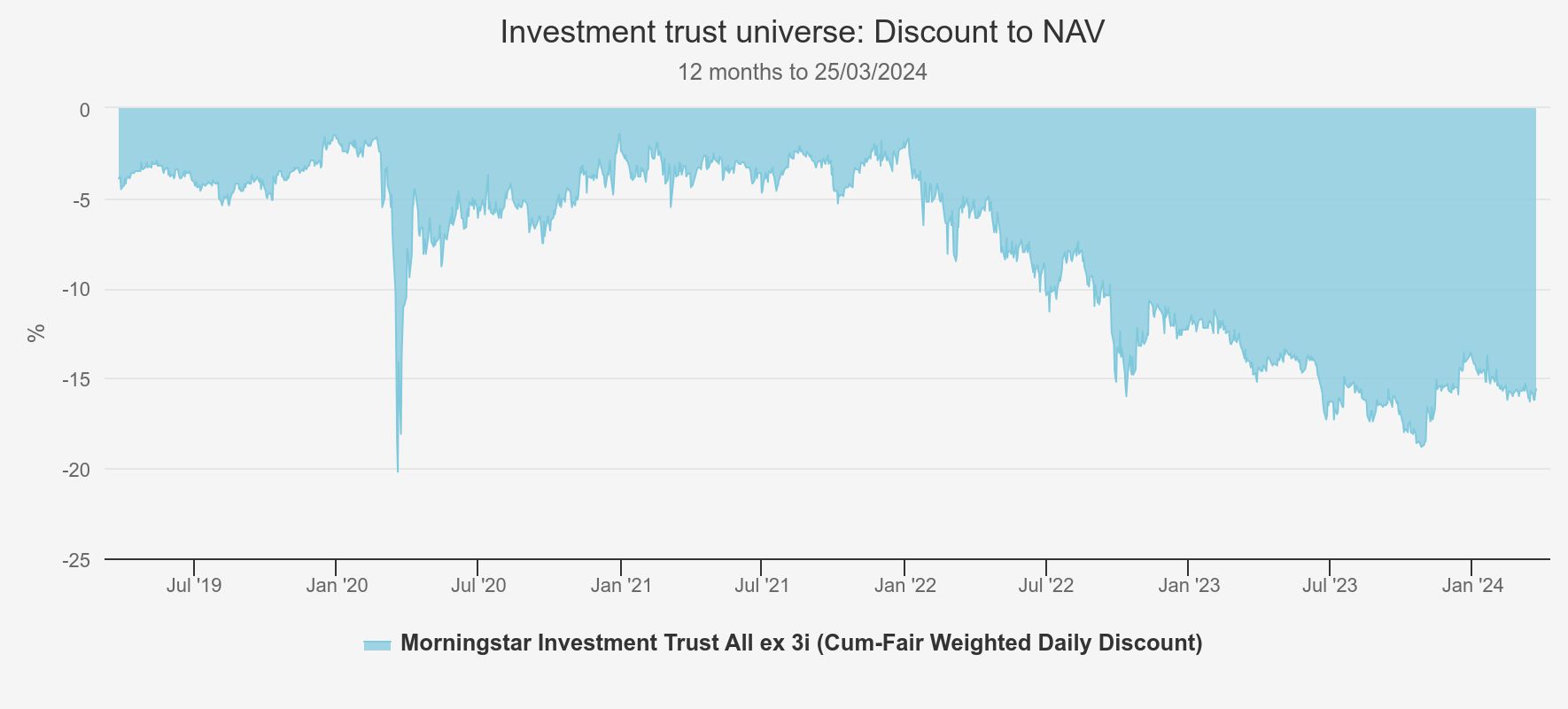

It is true though that in the first three months of 2024, discounts have widened slightly on the investment trust sector, as the below chart shows. This follows a decent bounce in Q4, as the market became convinced the peak of the US interest rate cycle was in.

