Share Sleuth: three winners to trim, here’s how I decided which one to pick

Richard Beddard is looking to build the portfolio’s cash pile back up so he can use it when he finds opportunities. With three companies over-represented in the portfolio, he explains how he decided which one to trim.

7th March 2024 10:14

by Richard Beddard from interactive investor

On what, under normal circumstances, would have been the last day of February, Wednesday 28, I sat down to decide a trade.

The decision to add more Focusrite shares last time, had left the coffers bare.

Dividends of £687 paid into the portfolio had only lifted the value of its molehill of cash from £44 to £731, which is insufficient to fund additions to the portfolio. That is because Share Sleuth’s minimum trade size was about £4,650.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The minimum trade size is set at 2.5% of the portfolio’s total value. Its purpose is to stop me from making trivial trades, which costs money and, more importantly in these days of low broker fees, takes time.

The Decision Engine gives me a precise ideal holding size for each share, but I will not trade shares unless the actual holding size deviates from the ideal by more than 2.5%. Neither will I add more shares if there is insufficient cash.

The decision would reduce or eliminate a holding, unless I decided to do nothing at all.

What I would have added

These were my thoughts on the shares I might have added, if Share Sleuth had had the money.

Had I not added more shares in Churchill China (LSE:CHH) as recently as November last year, I would almost surely have added more. It is the top-ranked share in the Decision Engine, with a near perfect score of 9.8/10.

In an update in January, the company reported that revenue for the year to December would be slightly lower than the record level it established in 2022, but Churchill China might still eke out a modest increase in profit.

Weak demand for tableware means it is unlikely to blow the lights out in 2024, but this is a high-quality business trading at, to my mind, a bargain valuation.

Among other highly ranked shares, Quartix Technologies (LSE:QTX) is excluded because I am unsure about the recent boardroom shenanigans, and I will be scoring its annual report next. Boardroom changes at the vehicle tracking firm that make me wonder about its strategic direction.

Elsewhere, Howden Joinery Group (LSE:HWDN) is already at its ideal holding size, and I added more Focusrite (LSE:TUNE) last month.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Insider: share slip is buying opportunity for these directors

Macfarlane Group (LSE:MACF) and Oxford Instruments (LSE:OXIG)s would have been new additions. I am due to reappraise Macfarlane soon, and I want a chance to read the first annual report under the leadership of Oxford Instruments’ new chief executive before I make a move on that company.

I would probably have bought more Shares in Dewhurst Group (LSE:DWHT), the manufacturer of lift components. I scored it highly in January and the company seems to agree the shares are undervalued because it has started buying them back.

Although the buyback has lifted the shares somewhat, they remain far below perhaps my most fortuitously timed reduction in a holding ever:

Dewhurst has two classes of shares; DWHT (unbroken line) are ordinary shares, DWHA (broken line) are ‘A’ shares. The ‘A’ shares have all the same rights as the ordinaries except the right to vote at company meetings. Share Sleuth holds the ordinary shares. A ‘b’ on the chart indicates an addition to the portfolio, and an ‘s’ indicates a reduction in the portfolio’s holding. Past performance is not a guide to future performance.

What I reduced

The Decision Engine is telling me to reduce or eliminate three holdings. This is not because they are bad businesses, in fact they are all rather special. It is because advances in their share prices mean they are over-represented in the portfolio.

Tristel (LSE:TSTL) is in the frame because it is the portfolio’s lowest-ranked share, with a score of 5.5/10. Almost all of its low score (3.5 out of 4.5 marks deducted) is down to the fact that the market values the shares at 42 times normalised profit.

Because I have already reduced it twice, Share Sleuth’s Tristel holding is only 1.9% of the portfolio’s total value, which means the next reduction would eliminate it (because the minimum trade size is 2.5%).

The portfolio’s holdings in Bloomsbury Publishing (LSE:BMY) (score 5.8) and 4imprint Group (LSE:FOUR) (score 6.3) are both just over 5% of the portfolio's total value. That means I could reduce them and still be left with holdings worth more than 2.5% of the portfolio’s total value.

To my shame, I chose to reduce the Bloomsbury holding. It is slightly bigger than the 4Imprint holding, and sentiment prevents me from saying goodbye to Tristel even though I want to reduce the number of holdings in the portfolio!

- Shares for the future: a company I like at a 12-year low

- What you can learn from how ISA millionaires made their fortunes

Bloomsbury shares have risen strongly after the company reported that House of Flame and Shadow, the latest fantasy novel from Sarah J. Maas, was number one pretty much across the English language-speaking world.

The author is even eclipsing the company’s other licences to print money, Harry Potter and Bloomsbury Digital Resources (digitised multimedia collections for schools and universities).

It is a very impressive performance, and although I have never read Sarah J. Maas, I have enjoyed lots of books published by Bloomsbury.

Reducing holdings in winners is really hard, but I am compelled to keep investing in the highest-scoring shares. To do that, I must liberate money from the lowest scorers.