DISCOUNT

Source: Morningstar. Past performance is not a reliable indicator of future results

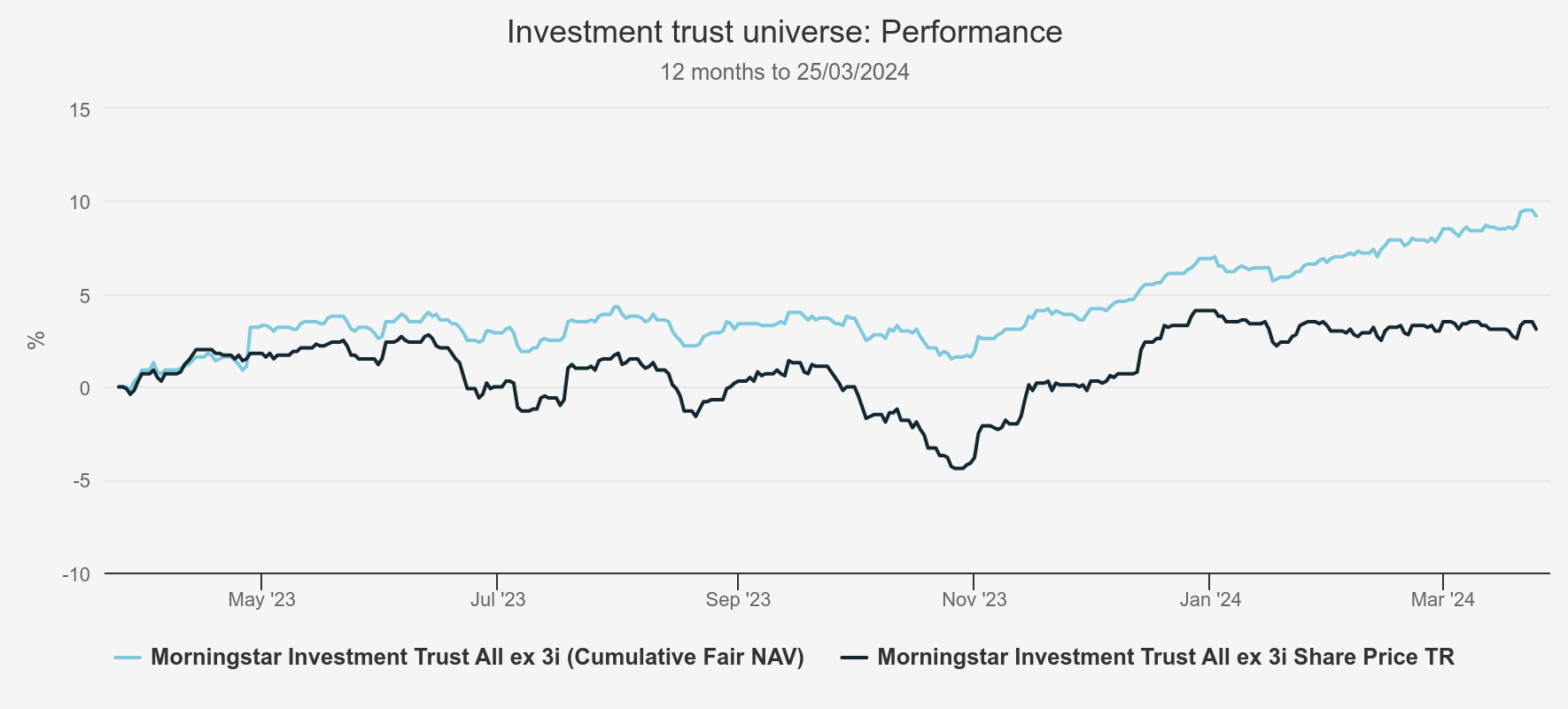

However, as the below chart shows, this has been down largely to the strength of NAVs reported rather than weakness in the share prices. Share prices have overall simply not quite kept up with underlying markets.

PERFORMANCE OF SECTOR IN 2024

Source: Morningstar. Past performance is not a reliable indicator of future results

The classic example of this is the Technology sector, which has seen an average NAV total return of 8.5% while the shares have delivered just 3.8% (to 25/03/2024). We have highlighted the sector as a discount opportunity in recent weeks. But this is a phenomenon seen across major equity sectors: the UK, Europe, Japan, as well as the Global sector, have all seen good NAV gains and share price gains which, while positive, have not kept up.

In the alternative asset space, the picture has been less positive. While positive NAV total returns have been delivered so far across the Renewable, Infrastructure and Property sectors, share prices have sold off, in some cases significantly. This has been contributed to by some poor individual stock situations. For example, the battery storage funds reported poor news on their dividends and the share prices dived. However, even the highest quality trusts have seen their discounts widen. We think this is likely due to interest rate volatility: the number of rate cuts expected in the US by the market has declined since the start of the year and so yielding assets have repriced. There may have also been some contagion from the issues in the battery trusts and Digital Infrastructure.