“b” indicates an addition to the portfolio and “s” a reduction in the holding. Past performance is not a guide to future performance.

This month’s trade

As usual, I slept on the decision. Then on Thursday 29 February (it’s a leap year!) I reduced the portfolio’s holding in Bloomsbury Publishing by 836 shares.

The actual price, quoted by a broker, was a shade over 557p, which raised £4,649 after deducting £10 in lieu of fees.

Share Sleuth performance

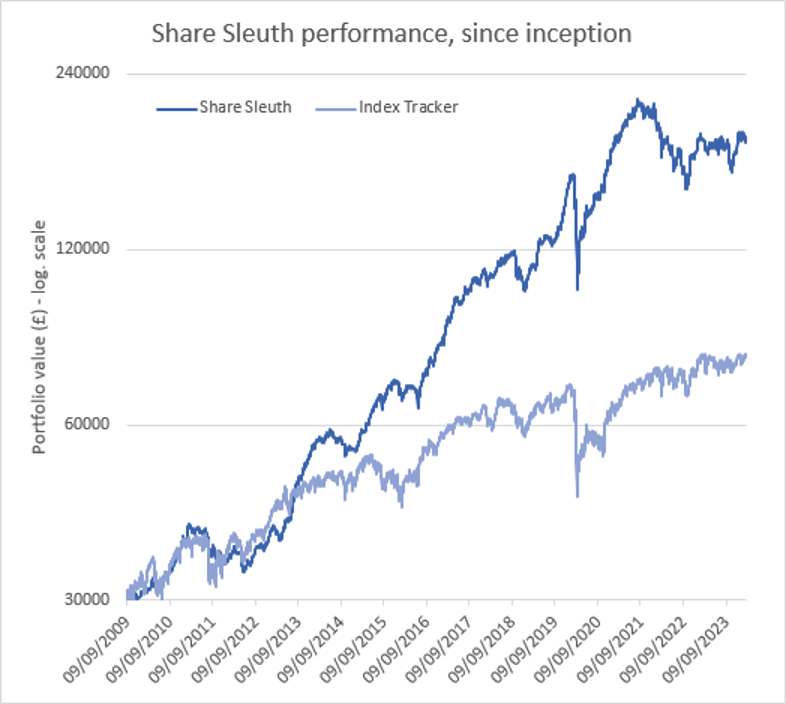

At the close on Friday 1 March, Share Sleuth was worth £185,486, 518% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £79,144, an increase of 164%.

Past performance is not a guide to future performance.

After the reduction in the Bloomsbury holding and dividends paid during the month from Cohort (LSE:CHRT), Dewhurst, Games Workshop Group (LSE:GAW), RWS Holdings (LSE:RWS), Solid State (LSE:SOLI) and Victrex (LSE:VCT), Share Sleuth’s cash pile is £5,380.

The minimum trade size, 2.5% of the portfolio’s value, is £4,675.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 5,380 | ||||

Shares | 180,098 | ||||

Since 9 September 2009 | 30,000 | 185,478 | 518 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,585 | -36 |

BMY | Bloomsbury | 845 | 3,203 | 4,479 | 40 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,077 | -9 |

BNZL | Bunzl | 201 | 4,714 | 6,239 | 32 |

CHH | Churchill China | 1,058 | 12,223 | 10,845 | -11 |

CHRT | Cohort | 1,600 | 3,747 | 8,480 | 126 |

CLBS | Celebrus | 1,528 | 3,509 | 3,171 | -10 |

DWHT | Dewhurst | 532 | 1,754 | 4,988 | 184 |

FOUR | 4Imprint | 190 | 3,688 | 11,058 | 200 |

GAW | Games Workshop | 100 | 4,571 | 9,500 | 108 |

GDWN | Goodwin | 266 | 6,646 | 14,896 | 124 |

GRMN | Garmin | 53 | 4,413 | 5,747 | 30 |

HWDN | Howden Joinery | 2,020 | 12,718 | 17,093 | 34 |

JET2 | Jet2 | 456 | 250 | 6,503 | 2,501 |

LTHM | James Latham | 750 | 9,235 | 8,400 | -9 |

PRV | Porvair | 906 | 4,999 | 5,961 | 19 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,904 | -51 |

QTX | Quartix | 3,285 | 7,296 | 5,256 | -28 |

RSW | Renishaw | 234 | 6,227 | 10,174 | 63 |

RWS | RWS | 2,790 | 9,199 | 5,781 | -37 |

SOLI | Solid State | 356 | 1,028 | 4,432 | 331 |

TET | Treatt | 763 | 1,082 | 3,083 | 185 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,220 | 227 |

TSTL | Tristel | 750 | 268 | 3,600 | 1,242 |

TUNE | Focusrite | 2,020 | 14,128 | 8,282 | -41 |

VCT | Victrex | 292 | 6,432 | 3,787 | -41 |

XPP | XP Power | 240 | 4,589 | 2,558 | -44 |

Notes

29 Feb 2024: Reduced Bloomsbury Publishing

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £185,486 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £79,144 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 1 March 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.