NAV AND SP MOVES OF SELECTED SECTORS

| SECTOR | NAV TR (%) | SHARE PRICE TR (%) | DIFF (%) |

| Morningstar Investment Trust Renewable Energy Infrastructure | 1.1 | -16.9 | 18.1 |

| Morningstar Investment Trust Royalties | 0.2 | -15.0 | 15.2 |

| Morningstar Investment Trust Property - UK Commercial | 1.3 | -9.2 | 10.5 |

| Morningstar Investment Trust Infrastructure | 0.7 | -7.6 | 8.3 |

| Morningstar Investment Trust Property - Europe | 0.0 | -5.7 | 5.7 |

| Morningstar Investment Trust Property - UK Healthcare | 1.4 | -4.2 | 5.5 |

| Morningstar Investment Trust Property - UK Residential | 1.2 | -3.6 | 4.8 |

| Morningstar Investment Trust Technology & Technology Innovation | 8.5 | 3.8 | 4.7 |

| Morningstar Investment Trust Leasing | 2.4 | -2.1 | 4.5 |

| Morningstar Investment Trust UK All Companies | 2.4 | 0.1 | 2.2 |

| Morningstar Investment Trust Global | 9.0 | 7.3 | 1.8 |

| Morningstar Investment Trust Japan | 9.2 | 7.8 | 1.4 |

| Morningstar Investment Trust Europe | 8.2 | 6.8 | 1.4 |

Source: Morningstar, as at 25/03/2024. Past performance is not a reliable indicator of future results.

Why are discounts sticky?

We think share prices have probably lagged because of technical reasons rather than sentiment towards asset classes on their own fundamentals. In the short term, investors who want to get back into the market can easily buy ETFs or other passive vehicles, and delay any stock selection decision. Furthermore, the retail and wealth management investors who purchase investment trusts are likely slower to put money to work than traders and institutional investors. Aside from anything else, when you are earning 5% on cash, you are liable to be a little less energetic in your buys. In this light, we would expect discounts to narrow as optimism about the path of markets firms, and so we think it looks increasingly attractive to take on risk via the investment trust sector.

For example, the tech sector is still trading on a 10.3% discount to NAV. This seems like a decent discount to lessen the pain of buying into a market that is not cheap. UK and European equities are also available on circa 10% discounts, while even the Japan sector is on an average discount of 10.4%. This is despite Japan being probably only the second hottest story next to AI this year. As a ‘soft landing’ looks increasingly likely in the major global economies this year, the risk/reward outlook for equities is improving, and good performance from the major markets to start the year reflects this.

That’s the optimistic view. There are concerns, though, about longer-term trends and whether they imply discounts will never close. Specifically, the decline in the footprint of wealth managers in the investment trust sector may well be having an impact: as consolidation proceeds, more and more WMs are operating from centralised buy lists that require large funds and/or with propositions that exclude investment trusts as a whole. The high costs that have to be reported on KIDs have also been deterring many large investors who have to report these as part of their look-through costs to their investors. This second issue is being addressed by the regulator, and there is scope for positive change in the months to come. The first trend looks more entrenched.

Additionally, on the negative, higher rates available on bonds will have led to asset allocations shifting and this means there may well be excess capacity in the investment trust sector that will need to come out via buybacks, liquidation or consolidation. A lot of this has already happened, but there may be more to come. We speculate that this may explain why tech discounts are wide: a lot of the demand for portfolios focused on tech in the broader sense may have been satisfied by the extraordinary growth of Scottish Mortgage Ord (LSE:SMT), which sits at circa £14 billion in net assets. The two tech trusts have total assets of circa £5.5 billion between them – maybe there isn’t £20 billion of demand for this sort of portfolio now that rates are around 5%, but more like £17 billion or £18 billion? If so, then it might take longer than we would like for some of the silliest discounts to close, like the 10.5% onAllianz Technology Trust Ord (LSE:ATT). But one way or another they will close, and SMT’s bold buyback announcement has seen its own rating improve already.

Who is issuing shares?

We think that our contention that it is technicals rather than fundamentals that are behind wide discounts is supported by the extraordinary success of a handful of investment trusts which have been able to issue shares while most of their peers are struggling on wide discounts. The table below shows the money raised in the AIC universe in the year-to-date, excluding mergers, and there are a number of patterns that emerge.

MONEY RAISED IN AIC UNIVERSE

| MONEY RAISED IN 2024 | |

| JPMorgan Global Growth & Income | £175,650,000 |

| Ashoka India Equity | £31,640,000 |

| Invesco Bond Income Plus | £16,250,000 |

| Rockwood Strategic | £6,140,000 |

| Odyssean Investment Trust | £3,420,000 |

| Merchants Trust | £2,670,000 |

| CQS New City High Yield Fund | £2,010,000 |

| Chelverton UK Dividend Trust | £560,000 |

| CT Global Managed Portfolio Growth | £200,000 |

Source: AIC, data to 01/03/2024.

One pattern is that excellent performance can still attract significant flows and see investors willing to invest at NAV. Perhaps differentiation of the strategy is important too. JPMorgan Global Growth & Income Ord (LSE:JGGI), for example, has outperformed its benchmark in each of the past five years, including the down year of 2022 in which it was almost flat. It also offers exposure to the large-cap tech trend from a vehicle which pays an attractive yield, thanks to the ability to pay a dividend out of capital reserves. The top holdings are Microsoft Corp (NASDAQ:MSFT), Amazon.com Inc (NASDAQ:AMZN), NVIDIA Corp (NASDAQ:NVDA) and Taiwan Semiconductor Manufacturing Co Ltd ADR (NYSE:TSM), so packed with growth potential rather than the typical high-yield plays.

Much of the money raised by JGGI came via one major placing of 5.2 million shares, following an indication of interest from a wealth manager to make a sizeable investment, alongside 1.3 million issued direct to retail clients. This raised £34.5 million, but the trust has continued to trade on a premium since, the board issuing shares into the market. (Note, we have attempted to exclude the effect of the merger with MATE which completed on 27/03, but we pass on the AIC's own disclaimer about their statistics.) Clearly if the mandate is right and performance is good, there is still demand from both retail and intermediaries.

Ashoka India Equity Investment Ord (LSE:AIE)is another case of strong performance being rewarded. While India has been in favour, the other all-cap vehicles in the sector have been trading on sizeable discounts. AIE has been the outstanding performer in the sector since launch and has traded on a premium for most of the time since then. It has managed to raise over £30 million in 2024 to date, contributing to total assets rising from £45 million at launch to today’s £340 million. One differentiating factor behind AIE’s success is the large team of analysts they have devoted purely to Indian equities. Additionally, the charging structure sees a management fee paid only if the trust outperforms the benchmark.

Rockwood Strategic Ord (LSE:RKW) is another highly differentiated strategy with a strong track record and has raised £6.1 million in 2024 so far. Richard Staveley took over in September 2019, and has handsomely outperformed since then. He runs a highly concentrated portfolio of micro-caps in which he invests with a private equity style approach, seeking to place representatives on the board and engage in order to unlock value in cheap companies. Richard has a significant shareholding, as has Christopher Mills, chief executive of Harwood Capital, RKW’s manager. In fact, Christopher Mills made a major purchase of shares this year, although the 1 million he bought compares to a total of circa 3 million issued. He now owns circa 27.5% of the company. It is interesting to see strong demand for RKW’s shares despite the small size of the net assets, and we note that as the trust grows a broader base of shareholders should be able to take a meaningful position.

Another trend that jumps out to us is the success of the bond funds. We think this reflects the highly attractive yields now available in the sector. Looking at those raising money, CQS New City High Yield Ord (LSE:NCYF) has a trailing yield of 8.7% and Invesco Bond Income Plus Ord (LSE:BIPS) 6.7%. BIPS raised £13.4 million from a placing aimed largely at retail investors during the quarter. M&G Credit Income Investment Ord (LSE:MGCI), which issued a small number of shares in March, has a trailing yield of 8.6%, but this understates the income being generated. MGCI pays a dividend of SONIA plus 4% (of NAV), quarterly, so the real annualised yield is circa 9.2% given where SONIA is. MGCI is a truly flexible strategic bond fund, able to invest across private debt markets as well as public. Currently, 75% of the portfolio is floating rate, which is contributing to the exceptional yield which is delivered from a portfolio of high credit quality – this is an investment grade quality portfolio rather than high yield. We published an updated note on the trust last week. In recent weeks, the trust has slipped out onto a discount once more, but in our view it looks well suited to the current economic environment, although it is true its minimal duration means that it will not benefit from rising capital values much, as and when rates are cut.

Conclusion

It will have been frustrating for investors in closed-ended funds to see their share prices lag NAVs in the rally of recent months. In our view, patience is required. In many of the core equity sectors, we would expect discounts to come in as the move is confirmed – i.e. as the rally seems to have legs, most likely as economic news continues to be reasonable and the first rate cuts are orderly.

However, market-wide technical factors could see this take some time, particularly in certain stocks or sectors where demand is lower in a high-rate world. At a market level, we might continue to see discounts persist therefore, but where trusts have differentiated offerings and a strong track record, there is still clearly demand out there – even if some of it is coming at the expense of other vehicles in the sector.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.